61% of NVIDIA’s revenue comes from just four mystery customers. Is this a warning sign for AI?

Wall Street came in hot on Thursday after NVIDIA posted blowout results and upbeat guidance. For a few hours, the rally did exactly what many expected. It reinforced the idea that NVIDIA sits at the center of the global AI buildout and can seemingly do no wrong.

By noon, that confidence was gone.

A surprisingly strong September jobs report took the wind out of the market and raised doubts that the Federal Reserve would cut rates in December. Traders stepped back. Analysts recalculated risk. NVIDIA, which had been up more than 5 percent, swung hard in the opposite direction and closed down more than 3 percent. In just one session, roughly $392 billion in market value disappeared.

The shift in mood wasn’t just about interest rates. Once the macro data was released, investors began digging into the details behind NVIDIA’s stunning growth. What they found raised questions that ran far deeper than a single jobs report.

Before the market opened, the U.S. released the delayed September nonfarm payrolls report. The economy added 119,000 jobs, far more than the 50,000 economists had expected. That strength quickly changed how Wall Street viewed the Fed’s next move.

“The sharp and broad rebound in payrolls (+119k) suggests the summertime slowdown might have been exaggerated… We no longer expect the Fed to lower the fed funds rate in December,” Morgan Stanley said in an intra-day note to clients.

At the same time, skeptics started pointing to pressure points in NVIDIA’s numbers. Accounts receivable had climbed sharply. Inventory was higher. And attention turned to a statistic quietly sitting in the company’s disclosures.

According to a report from Investing.com, for the quarter, four direct customers each made up more than 10 percent of NVIDIA’s revenue.

-

Customer A: 22%

-

Customer B: 15%

-

Customer C: 13%

-

Customer D: 11%

Together, just four customers accounted for 61 percent of the total revenue.

“NVIDIA’s accounts receivables in the quarter grew to $33.391 billion from $23.065 billion. Also pointed out by bears was that for the quarter, four direct customers had sales greater than 10% of total revenue. Customer A at 22%, Customer B at 15%, Customer C at 13%, and Customer D at 11%,” Investing.com reported.

That kind of concentration is rare for any public company, especially one valued in the trillions and viewed as the backbone of the AI economy. Most companies go out of their way to avoid relying too heavily on a small group of buyers. In NVIDIA’s case, more than half of its business now depends on four unnamed entities.

Those customers haven’t been disclosed, but the scale makes one thing clear. Only a handful of companies in the world can spend at this level. The likely candidates include the same technology giants and AI labs behind the largest models and data centers: Microsoft, Amazon, Google, Meta, Oracle, and players like OpenAI and xAI.

These aren’t just customers. They also act as:

-

Platform partners

-

Cloud providers

-

Strategic investors

-

Model builders

-

In some cases, shareholders of one another

In other words, the same handful of companies building AI systems are also the ones buying most of the hardware, funding expansion, and anchoring market optimism at the same time.

This isn’t an accusation of wrongdoing. It does, however, reveal how concentrated and interconnected the AI economy has become.

Another signal arrived quietly but carried real weight. SoftBank — one of the most aggressive technology backers of the past decade — sold its entire stake in Nvidia for $5.83 billion.

The timing stood out. NVIDIA remains at the center of the AI boom, its chips powering everything from generative models to massive data center builds. Yet SoftBank chose this moment to exit completely.

It did not offer a dramatic explanation. But in markets, timing often speaks louder than statements. When a group known for long-term bets steps away from what many still consider the hottest stock on the planet, it leaves people wondering what it sees that others may be ignoring.

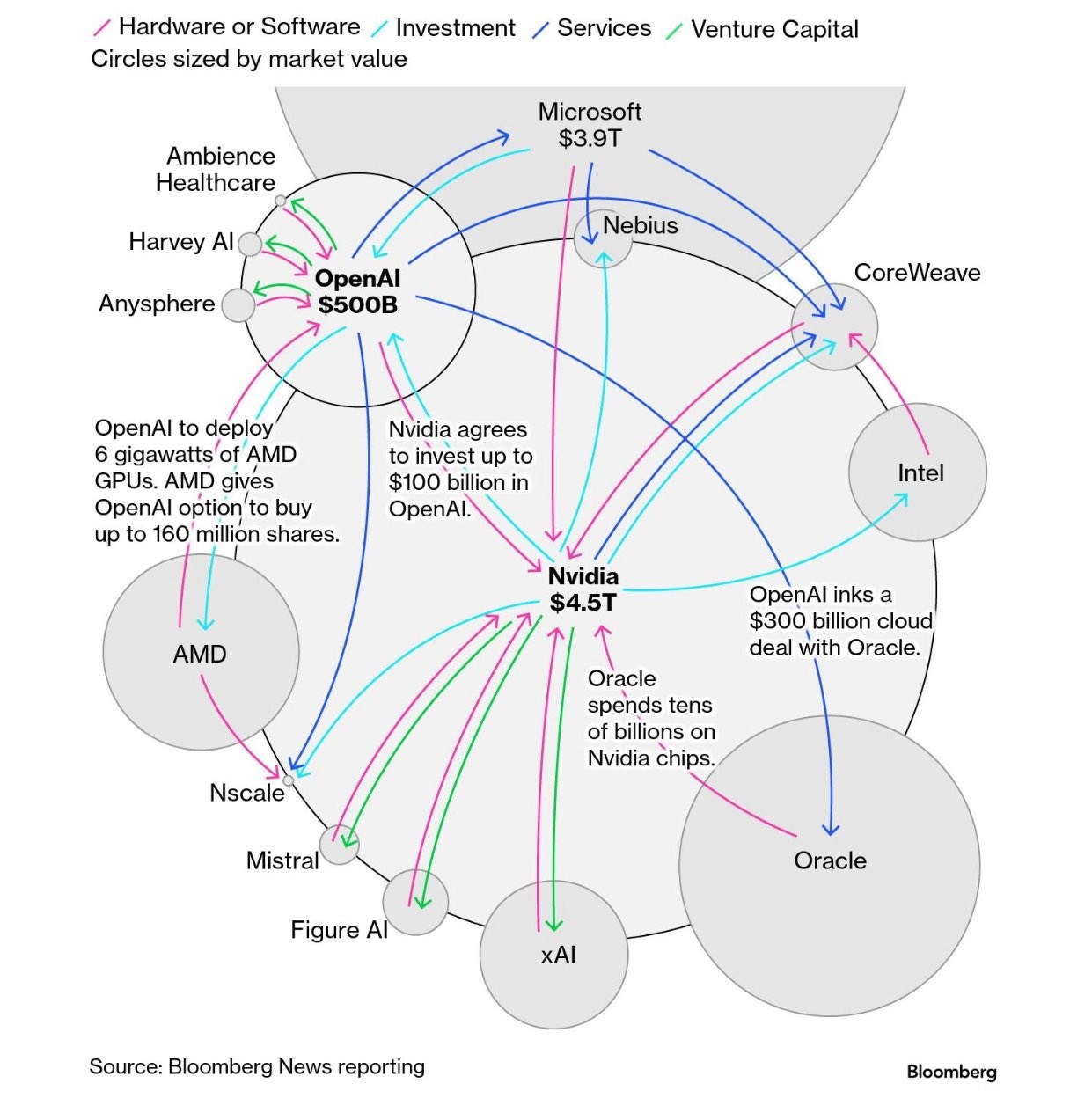

Bloomberg’s chart reveals the AI web beneath the surface

A recent Bloomberg network chart helped make that structure visible. At its center sits OpenAI, reportedly valued at around $500 billion and now functioning as a coordination point for computers, capital, and contracts across the industry.

Around that core:

-

NVIDIA continues supplying the bulk of the compute and has agreed to invest up to $100 billion

-

AMD locked in 6 gigawatts of GPU capacity and granted an option to purchase up to 160 million shares

-

Oracle signed a reported $300 billion hosting agreement

-

Microsoft remains tightly connected through Azure and deep product integration

Orbiting that core are a rising group of AI companies such as xAI, Mistral, Figure AI, and others, many of which have ties back to NVIDIA through funding or infrastructure.

OpenAI: The $500B Hub of the AI Ecosystem (Credit: Bloomberg)

What emerges is more than a supply chain. It is a tight web of capital, compute, and influence. It has driven extraordinary progress at a speed the tech industry has rarely seen. At the same time, it means a surprisingly small group now carries a disproportionate amount of weight for the entire ecosystem.

The first real cracks in NVIDIA’s AI chip grip?

Meanwhile, another development is challenging the idea that NVIDIA’s position is untouchable. Google recently unveiled Ironwood, its most advanced custom AI chip yet, built to reduce dependence on third-party hardware.

Google has spent years quietly designing its own silicon, and Ironwood signals a serious step up in that effort. It is not aimed at the consumer market, but at internal data centers and AI workloads — the same territory NVIDIA currently dominates.

If chips like Ironwood mature quickly, they could mark the beginning of a shift away from single-supplier dependence in AI infrastructure. That wouldn’t happen overnight. But even the suggestion of viable alternatives is enough to change long-term behavior among the largest buyers.

The quiet role of credit in the AI boom

Another detail adds to the tension. NVIDIA’s accounts receivable jumped to $33.391 billion in the quarter, up from $23.065 billion previously. That suggests a growing share of purchases is happening through:

-

Extended payment terms

-

Vendor-backed credit

-

Structured financing tied to future expectations

That doesn’t signal illegality on its own. Big corporations use credit every day. But it does raise a fair question: how much of the AI boom is being paid for with present cash, and how much rests on belief in future returns?

Short seller Mike Burry weighed in with his own view, calling the pattern he sees “fraud,” not a flywheel.” He added, “True end demand is ridiculously small. Almost all customers are funded by their dealers.” He also pushed readers to dig into OpenAI’s structure, asking, “One more. OpenAI is the linchpin here. Can anyone name their auditor?” FT.com later reported that sources indicate Deloitte is OpenAI’s U.S. auditor.

“Every company listed below has suspicious revenue recognition. The actual chart with ALL the give-and-take deals would be unreadable. The future will regard this a picture of fraud, not a flywheel. True end demand is ridiculously small. Almost all customers are funded by their dealers. If you can name OpenAI’s auditor in 1 hour you win some pride,” Burry wrote on X.

Even firms that remain broadly positive on NVIDIA took note of the market’s reaction.

“ The NVDA print and commentary was positive any way you slice it. Really good news not being rewarded is typically a bad sign,” Goldman Sachs said.

Goldman also pointed to a sharp move in Oracle’s credit default swaps, saying the company “becomes a barometer for AI risk and draws skeptics looking for a hedge.”

Every major technology wave begins with concentration. Rail, oil, software, and cloud all followed a similar pattern. AI is no different in that respect. What stands out here is the speed, the scale, the level of interdependence, and the fact that so much of the stack now hinges on such a small, connected group.

When 61 percent of the revenue of the company powering the AI boom comes from only four mystery customers, the story shifts from a simple stock move to a structural question about the foundation beneath the entire market.

That concentration has fueled stunning growth. It has also left far less room for error than most people realize.

And that may be the most important signal hiding beneath NVIDIA’s wild day on Wall Street.

A warning sign — or the early phase of a normal cycle?

Every major technological shift begins with concentration. Rail, oil, software, cloud. A handful of early winners always pull ahead first.

AI shows all the same patterns — but at a scale the market has never seen before. What stands out now is:

-

The speed at which capital is being deployed

-

The sheer size of the infrastructure spend

-

The web of cross-ownership and partnerships

-

The dependence on a very small group of buyers

-

And the growing role of credit behind the demand

None of this proves the AI boom is about to collapse.

But it does suggest it is far more centralized — and far more exposed — than many realize.

And when 61% of the world’s most important chip company depends on just four mystery customers, the real risk is not whether NVIDIA misses a quarter.

The real risk is whether the entire AI ecosystem has been built on a narrower foundation than anyone wants to admit.