AI chipmaker Cerebras raises $1.1B in funding at $8.1B valuation to challenge Nvidia, IPO on hold

Cerebras Systems just pulled in one of the biggest private funding rounds of the year. The Sunnyvale-based AI chip startup closed a $1.1 billion Series G at an $8.1 billion valuation, drawing in heavyweight backers and putting itself squarely on a collision course with Nvidia.

The round was led by Fidelity Management & Research Company and Atreides Management, with participation from Tiger Global, Valor Equity Partners, 1789 Capital, Altimeter Capital, Alpha Wave, and Benchmark. The funding comes at a moment when demand for AI infrastructure is surging and startups like Cerebras are trying to seize ground in a market dominated by Nvidia’s GPUs.

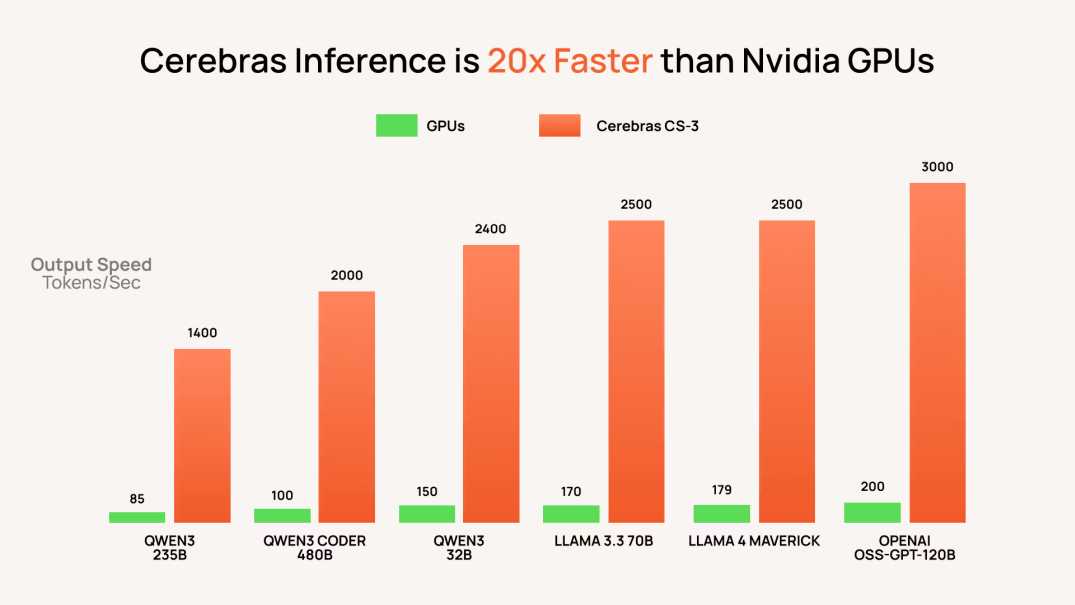

Founded in 2016 by Andrew Feldman, Cerebras has made its name on a bold bet: wafer-scale chips that dwarf anything else on the market. Its flagship Wafer-Scale Engine 3 (WSE-3) packs 900,000 AI cores and 4 trillion transistors—56 times larger than the biggest GPU. According to the company, the oversized design cuts out the complex interconnects required in GPU clusters, delivering inference speeds more than 20 times faster than competing chips.

“As measured by third-party independent benchmark firm Artificial Analysis, Cerebras outperforms Nvidia GPUs by orders of magnitude on every leading open-source model in head-to-head comparisons,” Cerebras claimed

That performance has turned heads across the industry. Customers, including AWS, Meta, and IBM, have already deployed Cerebras hardware for large-scale workloads. Feldman says the new capital will be used to expand R&D, increase U.S. manufacturing, and build out the company’s data center footprint.

“From our inception we have been backed by the most knowledgeable investors in the industry. They have seen the historic opportunity that is AI and have chosen to invest in Cerebras,” said Andrew Feldman, co-founder and CEO, Cerebras. “We are proud to expand our consortium of best-in-world investors.”

A Year After Its IPO Filing, Cerebras Stays Private With a $1.1B Raise

The raise also signals a strategic pivot. Cerebras had been lining up an IPO, filing confidentially in June 2024 and publicly in September, but a national security review by the Committee on Foreign Investment in the United States (CFIUS) stalled the process. Now, instead of heading to public markets, the company is doubling down on private capital.

The funding underscores investor confidence in Cerebras’s approach at a time when AI hardware is a make-or-break race. Benchmarking firms report that Cerebras consistently holds the performance crown for inference, with customers pushing trillions of tokens through its systems each month. The startup says its infrastructure is already powering new real-time use cases like code generation, reasoning, and agentic work—areas where speed directly translates to economic advantage.

Big-name enterprises, government agencies, and even individual developers have adopted its chips. On Hugging Face, Cerebras is now the top inference provider, with more than 5 million monthly requests. That momentum has put the startup in direct competition with Nvidia, whose GPUs still dominate AI training but face growing pressure on the inference side.

Citigroup and Barclays Capital acted as joint placement agents on the deal, which closes a chapter on Cerebras’s IPO ambitions—for now—and sets the stage for one of the most closely watched rivalries in AI hardware.

Cerebras Founder and CEO: Andrew Feldman