Top Startup and Tech Funding News – January 14, 2025

It’s Wednesday, January 14, 2026, and today’s funding landscape reflects growing confidence in AI-native robotics, security automation, and deep science ventures addressing energy and healthcare bottlenecks. From billion-dollar bets on general-purpose robot brains to quantum-resilient encryption for crypto networks, investors are aligning behind foundational technologies for the physical and digital worlds.

Skild AI dominated headlines with a staggering $1.4 billion Series C to scale its “omni-robotics brain” across humanoids, drones, and industrial machines, marking one of the largest single-day raises ever in robotics. On the fintech front, Alpaca locked in $150 million to expand its brokerage API infrastructure globally as embedded investing demand accelerates.

Cybersecurity saw a flurry of action. Aikido Security hit unicorn status with a $60 million round to automate dev-time defense, while stealth startup Novee emerged with $51.5 million to simulate AI-driven pen testing. On the crypto edge, Project Eleven raised $20 million to future-proof digital assets against quantum computing threats.

Frontier biotech and energy also featured prominently. Caldera Therapeutics launched with $112.5 million to advance dual-target IBD drugs, while Type One Energy added $87 million in bridge financing to advance fusion power. Meanwhile, Vista AI secured $29.5 million to automate MRI scanning, and SkyFi raised $12.7 million to bring real-time satellite intelligence to a broader user base.

From universal robot intelligence and post-quantum cryptography to MRI co-pilots and geospatial data marketplaces, today’s funding reflects investor appetite for technical platforms that are building the next layer of infrastructure across cyber, health, energy, and finance.

Tech Funding News

Funding Highlights

- Skild AI raises $1.4B Series C for omni-robotics foundation model

- Alpaca raises $150M Series D to scale global brokerage APIs

- Type One Energy raises $87M to power fusion energy development

- Aikido Security grabs $60M Series B to automate app security

- Caldera Therapeutics launches with $112.5M for inflammatory disease drugs

- Novee emerges with $51.5M to simulate an “AI hacker” for cyber defense

- SkyFi lands $12.7M Series A to democratize satellite intelligence

- Project Eleven raises $20M Series A to secure crypto for the quantum era

- Vista AI secures $29.5M Series B to automate MRI scanning

- depthfirst raises $40M Series A to power developer-native machine learning

Investor Activity

Today’s capital flowed from a diverse mix of global VCs, corporate venture arms, sovereign funds, and healthcare giants. The presence of strategic investors — from Nvidia and SoftBank to top hospital systems and national energy partners — underscores how AI and automation are driving convergence across defense, infrastructure, healthcare, and industrial systems.

Here’s the full breakdown of January 14’s most significant startup and tech funding news stories.

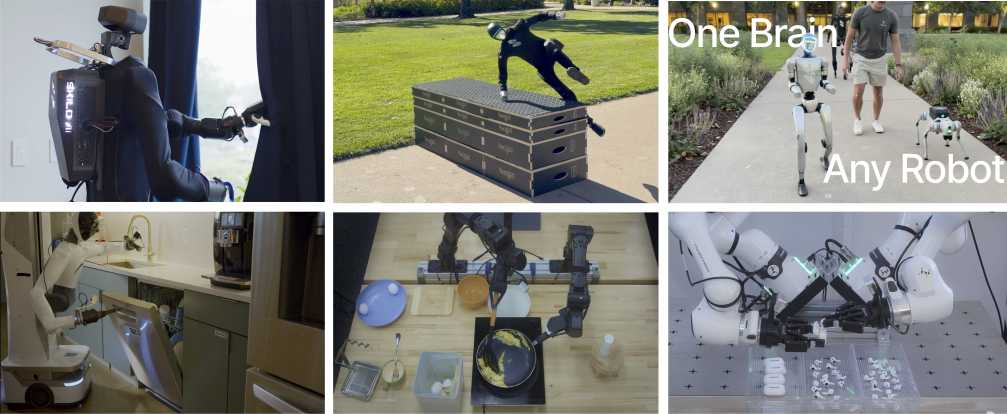

Skild AI raises $1.4B in Series C funding for omni‑robotics “brain”

Skild AI, a Pittsburgh-based robotics AI startup, secured a mammoth $1.4 billion funding round to accelerate development of its “omni-bodied” foundation model for robots. The company’s AI “brain” is designed to control an array of machines – from humanoids and drones to warehouse arms – using one unified system rather than specialized models for each. The Series C raise, one of the largest ever for a robotics startup, triples Skild’s valuation to over $14 billion and signals strong investor confidence in general-purpose AI for the physical world.

Founded in 2023 by leading AI researchers, Skild AI has rapidly gained traction with enterprise customers in logistics, manufacturing, data centers and security, reportedly scaling from zero to about $30 million in revenue in 2025. The new capital will fund extensive model training and global deployments of the Skild Brain platform, as the company eyes expansion into consumer applications after its initial enterprise focus. The round was led by SoftBank Group, joining a syndicate of tech and industrial backers, in a major endorsement of Skild’s vision to create a universal “brain” for robotics.

Funding Details:

-

Startup: Skild AI (Pittsburgh, PA)

-

Investors: SoftBank Group (lead); NVentures (Nvidia), Bezos Expeditions, Macquarie Capital, Samsung, LG, Schneider Electric, CommonSpirit Health, Salesforce Ventures; existing backers Lightspeed, Felicis, Coatue, Sequoia

-

Amount Raised: $1.4 billion

-

Total Raised: $1.83 billion

-

Funding Stage: Series C

-

Funding Date: January 14, 2026

Alpaca raises $150M in Series D funding to expand brokerage API platform

Alpaca, a San Mateo-based fintech that provides API-based brokerage infrastructure, closed a $150 million Series D round at a $1.15 billion valuation. The new funding will fuel Alpaca’s mission to become the “global standard” for embedded investing services, enabling fintech partners and financial institutions worldwide to offer trading in stocks, ETFs, crypto, and other assets via Alpaca’s scalable APIs. The company’s self-clearing brokerage platform and custody solution already power millions of brokerage accounts across 40+ countries, and it more than doubled revenue in the past year.

Founded in 2015, Alpaca has grown to over 300 partner clients by combining traditional securities and on-chain asset access on a single platform. Drive Capital led the Series D and will take a board seat, as Alpaca also secured a $40 million line of credit to bolster its balance sheet for global expansion. The startup plans to deploy the new capital to deepen its product suite (including tokenized assets and 24/5 trading), obtain regulatory licenses in key markets, and strengthen security and reliability as it bridges traditional finance and the crypto space.

Funding Details:

-

Startup: Alpaca (San Mateo, CA)

-

Investors: Drive Capital (lead); joined by Citadel Securities, BNP Paribas (Opera Tech Ventures), MUFG Innovation Partners, Flat Capital (Sebastian Siemiatkowski), DRW Venture Capital, Kraken, Altered Capital, X&KSK (Keisuke Honda), Bank Muscat, Endeavor Catalyst; returning backers Portage, Horizons Ventures, Social Leverage, Unbound, Diagram, Derayah Financial; plus angel investor Vlad Yatsenko (Revolut CTO)

-

Amount Raised: $150 million

-

Total Raised: $320 million

-

Funding Stage: Series D

-

Funding Date: January 14, 2026

Type One Energy raises $87M in funding to power fusion energy development

Type One Energy, a fusion power startup based in Wisconsin, raised $87 million in new financing to accelerate its reactor program. The funding – structured as a convertible note ahead of a planned $250 million Series B – brings Type One’s total venture backing to over $160 million and will support the push to prove its stellarator fusion technology at scale. Backed by Bill Gates’ Breakthrough Energy Ventures, among others, Type One is developing a novel stellarator reactor that uses twisting magnetic fields to confine plasma and generate fusion energy without the risk of meltdowns or significant radioactive waste.

Type One Energy has already inked an agreement with the Tennessee Valley Authority to host its first commercial fusion power plant at a retired coal site, with the 350 MW pilot expected in the mid-2030s. The startup’s approach focuses on selling its core reactor technology to utilities rather than building plants itself. With global electricity demand rising and data centers projected to triple their power usage by 2035, investors are betting that fusion’s promise of virtually limitless clean energy can be realized on the grid in coming years.

Funding Details:

-

Startup: Type One Energy (Madison, WI)

-

Investors: Undisclosed (existing backers include Breakthrough Energy Ventures, Doral Energy-Tech Ventures, and TDK Ventures)

-

Amount Raised: $87 million

-

Total Raised: ~$160 million

-

Funding Stage: Convertible Note (pre-Series B)

-

Funding Date: January 14, 2026

Aikido Security grabs $60M in Series B funding to automate app security

Aikido Security, a Belgium-based developer security startup, announced a $60 million Series B funding round at a $1 billion valuation, making it the latest cybersecurity unicorn. Aikido’s platform helps companies bake security into the software development lifecycle by continuously scanning code, running AI-driven penetration tests, and providing in-app defense and monitoring. The goal is a “self-securing” software pipeline where vulnerabilities are identified and remediated in real time, keeping pace with rapid release cycles.

The investment was led by DST Global, with participation from PSG Equity, Notion Capital, and Singular. The new capital brings Aikido’s total funding to over $84 million to date. Founded in 2019, Aikido says more than 100,000 development teams worldwide use its tools to catch bugs and exploits earlier in the development process. The Series B funds will be used to enhance Aikido’s autonomous security capabilities and expand its go-to-market presence as businesses seek to close the gap between increasingly automated attacks and legacy manual defenses.

Funding Details:

-

Startup: Aikido Security (Ghent, Belgium)

-

Investors: DST Global (lead); PSG Equity, Notion Capital, Singular

-

Amount Raised: $60 million

-

Total Raised: $84 million

-

Funding Stage: Series B

-

Funding Date: January 14, 2026

Caldera Therapeutics launches with $112.5M in funding for inflammatory disease drugs

Caldera Therapeutics, a Cambridge, MA-based biotech, officially launched with $112.5 million in total financing to develop new treatments for immune-inflammatory diseases. The company’s lead program, CLD-423, is a first-in-class bispecific antibody targeting two validated cytokine pathways (IL-23p19 and TL1A) implicated in inflammatory bowel disease (IBD). Caldera has already dosed the first patients in a Phase 1 trial of CLD-423, aiming to address the significant unmet need in IBD and related disorders by hitting both inflammation pathways simultaneously.

Caldera’s hefty funding comes in two tranches: a $75 million Series A raised from Atlas Venture, LifeArc Ventures (LAV), and venBio, and a recently closed $37.5 million Series A-1 led by Omega Funds with new investors Wellington Management and Janus Henderson joining. The combined $112.5 million war chest will enable Caldera to advance CLD-423 through early clinical trials and broaden its pipeline. The startup is led by CEO Praveen Tipirneni and staffed with experienced immunology researchers, positioning it to compete in the crowded autoimmune drug arena with a novel dual-target approach.

Funding Details:

-

Startup: Caldera Therapeutics (Cambridge, MA)

-

Investors: Atlas Venture, LAV, venBio (Series A); Omega Funds (Series A-1 lead), Wellington Management, Janus Henderson

-

Amount Raised: $112.5 million

-

Total Raised: $112.5 million

-

Funding Stage: Series A (incl. A-1 extension)

-

Funding Date: January 14, 2026

Novee emerges from stealth with $51.5M in funding to simulate an “AI hacker” for cyber defense

Novee, an offensive cybersecurity startup, emerged from stealth mode with $51.5 million in funding to automate penetration testing using artificial intelligence. With offices in Tel Aviv and New York, Novee has built a platform that acts like an “AI hacker,” continuously launching simulated cyberattacks on a client’s systems to probe for weaknesses. The AI-driven engine is trained on real-world hacking techniques and can uncover complex vulnerabilities – including business logic flaws – then validate them with exploits and suggest fixes in a closed loop. By reasoning like a real attacker, Novee’s system aims to identify and remediate security gaps faster than human penetration testers alone.

Founded in 2025 by veterans of Israeli military cyber units, Novee has quickly attracted significant backing. The company raised an $8.5 million seed round in May 2025 and a $33 million Series A in September, then added $10 million in venture debt, for a total of $51.5 million secured to date. The out-of-stealth funding was led by YL Ventures with participation from Canaan Partners and Zeev Ventures. Novee plans to expand its AI penetration testing platform to cover cloud infrastructure, mobile apps, and even AI systems themselves, as enterprises look to bolster their defenses against a new generation of AI-augmented threats.

Funding Details:

-

Startup: Novee (Tel Aviv, Israel & New York, NY)

-

Investors: YL Ventures (lead); Canaan Partners, Zeev Ventures

-

Amount Raised: $51.5 million

-

Total Raised: $51.5 million

-

Funding Stage: Seed + Series A

-

Funding Date: January 14, 2026

SkyFi lands $12.7M in Series A funding to democratize satellite intelligence

SkyFi, an Austin-based startup aiming to make satellite imagery accessible to anyone, raised $12.7 million in an oversubscribed Series A funding round. SkyFi operates a platform and mobile app that serve as a one-stop marketplace for Earth observation data, allowing users to task satellites to capture new images or purchase existing imagery and analytics on demand. By partnering with over 50 geospatial imagery providers, SkyFi offers a wide range of data (optical photos, radar, hyperspectral scans, aerial images, etc.) to industries including agriculture, energy, finance, construction, insurance, and defense. The startup’s user-friendly interface and analytics aim to “deliver actionable insights from space” without requiring specialized expertise.

The Series A was co-led by Buoyant Ventures (a climate-tech fund) and IronGate Capital (focused on dual-use tech), with new participation from DNV Ventures, TFX Capital, Beyond Earth, Nova Threshold, and angel investor Chris Morisoli. Existing seed investors R^2 (RSquared) VC and J2 Ventures also joined the round. SkyFi previously raised a $7 million seed round and has seen growing demand as companies seek timely satellite intelligence for applications ranging from crop monitoring to disaster response. The fresh $12.7 million will be used to enhance SkyFi’s platform UI and analytical tools, and to forge new partnerships with satellite operators to expand its on-demand data offerings and AI-powered analytics globally.

Funding Details:

-

Startup: SkyFi (Austin, TX)

-

Investors: Buoyant Ventures, IronGate Capital Advisors (co-leads); DNV Ventures, TFX Capital, Beyond Earth, Nova Threshold, Chris Morisoli; with RSquared VC and J2 Ventures (existing)

-

Amount Raised: $12.7 million

-

Total Raised: ~$20 million

-

Funding Stage: Series A

-

Funding Date: January 14, 2026

Project Eleven raises $20M in Series A funding to secure crypto for the quantum era

Project Eleven, a New York-based startup specializing in post-quantum cryptography, raised a $20 million Series A round to help secure digital asset networks against future quantum-computing threats. The company is developing tools to enable blockchains and other financial systems to migrate to quantum-proof encryption in an orderly manner. As advances in quantum computing could eventually break today’s cryptography (including the elliptic-curve algorithms that protect Bitcoin and other networks), Project Eleven provides readiness assessments, testing environments, and migration frameworks to enable the $4+ trillion crypto ecosystem to proactively upgrade its security protocols.

The Series A was led by crypto-focused Castle Island Ventures with participation from Coinbase Ventures, Fin Capital, Variant, Quantonation, Nebular, Formation, Lattice, and Satstreet Ventures, among others. Notably, former Coinbase CTO Balaji Srinivasan also invested. Project Eleven previously raised a $6 million seed round in 2025. The new funding comes as post-quantum encryption standards are being finalized and will support the early 2026 launch of the startup’s first product, helping institutions “future-proof” their blockchains. Project Eleven is already collaborating with networks such as Solana on quantum-resistant solutions and plans to use the capital to expand its engineering team as the countdown to the quantum era continues.

Funding Details:

-

Startup: Project Eleven (New York, NY)

-

Investors: Castle Island Ventures (lead); Coinbase Ventures, Fin Capital, Variant, Quantonation, Nebular, Formation, Lattice Fund, Satstreet Ventures; Balaji Srinivasan (angel)

-

Amount Raised: $20 million

-

Total Raised: $26 million (including $6M seed)

-

Funding Stage: Series A

-

Funding Date: January 14, 2026

Vista AI secures $29.5M in Series B funding to automate MRI scanning

Vista AI, a Palo Alto-based healthtech startup, secured a $29.5 million Series B investment to expand its AI software that automates MRI scanning procedures. Vista’s platform acts as a “co-pilot” for MRI technologists, using artificial intelligence to guide the imaging process so that even non-specialist staff can run complex scans like cardiac MRIs. By reducing human workload and variability, the software helps hospitals address the critical shortage of MRI technicians and cut patient wait times. With MRI demand far outpacing the number of trained personnel, Vista’s automation promises more consistent imaging quality and broader access to advanced diagnostics.

The Series B was backed by an impressive roster of hospital systems — Cedars-Sinai (Los Angeles), Intermountain Health (Utah), University of Utah Health, Temple University Health (Fox Chase Cancer Center), and Tampa General Hospital — all of which invested in the round alongside existing investor Khosla Ventures. Those five health systems are not only funders but also early adopters seeking to deploy Vista’s technology across their networks. Vista will use the funding to extend its FDA-cleared cardiac MRI platform to other anatomies, such as brain, prostate, and spine imaging (pending regulatory clearance), and to roll out remote scanning services that enable smaller hospitals to offer MRI scans with off-site experts. The strong support from major providers underscores the healthcare industry’s belief that automation will be key to maintaining imaging capacity and quality amid staffing challenges.

Funding Details:

-

Startup: Vista AI (Palo Alto, CA)

-

Investors: Cedars-Sinai, Intermountain Health, University of Utah Health, Temple/Fox Chase Cancer Center, Tampa General Hospital; Khosla Ventures, Bold Brain Ventures

-

Amount Raised: $29.5 million

-

Total Raised: ~$38 million (estimated)

-

Funding Stage: Series B

-

Funding Date: January 14, 2026

Tech Funding Summary

| Startup | Investors (Lead & Notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Skild AI | SoftBank Group (lead); NVentures, Bezos Expeditions, Macquarie; Samsung, LG, Schneider Electric, CommonSpirit, Salesforce; Lightspeed, Felicis, Coatue, Sequoia | $1.4B | $1.83B | Series C | Jan 14, 2026 |

| Alpaca | Drive Capital (lead); Citadel Securities, BNP Paribas, MUFG, Flat Capital, DRW, Kraken, Altered, X&KSK, Bank Muscat, Endeavor, Portage, Horizons Ventures, Social Leverage, others | $150M | $320M | Series D | Jan 14, 2026 |

| Type One Energy | Undisclosed (convertible note; prior backers include Breakthrough Energy Ventures, Doral, TDK Ventures) | $87M | ~$160M | Bridge to Series B | Jan 14, 2026 |

| Aikido Security | DST Global (lead); PSG Equity, Notion Capital, Singular | $60M | $84M | Series B | Jan 14, 2026 |

| Caldera Therapeutics | Atlas Venture, LAV, venBio (Series A); Omega Funds (A-1 lead), Wellington, Janus Henderson | $112.5M | $112.5M | Series A | Jan 14, 2026 |

| Novee | YL Ventures (lead); Canaan Partners, Zeev Ventures | $51.5M | $51.5M | Seed + Series A | Jan 14, 2026 |

| SkyFi | Buoyant Ventures, IronGate Capital (co-leads); DNV, TFX, Beyond Earth, Nova Threshold, Chris Morisoli; RSquared VC, J2 Ventures | $12.7M | ~$20M | Series A | Jan 14, 2026 |

| Project Eleven | Castle Island Ventures (lead); Coinbase Ventures, Fin Capital, Variant, Quantonation, Nebular, Formation, Lattice, Satstreet; Balaji Srinivasan | $20M | $26M | Series A | Jan 14, 2026 |

| Vista AI | Cedars-Sinai, Intermountain, Univ. of Utah, Temple/Fox Chase, Tampa General; Khosla Ventures, Bold Brain | $29.5M | ~$38M | Series B | Jan 14, 2026 |

| depthfirst | Accel (lead); Alt Capital, BoxGroup, Liquid 2, Mantis VC, SV Angel; angels (J. Dean, K. Green, etc.) | $40M | $40M | Series A | Jan 14, 2026 |