Tether scandal and Binance investigation: What does this mean for the future of bitcoin and stablecoins?

Just over a week ago, we wrote about Binance after the world’s largest cryptocurrency exchange came under investigation from DOJ and IRS for money laundering and tax offenses. The news quickly sent ripples to the crypto market and investors lost billions of dollars. As it turns out, there are deeper problems and a wide range of irregularities going on in the crypto market.

However, the problem with Binance is not an isolated incident. There’s is another scandal brewing in the crypto-verse. Tether or USDT is a controversial cryptocurrency that is now under investigation by the New York Attorney General’s Office. Tether tokens are issued by Tether Limited, which in turn is controlled by the owners of Bitfinex.

Tether is a surrogate crypto dollar that theoretically pegged at the same value as a dollar but can be traded without following regulation on dollars. Tether is one of the commonly known coins called Stablecoins, which are virtual currencies that are always supposed to have the same real-dollar value.

Crypto day traders typically use Stablecoins as safe haven by shifting their unstable tokens to safe real currencies (like the dollar) because wild market fluctuations make it unsafe to hold. Unlike regular cryptocurrencies like Bitcoin and Ether, stablecoins are cryptocurrencies without volatility. They are digital currencies that are linked to an underlying asset such as a national currency or a precious metal such as gold. The main types of stablecoins include fiat-backed, cryptocurrency-backed and commodity-backed stablecoins.

On February 23, the New York Attorney General’s Office said that “Bitfinex and Tether deceived clients and market by overstating reserves and hid approximately $850 million in losses around the globe.”

“New York Attorney General Letitia James today continued her efforts to protect investors from fraudulent and deceptive virtual or “crypto” currency trading platforms by requiring Bitfinex and Tether to end all trading activity with New Yorkers. Millions around the country and the world today use virtual currencies as decentralized digital currencies — unlike real, regulated government currencies, including the U.S. dollar — to buy goods and services, often times anonymously, through secure online transactions.”

Tether later announced it underwent a major “audit” partly to stay in compliance with a recent settlement agreement made between Tether and the New York Attorney General’s Office. But the veracity of this audit has been called into question by many crypto experts. Seen as an attempt to answer critics on what actually backs USDT, the audit still left many unanswered questions.

While Tether released a range of different figures, including that their reserves were made up of 65.39% “Commercial Paper”, no more detail was given—like the individual ratings of these backings or who they were issued by. Tether did not declare who the borrowers of loans were or what the collateral backing them was.

In addition, Tether has allegedly issued $59 billion virtual dollars. With this amount of money, it is highly unlikely any bank would hold those reserves on behalf of a crypto company, which leads to the question: Where is the money?

Most financial journalists have speculated that the company is engaged in some opaque accounting skulduggery where instead of matching tethers to inflow dollars, they produce *vast* amounts of tethers that aren’t backed by anything. Bitfinex, the owner of Tether is a Hong Kong-based cryptocurrency exchange owned but set up shop in the tax haven of the British Virgin Islands to avoid any regulation and reporting obligations.

Impact of Tether on Crypto Market

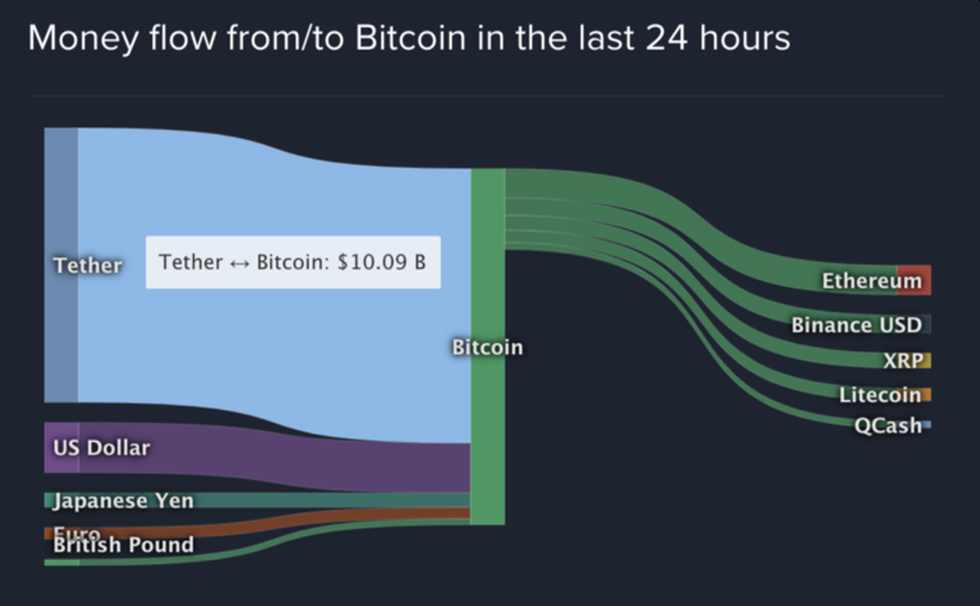

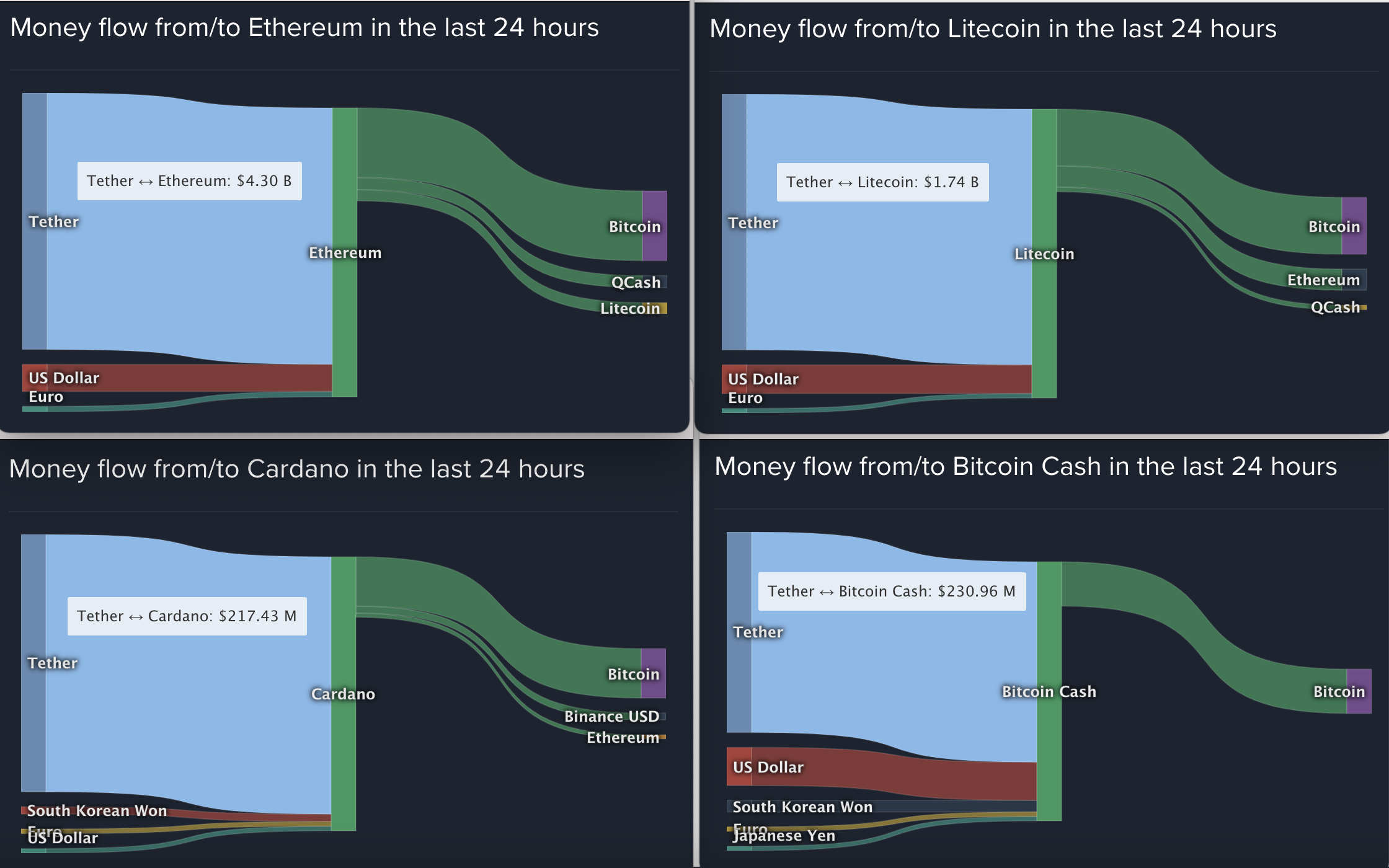

To understand the impact of Tether on the whole cryptocurrency market, we first need to know how much bitcoin purchases go through Tether. For example, looking a the money flow to and from bitcoin on January 8, 80% of bitcoin purchases originated from Tether, according to a post on Hacker News about Tether manipulating the price of Bitcoin.

Using data from CoinLib, below is a chart from Crypto Anonymous with a breakdown of the money flow.

Source: Coinlib BTC.

“The left-hand side of this chart shows which currencies are flowing into Bitcoin (that is, are being used to buy Bitcoin) across all crypto exchanges. The right-hand side shows which currencies are flowing out of Bitcoin (that is, that Bitcoin is being used to buy). The chart is showing typical numbers for early January 2021.”

Further analysis of the January 24 data by Crypto Anonymous further shows that “over two-thirds of all Bitcoin — $10 billion worth of it — that was bought in the previous 24 hours, was being purchased with Tethers.”

Crypto Anonymous said, “Even though $10 billion of Tether flows only constitutes 1.4% of Bitcoin’s $700B nominal market cap, all that really matters is what fraction of Bitcoin’s daily buying volume Tether accounts for — and that number is closer to 70%.”

This still leaves a lot of uncertainty around USDT, and has not fanned flames on the rumors that Tether prints tokens in order to back up the market and keep the price of USDT at $1. Investigation into Binance is another blow for their stablecoin

Major crypto exchange Binance has recently come under Federal investigation for potential money-laundering and tax issues. This casts more doubt on their own stablecoin, BUSD—one of the major and fast-growing stablecoin on the market.

This recent news has caused many to look for an alternative stablecoin option and has undoubtedly increased the prospects for Samecoin’s new ecosystem. Samecoin has a family of stablecoins like SameUSD that offer a number of benefits in a congested stablecoin market. There are currently over a dozen stablecoins on the market.