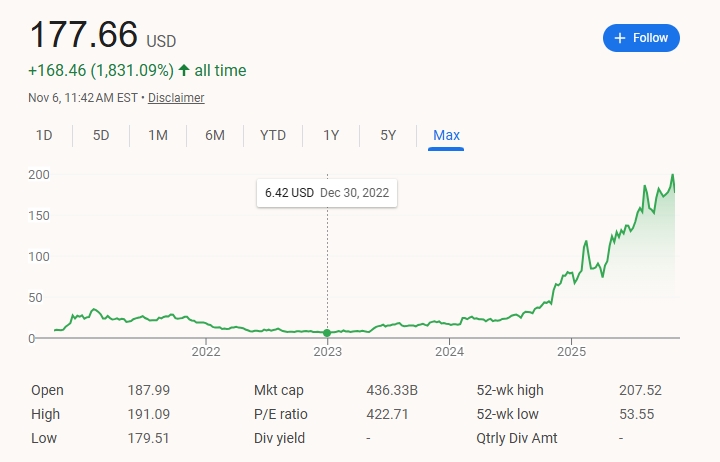

From $6.42 to $180 in 3 years: How Palantir became the poster child for the AI bubble

When Palantir Technologies went public in September 2020, its $10 Wall Street debut was met with curiosity more than conviction. Back then, the Peter Thiel-backed data analytics startup—best known for serving the U.S. intelligence community—closed its first day of trading at $9.50 a share, giving it a $22 billion valuation.

Five years later, that same stock trades above $180 a share (as of the time of writing), propelling Palantir’s valuation past $430 billion and cementing its place as one of the most improbable success stories of the AI era. The 1,866 percent rally has transformed Palantir from a shadowy government contractor into the market’s latest symbol of AI exuberance—and perhaps, its most telling warning sign.

Palantir Stock Price as of 11:00 AM, November 6, 2025

Palantir: From Secretive Quasi-Sovereign AI Government Contractor to AI Darling

Palantir CEO Alex Karp

Founded in 2003 by PayPal alumni Peter Thiel, Alex Karp, Joe Lonsdale, Nathan Gettings, and Stephen Cohen, Palantir built its reputation on platforms like Gotham and Foundry, used by intelligence agencies, hedge funds, and defense contractors to parse enormous data sets.

Palantir is known for three core projects: Gotham, Metropolis, and Foundry. Gotham is used by counter-terrorism analysts across the U.S. intelligence community and the Department of Defense, fraud investigators at the Recovery Accountability and Transparency Board, and cyber analysts at Information Warfare Monitor. Metropolis serves hedge funds, banks, and financial institutions, while Foundry bridges commercial operations with AI-driven data analytics.

But the company’s real metamorphosis began in 2023 with the launch of AIP: Artificial Intelligence Platform, a suite of tools that allowed enterprises to integrate AI models directly into their existing data pipelines. CEO Alex Karp leaned fully into the narrative, declaring Palantir an “AI software company” during multiple earnings calls. Investors listened.

By mid-2025, Palantir’s U.S. commercial revenue was growing 85% year-over-year, and total revenue guidance had been raised to nearly $4.4 billion, up from just over $1 billion in 2020. The message was clear: Palantir had found religion in AI—and Wall Street rewarded it.

From $6.42 in December 2022 to $180 in 2025: The Numbers Behind the AI Mania

Even for a company riding the AI wave, Palantir’s valuation defies gravity. With a market cap north of $430 billion and a price-to-earnings ratio above 420×, Palantir trades at multiples reserved for the most transformative names in tech. Yet its revenue remains a fraction of peers like Oracle or Microsoft.

In 2020, Palantir’s $22 billion valuation roughly aligned with fundamentals. Today, the stock’s 20× market-cap expansion has far outpaced its 4× revenue growth. Investors appear less interested in what Palantir earns and more captivated by what it might become—a software version of Nvidia, selling picks and shovels for the AI gold rush.

After years of trading sideways, Palantir’s real breakout began in late 2022, when its stock hovered around $6.42 a share. As the ChatGPT-fueled AI mania gripped Wall Street, the stock went vertical—soaring more than 2,600% to reach today’s levels near $180. That meteoric rise, condensed into less than three years, is what turned Palantir from a niche defense contractor into the face of speculative AI optimism.

Palantir Stock Price as of 11:51 AM, November 6, 2025

The Cult of Palantir

Much like Tesla a decade ago, Palantir has built a devout retail following. On X and Reddit, users trade memes of Alex Karp as a philosopher-king, and self-described “Palantir apes” dissect every quarterly report for hidden meaning.

For some, the enthusiasm is rationalized as a belief in Palantir’s unmatched position inside government and defense systems—what they see as a moat no startup can replicate. For others, it’s a speculative mania driven by the three-letter magic word: AI.

The line between visionary investing and collective delusion is getting thinner by the quarter.

Enter Michael Burry: The Big Short on AI Euphoria

Not everyone is buying the story.

Michael Burry, the contrarian investor who famously predicted the 2008 housing collapse, has placed a massive bet that Palantir’s rise won’t last. His fund, Scion Asset Management, disclosed $912 million in put options against Palantir and another $187 million against Nvidia, representing nearly 80 percent of its U.S. equity positions.

The timing is telling. Palantir shares are up 176% this year following its ninth straight earnings beat and revenue guidance upgrade. Nvidia, meanwhile, briefly crossed the $5 trillion market-cap mark. Both stocks symbolize AI’s speculative peak—and Burry’s bet signals he thinks that peak has already arrived.

“Sometimes the only winning move is not to play,” Burry wrote on X last week, warning of “market bubbles.”

His warning adds a sobering undertone to the euphoria—particularly as retail investors pour into anything labeled “AI infrastructure.”

Echoes of Past Bubbles

The parallels to past booms are hard to ignore. In 1999, dot-com stocks with “internet” in their names soared to absurd valuations. In 2021, SPACs promising “disruption” raised billions before vanishing. Now, AI is the narrative currency of the decade—and Palantir is its poster child.

For every genuine innovation, there’s a valuation bubble attached to it. Palantir’s AI story is undeniably real—but so are the laws of financial gravity.

What This Means for Startups

Palantir’s rise holds a lesson for founders racing to attach AI to their products. The market may reward you for the story in the short term, but investors eventually demand substance. If Palantir stumbles—or if AI growth slows—it could trigger a ripple effect that deflates the valuations of hundreds of startups riding the same wave.

In that sense, Palantir is more than a stock chart—it’s a mirror of the AI economy itself: ambitious, speculative, and defying gravity for now.

Five years ago, TechStartups covered its humble $9.50 debut and called it “a surge.” Today, that word barely captures the magnitude of the run. Whether this surge represents a revolution or a reckoning is a question that will define the next phase of the AI boom.