Follow the money: How OpenAI became the $500B hub of AI ecosystem — and why it could all come crashing down

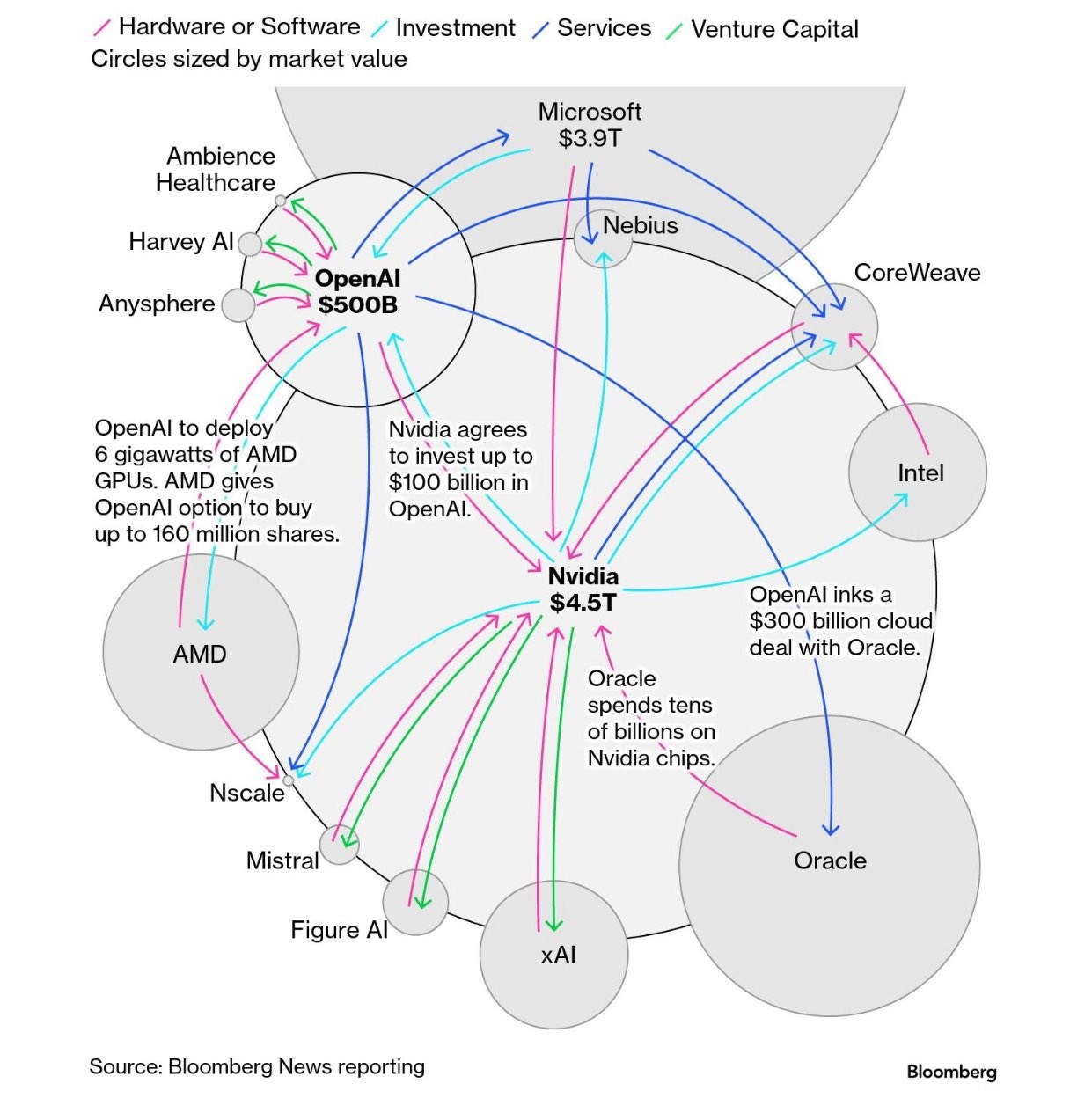

Bloomberg’s chart reveals a sprawling web of deals with OpenAI at the center — tying Nvidia, Microsoft, Oracle, and AMD into a single AI power structure that may be more fragile than it looks.

OpenAI: The $500B Hub of the AI Ecosystem

Bloomberg’s new network map exposes something remarkable: today’s AI economy runs through OpenAI. Valued at $500 billion, the San Francisco-based company is no longer just an AI model maker — it’s become the strategic center of gravity for chips, cloud, and capital.

At one end of the web sits Nvidia, the $4.5 trillion chipmaker whose GPUs power nearly every major AI model in production. Nvidia has agreed to invest up to $100 billion in OpenAI while continuing to supply the GPUs that keep its models running.

To diversify its hardware base, OpenAI has struck a major deal with AMD, locking in 6 gigawatts of GPU capacity and securing an option to buy up to 160 million AMD shares. On the cloud front, Oracle signed a $300 billion hosting deal, while Microsoft remains OpenAI’s closest strategic partner, deeply embedding its models into Azure and enterprise offerings.

Surrounding these giants is a growing ecosystem of startups — from xAI to Mistral, Figure AI, Nscale, and others — many of which are backed by Nvidia itself. Together, these links form a tight, multitrillion-dollar network where OpenAI functions as the central hub through which capital, compute, and influence flow.

How OpenAI Became the AI Industry’s Single Point of Failure

The Hidden Risk Few Want to Talk About

Behind the spectacle of mega-deals lies a structural vulnerability: OpenAI has become a single point of failure for the modern AI stack.

Thousands of startups depend on its APIs. Oracle and Microsoft’s long-term cloud strategies assume OpenAI’s continued growth. Nvidia’s record GPU demand is tethered in part to OpenAI’s scaling ambitions. And venture capital is pouring into companies whose business models rely — directly or indirectly — on OpenAI’s stability.

“If Nvidia falters, AI slows down. If OpenAI falters, the current AI economy could collapse almost overnight.”

This kind of concentration introduces systemic risk. If OpenAI were to face a regulatory clampdown, leadership crisis, major security incident, or technical breakdown, the shockwaves would not stop at its own balance sheet. They would ripple upstream to chipmakers and cloud providers, and downstream to the startups and investors that depend on it.

What looks like a triumph of strategic positioning is also a fragile architecture built around one node.

Too Big to Fail — AI Edition

The structure now emerging around OpenAI bears uncomfortable similarities to the 2008 financial system: a handful of institutions underpinning trillions in value, with limited redundancy.

Few companies maintain model “failover” strategies. Alternatives at scale — Anthropic, Mistral, xAI — exist but remain far smaller. Regulatory frameworks haven’t caught up to the idea of what happens if a private AI lab, now at the center of global infrastructure, suddenly falters.

A major disruption at OpenAI could trigger a GPU demand shock, unsettle long-term cloud contracts, and wipe out startup valuations almost overnight. Investor sentiment, which currently assumes infinite AI growth, could swing sharply if the ecosystem’s central pillar shows cracks.

Who’s Really the Single Point of Failure — Nvidia or OpenAI?

The question isn’t academic. Both companies sit at the core of the modern AI stack, but they occupy very different roles.

Nvidia is the infrastructure backbone. Its GPUs power nearly every major model, and few substitutes exist at a comparable scale. A disruption to its supply chain would slow AI development globally, but given time and capital, alternatives—AMD, custom silicon, TPUs—could emerge to fill the gap. The fallout would be painful, but not permanent.

OpenAI, by contrast, has become the strategic keystone. Its scaling plans drive Nvidia’s record GPU demand. Its models anchor Microsoft’s cloud offerings. Oracle’s $300 billion cloud deal hinges on its workloads. Thousands of startups depend on its APIs to run their products. In short, OpenAI isn’t just a participant—it’s the central node through which capital, compute, and growth currently flow.

If Nvidia falters, AI slows down. If OpenAI falters, the current AI economy could collapse almost overnight: GPU demand plunges, cloud contracts wobble, and an entire layer of startups loses its foundation. Nvidia’s dominance is infrastructural; OpenAI’s is economic and strategic.

For now, OpenAI is the true single point of failure in this $500B web. Nvidia is indispensable, but it’s OpenAI that holds the network together.

Why This Matters

OpenAI’s rise has supercharged innovation. It has accelerated model adoption, catalyzed infrastructure expansion, and made AI mainstream faster than anyone expected. But the industry’s unprecedented speed has come at the cost of resilience.

Right now, the AI boom looks less like a decentralized revolution and more like a hub-and-spoke system with a fragile hub. If OpenAI stumbles, it won’t just be one company’s problem — it could destabilize the very ecosystem it helped create.

The smartest founders, investors, and infrastructure players are already thinking ahead: diversifying dependencies, exploring open models, and reducing platform risk. Because in complex networks, strength doesn’t come from scale alone — it comes from redundancy.

Closing Thought

“Follow the money” reveals more than who’s winning — it shows where the fault lines run. OpenAI may be the $500B engine of the AI era, but it’s also the weakest link holding the system together. Whether this structure matures into a stable ecosystem or tips into crisis will depend on how fast the industry builds around — not just on — its most powerful player.