British fintech startup Revolut valued at $45 billion after secondary share sale

Revolut’s valuation has surged to $45 billion after a secondary share sale to new and existing investors, positioning the British fintech startup ahead of some of Europe’s largest banks.

Announced on Friday, the share sale—which allowed current employees to cash out a portion of their shares—was led by Coatue and D1 Capital Partners, with support from existing investor Tiger Global.

The news comes just a month after the UK fintech startup announced it was seeking to raise a $40 billion valuation following a record pretax profit of £438 million ($553.81 million) in 2023 and a global customer base of 45 million.

At a $45 billion valuation, Revolut’s worth is more than double that of France’s Societe Generale, which holds a market cap of $19 billion and surpasses the valuation of Britain’s Barclays at $43 billion, according to LSEG data.

Traditional European banks have struggled with low profitability and new regulations, which have hampered their valuations. Barclays, for instance, has only recently seen its share prices recover to levels from a decade ago. Investors in Revolut are banking on the nine-year-old firm’s potential for growth, which they believe outpaces that of traditional lenders.

The recent UK banking license granted to Revolut is expected to attract customers looking for app-based banking solutions, without the overhead costs associated with maintaining physical branches, Reuters reported.

No Plans for IPO

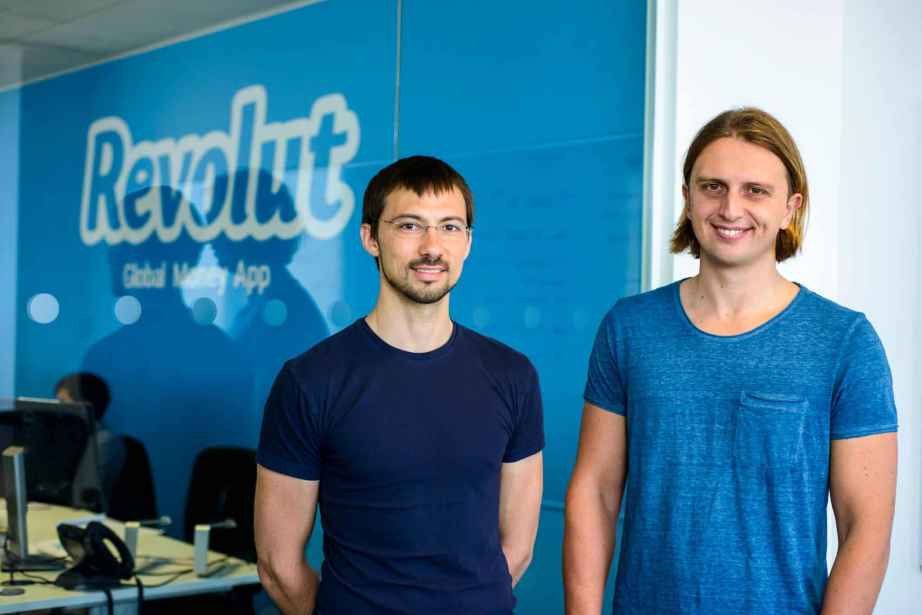

Founded in 2015 by Nikolay Storonsky, a former trader at Credit Suisse and Lehman Brothers, and Vlad Yatsenko, a former developer at Credit Suisse and Deutsche Bank, Revolut set out to offer transparent, fee-free financial services. Its goal was to simplify global financial management by eliminating hidden fees and providing interbank currency rates.

Revolut, one of several fintech apps to emerge in Britain over the past decade, provides financial services exclusively through an app, bypassing the need for physical branches. The company was last valued at $33 billion in a 2021 fundraising round.

Last month, Revolut finally secured a UK banking license after a three-year wait, following scrutiny over its internal accounting. The company has yet to confirm whether any existing investors have reduced their stakes or if CEO Storonsky has sold part of his share. Reports had suggested that Storonsky might sell a portion of his multibillion-dollar stake, with the sale amount previously pegged at $500 million.

Although Revolut has previously indicated plans for a public listing, interim CFO Victor Stinga in July did not provide a timeline for an IPO. Philippe Laffont, founder and portfolio manager at Coatue, praised Revolut’s product lineup, stating that it caters to a growing customer base and is contributing to changes in the global banking industry.