Crypto.com seeks to reassure jittery investors after accidental transfer of $400 million Ethereum tokens to Asian crypto exchange Gate.io

In the wake of the FTX scandal and fallout, Crypto.com CEO Kris Marszalek took to Twitter on Friday to reassure jittery investors that the company is financially sound and not facing the same liquidity crisis that led to the fall of the now-bankrupt FTX exchange.

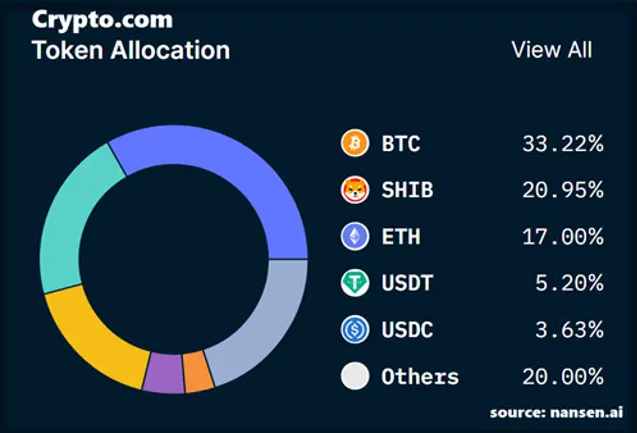

On Friday, Marszalek announced that he would share “a full audited proof of reserve.” The company’s reserve showed that over 20% of the company’s reserve was held in Shiba Inu SHIB/USD tokens, a speculative meme coin.

But after reviewing the shared data, a Twitter user @jconorgrogan asked the company about a transfer of 32,000 Ethereum that was made in mid-October worth about $400 million to an Asian exchange called Gate.io. The ETH tokens were later transferred back to Crypto.com on Oct. 21.

Marszalek later tweeted that the ether was recovered and returned to the exchange, but his response was not convincing and failed to calm the already-jittery investors. Some Twitter users worried that Crypto.com might be another shoe to drop.

All funds were returned. We have single digit USD million balance on Gate as of now.

— Kris | Crypto.com (@kris) November 13, 2022

Marszalek also said in another tweet that the transfer was a result of human error. Marszalek said someone on his team had erroneously sent about 80% of the ether in their reserves to a “whitelisted exchange.” The funds had been scheduled to move to a new cold storage wallet, he added.

“It was supposed to be a move to a new cold storage address but was sent to a whitelisted external exchange address. We worked with Gate team, and the funds were subsequently returned to our cold storage. New processes and features were implemented to prevent this from reoccurring,” Marszalek said.

It was supposed to be a move to a new cold storage address, but was sent to a whitelisted external exchange address. We worked with Gate team and the funds were subsequently returned to our cold storage. New process and features were implemented to prevent this from reoccurring.

— Kris | Crypto.com (@kris) November 13, 2022

However, it didn’t take long before some Crypto.com customers started to withdraw their funds from the exchange. The Wall Street Journal also confirmed that withdrawals at Crypto.com rose over the weekend after Marszalek’s tweet.

Over the weekend, Marszalek had ‘AMA’ (ask-me-anything) and took questions in a livestreaming YouTube address. He told the audience that Crypto.com always maintained reserves to match every coin customers held on its platform.

“We will just continue with our business as usual and we will prove all the naysayers and there is (sic) many of these right now on Twitter over the last couple of days,” Marszalek added.

Founded in 2016, Singapore-based Crypto.com is a pioneer of payments and cryptocurrency with a mission to accelerate the world’s transition to cryptocurrency. The startup is working towards this goal with its portfolio of consumer products, including the Crypto.com Wallet & Card App, the MCO Visa Card, Crypto Invest, Crypto.com Chain, as well as Crypto Credit.

To date, Crypto.com now serves over 5 million customers today, providing them with a powerful alternative to traditional financial services through the Crypto.com App, the Crypto.com Card, and the Crypto.com Exchange. The Crypto.com Wallet allows users to buy, sell, and pay with cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Binance Coin (BNB), and Crypto.com’s MCO and CRO Tokens.