Northvolt’s Collapse: CEO steps down amid chapter 11 filing, $5.8 billion debt, and Europe’s battery dreams shattered

Northvolt’s CEO and co-founder Peter Carlsson stepped down on Friday, just a day after the company filed for U.S. Chapter 11 bankruptcy protection, according to a report from Reuters. The move marks a dramatic turn for what was once Europe’s leading hope in the electric vehicle battery sector.

The news comes as a shock, especially after recent reports that Northvolt’s founder and Swedish funds were considering a $9.5 million injection to address its urgent cash needs. Just a week before, we covered the company’s push to secure €200 million in short-term funding, highlighting its deepening financial struggles.

Northvolt, a Swedish battery cell manufacturing startup, quickly went from being a major player in the energy transition to fighting for survival. Production issues and financial troubles left the company scrambling to stay afloat.

The collapse has significant implications for Europe’s efforts to reduce reliance on Chinese battery suppliers like CATL and BYD. Northvolt had aimed to be a cornerstone of the continent’s green industrial ambitions, operating under the motto, “make oil history.”

Since its founding in 2016, the company raised over $10 billion through equity, debt, and public financing. Its key backers include Volkswagen and Goldman Sachs, which together hold about 40% of its shares.

Seeking a Financial Lifeline

The company now needs between $1 billion and $1.2 billion to continue operations, Carlsson revealed. Describing the situation as emotional, he said Northvolt was “like a baby” to him, Reuters reported. Despite efforts to negotiate with investors and creditors, including Volkswagen and Goldman, talks fell apart, leading to the Chapter 11 filing.

The restructuring process gives Northvolt time to reorganize its operations while continuing commitments to customers and suppliers. However, the company is under immense pressure, with only $30 million in cash at the time of filing—enough to last just one week. Meanwhile, debts have reached $5.8 billion, including $313 million owed to the European Investment Bank (EIB) and $154 million in shareholder loans.

EIB Vice President Tomas Ostros acknowledged the strategic importance of a European battery industry but said it’s too early to predict the outcome of Northvolt’s restructuring.

“For us … it remains the case that Europe has a strategic interest in a European battery industry for electric cars and we will follow developments very closely,” he added.

Interim Measures and Leadership Changes

To keep operations running, Northvolt secured $100 million in new financing from Scania, one of its top customers and shareholders. The company aims to complete the restructuring process by early 2025.

Carlsson will remain on the board and serve as a senior adviser while the search for a new CEO begins. In the interim, the company will be led by finance chief Pia Aaltonen-Forsell and battery president Matthias Arleth, who is stepping into the role of chief operations officer.

We first covered Northvolt in 2019 when it received €5.8 million investment from EIT InnoEnergy to use 50% recycled materials in its battery cells by 2030. In March this year, Northvolt was reportedly in talks to raise over $5 billion to solidify its position as Europe’s largest battery manufacturer. The Financial Times reported that the startup was negotiating with several banks and hoped to finalize an agreement by the end of the year.

The Challenges of Scaling Battery Production

Insiders attribute Northvolt’s production struggles to machine faults, inexperienced staff, and overly ambitious targets. Carlsson admitted to underestimating the challenges, saying, “In hindsight, we were over-ambitious on the timing in which we could achieve it.”

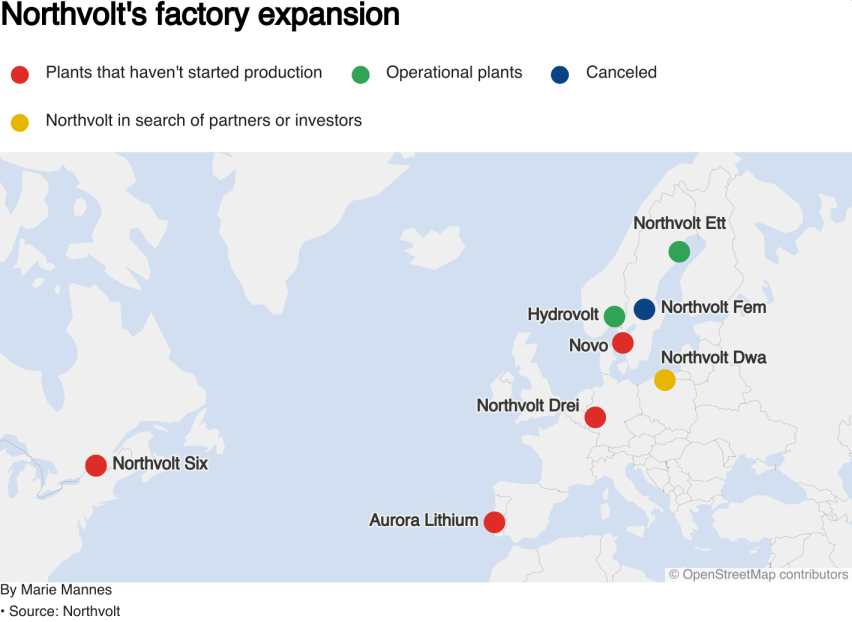

Currently, only one production line at Northvolt’s plant in northern Sweden is delivering finished products, supplying truck maker Scania. Efforts are underway to prepare two additional lines for deliveries to Porsche and Audi.

Industry experts say Northvolt’s problems highlight broader challenges in establishing a European EV battery industry. Bureaucracy, technical hurdles, and slower-than-expected demand for EVs have hindered progress.

Credit: Reuters

Next Steps

Northvolt has reached out to potential partners to finance its restructuring and resume long-term operations. Proposals are due by early December. If no suitable partner is found, the company has enlisted Hilco Global to prepare for an “orderly liquidation process.”

The outcome of Northvolt’s restructuring will not only determine its future but also impact Europe’s ambitions to lead in green energy industries. For now, the company remains in a precarious position, hoping to secure the support it needs to recover.

Founded in 2016 by Peter Carlsson, a former Tesla executive, and Paolo Cerruti, a former Airbus manager, Northvolt specializes in producing lithium-ion batteries for electric vehicles and energy storage. The company has quickly risen to prominence in Europe, securing partnerships with major brands like Volkswagen, BMW, and ABB. Its mission is to create high-quality, sustainable batteries to meet the growing demand for electric vehicles and renewable energy solutions.

While Northvolt currently has a U.S. facility, insiders say the company is close to finalizing plans for a multibillion-dollar battery factory in Canada, with an official announcement expected later this year. Northvolt has declined to comment on these potential factory plans.