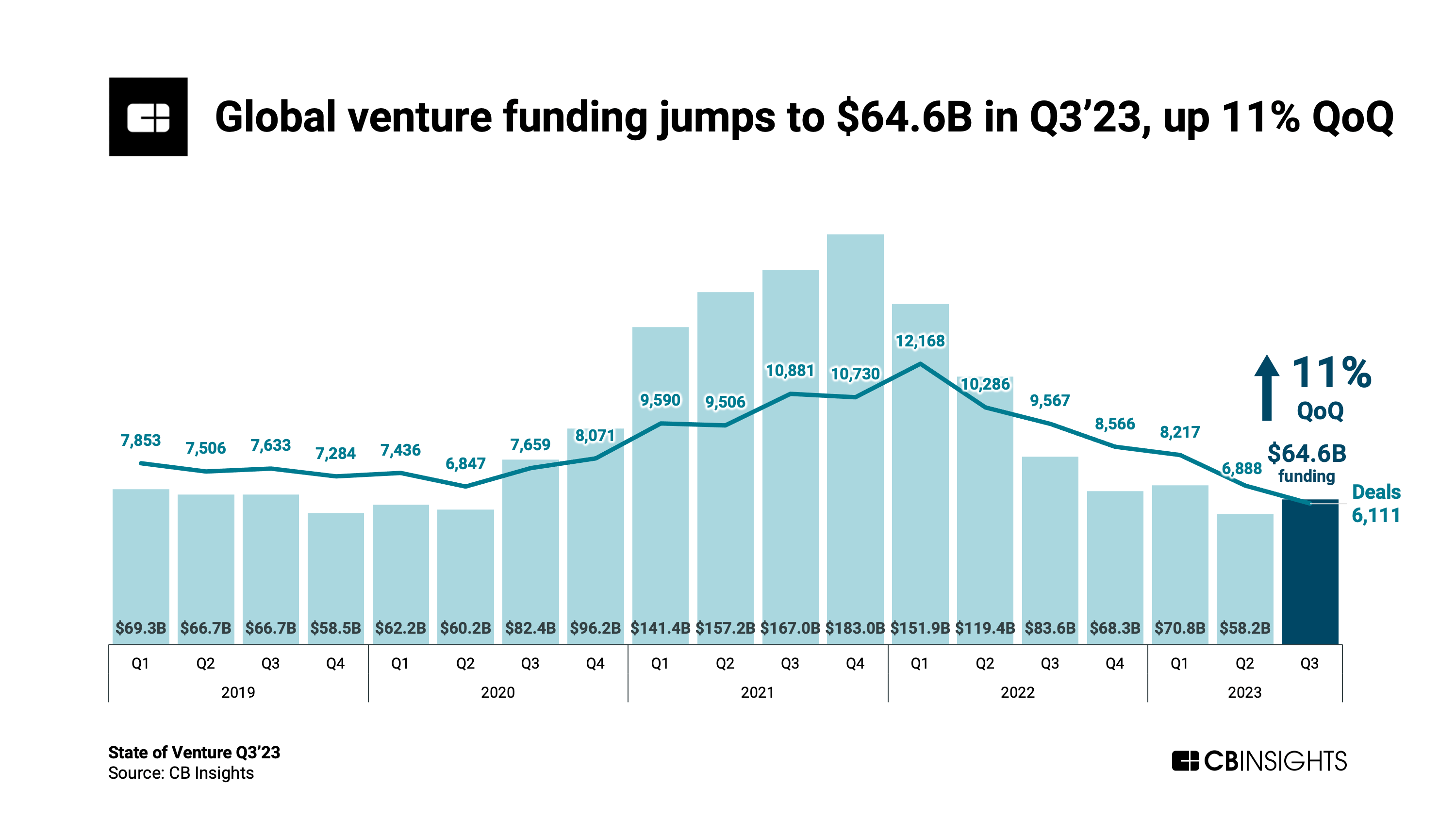

Global Venture Funding Increased in Q3 2023 to Reach $64.6 Billion, Up 11% From the Previous Quarter

CB Insight has released its highly anticipated “Q3 2023 State of Venture Report,” bringing with it some good news on the global venture funding front. According to the report, the funding landscape experienced a significant resurgence as global venture funding rose to an impressive $64.6 billion in Q3 of 2023, marking an encouraging 11% increase compared to the previous quarter. This boost was attributed, in part, to substantial deals within technology sectors such as electric vehicles, sustainable manufacturing, and artificial intelligence.

But when delving deeper into the funding data, the picture becomes more complex. The overall increase wasn’t the result of a resurgence in the number of deals. In fact, the deal count dropped to its lowest level since 2016. Instead, the Q3’23 funding total was buoyed by an impressive tally of mega-rounds, with six deals amounting to $1 billion or more. Excluding these six billion-dollar deals, the global funding would have experienced a decrease quarter over quarter in Q3’23. Overall, the total number of deals continued its downward trend for the sixth consecutive quarter, dropping to 6,111. This marks the lowest quarterly deal count since 2016.

Key Takeaways

Here are the key takeaways from CB Insight’s State of Venture Q3’23 Report:

- Global venture funding surged by 11% in QoQ to reach $64.6 billion.

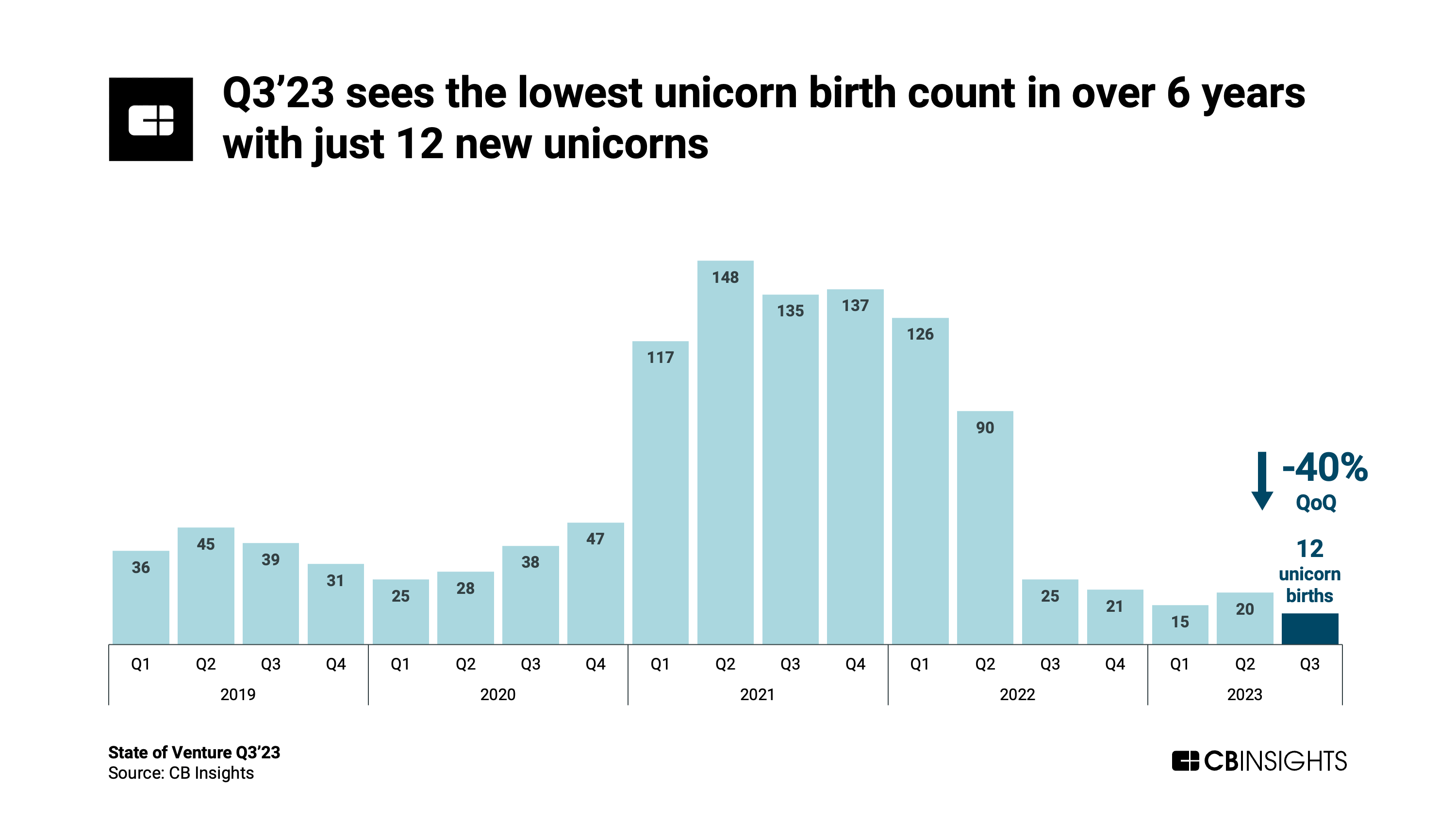

- New unicorn startups saw a significant 40% drop in Q3’23, hitting a multi-year low.

- The global IPO market maintained its recovery, with a 24% increase in IPOs compared to the previous quarter.

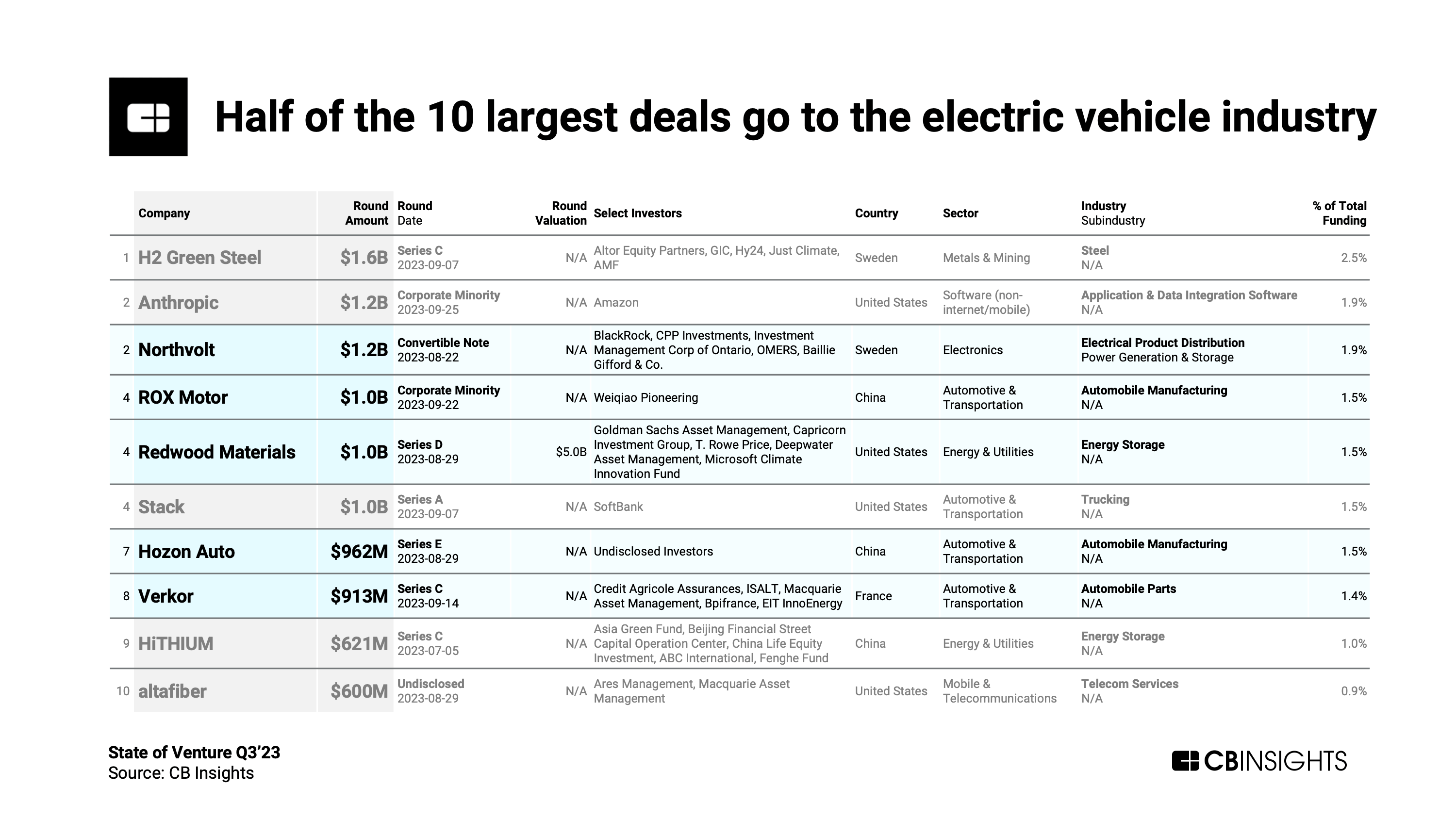

- Electric vehicle companies dominated the list, securing half of the top 10 largest equity deals.

- Europe led in global exit share at 38%, closely followed by the US at 35%.

Unicorn Funding

Speaking of the big round of funding, in Q3’23, the electric vehicle sector grabbed the spotlight, securing half of the top 10 largest deals. Clean energy and sustainable manufacturing also received substantial investments. This trend aligns with global efforts to reduce emissions in industries such as automotive, steel production, and mining. For a comprehensive look at top funding rounds across all stages, from seed to Series E and beyond, you can access the full State of Venture Q3’23 Report.

Despite a dozen new unicorns, private companies valued at over $1 billion, entering the scene in Q3’23, the unicorn birth rate experienced a significant 40% drop from the previous quarter, reaching its lowest point in over six years. The United States took the lead with five new unicorn births, followed by Asia with four and Europe with two. Notably, in Q3’23, three startups shared the distinction of being the highest-valued new unicorns, each holding an impressive $1.8 billion valuation. These startups included BitGo (US), Helsing (Germany), and Quest Global (Singapore).

The rise of new unicorns in Q3’23 featured a prominent presence of artificial intelligence (AI) startups, reflecting the sustained interest in this technology. This quarter witnessed the emergence of four AI companies as new unicorns:

- Helsing, a German-based defense startup leveraging AI for security (valued at $1.8 billion)

- AI21 Labs, an Israeli startup providing language models for AI developers (valued at $1.4 billion)

- Imbue, a US-based company specializing in custom AI agents (valued at $1 billion)

- Zhipu AI, a Chinese AI developer catering to both consumer and enterprise applications (valued at $1 billion)

Although most major regions saw a decrease in the number of new unicorns in Q3, the United States remained the frontrunner in unicorn births with a total of five, followed by Asia with four new unicorns and Europe with two.

Global IPO Rebound

In addition to the global venture funding, the report also offers some positive insights on the global IPO front. Global initial public offerings (IPOs) showed growth for the second consecutive quarter. Q3’23 witnessed 126 companies making their debut through IPOs, surpassing the 102 IPOs in Q2’23.

This indicates a notable improvement in the IPO market, particularly in the United States. The two highest-valued IPOs in Q3 were Instacart ($9.9 billion) and Klaviyo ($9.3 billion), both American companies. In contrast, mergers and acquisitions (M&A) deals continued to decline by 8% quarter-over-quarter, resulting in 1,887 exits, the lowest quarterly volume since 2020.

Half of the top 10 largest deals were directed towards the electric vehicle industry, while two more focused on clean energy and sustainable manufacturing, specifically H2 Green Steel and HiTHIUM. Investors are increasingly prioritizing clean tech investments, reflecting the global trend towards emissions reduction in sectors such as automotive, steel production, mining, and more. Notably, Northvolt and Redwood Materials, both operating in the lithium-ion battery space, secured deals exceeding $1 billion in Q3’23.

To delve deeper into the profiles of these new unicorn club members, you can access the full report and its underlying data at CBInsight.com