Figma pops 250% in IPO debut, pushing design startup to $68 billion valuation

Figma’s long-awaited IPO landed with a bang on Thursday, as shares of the collaborative design software startup more than tripled in their New York Stock Exchange debut. Priced at $33, the stock opened at $85 and surged as high as $112 before closing the day at $115.50—a jaw-dropping 250% gain that puts Figma’s market value just shy of $70 billion.

The explosive debut signals something bigger: the tech IPO window may finally be creaking back open. After nearly three years of drought, the public markets have seen a wave of fresh listings in recent months, including Chime, Circle, CoreWeave, Hinge Health, and Omada Health. But Figma’s performance is by far the loudest wake-up call.

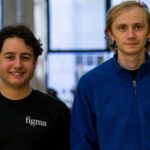

The IPO is a major win for CEO Dylan Field, 33, whose personal stake in the company is now worth over $6 billion. Speaking on CNBC’s Squawk Box Thursday morning, Field kept things grounded. “The most important thing to remind myself of, the team of, is share price is a moment in time,” he said. “We’re going to see all sorts of behavior probably today, over the weeks ahead.”

Founded in 2012 by Dylan Field and Evan Wallace, Figma has become a staple in design teams—and increasingly, non-design teams—thanks to its real-time collaboration tools. What started as a niche product for interface design has evolved into a workplace mainstay used for brainstorming, prototyping, and building everything from pitch decks to app interfaces. Google, Microsoft, Netflix, Uber, and Coinbase are all customers. More than 13 million people use Figma every month, and two-thirds of them aren’t even designers.

Figma’s IPO Debut: From Failed $20B Adobe Deal to $68B Valuation

Figma’s journey to the public markets hasn’t been straightforward. In 2022, Adobe agreed to acquire the company for $20 billion, a deal that would’ve been one of the largest in software history. But the merger fell apart in late 2023 after regulators in the UK and Europe raised concerns about competition. With that door closed, Figma quietly filed for an IPO just three months ago—and it’s been full steam ahead since.

On the business side, things are trending in the right direction. The company generated $247 million to $250 million in revenue last quarter, with sales growing 40% year over year and operating income between $9 million and $12 million. More than 1,000 enterprise clients are paying at least $100,000 annually, according to the company’s prospectus. Its bottom-up product-led growth strategy continues to pay off.

“Figma’s product is its primary marketing engine,” said Tomasz Tunguz of Theory Ventures. “Its collaborative nature fosters viral, bottoms-up adoption, leading to a best-in-class sales efficiency.”

Figma originally expected to price shares between $25 and $28. That was bumped to $30 to $32 earlier this week, and finally landed at $33. The company raised $1.2 billion in the offering, with most of that going to early investors like Greylock, Sequoia, Index Ventures, and Kleiner Perkins.

The IPO also breathes life into San Francisco’s tech scene. Lynn Martin, president of the NYSE, told Squawk on the Street that the strong reception could bring more deals to market. “I think this will open the floodgates,” she said.

Even with the public market enthusiasm, Figma’s not sitting still. Field has hinted at plans to pursue aggressive M&A, even if it might “not seem immediately rational.” At the same time, the company is threading a needle with AI—doubling down on it while being fully aware that generative tools could eventually reduce the need for manual design altogether.

Still, none of that seemed to matter on Thursday. Figma’s debut wasn’t just a win for one company—it might have just set the tone for the next wave of tech IPOs.