The World’s Most Valuable Private Companies in 2025

World’s 50 Most Valuable Private Companies (2025 Rankings)

Going public is often the milestone companies dream about — the big IPO moment that brings fresh capital, Wall Street attention, and a splash of credibility. But not every business follows that path. Some of the world’s most valuable companies remain private by choice. Many of these firms began as scrappy startups before growing into giants that rival public companies in scale, avoiding the pressure of quarterly earnings and shareholder demands, and instead staying under the control of founders, employees, and private backers.

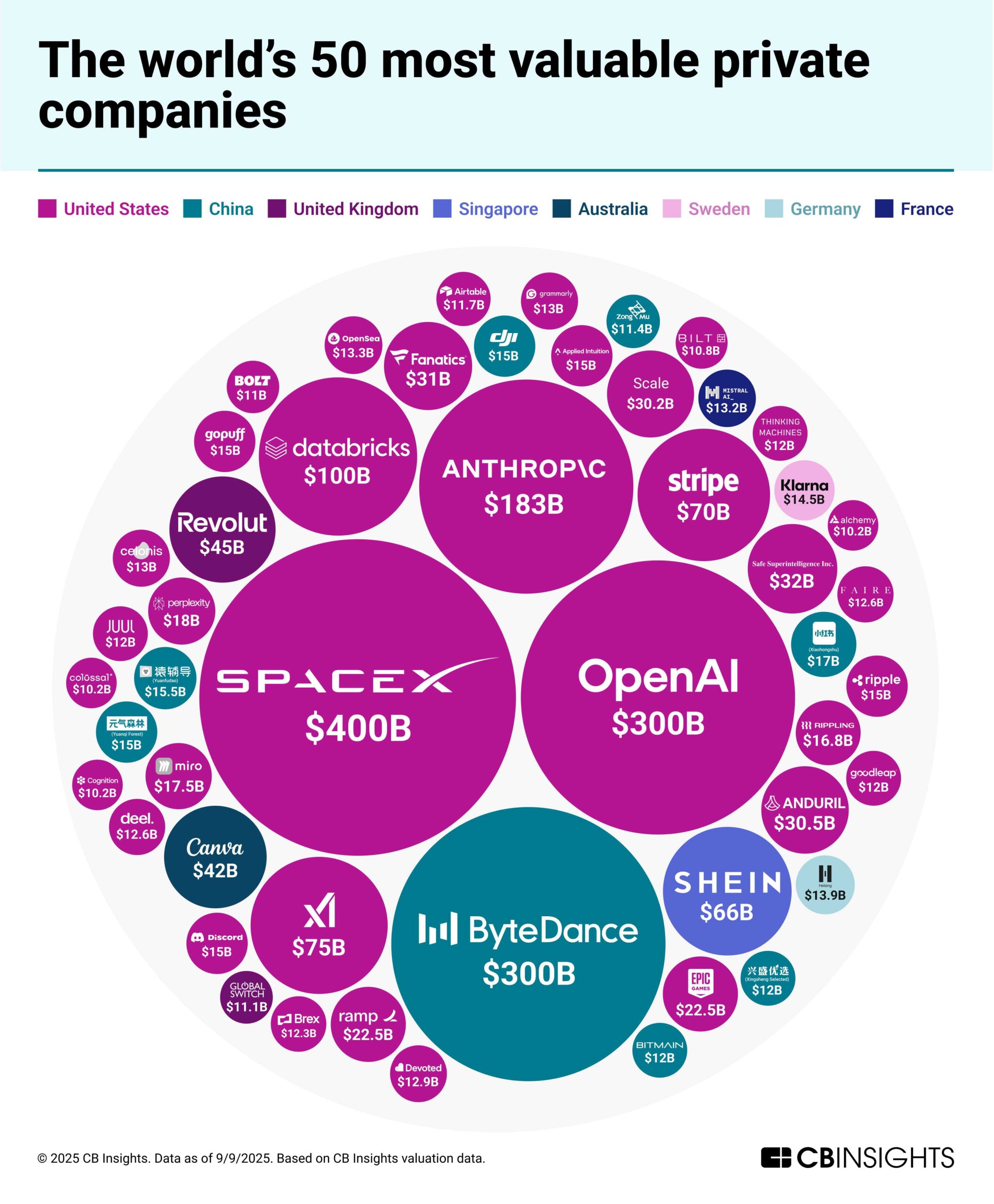

And they’re hardly small players. Private firms today rival, and sometimes surpass, publicly traded giants in both valuation and influence. According to CB Insights’ latest data in September 2025, the 50 most valuable private companies are collectively worth more than $2.5 trillion. Their reach spans tech, finance, retail, and energy — with dominance concentrated in the United States and China, and a rising share of new players in AI, fintech, and e-commerce.

The numbers tell the story. U.S. and Chinese companies account for 86% of the top 50, while AI startups alone make up 40%. OpenAI, the maker of ChatGPT, is reportedly on track for a $500 billion valuation, putting it closer to the league of Apple, Microsoft, and Nvidia than to other startups. For perspective, the combined valuation of the top 50 still doesn’t even equal half of Nvidia’s market cap of $4.3 trillion — a reminder of how massive the public tech titans remain.

SpaceX leads the private pack at $400 billion, propelled by reusable rockets and its growing Starlink satellite network. Elon Musk’s aerospace venture has stretched far beyond traditional industry limits and cemented its position as a company shaping the future of space. Just behind are two $300 billion heavyweights: OpenAI, whose work in generative AI is redefining software, and ByteDance, the TikTok parent that built an empire on algorithm-driven content despite mounting global scrutiny.

China’s presence on the list is anchored by ByteDance, Xiaohongshu, DJI, and Yuanfudao, underscoring the country’s grip on consumer tech and hardware. The U.S., meanwhile, dominates the list with 31 entries, including Anthropic, xAI, and Safe Superintelligence — all AI ventures drawing unprecedented investor interest.

This ranking highlights more than just valuation tables; it reflects where private capital is flowing and which industries are capturing investor confidence. Below, we spotlight the top 50 most valuable private companies in 2025, using CB Insights’ latest data as of September. The chart visualization tracks valuation by sector and geography, offering a clear look at the companies shaping tomorrow’s global economy.

The World’s 50 Most Valuable Private Companies in 2025

Based on CB Insights data from September 2025, the table below ranks the world’s 50 most valuable private companies by their latest reported valuations.

|

Rank

|

Company

|

Valuation ($B)

|

Country

|

Key Focus Area

|

|---|---|---|---|---|

|

1

|

SpaceX

|

400

|

United States

|

Aerospace & Satellites

|

|

2

|

ByteDance

|

300

|

China

|

Social Media & Content

|

|

3

|

OpenAI

|

300

|

United States

|

Artificial Intelligence

|

|

4

|

Databricks

|

100

|

United States

|

Data Analytics & AI

|

|

5

|

Stripe

|

70

|

United States

|

Fintech Payments

|

|

6

|

SHEIN

|

66

|

Singapore

|

Fast Fashion E-Commerce

|

|

7

|

Revolut

|

45

|

United Kingdom

|

Digital Banking

|

|

8

|

Canva

|

42

|

Australia

|

Graphic Design Software

|

|

9

|

Anduril

|

30.5

|

United States

|

Defense Technology

|

|

10

|

Epic Games

|

22.5

|

United States

|

Gaming & Metaverse

|

|

11

|

Fanatics

|

31

|

United States

|

Sports Merchandise

|

|

12

|

Anthropic

|

18.3

|

United States

|

Artificial Intelligence

|

|

13

|

Perplexity

|

18

|

United States

|

AI Search

|

|

14

|

Miro

|

17.5

|

United States

|

Collaboration Software

|

|

15

|

Rippling

|

17

|

United States

|

HR & Payroll Tech

|

|

16

|

Xiaohongshu

|

17

|

China

|

Social E-Commerce

|

|

17

|

Gopuff

|

15

|

United States

|

On-Demand Delivery

|

|

18

|

Discord

|

15

|

United States

|

Communication Platform

|

|

19

|

Ripple

|

15

|

United States

|

Blockchain & Payments

|

|

20

|

DJI

|

15

|

China

|

Drones & Consumer Electronics

|

|

21

|

Yuanfudao

|

15.5

|

China

|

EdTech

|

|

22

|

Chime

|

25

|

United States

|

Digital Banking

|

|

23

|

Klarna

|

10.5

|

Sweden

|

Buy Now, Pay Later

|

|

24

|

Scale AI

|

14

|

United States

|

Data Annotation for AI

|

|

25

|

OpenSea

|

13.3

|

United States

|

NFT Marketplace

|

|

26

|

Celonis

|

13

|

Germany

|

Process Mining

|

|

27

|

Ramp

|

12.5

|

United States

|

Corporate Cards & Spend Mgmt

|

|

28

|

Devoted Health

|

12.9

|

United States

|

Healthcare Insurance

|

|

29

|

Brex

|

12

|

United States

|

Corporate Credit Cards

|

|

30

|

Bitmain

|

12

|

China

|

Cryptocurrency Mining

|

|

31

|

Deel

|

12.6

|

United States

|

Global Payroll

|

|

32

|

Faire

|

12.6

|

United States

|

Wholesale Marketplace

|

|

33

|

Global Switch

|

11

|

United Kingdom

|

Data Centers

|

|

34

|

Checkout.com

|

11

|

United Kingdom

|

Payments Processing

|

|

35

|

Bolt

|

11

|

United States

|

E-Commerce Checkout

|

|

36

|

Airtable

|

11.7

|

United States

|

Collaboration Database

|

|

37

|

Alchemy

|

10

|

United States

|

Blockchain Developer Tools

|

|

38

|

Colossal

|

10

|

United States

|

Biotechnology (De-extinction)

|

|

39

|

Bilt

|

10.8

|

United States

|

Rewards & Rent Payments

|

|

40

|

Cognition Labs

|

10.2

|

United States

|

AI Research

|

|

41

|

JULO

|

12

|

Indonesia

|

Fintech Lending

|

|

42

|

Yuanqi Senlin

|

15

|

China

|

Beverages

|

|

43

|

Safe Superintelligence

|

30

|

United States

|

AI Safety

|

|

44

|

xAI

|

24

|

United States

|

Artificial Intelligence

|

|

45

|

Grammarly

|

13

|

United States

|

Writing Assistance

|

|

46

|

GoodLeap

|

12

|

United States

|

Solar Financing

|

|

47

|

Xingsheng Youxuan

|

12

|

China

|

Grocery Delivery

|

|

48

|

ZongMu Tech

|

11

|

China

|

Autonomous Driving

|

|

49

|

Huolala

|

10

|

China

|

Ride-Hailing & Logistics

|

|

50

|

JUUL Labs

|

12

|

United States

|

Vaping Products

|

Most Valuable Private Companies in The World By Valuation

Among the top names, a handful stand out for both scale and influence — SpaceX at $400 billion, OpenAI closing in on $500 billion, and ByteDance holding strong at $300 billion. Together, these giants show how private companies are reshaping industries from aerospace to artificial intelligence to consumer platforms, even as their public market peers dominate the headlines.

The leaders at the top of this year’s list reflect the private market’s appetite for high-growth tech. SpaceX’s valuation captures more than just rocket launches — its Starlink satellite network is reshaping broadband access in underserved regions on Earth. OpenAI’s rise, fueled by its close partnership with Microsoft, signals how central artificial intelligence has become, with AI firms now representing 40% of the top 50. ByteDance, meanwhile, continues to defy geopolitical tension, sustaining global user engagement and generating revenues that rival Meta.

U.S. and China Hold the Crown

The color-coded bubbles in the chart make one point clear: the U.S. dominates. Roughly 70% of the top 50 private companies are American, backed by deep venture capital pools and an ecosystem built for scaling. From AI players like Anthropic to fintech giants like Stripe, the U.S. remains the hub for high-value startups.

China follows with fewer names but heavyweight valuations. ByteDance still commands the spotlight, while e-commerce powerhouse SHEIN, strategically headquartered in Singapore but operating from Chinese supply chains, shows how agility and manufacturing strength underpin Asia’s rise in private markets.

Other countries manage to punch above their weight. Canva in Australia ($42 billion) has made design software accessible to everyone, Revolut in the UK ($45 billion) is reshaping consumer banking, Klarna in Sweden ($10.5 billion) and Celonis in Germany ($13 billion) bring European weight to fintech and enterprise software, and Faire in France ($12.6 billion) underscores the quiet growth of wholesale e-commerce.

Sector Currents: AI, Fintech, and Consumer Platforms

Artificial intelligence dominates the valuation charts. Databricks, now at $100 billion, powers enterprise AI with its lakehouse platform, while Anduril ($30.5 billion) applies AI to defense and autonomy. This AI surge is reinforced by secondary share sales, giving companies liquidity and valuations once reserved for IPOs — OpenAI’s rumored $500 billion mark being the boldest example.

Fintech continues to hold strong, with Stripe, Revolut, and Ripple ($15 billion) redefining global payments and digital finance. Consumer platforms also carry weight: Epic Games ($22.5 billion) and Discord ($15 billion) thrive on community and play, while e-commerce challengers like Gopuff ($15 billion) lean on instant delivery to capture attention. Legacy industries are largely absent, showing how investors are concentrating on sectors with scalability and technology at their core.

The Shape of Private Markets in 2025

CB Insights’ September 2025 snapshot shows how the private market has matured. Companies are staying private longer — on average, 16 years before going public, compared with 12 a decade ago. Secondary transactions are now standard practice, giving early investors liquidity while avoiding the volatility of stock exchanges. But risks remain. Geopolitical tension could slow China’s advance, and regulatory scrutiny on AI in the U.S. may temper growth across the sector.

For now, though, ambition defines the list. SpaceX is pushing humanity toward Mars, OpenAI is advancing artificial intelligence at an unprecedented scale, and ByteDance continues to shape global culture through algorithm-driven content. The loudest stories may come from Wall Street, but many of the world’s most valuable companies are still private startups — and they’re setting the pace for what’s next.

Data sourced from CB Insights’ September 2025 valuation analysis.