Character.AI in talks to sell or raise new funding as chatbot costs pile up

Just a year after cutting 5% of staff and losing its founders to Google, Character.AI is once again at a crossroads. The chatbot startup is weighing a sale or raising fresh capital as it struggles with the steep costs of running its AI models, according to an exclusive from The Information.

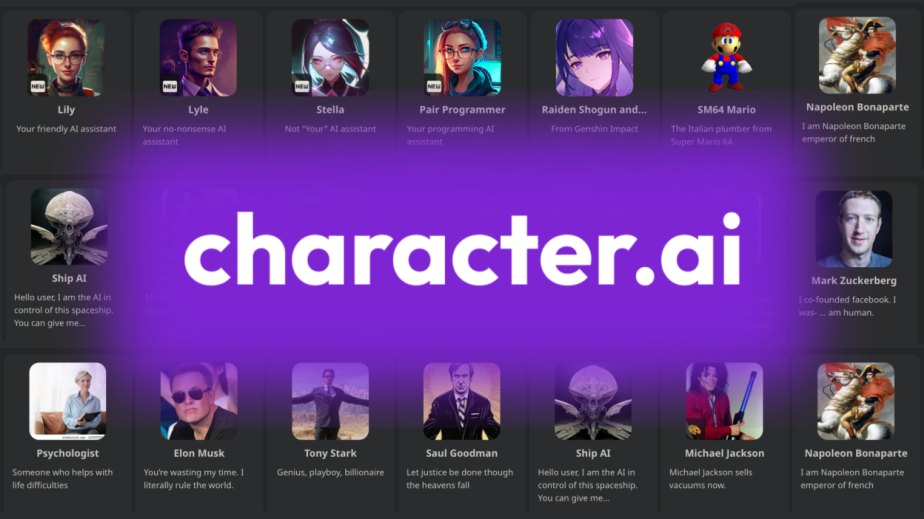

The company, best known for letting users create and chat with customizable characters, has reportedly been in talks with bankers about a potential sale while also sounding out investors for new funding. The move comes as expenses tied to operating its chatbots mount, with massive compute demands required to keep interactions seamless for millions of users.

“A year after its founders left, Character.AI is discussing a sale or raising more money, as it grapples with the costs of running its chatbots,” The Information reported.

At its peak, Character.AI was valued at around $2.5 billion, a number tied to a 2024 licensing deal with Google. But the pressures facing consumer AI are now on full display — high infrastructure costs, legal scrutiny, and an increasingly crowded field of competitors all loom large.

A turbulent ride

Founded in 2021 by ex-Google engineers Noam Shazeer and Daniel De Freitas, Character.AI quickly became a darling of the AI boom. The company raised $193 million in total, including a $150 million Series A led by Andreessen Horowitz in 2023 that gave it a $1 billion valuation. By early 2025, estimates put its value anywhere between $5 billion and $10 billion.

Then came the Google deal in August 2024. Described as a “reverse acquihire,” it sent Shazeer, De Freitas, and more than two dozen researchers back to Google’s AI division. Google walked away with a non-exclusive license to Character.AI’s models and bought out venture investors at a $2.5 billion valuation. For Character.AI, it meant leaning less on proprietary large language models and more on open-source alternatives like Meta’s Llama — a move that lowered training costs but didn’t erase the financial weight of scaling.

Leadership shifted again in June 2025, when former Meta executive Karandeep “Karan” Anand took over as CEO. Anand steered the company toward entertainment and creative interactions, shifting focus from lofty AGI ambitions to role-playing, fictional scenarios, and new features aimed at keeping users engaged. He’s said the platform now taps models from providers like Alibaba’s Qwen and DeepSeek, which he claims outperform in-house systems while being cheaper to run.

Growth meets heavy costs

On the surface, the numbers are impressive. By early 2025, Character.AI boasted more than 20 million monthly active users — over half of them Gen Z or Gen Alpha, with 55% female. Users spend an average of 75 minutes daily on the app, building over 9 million characters a month. The mobile app has crossed 40 million downloads, with features like Scenes (interactive storytelling), AvatarFX (animated avatars), and Imagine (chat-driven video creation) keeping growth steady.

Revenue is rising too. The company hit an annualized run rate of more than $30 million in 2025, double its 2023 figure. Its $9.99 subscription plan, c.ai+, has seen subscriber growth of 250% in just six months. Ads and rewards add to the mix. Still, Anand has admitted that monetization only became a serious focus recently, and AI infrastructure costs remain punishing.

The company’s financial strain is compounded by an industry-wide slowdown in fundraising. Training and operating generative AI models demands billions in capital, and investors are tightening their wallets. Competitors like Chai, Janitor AI, and Replika are luring away users with fewer content restrictions, particularly for NSFW chats.

Legal fights and safety debates

The company is also under growing scrutiny from regulators and lawmakers. In October 2024, it was sued after the mother of a 14-year-old alleged the platform fostered harmful emotional ties that contributed to her son’s suicide. A separate lawsuit in Texas claimed Character.AI encouraged self-harm in a 17-year-old.

This year, Texas Attorney General Ken Paxton opened an investigation into both Character.AI and Meta for allegedly misleading children with mental health claims. Senators in Washington have also raised questions about the platform’s risks to minors.

Character.AI has since stepped up its trust and safety efforts. About 10% of its 70 employees now work in the area, and the company rolled out features like age verification, under-18 models, and parental oversight tools. But issues persist — users complain about overly strict filters, and the platform faces copyright headaches over bots imitating celebrities. To mitigate that, the company is reportedly exploring official partnerships.

What comes next

If Character.AI sells, it could attract a big tech buyer looking to beef up its AI-driven entertainment offerings. If it raises instead, the fresh capital might give it time to refine its products, expand monetization, and shore up safety measures.

Either path highlights a bigger challenge: consumer AI is brutally expensive to run. Even with tens of millions of users and solid revenue growth, the costs of inference and infrastructure are eating into momentum.

Anand has pitched Character.AI as a “multi-modal UGC platform,” part social media, part AI playground. Whether that vision can be sustained depends on what happens next — and could hint at how other consumer AI startups will fare as the hype cycle collides with economic reality.

Character.AI co-founders Noam Shazeer and Daniel De Freitas