Top Tech News Today, November 12, 2025

Top Tech News Stories Today — Your Quick Briefing on the Latest Technology News, Global Innovation, and AI-Driven Shifts Reshaping the Future

It’s Wednesday, November 12, 2025, and we’re back with your in-depth look at the most important tech stories shaping today’s world — from billion-dollar AI bets and startup breakthroughs to regulatory flashpoints and innovations redefining global industries.

Whether you’re a founder, investor, or tech enthusiast, this daily briefing keeps you ahead of the curve — no endless scrolling, just the news that matters.

Here’s your roundup of the latest tech news making waves across the global tech scene.

Latest Tech News Today

1. Einride’s Self-Driving Trucks Startup Plans SPAC Listing

Einride, the Swedish autonomous-trucking startup, plans to go public via a SPAC after topping up its war chest with a fresh $100 million equity raise in October. The company, which blends driverless electric “pods” with a software platform for freight orchestration, has raised more than $600 million to date.

Executives say proceeds will fund U.S. expansion and carrier partnerships as shippers hunt for lower-emission, lower-cost logistics. The SPAC route comes amid a thaw in mobility listings and growing demand for AI-enabled autonomy in freight. TechCrunch

Einride’s cap table includes EQT Ventures — and even IonQ, a quantum-computing firm that previously partnered with Einride on optimization problems, underscoring the deep-tech angle behind routing at scale.

Why it matters: A successful listing would offer a new public benchmark for commercial autonomy and signal investor appetite for AI-driven logistics platforms.

Source: TechCrunch

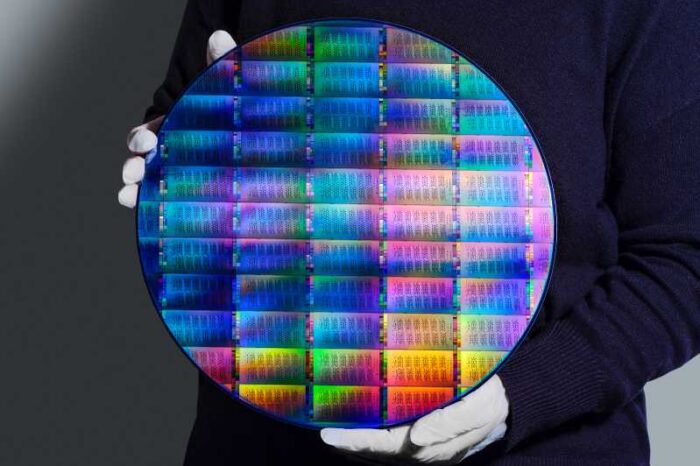

2. AI Chip Startup D-Matrix Raises $275M at $2B Valuation

D-Matrix, backed by Microsoft, has raised $275 million at a $2 billion valuation, bringing in sovereign investors like Qatar Investment Authority and Singapore’s EDBI. The company builds inference silicon for transformer workloads with an architecture aimed at reducing memory bottlenecks.

The raise arrives as hyperscalers weigh cost, power, and latency trade-offs of GPUs vs. specialized inference chips. Microsoft’s strategic interest suggests compute diversification beyond mainstream accelerators. D-Matrix will use funds to scale manufacturing, software, and customer pilots — especially cloud and enterprise deployments that need high-throughput inference at lower TCO.

Why it matters: Inference spending is exploding; alternative AI silicon could pressure GPU pricing and reshape data-center capex.

Source: Bloomberg

3. Teradar Exits Stealth With $150M for All-Weather Autonomy Sensor

Boston-based Teradar emerged from stealth, claiming a single sensor that outperforms lidar and radar in adverse weather, while cutting BOM complexity for AVs and robots.

It raised $150 million to ramp production and validation across automotive, industrial, and defense.

CEO Matt Carey says early pilots show strong performance through fog and heavy rain—conditions that confound stacked sensor suites. The company argues that fewer sensors reduce cost and simplify compute pipelines. Skeptics abound, so Teradar is leaning into third-party testing and OEM collaborations to prove repeatability at scale.

Why it matters: Robust perception remains autonomy’s rate-limiter; a credible all-weather sensor could speed commercial deployments and lower unit economics.

Source: TechCrunch

4. Legal-Tech’s AI Wave: $750M+ Flows to Vertical Tools

Investors poured more than $750 million in recent weeks into AI startups targeting lawyers — spanning contract review, e-discovery, research, and brief drafting — as firms seek measurable ROI from domain-specific models.

Buyers are favoring tools that plug into existing workflows (Microsoft 365, Google Workspace, case-management suites) with clear compliance stories and audit trails. The competitive set now includes incumbents building copilots and upstarts touting accuracy, cost, and privacy advantages with retrieval-augmented generation.

Why it matters: Vertical AI with clear KPIs (time saved, risk reduced) is proving fundable even as generic chatbots commoditize.

Source: Reuters

5. Microsoft Expands Flagship Quantum Site in Denmark

Microsoft is building a second lab outside Copenhagen, making Denmark its largest quantum location globally. The expansion supports its topological-qubit roadmap and deeper integration between quantum devices and Azure’s classical stack.

The company is recruiting experimental physicists, fabrication experts, and cryo-electronics engineers to accelerate qubit stability and error-mitigation research. Nordic governments have courted quantum investment with incentives and university pipelines; Microsoft’s move signals confidence in the region’s talent base.

Why it matters: Scaling useful qubits is a multi-year race; Microsoft’s footprint suggests a push to convert research milestones into cloud-accessible advantages.

Source: Reuters

6. IBM Unveils ‘Loon’ Quantum Chip Toward Practical Error Correction

IBM announced “Loon,” an experimental quantum chip that advances its approach to error correction by blending quantum hardware with classical signal-processing concepts. The company says the work keeps it on track for useful systems before the decade’s end.

Unlike monolithic fault-tolerance proposals, IBM’s strategy pairs algorithmic techniques with hardware improvements to manage noisy qubits.

Rivals, including Google and Amazon, are pursuing different error-handling paths; investors will watch who demonstrates reproducible, application-relevant benchmarks first.

Why it matters: Error correction is the gate to practical quantum advantage; a credible pathway could unlock new workloads in chemistry, logistics, and finance.

Source: Reuters

7. Google Strikes 15-Year Solar PPA With TotalEnergies to Power Ohio Data Centers

TotalEnergies will supply Google with 1.5 TWh of renewable electricity from its Montpelier solar project in Ohio over 15 years, plugging into the PJM grid to serve growing AI and cloud demand. The deal adds to Google’s long-duration clean-power contracts as energy needs soar with AI workloads.

PJM’s scale makes it an attractive hub, but congestion and curtailment risks require careful portfolio balancing.

Energy buyers say granular matching and firming are becoming standard to align carbon claims with real-world grid dynamics.

Why it matters: AI’s power hunger is forcing Big Tech into utility-scale procurement — shaping U.S. grid build-out and clean-energy financing.

Source: Reuters

8. Turkcell and Google Sign Cloud Technologies Cooperation Agreement

Turkey’s Turkcell signed a cooperation agreement with Google focused on cloud technologies, hinting at localized services and potential infrastructure investments as carriers diversify revenue beyond connectivity.

Regional telcos increasingly bundle cloud, security, and AI analytics for enterprise customers; partnerships with hyperscalers accelerate go-to-market while navigating data-sovereignty rules. For Google, the pact fits a string of EMEA investments — and positions it for public-sector and industrial AI opportunities in Turkey.

Why it matters: Telco-cloud tie-ups are reshaping enterprise IT in growth markets, expanding hyperscaler reach while creating regulated-market moats.

Source: Reuters

9. GlobalLogic Warns 10,000 Staff After Oracle EBS Breach

Hitachi-owned GlobalLogic notified about 10,000 employees that personal data was stolen via exploitation of Oracle E-Business Suite vulnerabilities tied to a broader extortion campaign. Authorities have posted a bounty for information linking the attackers to state sponsors.

Security firms say the wave targeted ERP systems with high-value HR and finance data; naming-and-shaming on leak sites has expanded the known victim list in recent days. Enterprises are racing to patch, segment ERP networks, and rotate credentials after third-party access was abused in some cases.

Why it matters: ERP breaches cascade across payroll, procurement, and supply chains — elevating board-level cyber risk and insurance scrutiny.

Source: BleepingComputer; SecurityWeek

10. Cisco Nears Dot-Com-Era Highs as Investors Bet on AI Networking

Cisco’s shares are approaching levels last seen at the peak of the dot-com era, as investors reassess its role in AI data-center networking and optical interconnects. While growth has been uneven, the market is pricing potential demand from Ethernet-based AI fabrics and campus AI upgrades.

Execution risks remain as hyperscalers weigh white-box alternatives. Analysts note that sustained multiple expansion hinges on translating AI headlines into backlog and margin. Bloomberg

Why it matters: If AI catalyzes a network upgrade cycle, incumbents like Cisco could ride a multi-year hardware and software refresh wave.

Source: Bloomberg

11. Figma Opens Bengaluru Office as It Pushes Beyond Design

Figma opened a new office in India to deepen developer outreach and expand beyond core design collaboration into workflow and platform integrations. India’s large user base and startup ecosystem make it a strategic beachhead.

Local presence will support enterprise adoption and education partnerships, as Figma competes with Adobe and upstarts adding AI features to product suites. The move signals continued internationalization ahead of potential future capital markets steps after last year’s terminated Adobe deal.

Why it matters: Developer ecosystems often start in India; winning here can compound growth across Asia and global enterprise accounts.

Source: TechCrunch

12. Futures Edge Up as Shutdown Resolution Lifts Big Tech Sentiment

U.S. stock futures rose as investors bet on an end to the prolonged federal shutdown, with megacap tech sentiment improving after a volatile week.

Earlier, “Morning Bid” flagged tech as a swing factor amid a data deluge, underscoring sensitivity to macro headlines before upcoming earnings and guidance. AI bellwethers remain market leadership as traders rotate on policy signals, liquidity, and capex outlooks for data-center build-outs.

Why it matters: Macro relief rallies can reset risk appetite for growth tech, affecting issuance windows and late-stage funding.

Source: Reuters

13. Meta’s AI Chief Scientist Yann LeCun Reportedly Planning Startup

Yann LeCun, Meta’s chief AI scientist and one of the original architects of deep learning, is preparing to leave the company after more than a decade at the center of its research efforts. The Financial Times first reported the news, citing associates who say LeCun plans to step down in the coming months to launch a new AI startup amid growing friction inside Meta’s AI division.

LeCun founded FAIR in 2013 and helped popularize convolutional neural networks. Any exit would follow Meta’s refocus on productized AI and infrastructure scale. Talent moves at this level ripple through research labs, funding syndicates, and recruiting across Big Tech and startups.

Why it matters: Star researchers spinning out can accelerate frontier ideas — and intensify the race for capital, compute, and talent.

Source: TechStartups (citing FT)

14. Google’s European Energy & Cloud Push Continues

Beyond today’s Ohio PPA, Google agreed a cooperation deal with Turkcell on cloud services and is advancing multi-billion-euro infrastructure commitments in Germany — an EMEA expansion to meet AI compute demand and data residency needs.

Investments include new facilities and fiber, positioning Google Cloud to chase industrial AI and public-sector workloads while navigating regulatory scrutiny. These moves mirror rival strategies as hyperscalers localize energy supply and regulatory compliance.

Why it matters: Energy + cloud capex is the new moat — tying data sovereignty, sustainability, and latency into competitive advantage.

Source: Reuters

15. AI/Identity: “Immortality” Startup Eternos Rebrands to Uare.ai, Raises $10.3M

Eternos, known for “Human Life Model” personal AIs trained solely on an individual’s data, rebranded as Uare.ai and raised $10.3 million, led by Mayfield and Boldstart. The company pitches enterprise-safe “personal agents” that mirror a user’s values and decision patterns.

The pivot reflects demand for agentic AI that’s privacy-preserving and controllable, not generalized on public corpora. Early pilots target professional workflows and customer service. TechCrunch

Founders argue individualized models will complement corporate copilots and reduce hallucinations via constrained training sets.

Why it matters: If “personal AIs” scale, they could change work software from app-centric to agent-centric — with new data-ownership dynamics.

Source: TechCrunch

16. Space Watch: Blue Origin Targets Today’s New Glenn Launch Window

After a weather scrub, Blue Origin aims to launch its New Glenn rocket at 2:50 p.m. ET today, carrying NASA’s ESCAPADE Mars probes. FAA constraints during the shutdown complicated scheduling, but today’s window remains open.

The mission would be the rocket’s second flight and a key step toward higher cadence — with implications for Kuiper and commercial customers. Space watchers will look for flight data on ascent and booster recovery improvements. Space

Why it matters: A successful launch would strengthen competition in heavy-lift and diversify flight options beyond SpaceX.

Source: Space.com; Space.com (FAA update)

17. Global EV Snapshot: Research Firm Flags 23% October Growth

A research roundup highlighted global EV sales up 23% in October, even as Tesla’s China unit sales hit a three-year low — illustrating stark regional divergence.

BYD and emerging Chinese brands continued to gain share, while Europe saw mixed results amid subsidy resets and consumer-confidence jitters. Investors are parsing how price wars and localization shape 2026 margins.

Why it matters: EV demand remains resilient globally, but competitive pressure is shifting profits to cost leaders and integrated supply chains.

Source: Reuters

18. Futures & Funding: Tech Sentiment Stabilizes as Investors Brace for Data

U.S. futures edged up this morning with Big Tech a swing factor; markets are digesting AI capex commitments and pending macro releases. Reuters’ “Morning Bid” framed the setup as “tech turbulence and data deluge,” highlighting megacaps’ outsized role in indices and policy-sensitive multiples.

Expectations for AI-driven earnings are colliding with energy costs and supply constraints on advanced chips.

Why it matters: Sentiment around AI spending drives both equity valuations and late-stage venture timelines.

Source: Reuters

Closing

That’s a wrap on today’s top stories shaping the global tech landscape — from billion-dollar AI funding rounds and quantum breakthroughs to the rising race for energy and autonomy.

Stay tuned for tomorrow’s edition as we continue tracking the pulse of innovation across startups, Big Tech, frontier science, and emerging technologies.

Until then, stay curious — and stay ahead.