Amazon takes $7.6 billion loss on Rivian stake after the once high-flying EV startup lost over 80% of its value; from its peak of $146.7 billion to $29.41 billion

We first covered Rivian in 2019 after the once secretive and high-flying electric truck startup raised $700 million in funding led by e-commerce giant Amazon. A year earlier, Rivian emerged from stealth mode with half a billion dollars in funding. With millions of gas guzzlers on the roads, Rivian believes it can reduce the amount of carbon dioxide emissions into the atmosphere, lower the carbon footprint and also make money doing good.

Just like Tesla and other electric car companies, Rivian wants to save the planet from the impending climate change doom. However, things are not turning out well for the Plymouth, Michigan-based Rivian as reality started to set in. By the end of 2019, Amazon, Ford, and T. Rowe Price invested an additional $1.3 billion in the company. Prior to that, Rivian had raised $2.2 billion and was valued at an estimated $5 billion to $7 billion.

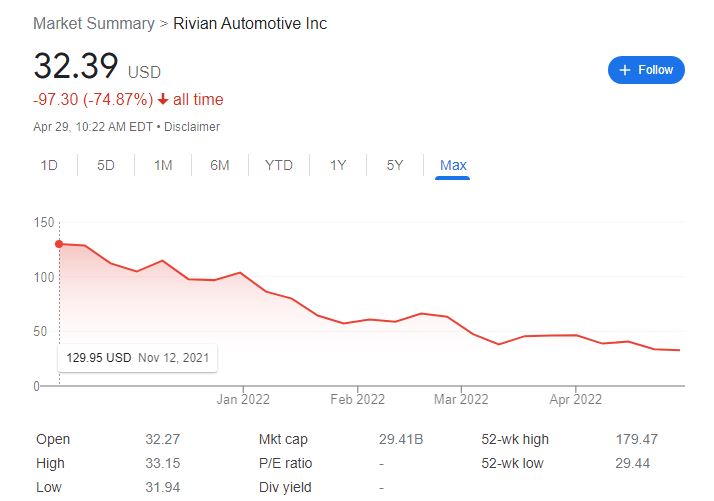

Amazon takes $7.6 billion loss on Rivian stake after the once high-flying EV tech startup lost over 75% of its market value; from its peak of $146.7 billion to $29.41 billion

Fast forward two years later, Rivian went public and the shares of Amazon-backed EV startup Rivian popped on IPO debut, surpassing GM at a $101 billion market cap despite less than 100 EV trucks delivered to customers, most of which are company employees.

Over the next three trading days, shares of Rivian climbed up reaching $172 per share at a market cap of $146.7 billion, valuing Rivian more than either GM, with a market cap of $88.8 billion, or Ford’s at $78.9 billion. As of October 2021, Rivian has built only 56 R1Ts, or an average of two vehicles a day.

However, October 2021 marked the end of the good news for the company. In November 2021, Rivian lost nearly all its IPO gains after the EV-truck startup said it’s not working together with Ford Motor to develop electric vehicles.

As we reported on November 22, 2021, Rivian stock was down about 15% to $108.50, which was $2 above the level of $106.75 where the stock began trading in its debut on the public market on Nov. 10. But that was just the beginning of the bad news for the 13-year-old company.

Fast forward to February 2022, shares of Rivian have been in free-fall after the company announced last December it expected production to fall “a few hundred vehicles short” of its 2021 target of 1,200 due to supply chain constraints. Rivian has lost about 75% from its peak market value of $146.7 billion. On February 12, 2022, Rivian market value to as low as $52.98 billion.

Some investors saw the fall as a buying opportunity. Sensing the opportunities that Rivian has more potential to grow and perhaps the stock is undervalued, Billionaire investor George Soros bought a $2 billion stake in the company in exchange for nearly 20 million shares. But the bloodbath didn’t end there.

Today, Amazon, one of the largest Rivian backers, announced today it has taken a $7.6 billion loss on Rivian stake after the EV company’s stock plunge, according to CNBC, citing the company’s Thursday earnings report. Unfortunately, Amazon is not the only company that took a haircut, on Wednesday, Ford also took a $5.4 billion loss on its Rivian stake. As of the time of writing, Rivian stocks are trading at $32.39, giving the company a valuation of only 29.41 billion.

Unfortunately, the future doesn’t look promising for the EV company. Rivian’s loss has continued into the second quarter of this year, with the stock plummetting another 36%. Rivian’s stock is now more than 80% off its high from November. “During the first quarter, it saw nothing but red,” CNBC said.

Founded in 2009 by Robert J. Scaringe, Rivian is the world’s first electric adventure vehicle. The company is developing vehicles, technology, and services that inspire people to get out and explore the world. Rivian is an automotive technology company that develops products and services to advance the shift to sustainable mobility.