Northvolt, once a symbol of Europe’s electric car revolution, files for bankruptcy after $10 billion investment loss

In November, we reported on the shake-up at Northvolt after CEO and co-founder Peter Carlsson stepped down. Fast forward four months later, the Swedish electric vehicle battery maker has filed for bankruptcy in Sweden.

Once seen as a key player in Europe’s push for electric vehicles, Northvolt has been weighed down by $5.8 billion in debt after burning through billions in funding. Recent reports show the company’s financial troubles were deeper than many had expected.

Announcing the bankruptcy on Wednesday, Northvolt said it filed for insolvency after “an exhaustive effort to explore all available means to secure a viable financial and operational future for the company.”

“Like many companies in the battery sector, Northvolt has faced a series of compounding challenges in recent months that eroded its financial position—including rising capital costs, geopolitical instability, supply chain disruptions, and shifts in market demand,” Northvolt said, according to CNBC.

The company cited several issues that pushed it over the edge, including rising capital costs, geopolitical instability, supply chain disruptions, and shifting market demand. “Further to this backdrop, the company has faced significant internal challenges in its ramp-up of production, both in ways that were expected by engagement in what is a highly complex industry, and others which were unforeseen,” Northvolt stated.

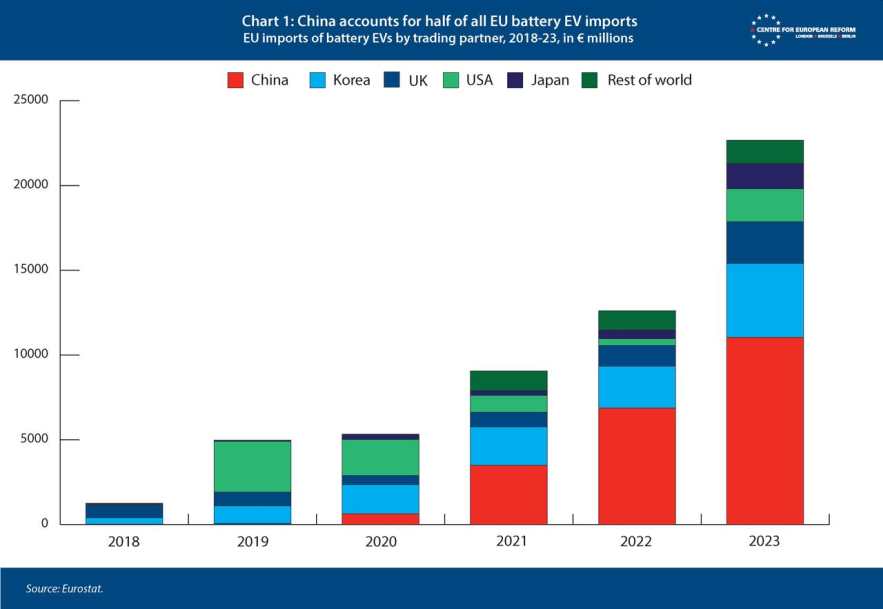

This bankruptcy marks a major setback for Europe’s goal of building a self-sufficient EV battery supply chain and reducing reliance on Chinese manufacturers like CATL and BYD.

Northvolt had been seeking financial support amid an ongoing Chapter 11 restructuring in the U.S., which began in November. “Despite liquidity support from our lenders and key counterparties, the company was unable to secure the necessary financial conditions to continue in its current form,” the company said.

A Swedish court-appointed trustee will now oversee the bankruptcy process, including the sale of the company’s assets and the settling of outstanding obligations.

The Rise and Fall of Northvolt

According to Bloomberg, Northvolt’s struggles worsened as Germany’s auto sector faced increased pressure from low-cost Chinese EV imports over the past three years. The startup’s collapse is a significant blow to Europe’s plans to secure its battery supply chain. Northvolt once operated under the slogan “make oil history.”

The bankruptcy filing comes despite last-minute efforts to stabilize finances. Just days before filing, reports emerged of a $9.5 million proposal from Swedish investors to cover immediate cash needs. This followed Northvolt’s attempt to raise €200 million in short-term funding, reflecting the depth of its financial crisis.

The trouble for Northvolt began in June when BMW canceled a multi-billion-dollar order. The decision didn’t make headlines then but triggered a series of setbacks leading to bankruptcy. Northvolt had attracted investment from major players like Goldman Sachs Asset Management, Denmark’s pension fund ATP, Baillie Gifford, and several Swedish entities. Volkswagen and BMW were also key partners, highlighting the scale of the fallout.

By late June, Volkswagen, which held a 23% stake, appeared willing to step in financially. However, a downturn in VW’s European and Chinese markets led to factory closures in Germany and looming layoffs. The company then withdrew from a planned investment in August and reduced its commitment to purchasing batteries from Northvolt.

Efforts to secure $300 million in bridge funding involving lenders, creditors, and customers also failed by October. On Friday, Carlsson confirmed that VW decided not to provide further support, sealing Northvolt’s fate.

Adding to its financial burden, Northvolt’s debt includes a $330 million convertible loan from Volkswagen, due in December 2025.

Founded in 2016 by former Tesla executive Peter Carlsson and former Airbus manager Paolo Cerruti, Northvolt gained attention for its lithium-ion batteries for EVs and energy storage. The company built partnerships with Volkswagen, BMW, and ABB, aiming to deliver sustainable, high-quality batteries for Europe’s green energy future. But delays and escalating costs led to its financial unraveling.