Bitcoin crashes to $33,000, losing more than 50% of its value in just 2 months

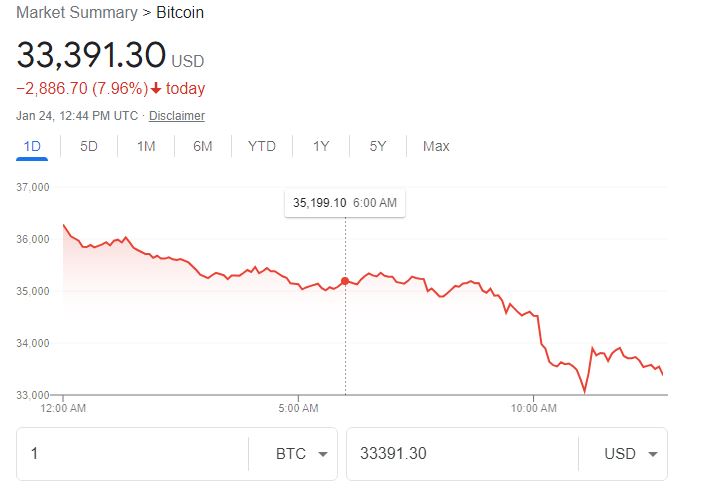

Bitcoin’s downward spiral continues early this morning as the world’s most popular cryptocurrency lost more than half of its value since its all-time high price of $68,990.90 on November 9, 2021. Bitcoin is now trading at $33,184 as of the time of writing, according to data from CoinDesk. Other cryptocurrencies also extend steep losses as “drums of war” between Russia and Ukraine reach a new level.

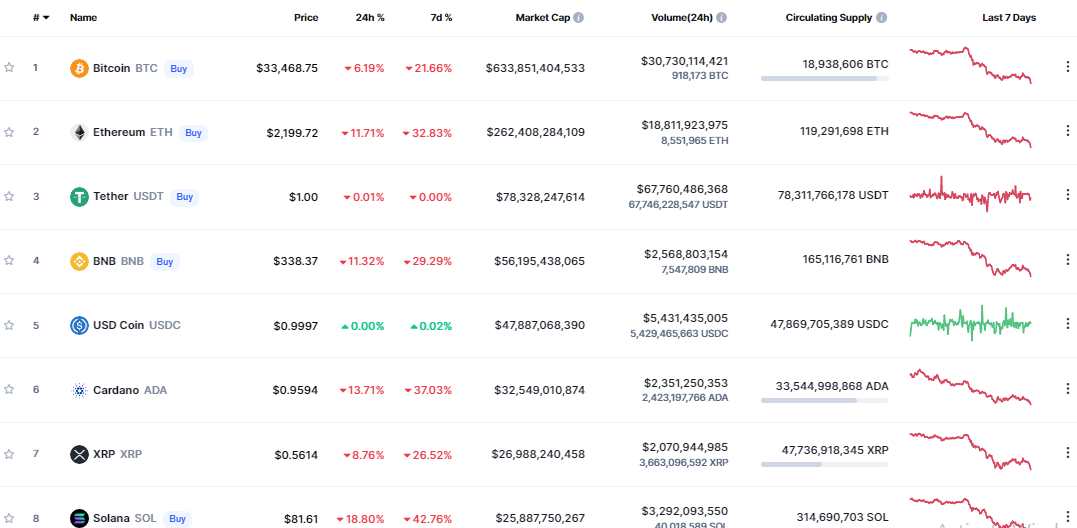

Bitcoin is not alone. The carnage also spreads to other altcoins. Ethereum, Solana, and Cardano suffered heavy losses as $1 trillion were wiped off from the crypto market. Ether, the second-largest cryptocurrency by market cap, suffered heavy losses dived nearly 11.71% in the last 24 hours. It was trading at $2,199 as of the time of writing, after falling as low as $2,019 in the past 24 hours, according to CoinMarketCap.

Why the sudden sell-off?

Many analysts blamed the broad sell-off on the news that Russia’s central bank had proposed a ban over the use and mining of cryptocurrencies on Russian territory, claiming the digital currency poses a risk to “financial stability and monetary policy sovereignty.”

Others said there’s a risk that a more hawkish Federal Reserve may take the wind out of the crypto market’s sails. Meanwhile, although Bitcoin has gone up by 24% in the last year, the majority of people who bought bitcoin in 2021 lost their investment.

As American stockbroker Peter Schiff also noted in a tweet early this month, he challenged the narrative that Bitcoin had a stellar 2021. The famed Bitcoin critic claimed that although Bitcoin had a 60% leap over the last year.

“Bitcoin bulls point to Bitcoin’s 50% gain in 2021 as more evidence that it’s the best asset to buy. But all of those gains occurred during the first five weeks of the year. Bitcoin is lower now than it was in Feb. The vast majority of people who bought Bitcoin in 2021 are down!” Schiff tweeted.