Top Startup and Tech Funding News Roundup – Week Ending September 19, 2025

It’s Friday, September 19, 2025, and we’re back with the top startup and tech funding news stories that shaped the week. From billion-dollar robotics and chip financings to early-stage breakthroughs in healthtech, fintech, and Web3, capital continued to flow across every stage and geography.

This week’s coverage spans Monday, September 15, through Friday, September 19, spotlighting both late-stage giants and scrappy up-and-comers. Figure stole the spotlight with a colossal $1 billion-plus Series C at a $39 billion valuation, while Groq doubled its worth to $6.9 billion with a $750 million raise. Tamara secured a record-setting $2.4 billion credit facility in the Gulf, and biotech players like Lila Sciences ($235M Series A) and Dualitas Therapeutics ($65M Series A) drew major backing to advance frontier science. On the climate front, Nofence closed $35M for virtual livestock fencing and Brineworks pulled in €6.8M to scale its carbon-neutral fuel tech.

Funding Highlights

-

Figure cemented its place as one of the world’s most valuable robotics startups with a $1B+ Series C.

-

Groq raised $750M at a $6.9B valuation to ramp up AI chip production.

-

Tamara secured a $2.4B Shariah-compliant credit facility to expand its fintech super app.

-

Lila Sciences brought in $235M to scale AI-powered research labs.

-

CuspAI raised $100M to accelerate materials discovery with AI.

-

Nofence expanded with $35M for its GPS-powered livestock collars, while Brineworks picked up €6.8M to commercialize carbon-neutral fuel.

-

Conceivable Life Sciences landed $50M to bring its AI-driven IVF labs to market.

-

Grvt closed $19M for a privacy-first decentralized exchange.

Investor Activity

The week drew heavyweight investors across the spectrum. Parkway Venture Capital, Tiger Global, and NEA anchored billion-dollar and nine-figure rounds, while corporates like Nvidia, Intel Capital, LG Technology Ventures, Salesforce, and Qualcomm doubled down on strategic bets in robotics, chips, and consumer tech. Meanwhile, sovereign and regional funds including Sanabil Investments, ADIA, and QED Investors, reinforced their presence in Middle Eastern fintech and biotech.

The mix underscored a familiar pattern: mega-rounds fueling capital-intensive AI, robotics, and fintech alongside steady seed and Series A activity in healthtech, Web3, and climate tech. Together, these financings signal strong investor conviction in ambitious founders reshaping how we build, compute, and live.

Here’s the full breakdown. Until next week, have a great weekend.

Lila Sciences Raises $235M in Series A Funding to Build AI-Powered Research Labs

Lila Sciences, a Flagship Pioneering–backed biotech startup in Cambridge, MA, closed a $235 million Series A round to expand its autonomous AI-driven research labs. The company is developing fully “AI-powered science factories” that can automate experiments and discovery processes.

This latest round was co-led by Braidwell and Collective Global, with participation from investors like Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, and Abu Dhabi Investment Authority. The new capital builds on a $200M seed raised in March and will help Lila scale its robotic lab operations and accelerate AI-driven drug and materials discovery, advancing what the team calls a “scientific superintelligence.”

Funding Details:

-

Startup: Lila Sciences

-

Investors: Braidwell (co-lead), Collective Global (co-lead), Altitude Life Science Ventures, Alumni Ventures, ARK Venture Fund, Common Metal, Abu Dhabi Investment Authority (ADIA)

-

Amount Raised: $235 million

-

Total Raised: ~$435 million (including prior seed)

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

Saudi Fintech Tamara Secures $2.4B Shariah-Compliant Credit Facility

Tamara, a Saudi “buy-now-pay-later” fintech unicorn, secured a massive $2.4 billion Shariah-compliant credit facility to fuel its expansion. The package provides an initial $1.4B drawdown with an additional $1.0B available over three years (subject to approvals), effectively refinancing and enlarging a prior $500M facility led by Goldman Sachs.

Major backers, including Goldman Sachs, Citi, and Apollo-managed funds, are backing the deal, making it one of the largest Gulf fintech financings on record. Tamara serves over 20 million customers and 87,000 merchants (including Apple, Amazon, IKEA) and plans to use the funds to broaden its payment and credit offerings, advancing its vision of a financial “super app” aligned with Saudi Arabia’s Vision 2030.

Funding Details:

-

Startup: Tamara

-

Investors: Goldman Sachs; Citi; Apollo-managed funds

-

Amount Raised: $2.4 billion (credit facility)

-

Total Raised: ~$2.74 billion (including prior equity rounds)

-

Funding Stage: Shariah-compliant debt facility

-

Funding Date: September 15, 2025

Conceivable Life Sciences Raises $50M in Series A Funding for Automated IVF Labs

Conceivable Life Sciences, a California-based fertility tech startup, raised $50 million in Series A funding to commercialize its AI-robotic IVF lab system, AURA. The round was led by Advance Venture Partners (AVP) with support from ARTIS Ventures, Stride, and ACME. Including a prior $20M seed, the company’s total equity funding now stands at $70M.

Conceivable’s AURA platform automates over 200 steps of the in-vitro fertilization process using robotics and AI, aiming to improve IVF success rates, reduce costs, and expand patient access. The startup plans a full commercial debut of its autonomous IVF lab in early 2026. CEO Alan Murray says the funding validates their vision of “transforming IVF” and will help bring this breakthrough lab technology to clinics faster.

Funding Details:

-

Startup: Conceivable Life Sciences

-

Investors: Advance Venture Partners (lead), ARTIS Ventures, Stride, ACME

-

Amount Raised: $50 million

-

Total Raised: $70 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

Tin Can Raises $3.5M in Seed Funding to Launch Kid-Friendly Landline Phone

Tin Can, a Seattle startup creating a colorful Wi-Fi–connected “landline” phone for kids, has raised $3.5 million in seed funding. Led by PSL Ventures with backing from Newfund Capital, Mother Ventures, and Solid Foundations, the round will help Tin Can scale production and market its toy-like phones.

The device – a chunky analog phone in a tin-can shape – lets children call approved contacts without using smartphones or apps, addressing parental demand for screen-free connectivity. Founder Chet Kittleson noted that Tin Can already sold out its first production batches, and the new capital will expand manufacturing and grow this kid-safe calling platform amid rising interest in analog digital alternatives.

Funding Details:

-

Startup: Tin Can

-

Investors: PSL Ventures (lead), Newfund Capital, Mother Ventures, Solid Foundations

-

Amount Raised: $3.5 million

-

Total Raised: $3.5 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

CuspAI Raises $100M in Series A Funding for AI Materials Discovery

CuspAI, a Cambridge, UK startup building an AI “search engine” for materials science, announced a $100 million Series A to scale its platform. Co-led by New Enterprise Associates (NEA) and Temasek, the round also included investors Samsung Ventures, Hyundai Motor Group, Nventues, Basis Set Ventures, Prosus Ventures, Northzone, LocalGlobe, and Giant Ventures.

The funding, following a $30M seed in 2024, brings CuspAI’s total funding to about $130M. CuspAI’s AI-driven platform enables rapid discovery of new materials for use in clean energy, electronics, and other fields. The company already partners with Hyundai (for sustainable energy tech) and Meta (for carbon capture). The new capital will help CuspAI expand operations in the U.S. and Asia and accelerate development of its AI materials workflows.

Funding Details:

-

Startup: CuspAI

-

Investors: New Enterprise Associates (co-lead), Temasek (co-lead), Samsung Ventures, Hyundai Motor Group, Nventues, Basis Set Ventures, Prosus Ventures, Northzone, LocalGlobe, Giant Ventures (plus prominent angel investors)

-

Amount Raised: $100 million

-

Total Raised: $130 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

PopChill Raises $3M Series A to Power Secondhand Fashion Marketplace

PopChill, a Taipei-based luxury resale marketplace, has raised $3 million in a Series A round led by Darwin Ventures. The funding, which also included ITIC, AVA Angels, Taipei Angels, and Dream Co-Founder Angel One ASO Global Fund, will be used to enhance PopChill’s AI-driven platform for buying and selling pre-owned designer fashion.

Founder Andy Kuo said PopChill aims to create a sustainable shopping community by letting users easily trade authenticated designer clothing, shoes, and bags. The company plans to use the new funds to develop smarter recommendation engines and fraud prevention, and to expand its user base in Taiwan and beyond.

Funding Details:

-

Startup: PopChill

-

Investors: Darwin Ventures (lead), ITIC, AVA Angels, Taipei Angels, Dream Co-Founder Angel One ASO Global Fund

-

Amount Raised: $3 million

-

Total Raised: $3 million

-

Funding Stage: Series A

-

Funding Date: September 15, 2025

CrazyGoldFish Secures Government Grant to Advance AI Education Tech

CrazyGoldFish, an AI education startup incubated at IIT Mandi (India), won a seed grant under India’s Startup India Seed Fund Scheme. The undisclosed grant (typically in the low millions of dollars) will help the company further develop its “plug-and-play” AI reasoning layer for educational content.

CrazyGoldFish’s platform unifies exam results, learning data, and content to deliver personalized, bias-free assessments. Founder Rahul Khandelwal said this government funding will help “reclaim teacher time and democratize personalization” by integrating their AI tutoring tools into ed-tech products. The company plans pilot programs in India before expanding globally to improve learning outcomes.

Funding Details:

-

Startup: CrazyGoldFish

-

Investors: Government of India (Startup India Seed Fund Scheme)

-

Amount Raised: Not disclosed (seed grant)

-

Total Raised: Not disclosed

-

Funding Stage: Seed (government grant)

-

Funding Date: September 15, 2025

MyNaksh Raises $0.9M Pre-Seed for AI Astrology Platform

MyNaksh, an AI-powered personal astrology platform based in India, closed a ₹7.5 crore (~$0.9 million) pre-seed round. The round was led by Eximius Ventures and Gemba Capital, with participation from angel syndicate Infinyte Club. MyNaksh’s mobile app uses AI to generate deeply personalized astrological guidance, combining technology with expert astrologers.

CEO Nitesh Salvi says the funding will help restore astrology’s cultural relevance, moving beyond gimmicks, and will be used to accelerate product development and expand MyNaksh’s user base in India’s large astrology market.

Funding Details:

-

Startup: MyNaksh

-

Investors: Eximius Ventures (lead), Gemba Capital, Infinyte Club (angel syndicate)

-

Amount Raised: ₹7.5 crore (≈$0.9 million)

-

Total Raised: ₹7.5 crore

-

Funding Stage: Pre-Seed

-

Funding Date: September 15, 2025

MarqVision Raises $48M in Series B Funding for AI Brand Protection

MarqVision, an L.A.-based AI startup specializing in detecting online counterfeits and piracy, closed a $48 million Series B round on September 15, 2025. The round was led by Peak XV Partners (Sequoia India & SEA spinout) and included Salesforce Ventures, HSG (ex-Sequoia China), Coral Capital, and Y Combinator partner Michael Seibel. Existing backers Y Combinator, Altos Ventures, and Atinum also participated.

MarqVision will use the new funds to accelerate international expansion and further develop its managed-service platform that automatically detects and removes counterfeits, digital piracy, and impersonation across e-commerce and social channels. The Series B brings the company’s total funding to $90 million and comes as it now serves over 350 global brands across industries.

Funding Details:

-

Startup: MarqVision

-

Investors: Peak XV Partners (lead), Salesforce Ventures, HSG, Coral Capital, Michael Seibel, Y Combinator, Altos Ventures, Atinum Investment

-

Amount Raised: $48 million

-

Total Raised: $90 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

Arch Raises $52M in Series B Funding to Scale Alternative Investment Platform

Arch, a New York fintech that automates private market investing, raised $52 million in a Series B round. Led by Oak HC/FT, the round also included Menlo Ventures, Craft Ventures, Quiet Capital, and others. Arch’s platform streamlines the lifecycle of alternative investments (private equity, venture, hedge funds, real estate, etc.), providing real-time visibility and reporting.

CEO Ryan Eisenman said the new funds will support Arch’s expansion and product development as its platform already manages over $250 billion in private assets for hundreds of allocators. Arch will use the capital to further enhance its SaaS offering and extend its reach among institutional investors and wealth managers.

Funding Details:

-

Startup: Arch

-

Investors: Oak HC/FT (lead), Menlo Ventures, Craft Ventures, Quiet Capital

-

Amount Raised: $52 million

-

Total Raised: $52 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

Epoch Protocol Closes $1.2M in Seed Funding for Web3 Coordination Layer

Epoch Protocol, a Singapore-based Web3 startup building an “intent-solver” coordination layer, closed $1.2 million in seed funding. The round was led by L2Iterative Ventures and included Alphemy Capital, G20 Ventures, LongHash Ventures, SAFE Ventures, Hadron Ventures, and a syndicate of angels (including engineers from projects like Avail, Anoma, Gaianet, Push Protocol, and Manta Network).

Epoch’s platform allows users to specify high-level “intents” and have transactions executed across blockchains without needing to understand gas mechanics. The funds will support the development of Epoch’s protocol and launch public testnets to onboard developers and node operators. The team plans to use the capital to finalize its multi-chain coordination technology, which aims to abstract blockchain complexity and enable cross-chain transactions in simple terms.

Funding Details:

-

Startup: Epoch Protocol

-

Investors: L2Iterative Ventures (lead), Alphemy Capital, G20 Ventures, LongHash Ventures, SAFE Ventures, Hadron Ventures, other angel investors

-

Amount Raised: $1.2 million

-

Total Raised: $1.2 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

GreenLite Raises $49.5M in Series B Funding for AI Construction Tech

GreenLite, a New York construction tech startup, raised $49.5 million in a Series B round to expand its AI-driven plan review platform. Insight Partners led the financing, with Energize Capital and returning backers Craft Ventures, LiveOak Ventures, and Chicago Ventures also participating. GreenLite’s LiteTable product uses computer vision and AI to automatically parse building plans and flag code compliance issues, dramatically speeding up the permitting process.

GreenLite counts nearly 100 Fortune 500 customers (retailers, developers, builders) using its platform. The company will use the funding to enter additional verticals (like lodging, industrial, and clean energy construction) and further enhance its machine-learning capabilities.

Funding Details:

-

Startup: GreenLite

-

Investors: Insight Partners (lead), Energize Capital, Craft Ventures, LiveOak Ventures, Chicago Ventures

-

Amount Raised: $49.5 million

-

Total Raised: $49.5 million

-

Funding Stage: Series B

-

Funding Date: September 15, 2025

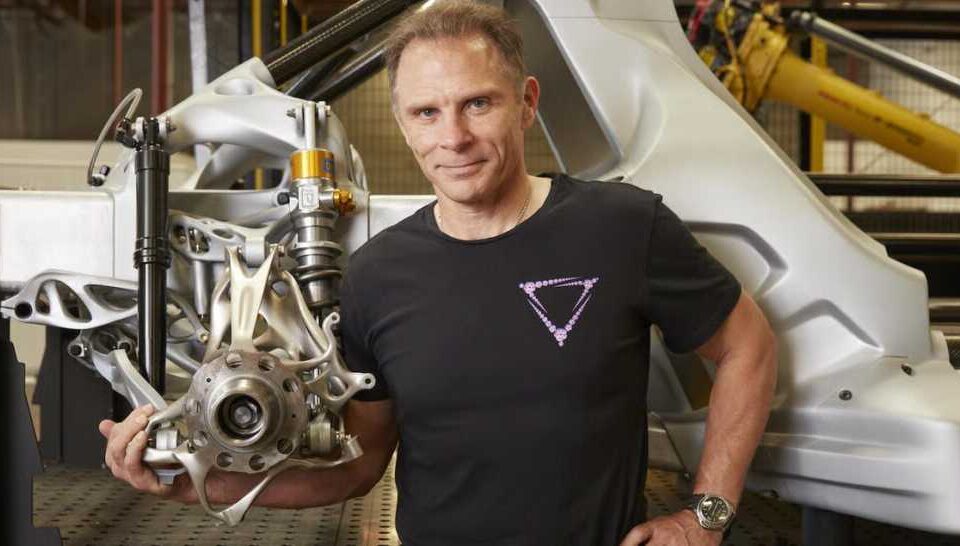

Divergent Technologies Raises $290M Series E to Scale 3D Manufacturing

Divergent Technologies, a Torrance, California startup pioneering AI-driven 3D manufacturing, closed a $290 million Series E round. The round was led by Rochefort Asset Management (tech manufacturing specialist) and included $250M equity plus $40M debt financing. Divergent’s end-to-end digital production system designs, 3D-prints, and assembles complex parts (like automotive components) with AI and robotics.

Founded in 2014 by CEO Lukas Czinger, Divergent has already produced parts for luxury brands like Aston Martin, Bugatti, and McLaren. The new capital will grow its manufacturing capacity and develop next-gen capabilities as it ramps up supply for aerospace, defense, and automotive customers.

Funding Details:

-

Startup: Divergent Technologies

-

Investors: Rochefort Asset Management (lead)

-

Amount Raised: $290 million

-

Total Raised: $290 million

-

Funding Stage: Series E

-

Funding Date: September 15, 2025

Nestimate Closes $3M Seed for Retirement Analytics

Nestimate, a Lincoln, Nebraska startup offering analytics for 401(k) retirement plans, has raised $3 million in funding. The round was led by S3 Ventures, with participation from PruVen Capital, TIAA Ventures, and Invest Nebraska. Nestimate’s platform provides fiduciaries, advisors, and employers with data-driven insights to help implement better retirement income solutions for plan participants.

CEO Kelby Meyers said the new funds will support expanding the engineering team and further developing the product. The capital will be used to extend Nestimate’s market reach and product offerings as it helps more organizations improve retirement outcomes for members.

Funding Details:

-

Startup: Nestimate

-

Investors: S3 Ventures (lead), PruVen Capital, TIAA Ventures, Invest Nebraska

-

Amount Raised: $3 million

-

Total Raised: $3 million

-

Funding Stage: Seed

-

Funding Date: September 15, 2025

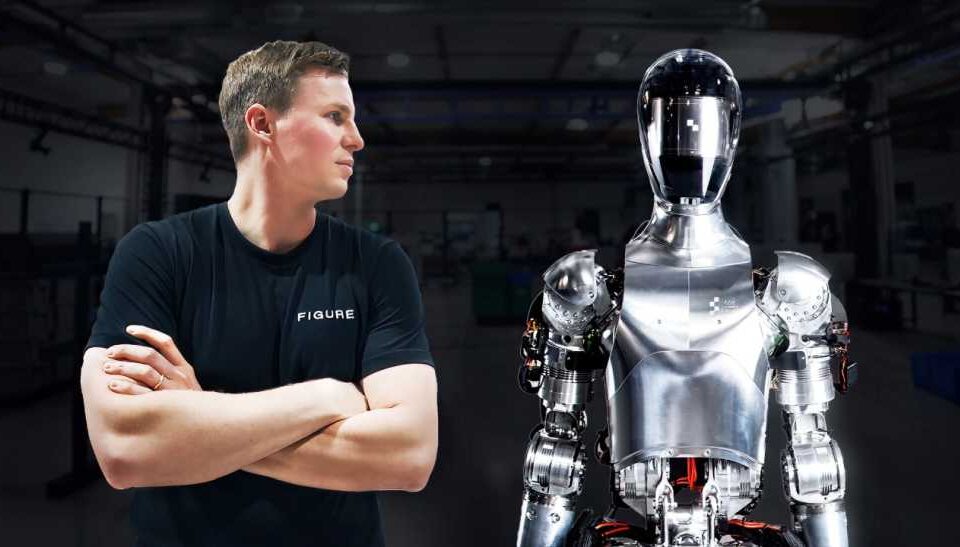

Figure Raises Over $1B in Series C Funding for Humanoid Robotics

Figure, a San Jose–based robotics startup, announced it has closed a Series C round of over $1 billion, bringing its valuation to about $39 billion. The round was led by Parkway Venture Capital, with participation from Nvidia, Intel Capital, LG Technology Ventures, Salesforce, T-Mobile Ventures, Qualcomm Ventures, Brookfield Asset Management, Macquarie Capital, Align Ventures, and Tamarack Global. Figure builds humanoid robots (such as the Helix and BotQ) for home and commercial use.

The company plans to use the new funding to scale production of its robots, expand AI training and simulation infrastructure, and double down on data collection to improve performance. This massive round comes amid a surge in VC interest in humanoid AI robots as companies address labor shortages in logistics, manufacturing, and home services.

Funding Details:

-

Startup: Figure

-

Investors: Parkway Venture Capital (lead), Nvidia, Intel Capital, LG Technology Ventures, Salesforce, T-Mobile Ventures, Qualcomm Ventures, Brookfield Asset Management, Macquarie Capital, Align Ventures, Tamarack Global

-

Amount Raised: Over $1 billion

-

Total Raised: Not disclosed (prior round was $675M)

-

Funding Stage: Series C

-

Funding Date: September 16, 2025

Nothing Raises $200M Series C for Next-Gen Consumer Electronics

Nothing, the London-based consumer electronics startup founded by Carl Pei, raised $200 million in a Series C round at a $1.3 billion valuation. The round was led by Tiger Global, with participation from existing backers including GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry, as well as new strategic investors such as Zerodha co-founder Nikhil Kamath and Qualcomm Ventures.

Nothing plans to use the capital to expand beyond smartphones into a broader lineup of AI-driven hardware (like phones, watches, audio devices, and even smart glasses, robots, and EVs). The fresh funding comes as Nothing surpasses $1B in cumulative sales and prepares to scale its distinctive transparent-design hardware to new markets.

Funding Details:

-

Startup: Nothing

-

Investors: Tiger Global (lead), GV, Highland Europe, EQT, Latitude, I2BF, Tapestry, Nikhil Kamath (Zerodha), Qualcomm Ventures

-

Amount Raised: $200 million

-

Total Raised: Over $450 million (to date)

-

Funding Stage: Series C

-

Funding Date: September 16, 2025

PharmEasy Secures $210M Debt Financing to Restructure Operations

PharmEasy, an Indian healthtech unicorn, raised INR 1,700 crore (about $210 million) in fresh debt financing. The round was led by 360 ONE, with participation from Alkram Ventures, MVS Ventures, Bennett Coleman, and others. The funds will primarily be used to repay an existing Goldman Sachs loan as PharmEasy works to stabilize after a valuation downgrade of roughly 90%.

This debt infusion comes amid broader restructuring efforts; the company’s founders have indicated that additional fundraising or corporate changes may follow to support the turnaround.

Funding Details:

-

Startup: PharmEasy

-

Investors: 360 ONE (lead), Alkram Ventures, MVS Ventures, Bennett Coleman, others

-

Amount Raised: INR 1,700 crore (approx. $205 million)

-

Total Raised: Not disclosed

-

Funding Stage: Debt Financing

-

Funding Date: September 16, 2025

Nofence Closes Over $35M Series B for Virtual Fencing

Nofence, a Norway-based agtech startup providing virtual-fencing solutions for livestock, closed a Series B round of over $35 million. The round was led by the European Circular Bioeconomy Fund, with participation from Capagro, Nysnø Climate Investments, Climate Innovation Capital, and Speedinvest. Existing investors Sandwater, Momentum, and Ferd also increased their stakes.

Nofence’s solar-powered GPS collar technology lets farmers create invisible boundaries to manage animals without physical fences. The new funding – one of Europe’s largest agtech rounds this year – will enable Nofence to accelerate expansion in the U.S. and other markets, further develop its collar hardware, and scale customer support for ranchers and farmers worldwide.

Funding Details:

-

Startup: Nofence

-

Investors: European Circular Bioeconomy Fund (lead), Capagro, Nysnø Climate Investments, Climate Innovation Capital, Speedinvest; plus existing backers Sandwater, Momentum, Ferd

-

Amount Raised: Over $35 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: September 16, 2025

Dualitas Therapeutics Raises $65M Series A for Immunology Drugs

Dualitas Therapeutics, a biotech spun out in 2023 from San Francisco, announced a $65 million Series A. The round was co-led by Versant Ventures and Qiming Venture Partners USA, with pharma giant Eli Lilly also participating. Dualitas is developing bispecific antibody therapies for immune-related diseases; its lead candidates target asthma and rheumatoid arthritis.

The company plans to use the funding to advance these candidates into clinical trials and to further develop its proprietary DualScreen drug-discovery platform for broader immunology applications.

Funding Details:

-

Startup: Dualitas Therapeutics

-

Investors: Versant Ventures (co-lead), Qiming Venture Partners USA (co-lead), Eli Lilly (participant), SV Health Investors, Chugai Venture Fund, Alexandria Venture Investments

-

Amount Raised: $65 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: September 16, 2025

AllRock Bio Raises $50M Series A for Pulmonary Hypertension Drug

AllRock Bio, a clinical-stage biotech in Natick, MA, closed a $50 million Series A round. The financing was co-led by Versant Ventures and Westlake BioPartners. AllRock licensed its lead asset (ROC-101), a first-in-class oral pan-ROCK inhibitor for pulmonary arterial hypertension, from Sanofi.

The company will use the proceeds to advance this drug into Phase 2a clinical trials and to support its broader cardiopulmonary and fibrotic disease pipeline. This Series A comes as AllRock builds a team with expertise in rare disease drug development ahead of upcoming trial readouts.

Funding Details:

-

Startup: AllRock Bio

-

Investors: Versant Ventures (co-lead), Westlake BioPartners (co-lead)

-

Amount Raised: $50 million

-

Total Raised: $50 million (all-time)

-

Funding Stage: Series A

-

Funding Date: September 16, 2025

WorkFusion Secures $45M for AI Compliance Automation

WorkFusion, a New York startup offering AI “agents” for financial compliance tasks, raised $45 million in funding on September 16, 2025. The round was led by Georgian Partners, which significantly increased its stake, and included Serengeti Asset Management, NGP Capital, Teralys Capital, Hawk Equity, and others.

WorkFusion’s pre-trained AI agents automate tasks like sanctions screening, transaction monitoring, and fraud review for banks. The new capital will further develop these out-of-the-box agents and expand WorkFusion’s reach among its 25+ banking clients worldwide. This infusion brings WorkFusion’s total equity funding to about $251 million, positioning the company to grow with large financial institutions and scale its automated compliance platform.

Funding Details:

-

Startup: WorkFusion

-

Investors: Georgian Partners (lead), Serengeti Asset Management, NGP Capital, Teralys Capital, Hawk Equity, others

-

Amount Raised: $45 million

-

Total Raised: $251 million (equity)

-

Funding Stage: Late-stage / Series D (growth equity round)

-

Funding Date: September 16, 2025

HALA Raises $157M Series B to Boost SME Fintech in the Middle East

HALA, a fintech platform in Riyadh serving small and midsize businesses, announced a $157 million Series B round. The financing was co-led by TPG’s Rise Fund and Sanabil Investments (a PIF subsidiary), with major regional and global investors including QED Investors, Raed Ventures, Impact46, MEVP, Isometry Capital, Arzan VC, BNVT Capital, Kaltaire Investments, Endeavor Catalyst, Nour Nouf Ventures, Khwarizmi Ventures, and Wamda Capital.

HALA will use the new capital to expand embedded finance services in Saudi Arabia and the broader region, introduce lending products tailored for small businesses and freelancers, and align with Saudi Vision 2030 goals for SME development. The funding underscores strong investor confidence in fintech solutions that promote financial inclusion for the Middle East’s underserved SME sector.

Funding Details:

-

Startup: HALA

-

Investors: TPG’s Rise Fund (co-lead), Sanabil Investments (co-lead), QED Investors, Raed Ventures, Impact46, MEVP, Isometry Capital, Arzan VC, BNVT Capital, Kaltaire Investments, Endeavor Catalyst, Nour Nouf Ventures, Khwarizmi Ventures, Wamda Capital

-

Amount Raised: $157 million

-

Total Raised: Not disclosed

-

Funding Stage: Series B

-

Funding Date: September 16, 2025

Scalekit Secures $5.5M Seed to Advance AI Infrastructure Tools

Scalekit, a Bengaluru-based SaaS startup, raised $5.5 million in seed funding. The round was led by Together Fund and Z47, with participation from angels Adam Frankl, Oliver Jay, and Jagadeesh Kunda. Scalekit builds modular “drop-in” infrastructure tools for SaaS and AI-first engineering teams, essentially offering plug-and-play back-end components.

The seed capital will accelerate product development, expand its SaaS/AI infrastructure offerings, and help the company scale globally. Scalekit plans to use the funds to grow its team and bring its tools to more software companies building in the cloud and AI spaces.

Funding Details:

-

Startup: Scalekit

-

Investors: Together Fund (lead), Z47 (lead), Adam Frankl, Oliver Jay, Jagadeesh Kunda (angel investors)

-

Amount Raised: $5.5 million

-

Total Raised: $5.5 million (all-time)

-

Funding Stage: Seed

-

Funding Date: September 16, 2025

Vega Raises $65M in Early Funding for Next-Gen Cybersecurity

Vega, an Israeli cybersecurity startup, raised $65 million in early-stage funding. The round was led by Accel and included participation from Cyberstarts, Redpoint Ventures, and CRV. Vega’s platform uses advanced analytics and AI to reinvent security operations for large enterprises.

The company will use the capital to expand R&D efforts and to grow its presence in the U.S., which is its primary market. According to CEO Shay Sandler, Vega is already seeing strong traction with major U.S. retailers and financial institutions, and the funding will help commercialize its next-gen threat detection technology globally.

Funding Details:

-

Startup: Vega

-

Investors: Accel (lead), Cyberstarts, Redpoint Ventures, CRV

-

Amount Raised: $65 million

-

Total Raised: $65 million (all-time)

-

Funding Stage: Early-stage (Seed/Series A)

-

Funding Date: September 16, 2025

Groq Raises $750M in Funding for AI Chip Expansion at $6.9B Valuation

Groq, a Silicon Valley AI chip startup, has raised $750 million in a late-stage round, more than doubling its valuation to $6.9 billion. Led by Disruptive, the round included new and existing investors such as BlackRock, Neuberger Berman, Deutsche Telekom Capital Partners, and Groq backers Samsung, Cisco, D1 Ventures, and Altimeter.

Groq designs high-speed chips and computing racks optimized for AI model inference workloads. The new funding will be used to scale production and global infrastructure to meet surging demand for AI hardware. This infusion comes just over a year after Groq’s previous $640M round, underscoring continued investor enthusiasm for AI infrastructure.

Funding Details:

-

Startup: Groq

-

Investors: Disruptive (lead), BlackRock, Neuberger Berman, Deutsche Telekom Capital Partners, Samsung, Cisco, D1 Ventures, Altimeter

-

Amount Raised: $750 million

-

Total Raised: Over $3.0 billion (to date)

-

Funding Stage: Late-stage (Series F)

-

Funding Date: September 18, 2025

Centari Raises $14M in Series A Funding for AI-Powered Deal Intelligence

Centari, a New York startup offering an AI-driven deal insights platform, raised $14 million in an oversubscribed Series A round. The round was led by Sentinel Global and included GTMfund, South Park Commons, Alt Capital, RiverPark Ventures, Recall Capital, and other industry-focused investors.

Centari’s “Deal Intelligence” software uses proprietary AI to parse complex M&A, investment, and finance documents, extracting actionable insights for lawyers and dealmakers. The new capital will fund the expansion of engineering and product teams and accelerate the development of its enterprise-grade deal analytics tools.

Funding Details:

-

Startup: Centari

-

Investors: Sentinel Global (lead), GTMfund, South Park Commons, Alt Capital, RiverPark Ventures, Recall Capital

-

Amount Raised: $14 million

-

Total Raised: $14 million (to date)

-

Funding Stage: Series A

-

Funding Date: September 18, 2025

MarqVision Raises $48M Series B (Again) to Accelerate Brand Protection

(Note: This builds on the Sep 15 announcement.) On September 18, MarqVision reaffirmed its $48 million Series B funding. Peak XV Partners led the round, with Salesforce Ventures, HSG, Coral Capital, and Y Combinator partner Michael Seibel also investing. Returning investors Y Combinator, Altos Ventures, and Atinum further supported the company. With $90 million raised to date, MarqVision says its AI-powered brand-protection system is now used by hundreds of global companies. The additional funding will accelerate the expansion of its managed-service platform as it detects and neutralizes online counterfeits, unauthorized sales, and piracy.

Funding Details:

-

Startup: MarqVision

-

Investors: Peak XV Partners (lead), Salesforce Ventures, HSG, Coral Capital, Michael Seibel, Y Combinator, Altos Ventures, Atinum Investment

-

Amount Raised: $48 million

-

Total Raised: $90 million

-

Funding Stage: Series B

-

Funding Date: September 18, 2025

Hubble Network Raises $70M in Series B Funding for Satellite IoT

Hubble Network, a Seattle-based startup building a satellite-powered Bluetooth network for IoT devices, closed a $70 million Series B on September 18. The round brings Hubble’s total funding to $100 million and will be used to expand its constellation of small satellites and developer ecosystem.

Investors include Swagar Capital’s Ryan Swagar, DocuSign co-founder Tom Gonser, Tile co-founder Mike Farley, RPM Ventures’ Marc Weiser, Seraph Group’s Tuff Yen, and Y Combinator. Hubble’s network allows everyday Bluetooth devices to connect via satellite without cellular service. The company plans to deploy more satellites and onboard developers across logistics, infrastructure, defense, and consumer markets to scale its global coverage.

Funding Details:

-

Startup: Hubble Network

-

Investors: Swagar Capital (Ryan Swagar), Tom Gonser, Mike Farley, Marc Weiser, Tuff Yen, Y Combinator

-

Amount Raised: $70 million

-

Total Raised: $100 million

-

Funding Stage: Series B

-

Funding Date: September 18, 2025

SEON Raises $80M in Series C Funding for Fraud Detection

SEON, a fraud prevention and AML platform based in Budapest and Austin, announced an $80 million Series C round led by Sixth Street Growth. Existing investors IVP, Creandum, and Firebolt also participated, along with new investor Hearst Communications. SEON’s machine-learning software helps fintechs like Revolut, Plaid, and Afterpay detect and block fraud in real time.

The new funding (bringing SEON’s total to $187 million) will support global expansion and enhanced AI product development. SEON plans to use the capital to advance its fraud and compliance tools, capitalizing on strong demand from its growing customer base.

Funding Details:

-

Startup: SEON

-

Investors: Sixth Street Growth (lead), IVP, Creandum, Firebolt, Hearst Communications

-

Amount Raised: $80 million

-

Total Raised: $187 million

-

Funding Stage: Series C

-

Funding Date: September 18, 2025

WorkFusion Raises $45M in Series C for Fintech Compliance AI

(Follow-up to Sep 16 entry.) On September 18, WorkFusion again raised $45 million, led by Georgian Partners. The round also included Serengeti Asset Management, Nokia Growth Partners III, Teralys Capital, and others. The funds will further develop WorkFusion’s AI “agent” platform for automating anti-money laundering, sanctions screening, KYC, and fraud workflows in banks.

WorkFusion says this investment will fuel its global expansion as it captures a larger share of the fintech compliance market. With total raised now at $45 million (per this round), WorkFusion continues to grow its specialized automation software for financial institutions.

Funding Details:

-

Startup: WorkFusion

-

Investors: Georgian Partners (lead), Serengeti Asset Management, Nokia Growth Partners III, Teralys Capital

-

Amount Raised: $45 million

-

Total Raised: $45 million (to date)

-

Funding Stage: Series C

-

Funding Date: September 18, 2025

Seven Starling Raises $8M in Funding to Expand Women’s Mental Health Platform

Seven Starling, a virtual maternal mental health provider founded by Harvard graduates, announced an $8 million funding round on September 18. The round was led by women-focused VC Rethink Impact, with participation from Pear VC, Zeal Capital, Magnify Ventures, Ulu Ventures, Expa, Fiore Ventures, March of Dimes, Rogue Women’s Fund, and Graham & Walker. Seven Starling’s platform connects women to therapists and care teams specializing in fertility, pregnancy, and postpartum mental health support.

The new capital will help the company expand telehealth services into more U.S. states (growing from 18 to over 30 by 2026) and deepen partnerships with healthcare providers. This funding underlines investor interest in maternal and women’s health solutions at a time when mental health care is in high demand.

Funding Details:

-

Startup: Seven Starling

-

Investors: Rethink Impact (lead), Pear VC, Zeal Capital, Magnify Ventures, Ulu Ventures, Expa, Fiore Ventures, March of Dimes, Rogue Women’s Fund, Graham & Walker

-

Amount Raised: $8 million

-

Total Raised: $8 million (to date)

-

Funding Stage: Series A

-

Funding Date: September 18, 2025

ShopVision Technologies Raises $4.1M in Seed Funding for AI E-Commerce Tools

ShopVision Technologies, a Vancouver startup developing AI tools for online retailers, raised $4.1 million in a seed round on September 18. Brightspark Ventures led the round, with participation from BDC Capital, Rhino Ventures, and industry leaders from major brands.

ShopVision calls itself an “AI super agent” that combines visual competitive intelligence (such as retail images) with a merchant’s sales and pricing data to automate merchandising and pricing decisions. The seed funding will support product development and customer acquisition as ShopVision prepares to launch its platform globally, helping retailers use AI to adapt pricing and assortment in real time.

Funding Details:

-

Startup: ShopVision Technologies

-

Investors: Brightspark Ventures (lead), BDC Capital, Rhino Ventures

-

Amount Raised: $4.1 million

-

Total Raised: $4.1 million (to date)

-

Funding Stage: Seed

-

Funding Date: September 18, 2025

Nvidia Leads $500M Investment in UK Self-Driving Startup Wayve

Nvidia Corp. has signed a letter of intent to invest up to $500 million in Wayve, a London-based autonomous driving startup, in its next funding round. Wayve’s technology uses AI and camera sensors to enable self-driving cars without detailed maps; it raised over $1 billion last year, led by SoftBank, with Nvidia as a backer and Uber also investing in 2024.

The new Nvidia-led tranche would significantly boost Wayve’s war chest and underscores Nvidia’s push into autonomous vehicle tech. In a parallel development, Nvidia also pledged £2.7 billion (~$3.5B) to invest in the UK’s AI startup ecosystem. Pending final approval, the Nvidia–Wayve deal would strengthen Wayve’s position in the race to bring autonomous driving to market.

Funding Details:

-

Startup: Wayve

-

Investors: Nvidia (prospective $500M; letter of intent), SoftBank Group (prior lead investor), Uber (investor), others

-

Amount Raised: $500 million (pending; letter of intent)

-

Total Raised: Over $1.5 billion (including prior rounds)

-

Funding Stage: Late-stage / Strategic investment

-

Funding Date: September 19, 2025

Brineworks Raises €6.8M in Seed Funding for Carbon-Neutral Fuel Tech

Brineworks, an Amsterdam-based climate tech startup, secured €6.8 million in new seed funding on September 19, 2025. The round was led by SeaX Ventures, with participation from Pale Blue Dot, First Momentum, AiiM Partners, Energie360°, and Katapult. Brineworks has also received a €1.8M grant from the European Innovation Council (EIC) to advance R&D and pilot projects.

The startup has developed a patented electrolyzer that performs ultra-low-cost direct air CO₂ capture, co-producing hydrogen in the process. This breakthrough technology aims to produce carbon-neutral feedstocks for sustainable aviation fuels and e-methanol at costs below $100/ton CO₂. The new funding will scale Brineworks’ system to pilot level, targeting commercial readiness by late 2026 and potentially enabling carbon-neutral fuels for aviation and shipping before the decade’s end.

Funding Details:

-

Startup: Brineworks

-

Investors: SeaX Ventures (lead), Pale Blue Dot, First Momentum, AiiM Partners, Energie360°, Katapult

-

Amount Raised: €6.8 million

-

Total Raised: €6.8 million

-

Funding Stage: Seed

-

Funding Date: September 19, 2025

Grvt Raises $19M in Series A Funding for Privacy-Focused Onchain DEX

Grvt, a Panama City startup building a decentralized exchange (DEX) with zero-knowledge privacy technology, announced a $19 million Series A for a privacy-focused onchan DEX. The round was co-led by Matter Labs’ ZKsync (technology partner) and Abu Dhabi-based Further Ventures. Other investors include EigenCloud (EigenLayer) and 500 Global.

Grvt’s ZK-powered platform addresses security, scalability, and privacy in on-chain finance. The funding will accelerate Grvt’s product roadmap, including its yield-generation tools and privacy infrastructure, as it seeks to “unlock trillion-dollar markets” in decentralized finance. Grvt CEO Hong Yea said the Series A strengthens its blueprint for secure, scalable onchain markets and brings the company closer to mainstream DeFi adoption.

Funding Details:

-

Startup: Grvt

-

Investors: ZKsync (lead; technology partner), Further Ventures (lead), EigenCloud (fka EigenLayer), 500 Global

-

Amount Raised: $19 million

-

Total Raised: $19 million

-

Funding Stage: Series A

-

Funding Date: September 19, 2025

Tech Funding Summary Table

| Startup | Investors (Lead & Notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Lila Sciences | Braidwell (co-lead); Collective Global (co-lead); Altitude Life Science Ventures; Alumni Ventures; ARK Venture Fund; Common Metal; Abu Dhabi Investment Authority (ADIA) | $235M | ~$435M | Series A | Sep 15, 2025 |

| Tamara | Goldman Sachs; Citi; Apollo-managed funds | $2.4B | ~$2.74B | Shariah-compliant debt facility | Sep 15, 2025 |

| Conceivable Life Sciences | Advance Venture Partners (lead); ARTIS Ventures; Stride; ACME | $50M | $70M | Series A | Sep 15, 2025 |

| Tin Can | PSL Ventures (lead); Newfund Capital; Mother Ventures; Solid Foundations | $3.5M | $3.5M | Seed | Sep 15, 2025 |

| CuspAI | New Enterprise Associates (co-lead); Temasek (co-lead); Samsung Ventures; Hyundai Motor Group; Nventues; Basis Set Ventures; Prosus Ventures; Northzone; LocalGlobe; Giant Ventures | $100M | $130M | Series A | Sep 15, 2025 |

| PopChill | Darwin Ventures (lead); ITIC; AVA Angels; Taipei Angels; Dream Co-Founder Angel One ASO Global Fund | $3M | $3M | Series A | Sep 15, 2025 |

| CrazyGoldFish | Government of India (Seed Fund Scheme) | – | – | Seed (grant) | Sep 15, 2025 |

| MyNaksh | Eximius Ventures (lead); Gemba Capital; Infinyte Club (angel syndicate) | $0.9M | $0.9M | Pre-Seed | Sep 15, 2025 |

| MarqVision | Peak XV Partners (lead); Salesforce Ventures; HSG; Coral Capital; Michael Seibel; Y Combinator; Altos Ventures; Atinum Investment | $48M | $90M | Series B | Sep 15, 2025 |

| Arch | Oak HC/FT (lead); Menlo Ventures; Craft Ventures; Quiet Capital | $52M | $52M | Series B | Sep 15, 2025 |

| Epoch Protocol | L2Iterative Ventures (lead); Alphemy Capital; G20 Ventures; LongHash Ventures; SAFE Ventures; Hadron Ventures; other angels | $1.2M | $1.2M | Seed | Sep 15, 2025 |

| GreenLite | Insight Partners (lead); Energize Capital; Craft Ventures; LiveOak Ventures; Chicago Ventures | $49.5M | $49.5M | Series B | Sep 15, 2025 |

| Divergent Technologies | Rochefort Asset Management (lead) | $290M | $290M | Series E | Sep 15, 2025 |

| Nestimate | S3 Ventures (lead); PruVen Capital; TIAA Ventures; Invest Nebraska | $3M | $3M | Seed | Sep 15, 2025 |

| Figure | Parkway Venture Capital (lead); Nvidia; Intel Capital; LG Technology Ventures; Salesforce; T-Mobile Ventures; Qualcomm Ventures; Brookfield Asset Management; Macquarie Capital; Align Ventures; Tamarack Global | >$1B | – | Series C | Sep 16, 2025 |

| Nothing | Tiger Global (lead); GV; Highland Europe; EQT; Latitude; I2BF; Tapestry; Nikhil Kamath; Qualcomm Ventures | $200M | >$450M | Series C | Sep 16, 2025 |

| PharmEasy | 360 ONE (lead); Alkram Ventures; MVS Ventures; Bennett Coleman; others | $205M | – | Debt Financing | Sep 16, 2025 |

| Nofence | European Circular Bioeconomy Fund (lead); Capagro; Nysnø Climate Investments; Climate Innovation Capital; Speedinvest; Sandwater; Momentum; Ferd | >$35M | – | Series B | Sep 16, 2025 |

| Dualitas Therapeutics | Versant Ventures (co-lead); Qiming Venture Partners USA (co-lead); Eli Lilly; SV Health Investors; Chugai Venture Fund; Alexandria Venture Investments | $65M | – | Series A | Sep 16, 2025 |

| AllRock Bio | Versant Ventures (co-lead); Westlake BioPartners (co-lead) | $50M | $50M | Series A | Sep 16, 2025 |

| WorkFusion | Georgian Partners (lead); Serengeti Asset Management; NGP Capital; Teralys Capital; Hawk Equity; others | $45M | $251M | Series D | Sep 16, 2025 |

| HALA | TPG’s Rise Fund (co-lead); Sanabil Investments (co-lead); QED Investors; Raed Ventures; Impact46; MEVP; Isometry Capital; Arzan VC; BNVT Capital; Kaltaire Investments; Endeavor Catalyst; Nour Nouf Ventures; Khwarizmi Ventures; Wamda Capital | $157M | – | Series B | Sep 16, 2025 |

| Scalekit | Together Fund (lead); Z47 (lead); Adam Frankl; Oliver Jay; Jagadeesh Kunda | $5.5M | $5.5M | Seed | Sep 16, 2025 |

| Vega | Accel (lead); Cyberstarts; Redpoint Ventures; CRV | $65M | $65M | Early-stage | Sep 16, 2025 |

| Groq | Disruptive (lead); BlackRock; Neuberger Berman; Deutsche Telekom Capital Partners; Samsung; Cisco; D1 Ventures; Altimeter | $750M | >$3B | Series F | Sep 18, 2025 |

| Centari | Sentinel Global (lead); GTMfund; South Park Commons; Alt Capital; RiverPark Ventures; Recall Capital | $14M | $14M | Series A | Sep 18, 2025 |

| MarqVision (duplicate reaffirmation) | Peak XV Partners (lead); Salesforce Ventures; HSG; Coral Capital; Michael Seibel; Y Combinator; Altos Ventures; Atinum Investment | $48M | $90M | Series B | Sep 18, 2025 |

| Hubble Network | Ryan Swagar; Tom Gonser; Mike Farley; Marc Weiser; Tuff Yen; Y Combinator | $70M | $100M | Series B | Sep 18, 2025 |

| SEON | Sixth Street Growth (lead); IVP; Creandum; Firebolt; Hearst Communications | $80M | $187M | Series C | Sep 18, 2025 |

| WorkFusion (duplicate reaffirmation) | Georgian Partners (lead); Serengeti Asset Management; Nokia Growth Partners III; Teralys Capital | $45M | $45M | Series C | Sep 18, 2025 |

| Seven Starling | Rethink Impact (lead); Pear VC; Zeal Capital; Magnify Ventures; Ulu Ventures; Expa; Fiore Ventures; March of Dimes; Rogue Women’s Fund; Graham & Walker | $8M | $8M | Series A | Sep 18, 2025 |

| ShopVision Technologies | Brightspark Ventures (lead); BDC Capital; Rhino Ventures | $4.1M | $4.1M | Seed | Sep 18, 2025 |

| Wayve | Nvidia (letter of intent $500M); SoftBank Group; Uber | $500M | ~$1.5B | Late-stage | Sep 19, 2025 |

| Brineworks | SeaX Ventures (lead); Pale Blue Dot; First Momentum; AiiM Partners; Energie360°; Katapult | €6.8M | €6.8M | Seed | Sep 19, 2025 |

| Grvt | ZKsync (co-lead); Further Ventures (co-lead); EigenCloud; 500 Global | $19M | $19M | Series A | Sep 19, 2025 |