Clean Energy Finance Is Broken – Why Decentralization Could be the Gamechanger

Clean energy is one of the important topics in today’s climate-conscious world; it aligns with the UN Sustainable Development Goal 7, which focuses on access to affordable, reliable, sustainable, and modern energy for all by 2030.

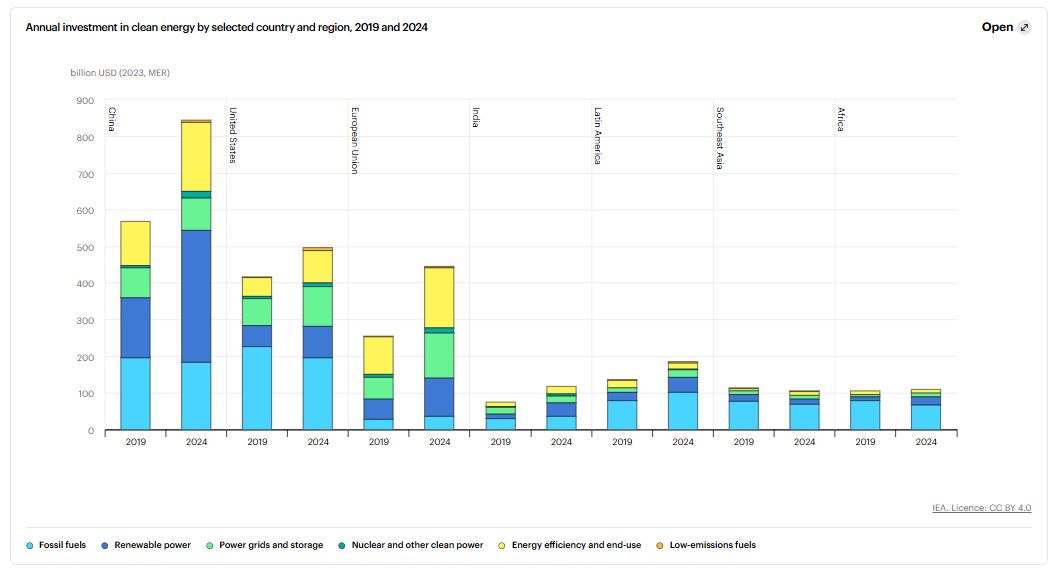

According to the latest report by the International Energy Agency (IEA), the world is now investing twice as much in clean energy compared to fossil fuels. In 2024, projections revealed that out of the $3 trillion set for allocation on global energy investments, $2 trillion was to be directed towards clean energy infrastructure and related technologies.

While the numbers are impressive, clean energy finance in its current state is broken. Capital struggles to reach projects where it’s needed most, especially in emerging markets. For context, Emerging Market and Developing Economies (EMDE) outside China only account for a mere 15% of the annual investments allocated towards clean energy spending.

Source: IEA

Loopholes in the Current Clean Energy Finance System

That’s just the tip of the iceberg. This section will highlight in detail some of the fundamental challenges before diving into the value proposition of decentralizing the clean energy financing market.

1. Legacy systems are slow, centralized, and institution-dominated

One of the major problems that clean energy finance faces is the reliance on centralized institutions, from governments that are tasked with policymaking to large banks that handle transactions. There have been many times when the bureaucracy of such established institutions has become a hurdle in advancing the climate change agenda. A good example is the divided stance by U.S. authorities, regardless of the administration in power.

2. “Mega-polluters” taking advantage of the surplus financing

Ironically, some of the companies that are known to produce the most carbon emissions have been the largest beneficiaries of the so-called sustainability-linked loans (SLLs). According to an article by Associated Press (AP) News, banks have allocated over $286 billion in SLL loans, but there’s a worrying trend. Some of these notorious polluters are using the loans to expand their businesses or improve their reputation while completely neglecting the obligation to reduce environmental harm.

3. Retail Investors face high barriers to entry

Another serious challenge in the clean energy financing model is its focus on governments, institutions, and high net worth individuals while leaving out the larger retail population. Think about it, it is almost impossible for the average retail investor to get a $100 exposure in clean energy financing markets; on the other hand, institutions are busy making boardroom deals that will have a huge impact on our climate. Why not let everyone have a say by getting a piece of the pie?

4. Low ESG transparency

Lastly, clean energy financing is not as transparent as it should be. Some of the notable instances that have exposed this shortcoming include Shell’s $10 billion sustainability-linked loan (SLL), whereby the company managed to secure the loan with vague ESG metrics. Deutsche Bank’s DWS has also been in the spotlight for overstating its allocations in ESG investments; the asset manager was recently fined $27 million for greenwashing by German authorities.

Decentralization Meets Clean Energy Finance

By now, you’ve likely heard about cryptocurrencies, but what exactly stands out about this new form of money? The decentralized nature of the underlying infrastructure. Imagine a global monetary system that is not controlled by central banks or the Fed but rather the people who use it; that’s the main idea behind decentralization. Similarly, clean energy finance stands to benefit a great deal from decentralizing the whole funding system.

To provide some more context, let’s take the example of Ecoyield, a decentralized platform that has been specifically built to tokenize clean energy infrastructure, making it possible for the average investor to fund renewable energy projects in return for a verifiable on-chain yield. In other words, everyday users can allocate as little as $100 towards global solar and battery projects through Ecoyield and earn passive income from their investments.

Ecoyield’s decentralized clean energy funding platform is also built on the core principle of asset-backed yield. This is derived from the fact that Ecoyield places investors’ capital to use in projects that actually have an impact and are revenue-generating. For example, one of the projects that is up for investment at the moment (30 kW Hydro Turbine in North Yorkshire, UK) can yield an estimated APY of 19.7% with an estimated PPA duration of 10 years.

More importantly, it is possible to track and verify one’s impact through Ecoyield’s verifiable ESG and carbon tracking feature. The platform operates on a dual-token model that combines energy-backed LP token rewards with a native token $EYE staking for governance and rewards. An approach designed to create a transparent and compliant solution aligned with global ESG goals, institutional standards, and on-chain financial innovation.

Looking Into the Future

Climate change is here to stay, whether we like it or not. But what will matter in the end is how human beings handle this challenge for the survival of future generations. One of the surest ways to improve is to tackle the current issues in the funding model by adopting newer technologies like blockchain and AI to introduce transparency, equality, and accountability.

The example featured in this article is just a glimpse into what decentralized ecosystems can do for the clean energy finance market. Other possibilities include supporting decentralized markets for clean energy market instruments like carbon credits and renewable energy certificates (RECs), and in turn, eliminating the monopoly by centralized players that have taken over these burgeoning markets