Facebook lost $237.6 billion in market value in just 8 hours, setting the record for the biggest one-day value drop in stock market history

As you may recall just a few hours ago, we told you about Meta after Facebook’s parent company lost 20% of its market value as users abandon the social media platform. For the first time ever, Meta reported declining users causing the company to lose $200 billion off its market cap.

Everyone thought the bloodbath was over. But the social giant extends its losses at the close of the market Thursday. When the dust settles, Meta lost more than $237 billion in value, making it the biggest one-day drop in value in the history of the U.S. stock market.

Meta’s loss also ripples to the CEO Mark Zuckerberg, who also lost more than $31 billion of his net worth. The $220 billion loss comes at a time of the company’s unexpectedly heavy spending on its Metaverse project. In the earnings call yesterday, Meta revealed 500,000 fewer daily log-ins and declining profits. Zuckerberg said Facebook users’ decline was partly due to the boom in popularity of the competitor platform TikTok. That’s not all. Meta also blamed the woes on a combination of other factors, including privacy changes to Apple’s iOS and economic challenges, for Wednesday’s decline in stock prices.

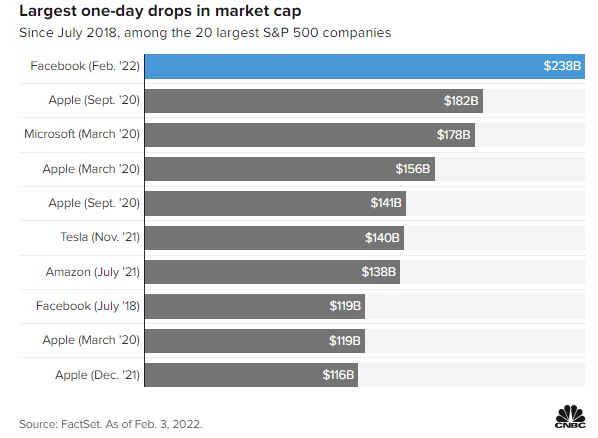

Meta’s loss topped the prior record set by Apple in September 2020 when the iPhone maker lost $182 billion in market value. According to CNBC analysis, the seven biggest drops in stock market history have all occurred in the last two years, as Apple, Microsoft, Tesla, and Amazon have ballooned in valuation.

Before 2020, the biggest drop was also from Facebook after the company saw a $119 billion decline in 2018. That loss was also a result of Facebook’s forecast revenue coming below analyst estimates. The chart below shows some of the largest one-day valuation drops in U.S. stock market history since July 2018:

Credit: CNBC