X10, a crypto exchange startup founded by Ex-Revolut alumni, launches with $6.5M in funding

X10, a hybrid crypto exchange founded by a former Revolut executive, has emerged from stealth today with $6.5 million in funding. This funding round saw significant backing from both major players in the crypto space and traditional investors, including Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware, and Cyber Fund. Notable individuals such as executives from Revolut and Konstantin Lomashuk, the founder of Lido, also contributed as angel investors.

What distinguishes X10 from its competitors is its hybrid model, which aims to bridge the gap between centralized and decentralized finance. Unlike other exchanges, X10 combines the speed and product variety typical of centralized exchanges with the security and transparency features of decentralized finance. This innovative approach positions X10 favorably in the evolving landscape of crypto trading post-FTX 2024.

The brainchild behind X10 is Ruslan Fakhrutdinov, formerly the Head of Crypto Ops at Revolut, who has teamed up with other ex-Revolut employees with a wealth of experience in designing and developing financial products for millions of users. Their goal is to introduce efficient and profitable trading practices into the transparent realm of web3.

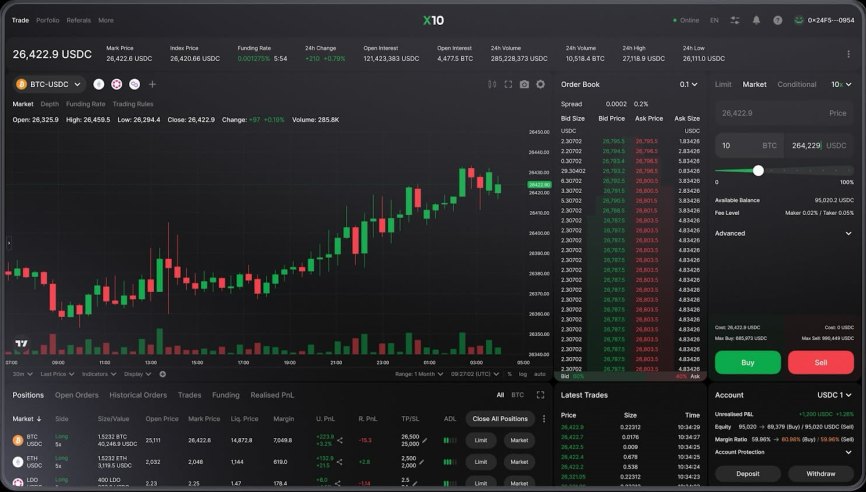

X10 boasts an Optimized Hybrid Model and Enhanced Settlement Architecture, enabling users to engage in perpetuals trading in the DeFi realm with unparalleled speed and efficiency while ensuring self-custody and on-chain settlement. This combination not only enhances liquidity and user experience but also guarantees the safety of customer funds and transparency.

Fakhrutdinov emphasizes the importance of trust and efficiency in crypto trading, especially in light of past incidents such as the FTX situation. With X10, he aims to offer users the speed and features of leading centralized exchanges like Coinbase and Binance but with the added security of full self-custody.

“With X10, we want to give our users and traders the best of both worlds. Imagine the features and the speed of Coinbase or Binance but with full self-custody. The FTX situation, where users only got back a third of their funds, serves as a wake-up call for the industry. It urges us to reinforce trust and efficiency in crypto trading through on-chain trade settlement, validation, and self-custody,” Fakhrutdinov said.

Operating as a hybrid Central Limit Order Book (CLOB) exchange, X10 handles order processing, matching, and transaction sequencing off-chain to ensure optimal performance. On-chain trade settlement via the StarkEx Layer 2 engine ensures self-custody and transparency, safeguarded by on-chain validations and independent Oracle price providers.

In addition to its safety and performance features, X10 prioritizes user experience, offering a range of advanced trading options and analytics. With plans for a mobile app and Telegram bot, X10 aims to provide seamless onboarding and trading convenience for retail users.

X10’s emergence marks an exciting development in the crypto trading landscape, promising to revolutionize the way traders engage with digital assets.