Bitcoin crashes to $74,508 as tariff fallout triggers crypto bloodbath, billions wiped out

After holding steady through last week’s stock sell-off, crypto markets finally buckled. Bitcoin, which had already dropped nearly 5% last week, extended its slide on Monday—briefly touching a new 2025 low of $74,508 during the Asian trading session.

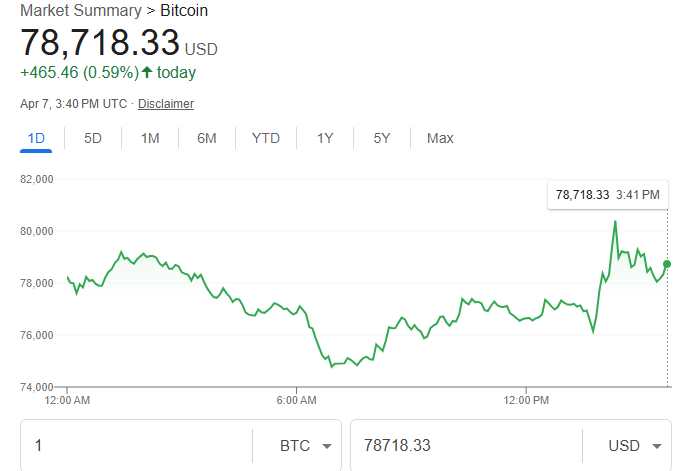

It has since recovered some ground, hovering around $76,000 at the time of writing. But the broader trend remains downward. Bitcoin is currently trading at $78,718 at the time of writing.

The trigger? An escalating global trade war.

Markets took a hit after U.S. President Donald Trump proposed a fresh wave of tariffs last Wednesday. China responded with a 34% levy on U.S. imports. The fallout didn’t just hammer crypto—it dragged down Asian markets, too.

“Bitcoin (BTC) recovers part of the initial losses and trades around $76,000 at the time of writing on Monday after reaching a new yearly low of $74,508 during the Asian trading session, FXStreet reported.

The deepening trade war hit crypto markets hard, liquidating 452,976 leveraged positions and wiping out $1.39 billion in the past 24 hours. At the same time, U.S. institutional interest is fading, with Bitcoin spot ETFs seeing net outflows of $172.69 million last week.

Meanwhile, other major tokens took even bigger hits. Ether, Solana, and XRP all dropped hard—each logging double-digit losses before managing a partial recovery. Ether, the second-largest cryptocurrency after bitcoin, is still down roughly 5%.

The pressure on crypto intensified after China hit back against Trump-era tariffs, spooking investors already on edge. Around $1.2 billion in bullish crypto positions were wiped out in the past 24 hours, according to Coinglass.

“This was the tipping point,” Manuel Villegas, an analyst at Julius Baer, told the Wall Street Journal. He explained that the market drop triggered margin calls for institutions with heavy crypto exposure, pushing some of them past their risk thresholds.

Publicly traded crypto firms didn’t escape the selloff either. Shares of MicroStrategy, the software company turned bitcoin bull under CEO Michael Saylor, fell sharply in premarket trading.

Saylor, never one to stay quiet during market volatility, tweeted Friday: “Bitcoin offers resilience in a world full of hidden risks.”