Twitter founder Jack Dorsey warns: “Hyperinflation is going to change everything,” even as Federal Reserve continues to print trillions out of thin air with no productivity to back it up

As millions of Americans struggle to make ends meet due to the covid induced pandemic, the Federal Reserve has been busy printing trillions of dollars out of thin air, further devaluing the US dollars. In fact, 40% of US dollars in circulation were printed in the last 12 months alone, which further devalued the US dollars.

By increasing the amount of U.S. dollars in circulation and with no productivity to back it up, the U.S. government has, in essence, reduced the purchasing power of the dollar and inflated the prices of necessities like food, gas, and housing.

With trillions of dollars in circulation, US inflation has reached levels not seen in over a decade. According to U.S. Labor Department data published October 13, the annual inflation rate for the United States is 5.4% for the 12 months ended September 2021. However, some analysts said the inflation rate is higher. Others said hyperinflation is already happening.

Yesterday, Twitter co-founder Jack Dorsey weighed in on escalating inflation in the U.S., saying things are going to get considerably worse. In a tweet on Friday, Jack warned saying, “Hyperinflation is going to change everything. It’s happening.”

Hyperinflation is going to change everything. It’s happening.

— jack (@jack) October 23, 2021

In his response to user comments, Dorsey added Friday that he sees the inflation problem escalating around the globe. “It will happen in the US soon, and so the world,” he tweeted.

https://twitter.com/oviosu/status/1451735320349736962

Jack is right. Hyperinflation is already here but we just haven’t realized it yet. Unfortunately, what the Fed is doing now has been tried throughout history. The outcome is always the same. Take, for example, Germany. Between June 1921 and November 1923 in Weimar Germany, the highest monthly inflation rate rose by over 30,000%. Zimbabwe is another country with hyperinflation.

Money printing is nothing new. The Federal Reserve has been printing money since 1971 when the United States moved away from the gold standard and President Nixon ended the convertibility of U.S. dollars to gold.

On Aug. 15, 1971, Former President Richard Nixon said in a speech, “I have directed [Treasury] Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

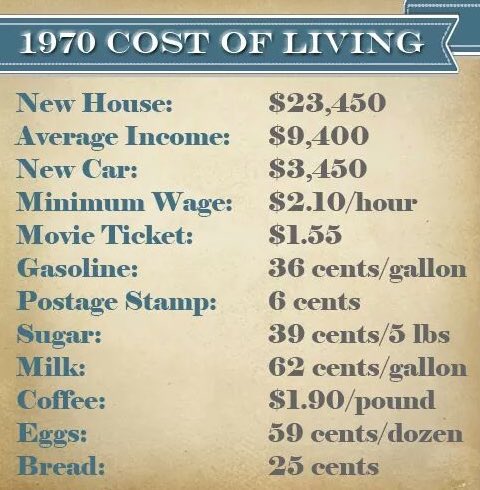

In 1970, the average income was $9,400 and a new house was $23,400. Today, the cost of an average home is over $200,000.

Below is a video of the effect of hyperinflation and how it has driven up the price of most goods.