This founder quit a $1M consulting job to build a $5M ARR SaaS without funding and turned down a $10M buyout

On a quiet weekday morning, Raf Howery sat at his desk at KPMG, staring at a screen filled with client files and calendar alerts. By most standards, he had already won. A senior consultant with a reputation for sharp thinking, he earned close to a million dollars a year. The perks were generous. The career path was clear. The respect came easily.

For many tech founders, this is where the story stops.

They talk about starting something “one day.” They sketch ideas at night. They listen to podcasts on the commute. They wait for funding. They wait for the right time. The comfort of a steady paycheck makes the leap feel optional. Safe to delay.

Raf felt the same pull. He just didn’t obey it.

He remembers the decision not as a dramatic outburst or a sudden break, but as a steady pressure that refused to fade. “It was a difficult choice to make,” he said. “But for me, I never look back, and I never regret it.”

That morning, he drafted his resignation. No investor deck. No exit plan. No safety net waiting on the other side. Just an idea and a belief that he could build something better on his own terms.

Friends questioned the move. Colleagues thought he was reckless. Walking away from that kind of paycheck felt irrational. Yet Raf signed the letter anyway.

He stood up from his chair, shut his laptop, and walked out.

He didn’t know how long it would take. He didn’t know how far it would go. He only knew he wasn’t turning back.

Meet Raf Howery, the Founder Behind Kukun

Before he became a founder, Raf built his career within KPMG, one of the world’s largest consulting firms. He worked with enterprise clients, learned how large organizations make decisions, and saw firsthand how slow innovation can be inside big institutions.

He wasn’t chasing a lifestyle upgrade. He already had one. His days were structured. His future is predictable. Promotions kept coming. His name carried weight.

Yet security started to feel like a cage. He didn’t want to spend decades solving other people’s problems. He wanted to own one.

Raf speaks with calm confidence, the kind shaped by long meetings and high-stakes decisions. He doesn’t romanticize risk. He treats it like a calculated step. When asked about leaving KPMG, he doesn’t talk about dreams or passion. He talks about choice.

For him, walking away wasn’t rebellion. It was clarity.

Trading Certainty for Uncertainty

The paycheck stopped the day he left. The schedule vanished. The prestige followed. In its place came long days, short nights, and a question he faced every morning: Was this worth it?

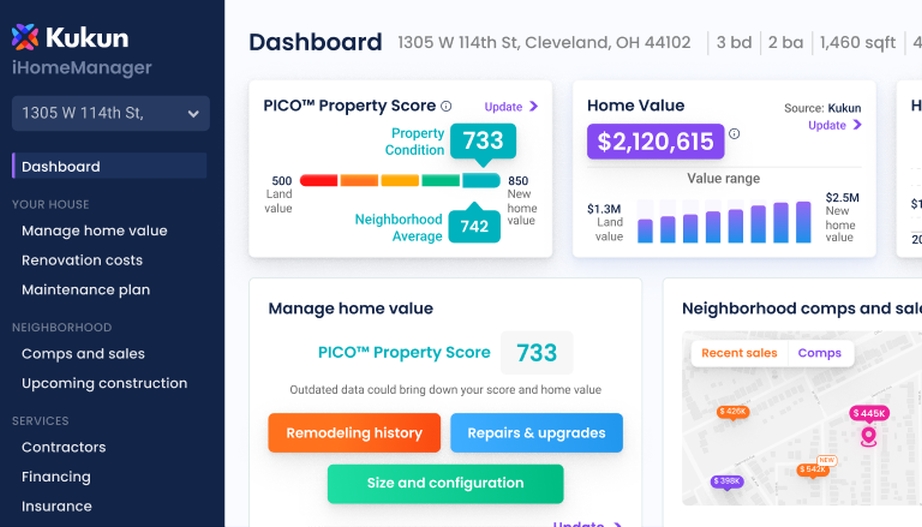

In 2014, he started Kukun, a B2B SaaS platform that powers property data for banks, insurers, and investors, helping homeowners make smarter decisions about equity and long-term value. There was no outside capital. No press. No splashy launch. Just a problem he believed mattered.

Homes are the biggest investment most people ever make. Yet homeowners rarely know how to protect or grow that value. Banks, insurers, and lenders often disappear once a deal closes. The relationship ends at the transaction.

Raf saw the gap. He wanted to fill it.

Starting from scratch felt lonely. Friends in consulting talked about bonuses and promotions. Raf talked about product bugs and sales calls. Some months were strong. Others dragged on.

Still, he kept going.

“I never look back,” he said. And he meant it.

Kukun – Home Investment Intelligence

The Problem Raf Wanted to Solve

Raf kept circling the same idea. People treat their homes like one-time purchases when they should treat them as long-term assets. For most families, a house holds more wealth than any stock portfolio or retirement account. Yet homeowners rarely know which upgrades matter, which repairs move the needle, or how to plan improvements with purpose.

Banks weren’t helping. Insurers weren’t guiding. Lenders vanished after closing.

Raf saw that as a missed opportunity.

Homeowners needed better tools. Clear data. Practical insight. A way to see how a new kitchen, roof, or extension could shape future value. He wanted to bring the kind of analytics used by financial institutions into everyday decisions.

That idea became Kukun.

Yet he didn’t stop with consumers. Banks and insurers needed better ways to stay relevant after a deal closed. If they could offer real value rather than just marketing emails, relationships would last longer.

Kukun would sit in the middle, quietly doing the work.

Building Kukun From the Ground Up

The early days felt unglamorous. No launch parties. No investor roadshows. Raf focused on the product. Data quality. User feedback. Long sales calls.

Kukun began as a simple tool. Over time, it grew into a full platform. Cost estimators. Property insights. Upgrade tracking. Each feature came from real customer needs, not pitch decks.

Raf made a key choice early. He went B2B.

Instead of chasing millions of individual users, he sold to institutions. Banks. Insurance firms. Brokerages. Fintech companies. They embedded Kukun inside their own websites and apps. To customers, it looked native. Behind the scenes, it ran on Kukun’s system.

This white-label model changed everything. One contract could reach thousands of homeowners. Enterprise clients paid real money. Contracts lasted years.

Sales cycles moved slowly. Legal reviews dragged on. Security audits took months. Raf learned patience. He learned how to speak the language of large organizations without losing his own voice.

Raf wasn’t building for headlines. He was building for stability.

How the Business Really Works

Kukun doesn’t list pricing on its website. Every client looks different. A regional bank wants one tool. A national lender wants five. An insurance firm wants risk data. A brokerage wants engagement metrics.

Clients pay based on how many homeowners they want to reach and which tools they choose. A small setup might cost $10,000 a month. Larger contracts run much higher.

Most customers use several products. Bundles bring discounts. Volumes scale. Usage grows.

Today, Kukun works with roughly two dozen enterprise clients. They run thousands of property assessments each month. Some use the platform inside private dashboards. Others place it on public sites. Engagement patterns vary. Results don’t.

Banks see more loan applications. Insurers spot risk earlier. Brokerages stay relevant longer.

Raf watches the numbers closely. Revenue rises and falls with seasons. Summer spikes. Winter slows.

The rhythm feels familiar now.

No venture capital. No burn-rate drama. Just a steady business built one client at a time.

Kukun: Real Revenue, No Venture Capital

By the time Kukun found its stride, Raf had built something rare. A real business. Paying customers. Repeat contracts. No investor pressure.

On average, each customer has around 20,000 property interactions per month. Some do more. Some less. It depends on placement and use.

Pricing reflects that range. Contracts start at five figures and can go higher based on volume and features.

Raf doesn’t share the exact revenue. He doesn’t need to. The math speaks for itself. With twenty clients paying that much, the company clears hundreds of thousands in recurring revenue.

The pipeline looks strong. More institutions want to stay connected with homeowners after deals close. Kukun fits that shift. Raf sees it in the calls. In the demos. In the contracts waiting to be signed.

Chasing the $5M ARR Mark

Raf believes Kukun can reach $5 million in annual recurring revenue within a year. The confidence comes from deals already in motion.

Banks are paying more attention to retention. The transaction no longer marks the end of the relationship. Institutions want to stay useful. They want to offer tools that matter.

Each new client adds predictable revenue. Contracts last. Expansion happens inside accounts. One product becomes three. Volume climbs. Bills rise.

Raf built this model on purpose. Slow growth. Strong foundations. No rush.

The $10M Question

During a podcast interview, the host asked a simple question.

If someone offered ten million dollars in cash for the company, would he sell?

Raf didn’t hesitate.

No.

Ten million sounded big. To most people, it felt life-changing. To Raf, it felt small.

He thought about what he had built. The years. The customers. The future. Kukun was just getting started.

Money wasn’t the issue. Control mattered. So did vision.

He didn’t leave a million-dollar job to exit early. He left to build something lasting.

What Most People Miss About Success

From the outside, Raf’s story sounds like an overnight leap. Quit a high-paying job. Start a company. Build it into a multimillion-dollar business.

The truth looks quieter.

Kukun took years to find its rhythm. Enterprise sales moved slowly. Contracts crawled through legal teams. Security audits dragged on. Growth came in inches, not miles.

He didn’t chase trends. He focused on customers. He rebuilt when something broke. He stayed close to the product.

Most people only see the outcome. They don’t see the ten-year runway it took to get there.

Lessons From the Long Road

Walking away from security forced discipline. With no investor money, every hire mattered. Every expense counted.

Real traction came from solving real problems. Kukun won clients with results. More loan applications. Better engagement. Clear returns.

Prestige can trap you. A big salary feels safe. A famous company feels permanent. Neither is guaranteed.

Short wins don’t build companies. Steady execution does.

This wasn’t about freedom. It was about ownership.

Looking Ahead

Today, Raf wakes up to a different kind of pressure. Not corporate deadlines. Just the weight of his own expectations.

Kukun keeps growing. New banks call. Existing clients expand. The roadmap stretches forward.

He still remembers that morning at KPMG. The resignation letter. The empty calendar. The fear. The relief.

If he could speak to his younger self, he wouldn’t give advice. He’d offer reassurance.

You were right to leave.

The offer still stands. Ten million dollars. Cash.

He still says no.

The details in this article are drawn from a recent podcast interview with Raf Howery, originally published on YouTube under the title “He Quit a $1M Consulting Job to Build a $5M/yr SaaS (with no funding).”