Circle, the startup behind USDC stablecoin, files for $5B IPO amid crypto market revival

Just a year after it confidentially filed for a U.S. IPO, the company behind the USDC stablecoin is officially going public.

Circle filed its S-1 with the SEC on Tuesday and plans to list it on the New York Stock Exchange under the ticker symbol “CRCL.” JPMorgan Chase and Citigroup are leading the underwriting. The company is reportedly targeting a valuation of up to $5 billion.

This isn’t Circle’s first attempt to go public. A planned SPAC merger collapsed in late 2022 after running into regulatory headwinds. Since then, the company has shifted gears, moving its headquarters from Boston to One World Trade Center in New York, signaling a more serious push into traditional finance circles.

Circle generated $1.68 billion in revenue and reserve income in 2024, up from $1.45 billion the year before. Net income, however, dropped to $156 million in 2024 from $268 million in 2023, CNBC reported.

If the IPO goes through, Circle would become one of the most prominent crypto-native companies to list on a U.S. exchange. Coinbase, which went public via direct listing in 2021, now sits at a market cap of around $44 billion.

Circle’s timing isn’t without risk. The Nasdaq just wrapped up its sharpest quarterly drop since 2022, and tech IPOs have been few and far between over the past three years. That said, the pipeline is starting to show signs of activity. Klarna, Hinge Health, and StubHub have all filed recently, and CoreWeave just pulled off the biggest IPO for a U.S. VC-backed tech company since 2021—even though it stumbled out of the gate before bouncing back.

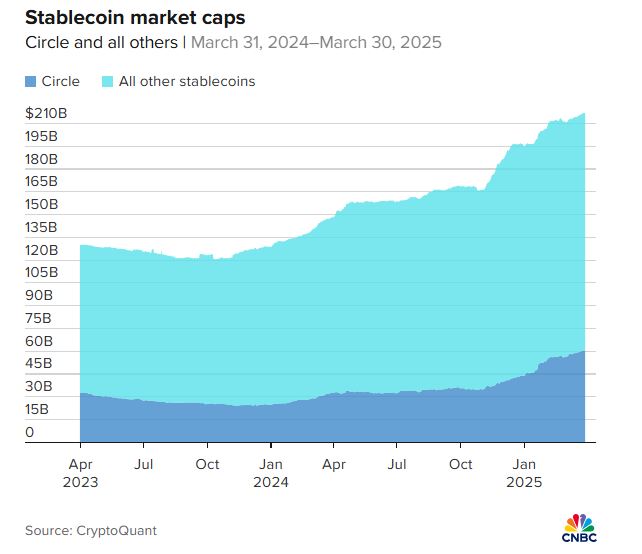

Circle is best known as the issuer of USDC, the second-largest stablecoin by market cap. With around $60 billion in circulation, USDC accounts for roughly 26% of the stablecoin market, behind Tether’s 67%. But USDC’s growth has been picking up. Its market cap has jumped 36% this year, compared to Tether’s 5%.

Credit: CNBC

The broader stablecoin sector is also gaining momentum, helped in part by a more favorable political climate. The crypto industry is hoping Congress will pass legislation focused on stablecoins later this year. Former President Donald Trump recently said he wants lawmakers to get a bill to his desk before the August recess.

A shift in regulation could also have ripple effects on platforms like Coinbase and Robinhood, where stablecoins are playing a bigger role in trading and cross-border transfers. Coinbase and Circle share revenue from USDC, and CEO Brian Armstrong said during a recent earnings call that they have a “stretch goal to make USDC the number 1 stablecoin.”

Stablecoins have become a key piece of crypto infrastructure. Their market has grown 11% this year and 47% over the past 12 months. Analysts at Bernstein recently called the sector “systemically important” within crypto, pointing to how often stablecoins are used in trading and DeFi activity.

Circle’s IPO will be a test of whether public markets are ready to bet on stablecoins—and whether crypto companies can find their footing outside of a bull market.

Stablecoins like Circle’s USDC have gained popularity among crypto-day traders seeking a safe haven amid market volatility. Unlike traditional cryptocurrencies such as Bitcoin and Ether, stablecoins offer a more stable value by being pegged to real-world currencies like the dollar.