Berlin-based tech startup Grover raises $70M in Series B funding to offer you the latest tech products as a subscription

Why rent when you can own? This is a question that often gets asked. However, in today’s world where technology changes almost every minute, maybe it is better to rent than to own. Just like car leasing, renting gives you the opportunity to get the latest tech products without having to worry about keeping up with the latest technology changes.

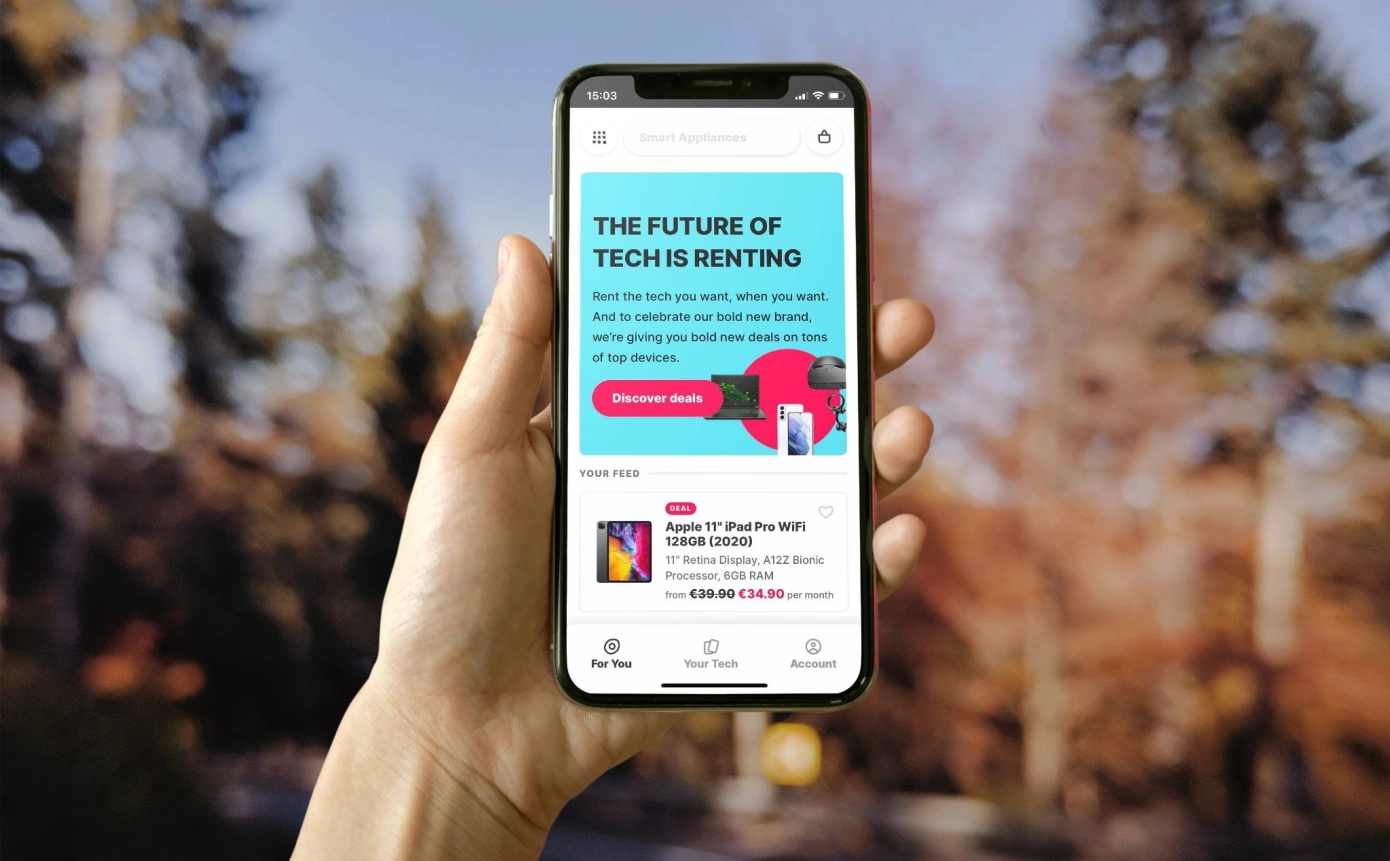

One of the leading companies in the tech subscriptions space is Grover, a Berlin, Germany-based tech startup that brings the access economy to the consumer electronics market, by offering a simple, monthly subscription model for the best in tech.

Today, Grover announced it has secured $70 million (€60 million) in a Series B round. The round consists of €45 million from equity investors and €15 million in venture debt financing. Investors in the round are a combination of existing, new investors, and angel investors from Europe and North America. New investors in the round were led by Jonathan Schneider at private equity firm JMS Capital-Everglen, with participation from Seedcamp and Samsung Next, and others. The €15 million venture debt portion of the round was issued by European growth debt provider Kreos Capital.

Grover said it will use the new capital infusion to increase market penetration, advance product innovation, and accelerate international expansion in support of the company’s ambitious goals of tripling its subscriptions by the end of the year and driving an industry shift toward a more circular approach to consumer electronics. The funding round follows a strong year of growth in 2020, which saw the business increase by 2.5x as consumers flocked to the company’s flexible rental service.

Founded in 2015 by Michael Cassau, Grover enables people and businesses to rent technology monthly instead of buying it, giving them more flexibility than an outright purchase or financing plan, and allowing them to get the tech they want in a way that fits both their lifestyle and their wallet. By recirculating products across multiple rental cycles, Grover’s subscription model also offers a more sustainable alternative to conventional linear consumption.

This customer value proposition proved especially strong during the last year of the Coronavirus pandemic, where technology gained greater significance in people’s lives, consumers shopped more mindfully and sought out flexible access options to help them stay in control of spending. Grover experienced record demand in 2020, closing out the year with 2.5x year-over-year growth, net revenues of €37 million for the fiscal year, and over 4,000 metric tons of CO2 saved thanks to device recirculation. 2020 also saw the company achieve €60 million in annual recurring revenue (ARR) and become profitable on EBITDA-level for the first time.

Grover will use the new capital to double down on its core purpose of giving people a flexible, sustainable, and financially healthy way of accessing tech, with the aim of tripling its subscriptions to a total of 450,000 by the end of 2021 and driving an industry shift toward a more circular approach to consumer electronics.

Grover founder and CEO Michael Cassau said, “Now more than ever, consumers value convenience, flexibility, and sustainability when they shop for and use products. This is especially true when it comes to technology and all of the possibilities that it has to offer — whether that’s productivity, fun, or staying in touch with our loved ones.”

Cassau added: “The fresh funding allows us to bring these possibilities to even more people across the world. It enables us to double down on creating an unparalleled customer experience for our subscribers and to push the boundaries of the most innovative ways for people and businesses to access and enjoy technology. The strong support from our investors confirms not only the important value our service brings to people but also Grover’s vast growth potential. We’re still just scratching the surface of a €1 trillion global market.”