Truflation Releases its US Inflation Report Update for July 2024: US Economy Grows By 2.8% in Q2

In recent months, the U.S. economy has been dealing with considerable uncertainty, characterized by changing inflation rates, supply chain issues, and shifting consumer habits. Now, Truflation has just come out with its comprehensive, US Inflation Report Update for July 2024.

The report shows an economy shifting into a higher gear, with GDP growing at 2.8% in Q2 on consumer spending and government investments supporting the headline metric of personal consumption expenditures (PCE) inflation stripping out food and energy.

Report Highlights:

- Inflation above target, running at 2% or higher

- Unemployment edged up to 4.3 percent, a near three-year high

- Spending by Americans and retail sales rose.

- The Q2 2024 GDP growth however slowed sharply to just +0.2%

According to the report, inflation remains well above target, particularly in housing and utilities. This includes a rise in the unemployment rate to 4.3% and soft wage growth, which could be an early warning sign for economic headwinds/momentum ahead. That said, the Fed still treads carefully on rate cuts and is unlikely to act until September.

The housing market is showing mixed signals with rising prices but declining sales, making the economic outlook uncertain.

Key Sections:

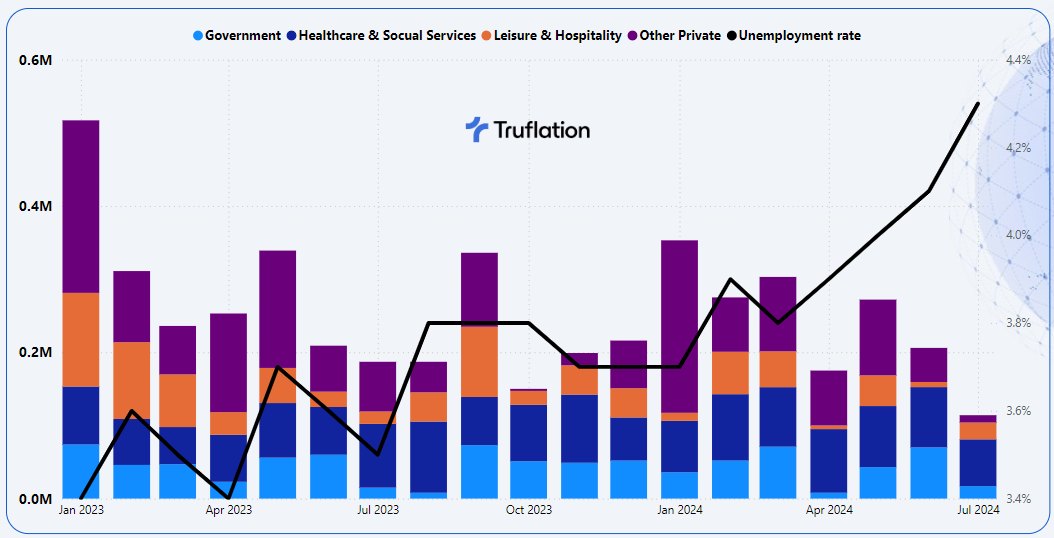

Previous Month Change in Non-Farm Payroll & Unemployment Rate

Economic Growth: The U.S. economy grew by 2.8% in Q2 2024, with consumer spending up 2.3%. Despite high interest rates and inflation, consumer demand stays strong.

Employment and Wages: Unemployment hit 4.3%, the highest in almost three years. Wage growth is slowing, raising concerns about a potential recession. Job growth is also slowing down.

Consumer Confidence: The Consumer Confidence Index went up in July after a dip in June. Despite this, inflation and interest rates are still weighing on consumer sentiment, making the path to lower inflation tough.

Inflation Trends: Inflation is cooling slightly, with July’s Consumer Price Index expected between 2.7% and 3.1%. Housing and utility costs remain high. The Fed is likely to cut rates in September if progress continues. In August 2024, inflation trends are influenced by a mix of domestic factors, including consumer spending, job market changes, and housing pressures, as well as global factors like geopolitical tensions and adjustments in international supply chains.

Housing Market: Housing prices fell by 0.49% MoM in July but rose 1.71% YoY. Prices are up, but sales are down, making it harder for first-time buyers. A shift toward a more balanced market may be happening as inventory grows and mortgage rates drop.

Sector-Specific Inflation Analysis

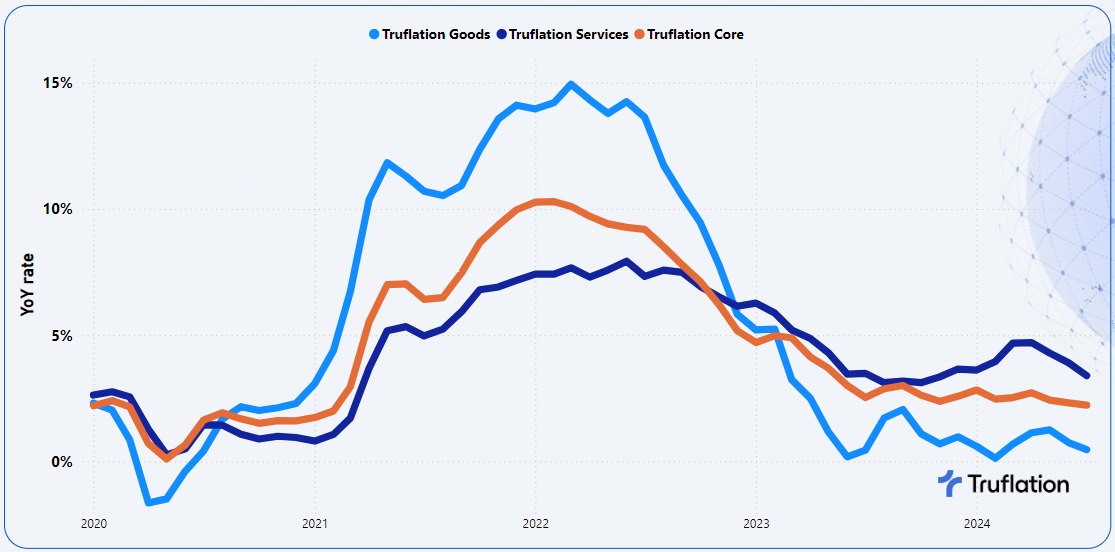

Truflation key inflationary metrics: Goods vs Services vs Core Inflation

Sector-Specific Inflation Analysis: Inflation trends vary across sectors:

- Food & Non-Alcoholic Beverages: Prices dropped by 0.42% MoM, with YoY growth at 0.65%. Lower commodity prices and wages contributed to this.

- Clothing: Prices fell by 0.18% MoM, up 1.25% YoY. Shoppers are hesitant to spend more on non-essentials.

- Utilities: Prices rose by 0.53% MoM and 1.94% YoY, reflecting higher costs for electricity, gas, and water.

- Health: Costs went up by 0.20% MoM and 3.23% YoY due to rising healthcare expenses.

- Transportation: Costs increased by 0.25% MoM and 3.33% YoY, with gasoline prices up due to higher demand and increased vehicle sales.

Monetary Policy Impact: Recent rate hikes are slowing inflation, but the Fed might start lowering rates soon. The timing and size of these cuts will impact the economy, especially in housing and consumer spending.

Global Context: Global factors like geopolitical tensions and trade disruptions are influencing U.S. inflation. The interconnected global economy could affect domestic inflation rates.

Longer-Term Views: The U.S. economy is at a pivotal point. Inflation is cooling, but underlying pressures remain. The second half of 2024 could see continued volatility with high inflation, rising interest rates, and a cooling job market. The housing market and monetary policy will be key to the economic outlook, with the possibility of a soft landing still on the table.

Conclusion

The report concludes with challenges facing the US economy and the opportunities ahead. “By staying informed and adaptable, businesses, policymakers, and consumers alike can navigate the complexities of this economic environment,” the report read. The report added that the potential for a soft landing remains, but it will require careful management of the factors driving inflation and economic growth.

Founded in 2021, Truflation offers a collection of independent inflation indexes based on data from over 30 sources and more than 14 million product prices in the US. Updated daily, these indexes are among the most current and thorough tools for measuring inflation. Truflation has used these indexes to forecast the BLS CPI number, achieving four accurate predictions and only one deviation of up to 20 basis points since the tool’s launch.