Home battery startup Base Power targets $4B valuation after $200M series B backed by a16z and Lightspeed

Texas has seen its share of power struggles, but the latest one isn’t political—it’s about who controls the future of home energy. Just four months after raising $200 million in Series B funding, Austin-based Base Power is already eyeing a $4 billion valuation as it looks to scale its grid-connected home batteries across the state and beyond, The Information reported Friday.

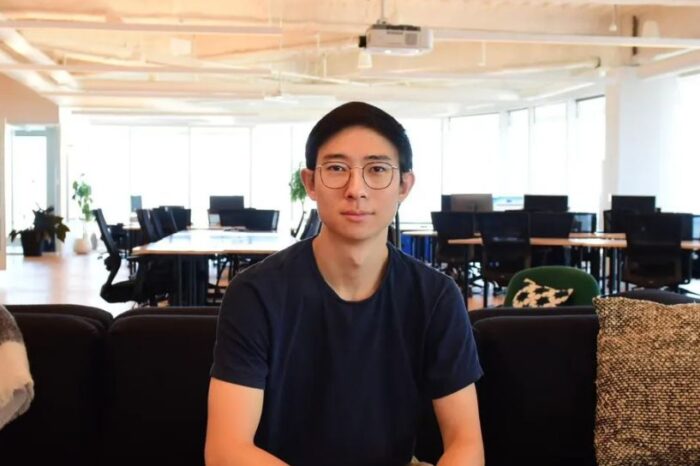

Founded in June 2023 by Zach Dell—son of Dell Technologies founder Michael Dell—and Justin Lopas, Base Power is pitching itself as America’s next-generation power company. Its bet: distributed home batteries, installed cheaply in houses across Texas, that double as a personal backup system and a collective force for stabilizing the state’s fragile grid.

How Base Power Works

Instead of selling batteries outright like Tesla does with its Powerwall, Base Power installs lithium iron phosphate batteries—usually 20–30 kWh—in customer homes with almost no upfront cost. Homeowners pay a one-time installation fee of $495 to $2,000, plus around $16 a month, and commit to buying electricity from Base Power at competitive rates. In return, they get backup power during outages that can keep the lights on for a full day, while Base Power aggregates those batteries into a massive virtual power plant.

This VPP model allows Base Power to participate in Texas’ wholesale energy markets by charging batteries when electricity is cheap and discharging when prices spike. It’s arbitrage at grid scale, but with consumer benefits baked in. As co-founder Zach Dell put it, “We’re selling you more affordable, more reliable power… with more affordable pricing and a battery to protect your home from power outages.”

That proposition looks especially attractive in Texas, where blackouts and price volatility are no longer rare events. Unlike many traditional providers, Base Power is vertically integrated—handling installation, operations, and maintenance itself—making the customer experience more straightforward than competitors that lean on third-party contractors.

Growth and Funding

Base Power has been moving fast. Since its commercial launch in May 2024, it’s gone from serving a few towns outside Austin to more than 70 municipalities, including Houston and Dallas, with an NPS score around 80. Installations jumped from one a week to 20 a day, and the company deployed over 10 MWh of storage in a single month this summer.

Backed by Addition, Andreessen Horowitz (a16z), Lightspeed, Valor Equity Partners, Thrive Capital, and others, the $200 million Series B announced in April 2025 is fueling that scale-up. Investors like Lee Fixel of Addition and Antonio Gracias of Valor have already joined the board. The company is building a factory near Austin to manufacture thousands of batteries weekly and aims to install the equivalent of a utility-scale plant—100 MWh—by mid-2025.

Partnerships have helped accelerate adoption. Base Power struck a deal with Lennar to integrate batteries into new homes and launched a pilot with Bandera Electric Cooperative, where the utility pays for dispatchable capacity from Base’s distributed fleet. Those models give the company a playbook for entering regulated markets outside Texas.

The Push for $4 Billion

Base Power is now in talks to raise as much as $1 billion at a $4 billion valuation, part of a broader wave where battery startups are chasing lofty price tags, snapping up distressed assets, and leaning on AI for an edge. That would mark a twentyfold jump over its Series B valuation, reflecting the intense investor appetite for energy storage as AI data centers, electric vehicles, and renewable energy strain existing grids.

“Texas-based Base Power is seeking a $4B valuation as it scales home battery installs tied to the grid,” The Information reported.

The flood of capital raises a familiar question: will these plays lead to lasting profits—or just fuel the hype cycle?

For Base Power, the company’s pitch is that its vertically integrated model can scale faster than competitors, that its software makes sub-second fleet management possible, and that Texas’ deregulated market is the perfect testbed. If it can prove out the economics and reliability, the upside could be huge—not just for the company, but for a grid struggling under the weight of electrification.

Looking Ahead

Base Power’s challenge is hardware scale-up—thermal management, supply chain, and manufacturing are never easy in this business. But if the company hits its goals, it could quickly become one of the largest distributed storage providers in the U.S.

As Lopas described it, the goal is a “deployment factory” where everything from signup to installation is streamlined. That’s how Base Power believes it can turn a young startup into a multi-billion-dollar force in energy.

And in a state where the grid can fail with little warning, the idea of reliable, affordable backup power is more than just a nice-to-have—it’s survival.