Is Nvidia in Trouble? Tech giants are building their own custom AI chips to slash costs and break free

Earlier today, Google unveiled Gemma 3—a series of open-source AI models that run on just a single GPU or TPU, designed to make AI development faster and more accessible. That’s a sharp contrast to rivals like DeepSeek’s 6R1, which burns through dozens of Nvidia chips. It’s a bold statement that advanced AI doesn’t necessarily need an army of silicon to compete.

But this isn’t just Google flexing—it’s the latest in a growing rebellion that’s been brewing for months. Imagine a king on a golden throne, his empire of silicon unchallenged—until the rebels start crafting their own crowns. That’s the current shift in the AI hardware world.

Nvidia, the long-reigning GPU titan, is facing a challenge from tech giants like Google, OpenAI, and Meta, who are building their own chips to cut costs and gain independence from Nvidia’s expensive grip. Is Nvidia’s reign under threat? Let’s break it down.

OpenAI Sparks the Fire in February

The first strike landed earlier this year. On February 5, 2025, reports revealed that OpenAI was nearing completion of its first custom AI chip, aiming to reduce reliance on Nvidia. This wasn’t a side hustle—it was a clear strategy to fuel their next-gen models without leaning on Nvidia hardware. For a company with huge AI ambitions, this was a big move. If OpenAI doesn’t need Nvidia, who does?

“OpenAI is moving forward with its plan to reduce its reliance on Nvidia by creating its own AI chips. The company is expected to finalize the design for its first custom chip in the coming months and send it to Taiwan Semiconductor Manufacturing Co (TSMC) for production.”

Meta Enters the Fight on March 11

Just yesterday, Meta jumped into the fray. The social media giant began testing its first in-house AI chip, designed for both training and inference, while cutting the sky-high costs that come with Nvidia’s GPUs. Meta’s goal? Full control over its AI operations without handing billions to an external supplier. It’s a calculated move that’s part of a bigger shift—hyperscalers looking to cut loose from Nvidia’s orbit. For Meta, this chip is their ticket.

Google Turns Up the Heat Today

Today, Google dropped Gemma 3, and it’s a clear shot across Nvidia’s bow. While DeepSeek’s 6R1 reportedly needs 34 Nvidia H100s and Meta’s Llama 3 needs 16, Gemma 3 can run on just one H100 or TPU. It’s available in sizes from 1 billion to 27 billion parameters, with a 128k-token context window and support for over 140 languages.

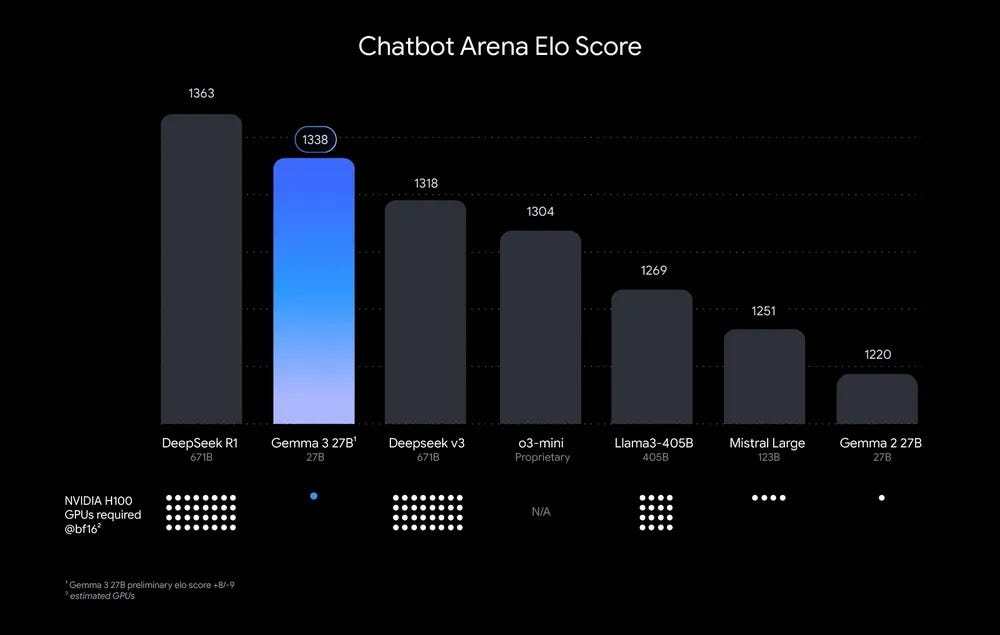

Early tests suggest it’s outperforming rivals like Llama-405B and OpenAI’s o3-mini. Google isn’t just showing off; they’re making a point—advanced AI doesn’t have to drain billions in GPU spending. It’s faster, cheaper, and more accessible for enterprises.

The GPU Demand Dilemma

Gemma 3 isn’t just a tech milestone—it’s a warning sign for Nvidia’s business model. DeepSeek’s models historically leaned on dozens of GPUs—32 H100s for R1 and 34 for 6R1, according to reports.

But Google’s Gemma 3 achieves similar results with just one chip. This leap in efficiency suggests a future where AI strength isn’t measured by GPU count. OpenAI and Meta’s custom chips are part of this shift, but Google’s move brings it to the forefront.

If new models require fewer GPUs to match or outperform older ones, the demand for Nvidia’s hardware could drop. Enterprises, startups, and cloud providers might opt for leaner setups, putting pressure on Nvidia’s dominance. It’s not just about building alternative chips—it’s about needing fewer of Nvidia’s chips to begin with.

The Ripple Effect: Amazon, Startups, and Leaner Models

The shift isn’t limited to the tech giants. Amazon has been quietly advancing its Trainium chips, supported by its investment in Anthropic—an AI company that already uses Google’s TPUs for most of its inference. Startups like Cerebras are stepping up, too, with specialized chips that power models like Perplexity’s Sonar and Mistral’s chatbot. The trend is moving toward efficiency, not brute force, and that’s a threat to Nvidia’s premium margins. If Google can run Gemma 3 on one chip, why should others pay for Nvidia’s hardware fleet?

Lessons from the Past: Cisco’s Warning

History echoes here. Cisco ruled the networking world in the 1990s, its routers and switches forming the backbone of the internet—just as Nvidia’s GPUs are key to AI today. However, in the 2000s, competitors like Juniper and Arista introduced cheaper, more flexible solutions that chipped away at Cisco’s dominance. Cisco adapted, but its market grip shrank as buyers favored cost and customization over a one-size-fits-all empire. Nvidia’s dominance feels similar. It seems unshakeable, but custom chips and efficient models could be Nvidia’s Juniper moment.

Nvidia’s Throne Is Shaking

The market is feeling the shift. Nvidia’s stock is down 15% this year, though it saw a 6% bounce today. That’s a sharp contrast to massive spending projects like Project Stargate’s multi-billion-dollar data center plans. All eyes are on Nvidia’s upcoming GTC conference next week, where CEO Jensen Huang will defend Nvidia’s position. Huang argues that their chips still lead in training and inference, and the ecosystem is unmatched. But the economics are shifting, and the rise of custom silicon is real. Nvidia’s premium pricing model could be at risk.

Is This a Turning Point for AI Hardware?

This isn’t just Nvidia’s battle; it’s a glimpse into the future of AI hardware. As the industry moves from training to inference, efficiency is becoming the priority. OpenAI’s custom chip (due later this year), Meta’s ongoing tests, and Google’s launch of Gemma 3 show a shift toward independence from Nvidia. Anthropic already leans on Google’s TPUs, and companies like Cerebras are gaining ground. The challengers are building momentum.

Conclusion

Nvidia isn’t out yet. Its ecosystem is still massive, and Huang isn’t wrong about versatility. But the throne is wobbling. Is Nvidia in trouble? Not today—but the crown is up for grabs, and tech giants are forging their own path. The real question is: Can Nvidia hold the line, or is this the start of a new era in AI hardware?

The writing’s on the wall for Nvidia, and we’re not the only ones seeing it. CNBC weighs in on what Google’s efficient ‘Gemma 3’ model could mean for Nvidia’s future.