Tesla surges 20% after losing over $0.25 trillion in just one month

Tesla stocks have been soaring since the beginning of 2021 reaching a record high of over $900 billion in market capitalization on January 25. Since then, Tesla stocks have been in free fall with market cap fallen by almost $300 billion since its January 26 record high to $550 billion.

According to Reuters, the weeks-long sell-off has reduced Musk’s wealth by more than $49 billion as of Friday, costing him his place as the world’s richest person. Shares of Tesla closed lower for a 5th consecutive session on Monday. The electric car giant was caught in a tech-led selloff that has wiped more than $550 billion off its market value.

Tesla is not alone. The broader tech and auto industries have also been affected by a global semiconductor chip shortage, which has caused a major delay in manufacturing activities and forced many automakers to scale down production.

But there is one other problem unique to Tesla stock. On February 8, Tesla announced the purchase of $1.5 billion worth of bitcoin. In a regulatory filing with the U.S. Securities and Exchange Commission (SEC), Tesla said it bought the bitcoin for “more flexibility to further diversify and maximize returns on our cash.”

About two weeks after the announcement, on February 22, Tesla’s made about $1 billion in profit on its bitcoin investment. However, the excitement about the profit was short-lived. On February 23, Tesla lost 20% of its market value two weeks after spending $1.5 billion to buy bitcoin.

Peter Shiff, Chief Market Strategist and Senior Economist at Europac first wrote on Twitter, “Two weeks after @elonmusk announced that he spent $1.5 billion of shareholder money buying Bitcoin, #Tesla stock entered a bear market, plunging 20% from its all-time high set on Jan. 25th, and 16% since disclosing the #Bitcoin buy. Not an example other CEOs will likely follow!”

Roth Capital Partners analyst Craig Irwin also attributed the Tesla stock’s decline to investors’ buying patterns. “People went into this stock super aggressively to drive it from $40 to $900, and that means will usually come out just as fast,” Irwin wrote.

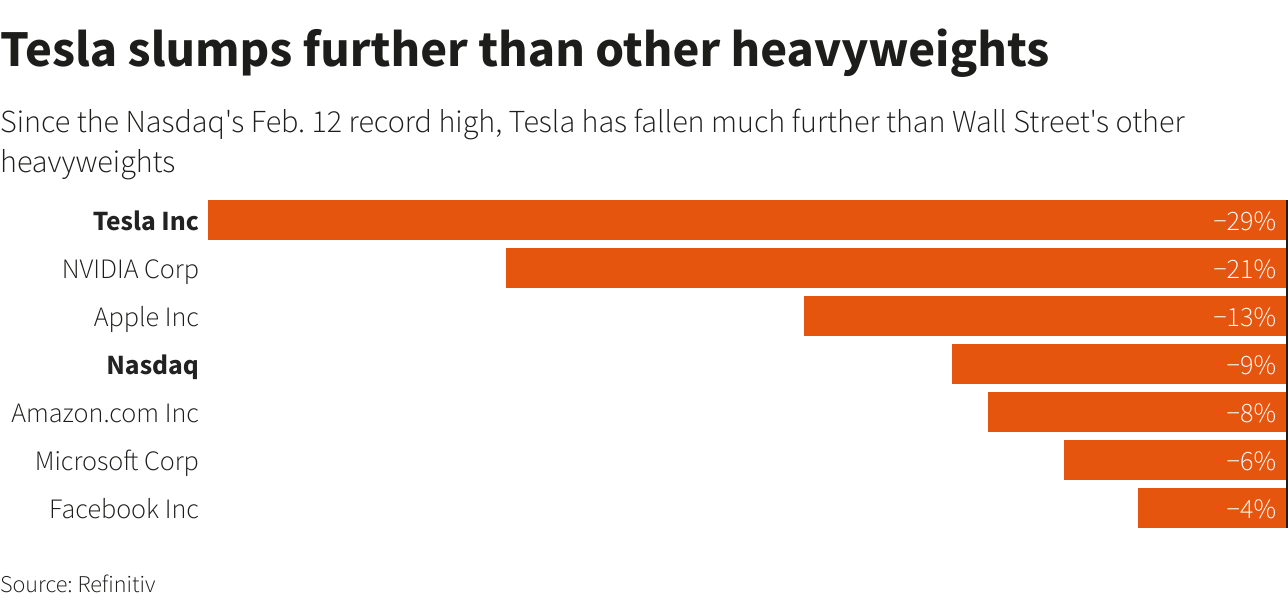

Below is a chart of Tesla stock compared to other big tech companies like Invidia, Apple, Amazon, Microsoft, and others.

It’s not all bad news for Tesla. As of the close of the market today, Tesla surges 20%, nearly wiping out five straight days of loss. However, Tesla is still down about 25% from its all-time intraday high of $900 per share on January 25.

Meanwhile, CNBC reported today that “some Tesla proponents have begun to acknowledge increasing competition for Tesla in the electric vehicle market.” At the same time, many see the recent declines in Tesla stock’s price as a buying opportunity.