Meet Card Blanch: The All-In-One Solution That Combines All Of Your Reward and Bank Cards

According to the Experian Consumer Credit Review, the average American has up to four credit cards on them at any given moment. When you consider the mountains of loyalty cards, reward programs, and discount coupons that individuals carry, it’s no wonder that their wallets resemble a three-inch-thick paperback novel.

This is not only frustrating, but it also makes it tough to keep track of your finances. Monitoring your spending across multiple accounts can be challenging, especially if you have joint bank accounts or various investments/credit accounts.

Fortunately, Card Blanch, a California-based fintech start-up, has devised an innovative one-card solution that aims to address these issues. Using their platform, you can now consolidate all of your debit and credit cards, as well as loyalty and reward cards, in one place, eliminating the need to carry all of your cards simultaneously.

Let’s take a quick dive into the main features of this exciting new start-up and what you can expect to find when using their services:

Spending simplicity

Nowadays, everything is going digital, and the financial industry is no exception. Before the fintech revolution came along, banks became outdated, rigid, and slow to adapt to consumer preferences.

The emergence of companies like Card Blanch is an excellent example that people seek simplifications with their financial products. In an industry renowned for its complexity and jargon-heavy approach, consumers are opting for better experiences and simplified products rather than more abstract banking solutions.

With this in mind, Card Blanch developed a product designed to bring much-needed simplicity to your spending. Instead of adding more products, it condenses everything you already use into one card.

Now, you don’t have to carry every single bank card and loyalty card in your wallet every time you go out, as you can add them all to the Card Blanch app. All you need to do is download the application from the app store and add the accounts you wish to use, and voila, you have everything you need right on your card/smartphone.

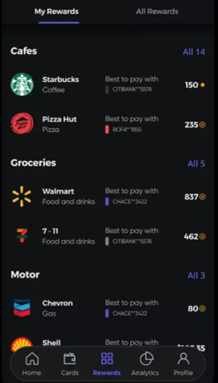

Make the most out of your loyalty programs

Loyalty cards and reward programs are great, but let’s be honest, they can get a little confusing at times. You have one credit card that gives you 2% cashback, another that rewards you with air miles, and another that gives you a discount on purchases. When you’re standing the cashier fumbling through your wallet, you could be forgiven for just picking out the first one that jumps out at you and worrying about it later. However, that means you’re not making the most out of your services.

When you use Card Blanch, merchant discounts and rewards are automatically applied, so you won’t have to carry all of your loyalty cards with you at once, freeing up space in your back pocket while guaranteeing you keep earning rewards and collecting points.

Get insights into your spending habits

Spending insights gives you a sneak peek into the inner workings of your own financial life, which is why it’s essential to keep an eye on your habits, especially if you’re trying to rack up some savings. These days there is an abundance of applications that help you manage your money and outline budgets. However, they are usually a pain to work with as you must manually enter all of your transactions.

With Card Blach, their user-friendly software provides you with comprehensive spending insights from all of your accounts at the same time. It logs both your online and offline spending for you to view whenever you wish, which eliminates the need for third-party software to manually track all of your transactions across multiple accounts.

You can observe and analyze your spending data by card, category, date, or merchant on their application. The choice is yours.

Make all of your cards contactless

One of the more interesting developments that came out of the global pandemic was how it made contactless payments the new normal. With businesses forced to follow social distancing guidelines and set up safe and sterile conditions for their customers, contactless payments skyrocketed in popularity. Not only does this make completing transactions safer, but it’s also faster and more convenient for both the consumer and the cashier.

The Card Blanch card (and app) is payWave compatible, which means that it can be added to your Google and Apple wallets. Now, when you connect any of your cards, they become payWave ready. Pretty nifty! Oh, and the card is 100% plastic-free, as it’s made out of premium ceramic, which is a nice added touch for all of the environmentally-conscious people out there.

Final word

Managing your finances is challenging enough on its own, but it’s even more difficult when you have dozens of different cards in your wallet every time you leave the house. Fortunately, the emergence of the fintech sector has resulted in the development of new and innovative solutions to many of the financial industry’s long-standing issues.

With its all-in-one solution, Card Blanch is an exciting new start-up that enables you to save all of your bank and loyalty cards in one place. You can then use their app or premium ceramic card to make purchases either online, or instores. Amazingly, this means you can access all of your accounts in one place without actually having the card on your person.

Not only does this help you get the most out of your loyalty programs, but it also provides you with important insights into your spending patterns – something that would have required third-party software beforehand.