Cognizant to pay $95 million settlement for defrauding shareholders and bribery allegation case in India

Cognizant Technology Solutions has reached a $95 million settlement deal to resolve a lawsuit brought by its investors accusing the New Jersey-based information technology services company of defrauding shareholders by concealing bribes to officials in India for facility permits.

The shareholders accused Cognizant of failing to disclose payments made in India to obtain permits for facilities in “special economic zones,” including its Indian headquarters in Chennai, where it could enjoy tax and other benefits, Reuters reported.

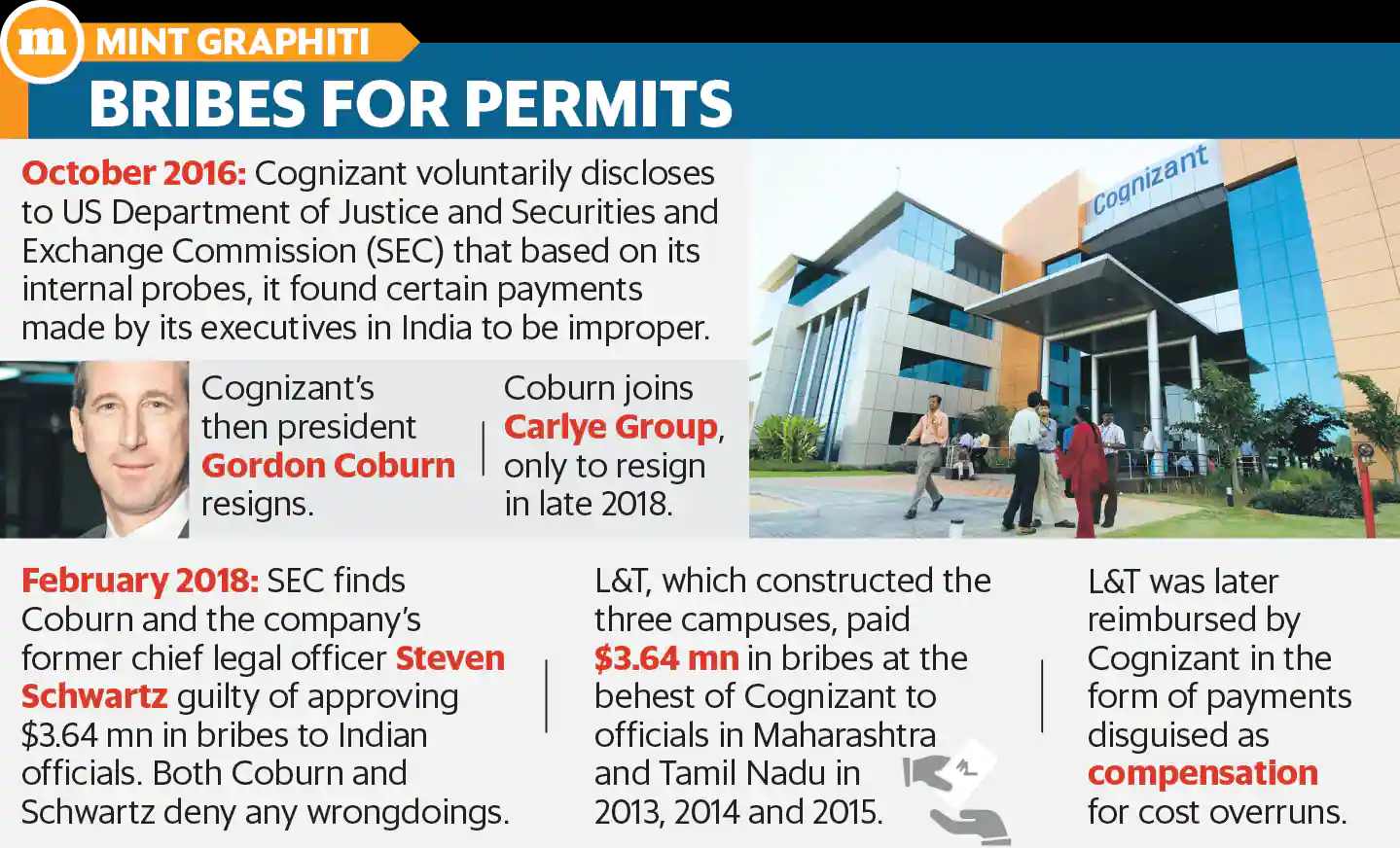

The defendants, including former president Gordon Coburn and former chief legal officer Steven Schwartz, denied any wrongdoing in agreeing to settle. Cognizant said it expected insurers to cover a substantial majority of the settlement payment.

U.S. prosecutors also charged Coburn and Schwartz with FCPA and other violations. Those criminal cases are still pending. The SEC action has been paused until those cases are resolved, and a limited stay of discovery in the investors’ suit was granted in July pending the resolution of the criminal charges.

A preliminary settlement of the proposed class action was filed on Tuesday with the federal court in Newark, New Jersey, and requires a judge’s approval. In the preliminary settlement, the class counsel detailed how Cognizant will dispense $95 million in cash on behalf of all defendants, which include two of the company’s former executives. The funds would then be deposited in an escrow account within 20 business days of the preliminary approval date.

Class counsel also stated in the 33- page motion that they intend to seek up to 20% of the settlement fund, almost $19 million, to cover attorney fees. They also applauded the proposed settlement, acknowledging the risks ahead with continued litigation.

“Lead Plaintiffs would have had to prevail at several stages of litigation, including at summary judgment and trial — and then again on the appeals that would likely have followed,” the attorneys wrote in their motion.

This is not the first time the company has been charged with bribery. Two years ago, the U.S. Securities and Exchange Commission (SEC) charged Cognizant and two former executives with foreign bribery. In a statement on its website, the SEC wrote in September 2019:

“Cognizant Technology Solutions Corporation has agreed to pay $25 million to settle charges that it violated the Foreign Corrupt Practices Act (FCPA), and two of the company’s former executives were charged for their roles in facilitating the payment of millions of dollars in a bribe to an Indian government official.”

Below is a quick overview of how Cognizant offered bribes for permits in India.