What is a Cap Table?

A capitalization table, or “cap table,” is simply a spreadsheet that shows who owns what in a company. If you’re asking this question, you’re probably trying to figure out how startups keep track of shares, ownership percentages, and types of stock or options. It’s a straightforward but important tool for founders, investors, and employees to keep an eye on equity and understand how things shift after each funding round.

Let’s walk through what it is, why it matters, when you’ll need one, how to set it up, and how to avoid some common mistakes.

Breaking Down a Cap Table With a Simple Example

Say there’s a startup called TechTrend Innovations, founded by Alice and Bob. They start with 1 million shares, split equally—500,000 each. That’s their first cap table. Basic. Two shareholders. Each owns 50%.

Now let’s say they raise a $1 million seed round from an angel investor named Claire. She gets 200,000 new shares. The total share count jumps to 1.2 million. Alice and Bob now each hold 41.67%, and Claire gets 16.67%. That’s how a cap table adjusts with every change in ownership. It tracks the numbers and keeps everything transparent.

Why Startups Need a Cap Table

Cap tables are the go-to reference point for ownership. If you’re raising funds, issuing stock options, or thinking about an exit, this table is where it all begins.

If Alice and Bob try pitching a VC without a solid cap table, they risk confusing or even alienating investors. Numbers have to add up. A messy cap table raises red flags. It’s also a compliance issue—especially for taxes, audits, or if the company gets acquired.

It’s just as important for team members. Let’s say TechTrend hires Dana, an engineer, and offers her 50,000 shares in options. That’s 4.17% post-investment. Seeing those numbers spelled out keeps everyone aligned and invested—literally.

When You Need A Cap Table

You’ll want a cap table from day one, even if it’s just two founders. It doesn’t need to be complex in the early stages, but as soon as you bring in investors or employees with equity, the stakes get higher.

During a Series A, for example, TechTrend might issue another 300,000 shares to a VC firm. That means more dilution—Alice and Bob’s ownership shrinks to around 35% each. The cap table makes that shift clear. And in the event of a buyout—say the company sells for $20 million—it decides who walks away with what. Claire’s 16.67% becomes $3.33 million. Dana’s options? That’s her payday too.

It also helps with employee grants, convertible notes, and more. If it’s not kept current, confusion or disputes are just around the corner.

What Goes Into a Cap Table Template

A basic template includes names, the number of shares, and ownership percentages. A more detailed version adds share class (common or preferred), price per share, vesting schedules, and liquidation preferences.

For example, after TechTrend’s Series A, it could look something like this:

| Shareholder | Share Class | Shares Owned | Price/Share | Ownership % |

|---|---|---|---|---|

| Alice (Founder) | Common | 500,000 | $0.001 | 35.71% |

| Bob (Founder) | Common | 500,000 | $0.001 | 35.71% |

| Claire (Angel) | Preferred | 200,000 | $5.00 | 14.29% |

| VC Firm | Preferred | 150,000 | $5.00 | 10.71% |

| Dana (Employee) | Options | 50,000 | $5.00 | 3.57% |

This structure can grow as the company adds more stakeholders. But even a simple version gets the job done early on.

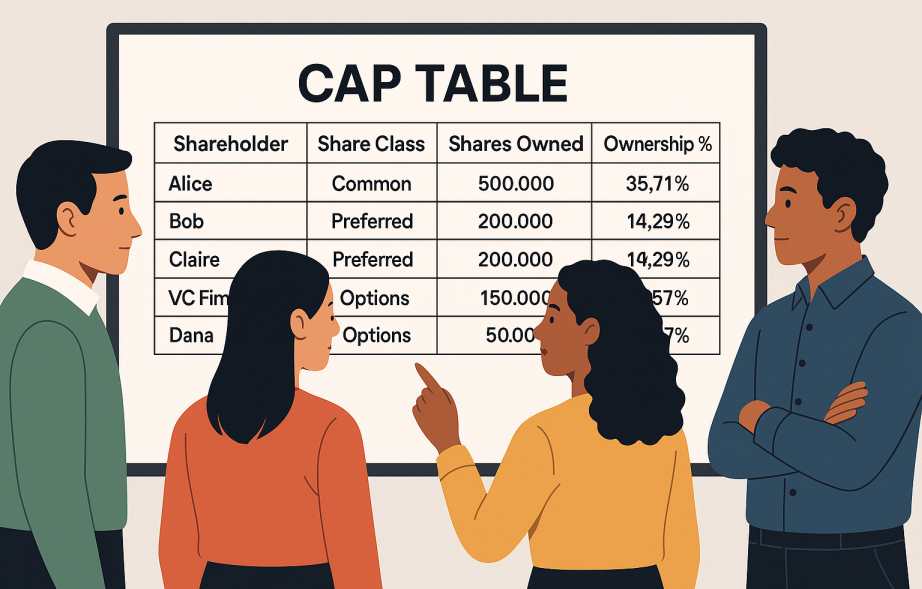

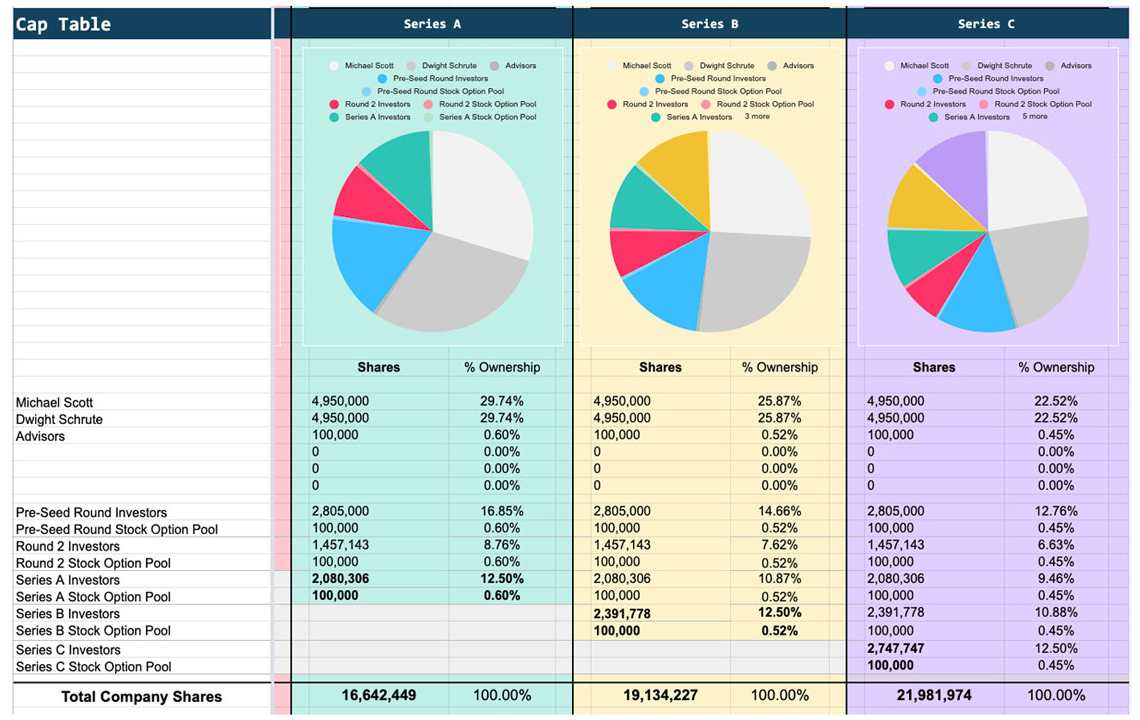

Cap Table Example (Credit: Slide Bean)

How to Build a Cap Table

Start with the total number of shares—like TechTrend’s 1 million. Assign them to founders. Then lay everything out in a spreadsheet. Excel or Google Sheets works fine.

Next, include the columns: shareholder name, share class, number of shares, and percentage of ownership. You can calculate ownership by dividing the shares owned by the total number of shares.

Every time there’s a new round, a grant, or a change—update it. If Claire gets 200,000 shares, the total rises, percentages change. Make sure the math checks out and cross-reference with legal docs.

As things get more complex, tools like Carta or Pulley can help. But early on, a clean spreadsheet can carry you far.

Using a Cap Table the Right Way

The real value of a cap table is in how you use it. Keep it updated. Use it in discussions with investors, to negotiate terms, or to help employees understand their equity.

If a VC firm wants to see ownership breakdown before investing, a clean cap table gives them confidence. If Dana wants to estimate what her options are worth, it’s all right there.

Skip an update or forget a grant, and you risk confusion—or worse, legal problems. The cap table isn’t just a formality. It’s part of the day-to-day.

Real-World Example of How Cap Table is Used

Take FoodieTech, a startup with a messy cap table. They had three founders, two early investors, and no clear records. Right before a Series B, they found a surprise—an unaccounted-for 100,000-share option pool. Fixing that error cost them $50,000 in legal fees. Avoidable? Definitely. All they needed was a clean spreadsheet and some attention to detail.

Final Thoughts

A cap table starts out simple—just names and numbers. But as a company grows, it becomes the blueprint for everything equity-related. Whether you’re raising capital, issuing options, or getting acquired, it’s the one document you can’t afford to mess up.

For startups like TechTrend, keeping the cap table clean and current isn’t just good practice—it’s the difference between chaos and clarity.