Why did Silicon Valley Bank collapse? Here’s why the Federal Reserve may be responsible for the collapse of Silicon Valley Bank

Silicon Valley Bank (SVB) is the US’s 16th largest bank that mostly served venture capital firms and tech companies and startups, including some of Silicon Valley’s biggest names, such as Roku. With over 200 billion dollars of assets, Silicon Valley Bank is heavily focused on the tech industry having funded early-stage startups including Airbnb, Uber, Square, and others. SVB’s collapse is the largest U.S. bank failure since the 2009 financial crisis.

Silicon Valley Bank’s downward spiral began late Wednesday after the bank surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. This news quickly caused SVB’s share price to lose more than 60 percent of its value the next day and another 60 in the aftermarket.

Within 48 hours, a panic induced by the very venture capital community that SVB was created to serve and cared for ended. On the same day, the US regulators seized control of the bank. Yesterday, the US government guaranteed Silicon Valley Bank customers will have access to all their deposits starting Monday, March 13.

Why did Silicon Valley Bank collapse?

SVB has been profitable for over a decade and was also a major beneficiary of the tech bull run over the past 10 years with its share price having risen almost 20-fold between 2009 and its peak in 2021. The question many are asking is: Why did Silicon bank Valley collapse all of a sudden and who’s to blame for the downfall?

Founded in 1983 and headquartered in Santa Clara, California, Silicon Valley Bank (SVB) was a commercial bank that primarily serves the technology, life science, and venture capital industries because most traditional banks avoided tech startups and viewed them as too risky. The bank offers a range of financial services, including commercial banking, investment banking, and asset management to companies in the innovation sector.

Over the years, SVB became the go-to bank for venture capital funds that deposited their cash with the bank. The boom came in the early 2010s during the low-interest rate environment that created a gold rush for the venture capital industry investors who were pumping hundreds of billions of dollars into VC funds, and much of this cash found its way onto SVB’s balance sheet.

Looking into SVB’s 2023 balance sheet, the bank appeared to be in pretty good shape. As of December 31st, 2022 they had $212 billion dollars of assets and $195 billion, giving the bank equity of a little over $16 billion. On paper, the bank was solvent with a 16 billion dollar cushion, at least that’s it appears on the surface.

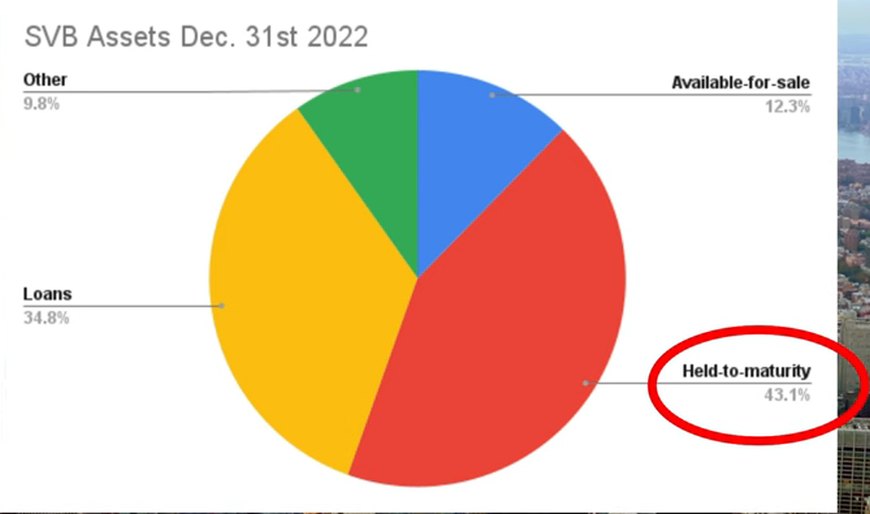

Of the $212 billion assets, $73 billion of the assets were loans, $26 billion were Available-for sale-securities, $91 billion were Held-to-maturity securities and the remaining $21 billion were others. From the chart, you can see that Available-for sale-securities and Held-to-maturity securities make up the majority of SVB’s balance sheet, and there lies the root cause of SVB’s collapse as we dig deeper.

The Held-to-maturity securities are SVB’s investments in the US government bonds the bank made two years ago when it had healthy deposit levels, concentrated in the tech sector and among venture capital investors. With a fall in US government bond prices, as the Fed raised interest rates, the value of its investments dropped causing SVB to lose more than $15 billion in unrealized losses on its bond portfolio.

“The problem was they bought in at almost exactly the wrong time they acquired more of their bond portfolio in 2020 and 2021 when the Fed was pursuing its quantitative easing policy they thus bought the bonds at very low yields since then the yields have increased dramatically as the FED has raised rates bond prices are inversely related to yield thus as the yields have increased SVB has incurred $15 billion of unrealized losses on their bond portfolio.”

In other words, the collapse of Silicon Valley Bank is a result of Federal Reserve actions of the rapid increase in interest rates multiple times in a period of less than one year. The bank failed because it didn’t fully understand the implications of the actions of the Federal Reserve.

“We must also call out that the Federal Reserve created this scenario. They held interest rates at 0% for too long and told everyone they would not aggressively raise rates by having forward guidance suggest less than 0.5% interest rates months and years out. Of course, the situation changed and the Fed increased interest rates by 4.5% and it completely screwed every bank that listened to what the Fed had originally told them,” Tony Pompliano said in his newsletter today.

Below is a video that goes into detail about Silicon Valley Bank’s collapse and why the actions of the Federal Reserve’s effort to fight inflation with high-interest rates might be responsible for the bank’s collapse.

Here’s another video on why “The Fed Is To Blame For The Collapse of Silicon Valley Bank.”