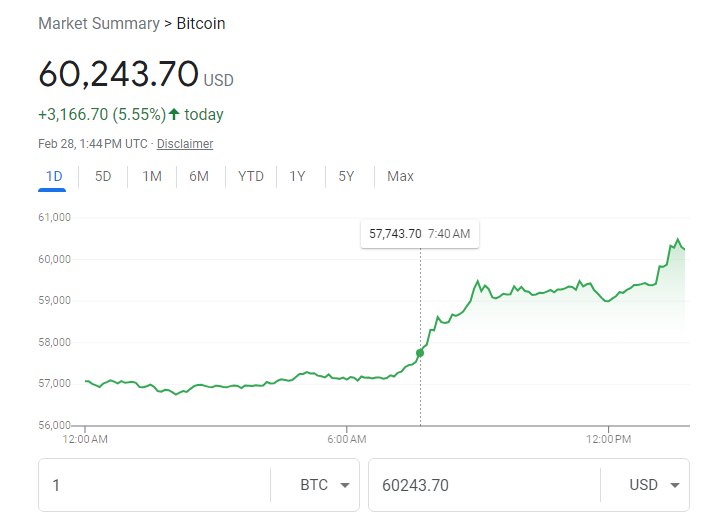

Bitcoin soars above $60,000, reaching new high since November 2021

Bitcoin, the world’s largest cryptocurrency, made a dramatic comeback this week, soaring for a fifth consecutive day shooting above the $60,000 mark. This surge represents its most significant monthly rally since late 2021.

The impressive rise in February, nearly 40%, has been largely attributed to the influx of investments into new U.S. spot bitcoin exchange-traded products. The price of Bitcoin surged by 6% to $60,391.10 on Wednesday morning, according to data from Coin Metrics. Earlier, it reached a peak of $60,734.42. Presently, it remains just below its all-time high of $68,982.20.

Credit: Google

Investors are flocking to Bitcoin, anticipating the upcoming halving event scheduled for April. This event, aimed at slowing the release of the cryptocurrency, has spurred increased interest in Bitcoin. Moreover, with the Federal Reserve hinting at potential interest rate cuts throughout the year, investors are seeking assets with higher yields and greater volatility, further boosting Bitcoin’s appeal.

According to Ben Laidler, a global markets strategist at eToro, the consistent inflows into new spot ETFs, coupled with expectations for the halving event in April and potential Fed rate cuts in June, are the driving forces behind Bitcoin’s surge, Reuters reported.

“Bitcoin is being driven by the support of consistent inflows into the new spot ETFs and outlook for April’s halving event and June’s Fed interest rate cuts,” Laidler said.

This month, the total value of Bitcoin in circulation surpassed $2 trillion for the first time in two years, as reported by crypto platform CoinGecko. Meanwhile, the price of Bitcoin has doubled in just four months.

The larger Bitcoin exchange-traded funds (ETFs), such as those managed by Grayscale, Fidelity, and BlackRock, have experienced a notable increase in trading volumes. Trading volumes in these ETFs have surpassed those of some of the market’s most valuable companies, including Apple, Microsoft, and Nvidia.

Joseph Edwards, head of research at Enigma Securities, noted that the influx of investments into ETFs has accelerated, with advisors quickly selling these products to clients. Flows into the top 10 spot bitcoin ETFs reached $420 million on Tuesday alone, the highest in nearly two weeks.

MicroStrategy, a crypto investor and software firm, recently disclosed its purchase of about 3,000 bitcoins for $155 million. Additionally, social media platform Reddit revealed in a regulatory filing that it has acquired small amounts of bitcoin and ether.

Bitcoin is not the only cryptocurrency experiencing a surge. Ethereum, the second-largest cryptocurrency, rose 2.2% to $3,320, hitting another two-year high. Its price surged by 47% in February, marking the largest monthly gain since July 2022.

Some investors are hopeful that U.S. regulators will approve applications for ETFs based on spot ether. Edwards commented on the steady rise in Ethereum, noting a hint of FOMO (fear of missing out) among investors, but overall, a measured environment prevails.

Meanwhile, Bernstein analysts recently made a bold prediction for Bitcoin’s future. They anticipate that by 2025, Bitcoin could surge to $150,000. This forecast suggests that Bitcoin might surpass its previous record high of $69,000, which was reached in November 2021, potentially more than doubling its previous peak.