Climate startup Climatize raises $1.75M in pre-seed funding to boost renewable energy

With the surge in artificial intelligence funding, climate tech has seen a notable decline in financial support, particularly for small and mid-sized renewable projects. To tackle this, a new platform aims to channel more funds into sustainable initiatives.

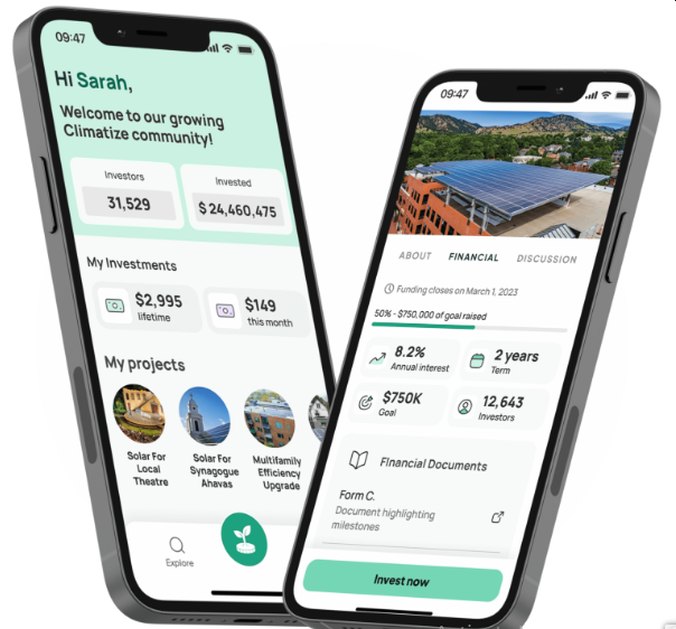

Enter Climatize, a climate startup and an impact investing platform that invests in solar energy projects to accelerate renewable energy adoption and support the clean energy transition for businesses of all sizes.

Today, Climatize announced it has secured $1.75 million in pre-seed funding led by Myriad Venture Partners to expand its global network of climate-focused investors.

The growing adoption of distributed energy resources and renewable energy generation presents significant opportunities for businesses and organizations to access more affordable, cleaner, and reliable energy, while also reducing scope 2 emissions.

However, financing remains a hurdle for many small to medium-sized energy projects. These projects are often too large for community lenders and too small for traditional renewable energy investors. This funding gap hinders the clean energy transition.

Climatize is addressing this funding gap by allowing individuals and institutional investors to directly invest in renewable energy projects. The platform’s goal is to channel billions of dollars into these projects, lower energy costs, electrify and decarbonize businesses, and mitigate climate change effects.

Co-founded by CEO Will Wiseman and COO Alba Forns, both Forbes 30 under 30 honorees, Climatize is making solar financing and investing more efficient, transparent, and accessible.

Democratizing Access to Clean Energy Investments

Climatize is democratizing clean energy investments by supporting projects often overlooked by traditional investors. Focusing on small and medium-sized projects in communities that benefit most from affordable renewable energy, Climatize helps lower energy costs and decarbonize businesses, especially in rural and suburban areas that produce food and goods.

The platform also allows non-traditional investors, including any US-based investor over 18, to fund these initiatives with potential returns of up to 10 percent annually.

Since its launch in 2023, Climatize has funded 11 projects across seven states, raising over $4.6 million from more than 950 investors. These investments have supported the installation of 965 kW of new solar capacity and 1357 kWh of energy storage, benefiting businesses like farms, community centers, and houses of worship. Investors not only support these installations but also contribute to the clean energy transition in their communities.

Unlocking Green Potential with Tax Credits

The Inflation Reduction Act (IRA) plays a significant role in speeding up the energy transition. Tax credits from renewable energy projects are now transferable, which has significant implications for small and medium-sized projects associated with SMBs. Over 500 companies have registered 45,500 projects for these tax credits, highlighting their importance in funding renewable energy projects.

Many businesses and holders of these tax credits do not generate enough liabilities to benefit from them, resulting in excess credits that go unmonetized. The IRA’s provision for these tax credits to be sold will attract new tax equity investors like corporations, fueling the growth of energy projects that previously struggled with financing. Climatize’s ability to offer investment-grade projects will also help monetize these investment tax credits.

Climatize has partnered with industry leaders like Ovanova, Arcadia, and Crux to co-invest in community energy and maximize developer tax credits. These partnerships demonstrate the company’s commitment to building a strong and supportive network for renewable energy growth.