Top Startup and Tech Funding News Roundup – Week Ending August 29, 2025

It’s Friday, August 29, 2025, and we’re back with the top startup and tech funding news stories that shaped the week. From billion-dollar bets on fusion energy and robotics to early-stage breakthroughs in fintech, climate tech, and health, capital continued to flow across every stage and geography.

This week’s coverage spans Monday, August 25, through Friday, August 29, 2025, highlighting a mix of late-stage giants and scrappy up-and-comers. Commonwealth Fusion Systems stole the spotlight with an $863 million raise to advance its SPARC reactor, while FieldAI secured $405 million to push forward robotics intelligence. Nuro added $203 million to fuel its autonomous vehicle platform, and design platform Framer hit a $2 billion valuation with its $100 million Series D.

Funding Highlights

-

Commonwealth Fusion Systems led the week with an $863 million mega-round to advance its SPARC reactor, reinforcing fusion as a serious contender for the future of clean energy.

-

FieldAI secured $405 million to accelerate the development of universal robotics intelligence, while Nuro added $203 million to scale its autonomous delivery platform.

-

Framer reached a $2 billion valuation with its $100 million Series D, and Eight Sleep banked another $100 million to push its AI-driven sleep technology into health applications.

-

Attio raised $52 million for its AI-native CRM, Rain collected $58 million to expand stablecoin payments infrastructure, and Aalo Atomics raised $100 million to fast-track its modular nuclear reactors.

-

Early-stage momentum was equally strong: Aurasell ($30M seed), Central ($8.6M seed), and Vox AI ($8.7M seed) captured investor attention in vertical AI. Meanwhile, climate tech innovators Terraton ($11.5M seed) and Equatic ($11.6M Series A) underscored global demand for scalable carbon removal solutions.

Investor Activity

The week drew participation from some of the most influential names in venture capital and beyond. Google Ventures, Nvidia, Sapphire Ventures, Valor Equity Partners, Polychain Capital, and Insight Partners anchored landmark deals, while corporates like Samsung, Intel, Uber, and L’Oréal doubled down with strategic investments. Angels and operators—including Jeff Dean, Bret Taylor, and Tobias Lütke—also made bold entries across seed rounds.

The spread showed a barbell pattern: mega-rounds powering capital-intensive deeptech companies alongside healthy seed and Series A activity. Together, these deals underscore that even in a selective market, investors are backing ambitious founders tackling infrastructure, AI, and climate at scale.

Here’s the full breakdown. Until next week, have a great weekend.

Nuro Raises $203M in Series E Funding for Autonomous Delivery

Mountain View’s Nuro, an autonomous delivery vehicle startup founded by ex-Google engineers, has closed a $203 million Series E round at a $6 billion post-money valuation. The financing came in two tranches this year and brings Nuro’s total funding to roughly $2.3 billion. Key backers included Nvidia (lead), Icehouse Ventures, Kindred Ventures, Pledge Ventures, and strategic partner Uber, along with institutional investors Baillie Gifford, T. Rowe Price, Fidelity, Tiger Global, Greylock, and XN.

Nuro is shifting from running its own delivery fleets to licensing its autonomous “Nuro Driver” system to automakers and other partners, and this new capital will accelerate development of its AI-powered vehicle platform and expansion of partnerships (for example, Uber plans to deploy Nuro’s tech in Lucid robotaxis).

Funding Details:

-

Startup: Nuro

-

Investors: Nvidia (lead), Icehouse Ventures, Kindred Ventures, Pledge Ventures, Uber (strategic partner); with participation from Baillie Gifford, T. Rowe Price, Fidelity Management, Tiger Global, Greylock Partners, XN, and others.

-

Amount Raised: $203 million

-

Total Raised: ~$2.3 billion (approx.)

-

Funding Stage: Series E

-

Funding Date: August 25, 2025

Eight Sleep Raises $100M in Funding for AI-Powered Sleep Tech

New York–based Eight Sleep, maker of AI-driven smart mattresses, secured a $100 million funding round to expand its sleep optimization platform. The raise was led by Valor Equity Partners, with participation from Founders Fund, Y Combinator, Atreides, HSG, and notable sports figures Charles Leclerc and Zak Brown. Eight Sleep has already sold over $500 million worth of its smart “Pods” and collected a billion hours of sleep data, and it is now developing an AI Sleep Agent to proactively optimize sleep in real time.

The new funds will also support Eight Sleep’s expansion into medical sleep applications (e.g., menopause, sleep apnea) and pursue FDA approvals for related therapies.

Eight Sleep has already sold over $500 million worth of its smart “Pods” and analyzed more than one billion hours of sleep data, and it is now developing an AI Sleep Agent that uses biometric data to proactively optimize users’ sleep in real time. The fresh capital will also support Eight Sleep’s expansion into medical applications – from menopause-related sleep issues to sleep apnea – and help pursue FDA approvals for sleep health solutions.

Funding Details:

-

Startup: Eight Sleep

-

Investors: Valor Equity Partners (lead), Founders Fund, Y Combinator, Atreides, HSG; plus Charles Leclerc and Zak Brown.

-

Amount Raised: $100 million

-

Total Raised: Not disclosed

-

Funding Stage: Growth round (undisclosed stage)

-

Funding Date: August 25, 2025

Aalo Atomics Raises $100M in Series B Funding for Modular Nuclear Reactors

Austin-based Aalo Atomics, which builds factory-made modular nuclear reactors, announced a $100 million Series B co-led by Valor Equity Partners. This brings Aalo’s total funding to $136 million. Other backers include Fine Structure Ventures, Hitachi Ventures, NRG Energy, LGT Crestone, Tishman Speyer, Kindred Ventures, 50 Years, Harpoon Ventures, and alumni VCs.

Aalo has already completed its first full-scale non-nuclear reactor prototype this year and plans to finish an operational 50 MWe “extra modular reactor” (XMR) by 2026. Other backers in the round include Fine Structure Ventures, Hitachi Ventures, NRG Energy, LGT Crestone, Tishman Speyer, Kindred Ventures, 50 Years, Harpoon Ventures, and alumni VCs.

Aalo plans to use the new capital to double its team and fast-track construction of its “XMR” (extra modular reactor) units, aiming to deploy ultra-compact 50 MWe reactors for AI data centers by 2026.

Funding Details:

-

Startup: Aalo Atomics

-

Investors: Valor Equity Partners (lead), Fine Structure Ventures, Hitachi Ventures, NRG Energy, LGT Crestone, Tishman Speyer, Kindred Ventures, 50 Years, Harpoon Ventures, Alumni Ventures, and others.

-

Amount Raised: $100 million

-

Total Raised: $136 million

-

Funding Stage: Series B

-

Funding Date: August 25, 2025

Firecrawl Raises $14.5M in Series A Funding for AI Web Data Platform

Firecrawl, an AI-powered web data platform, closed a $14.5 million Series A round led by Nexus Venture Partners. Shopify CEO Tobias Lütke and Y Combinator (an early investor) also participated. Firecrawl’s engine turns raw web pages into structured data for AI use cases; it already serves hundreds of thousands of developers and companies (Zapier, Shopify, Replit) by enabling AI agents and analytics to crawl live web content at scale.

The new funding (bringing Firecrawl’s total raised to $16.2 million) will further grow its engineering team and cloud infrastructure to make live web data universally accessible for AI applications.

The funding announcement came with a fun anecdote: CEO Caleb Peffer literally fell off his chair in excitement when Nexus partner Abhishek Sharma agreed to lead the round – and Sharma caught him mid-fall, sealing the partnership. Firecrawl will also use the fresh capital to roll out new features like natural language querying for its web crawling API.

Funding Details:

-

Startup: Firecrawl

-

Investors: Nexus Venture Partners (lead), Y Combinator, Tobias Lütke (Shopify CEO).

-

Amount Raised: $14.5 million

-

Total Raised: $16.2 million

-

Funding Stage: Series A

-

Funding Date: August 25, 2025

Cointel Raises $7.4M in Funding for AI Crypto Education Platform

Dubai-based Cointel, an AI-driven crypto education and research platform, raised $7.4 million in a strategic round led by the Avalanche blockchain project.

The raise included Sugafam Inc. (a Japanese Web3 firm) and other strategic investors. Cointel combines real-time trading tools with gamified learning to help new crypto users, and the funding will accelerate its expansion into North America after early traction in Japan and Turkey.

Funding Details:

-

Startup: Cointel

-

Investors: Avalanche (layer-1 blockchain) (lead), Sugafam Inc., and other strategic investors.

-

Amount Raised: $7.4 million

-

Total Raised: $7.4 million

-

Funding Stage: Strategic (early-stage)

-

Funding Date: August 25, 2025

Equatic Raises $11.6M in Series A Funding for Ocean Carbon Capture

Equatic, a Santa Monica climate tech startup, closed an $11.6 million Series A to commercialize its ocean-based carbon removal and green hydrogen technology. Catalytic Capital (a Temasek Trust fund) and climate investor Kibo Invest led the round.

Equatic’s platform uses electrochemical processes to capture CO₂ from seawater while producing hydrogen, achieving vastly faster carbon removal than the ocean alone. The funding will finance pilot plant construction and entry into markets for regulated carbon removal and green fuels.

Funding Details:

-

Startup: Equatic

-

Investors: Catalytic Capital (Temasek Trust) (lead), Kibo Invest

-

Amount Raised: $11.6 million

-

Total Raised: $11.6 million

-

Funding Stage: Series A

-

Funding Date: August 25, 2025

Vaxxas Secures $60M in Series D Funding to Scale Needle-Free Vaccines

Australia’s Vaxxas announced roughly A$90 million (about $60 million) in its latest funding round, one of the year’s largest biotech raises in Australia. The round comprised A$49.2 million in new equity (Series D) and A$40 million in R&D-linked debt. SPRIM Global Investments led the equity portion, joined by LGT Crestone, and existing backers OneVentures and Brandon Capital–Hostplus.

Vaxxas develops a high-density microarray patch (HD-MAP) that delivers vaccines through the skin without needles. The funds will scale up manufacturing and late-stage trials, extending the company’s runway into 2027.

Funding Details:

-

Startup: Vaxxas

-

Investors: SPRIM Global Investments (lead), LGT Crestone, OneVentures, Brandon Capital–Hostplus

-

Amount Raised: ~$60 million (A$90M equity + debt)

-

Total Raised: ~$60 million

-

Funding Stage: Series D (equity + debt)

-

Funding Date: August 25, 2025

Attio Raises $52M in Series B Funding for AI-Native CRM

San Francisco-based Attio announced a $52 million Series B led by Google Ventures to accelerate development of its AI-native CRM platform. Existing investors Redpoint Ventures, Balderton Capital, Point Nine, and 01A also participated.

Attio’s platform allows businesses to build custom CRM and go-to-market workflows; the company has grown to 5,000 customers and is on track for 4× ARR this year. The new funding doubles down on AI features and brings total funding to $116 million.

Funding Details:

-

Startup: Attio

-

Investors: Google Ventures (lead), Redpoint Ventures, Balderton Capital, Point Nine Capital, 01A

-

Amount Raised: $52 million

-

Total Raised: $116 million

-

Funding Stage: Series B

-

Funding Date: August 26, 2025

Aurasell Raises $30M in Seed Funding for AI Sales Engagement

San Francisco’s Aurasell, an AI-driven sales CRM for enterprises, closed a $30 million seed round led by Next47, with participation from Menlo Ventures and Unusual Ventures.

Aurasell’s platform automates outreach to prospective customers across channels, improving engagement and lead quality. The new funding will enable hiring and product development to meet demand from Fortune 500 companies.

Funding Details:

-

Startup: Aurasell

-

Investors: Next47 (lead), Menlo Ventures, Unusual Ventures

-

Amount Raised: $30 million

-

Total Raised: $30 million

-

Funding Stage: Seed

-

Funding Date: August 26, 2025

GoodShip Raises $25M in Series B Funding for AI Freight Orchestration

Seattle-based GoodShip announced a $25 million Series B led by Greenfield Partners. Other investors include Bessemer Venture Partners, Ironspring Ventures, Chicago Ventures, and FUSE VC.

GoodShip’s AI-driven platform automates freight planning and procurement for large shippers (such as Tropicana and Kellogg), and it will use the new capital to expand its team and scale its technology in the $1 trillion freight industry.

The raise comes after a breakout year that saw GoodShip grow revenue more than tenfold in 2024. The company now counts dozens of the largest enterprise shippers in North America as customers, including Tropicana, KeHe Distributors, Kellanova (formerly Kellogg Company), and KBX Logistics, part of Koch Industries. The new capital will go into scaling the platform and pushing further into AI to help shippers get a grip on complex networks and improve outcomes across truckload, LTL, and spot markets.

Funding Details:

-

Startup: GoodShip

-

Investors: Greenfield Partners (lead), Bessemer Venture Partners, Ironspring Ventures, Chicago Ventures, FUSE VC

-

Amount Raised: $25 million

-

Total Raised: ~$40 million (approx.)

-

Funding Stage: Series B

-

Funding Date: August 26, 2025

Debut Raises $20M in Funding for AI-Powered Skincare Biotech

San Diego-based biotech Debut raised $20 million in Series A funding for its AI-driven skincare ingredient discovery platform. The round was led by Fine Structure Ventures and included EDBI (Singapore’s GIC venture arm), Wealthberry, L’Oréal’s BOLD Ventures, GS Futures, Sandbox Industries, and Material Impact.

Debut uses AI to screen billions of molecules and accelerate the formulation of novel biotech skincare ingredients. The new funding will help the company scale its platform, bring on top scientific talent, and prepare for expansion into Asia (beginning in Singapore).

Funding Details:

-

Startup: Debut

-

Investors: Fine Structure Ventures (lead), EDBI, Wealthberry, Bold (L’Oréal’s fund), GS Futures, Sandbox Industries, Material Impact

-

Amount Raised: $20 million

-

Total Raised: $20 million

-

Funding Stage: Series A

-

Funding Date: August 27, 2025

Eyebot Raises $20M in Series A Funding for Vision-Testing Kiosks

Boston’s Eyebot secured a $20 million Series A led by General Catalyst, with participation from returning investors AlleyCorp, Baukunst, Village Global, and Ubiquity Ventures. Eyebot makes self-service vision-testing kiosks that deliver doctor-verified eyeglass prescriptions in 90 seconds.

The new funding (bringing the total raised to over $30 million) will support the deployment of hundreds more kiosks across the U.S., expansion of its clinical and engineering teams, and deeper partnerships with optometrists.

Funding Details:

-

Startup: Eyebot

-

Investors: General Catalyst (lead), AlleyCorp, Baukunst, Village Global, Ubiquity Ventures

-

Amount Raised: $20 million

-

Total Raised: $30+ million

-

Funding Stage: Series A

-

Funding Date: August 26, 2025

Hemi Labs Raises $15M in Funding for Bitcoin Programmability

Bitcoin layer startup Hemi Labs, co-founded by Jeff Garzik, raised $15 million to expand its network that brings Ethereum-style programmability to Bitcoin. The round included YZi Labs (Binance’s venture arm), Republic Digital, HyperChain Capital, Breyer Capital, Big Brain Holdings, Crypto.com, and others.

Hemi’s capital will support new borrowing, lending, and trading applications on Bitcoin and further development of its Hemi Virtual Machine (hVM) to enable smart contracts on Bitcoin.

Funding Details:

-

Startup: Hemi Labs

-

Investors: YZi Labs (Binance Labs, lead), Republic Digital, HyperChain Capital, Breyer Capital, Big Brain Holdings, Crypto.com, and others

-

Amount Raised: $15 million

-

Total Raised: $30 million (approx.)

-

Funding Stage: Growth round

-

Funding Date: August 27, 2025

Splight Raises $12.4M in Seed (SAFE) Funding for AI Grid Management

San Francisco’s Splight secured a $12.4 million SAFE seed round led by Blue Bear Capital, with participation from ZOMA Capital. Splight’s machine-learning platform (Dynamic Congestion Management™) safely unlocks extra capacity on congested power grids without building new lines.

The funding will accelerate deployment of Splight’s technology in the U.S. and Europe, support new AI features, and expand its engineering and commercial teams amid surging demand from data centers and utilities.

Funding Details:

-

Startup: Splight

-

Investors: Blue Bear Capital (lead), ZOMA Capital

-

Amount Raised: $12.4 million

-

Total Raised: $12.4 million

-

Funding Stage: Seed (SAFE)

-

Funding Date: August 26, 2025

Nauta Raises $7M in Seed Funding to Modernize Import Logistics

New York-based Nauta, an AI logistics startup, has raised $7 million in seed funding led by Construct Capital and Predictive VC. Nauta aggregates shipping data from emails, documents, and systems to give importers real-time visibility on container shipments. The new capital will fund international expansion and product development as Nauta brings AI-driven orchestration tools to a traditionally manual supply chain.

Co-founded by Valentina Jordan, who led product and engineering teams at Latin American logistics unicorn Rappi, and Rafael Santiago, a longtime operator of a major importing logistics company in the Caribbean, Nauta was built by people who’ve lived the headaches of cross-border trade.

The funding comes as global logistics grows more complex. Supply chains are shifting amid tariff swings, climate disruptions, and geopolitical uncertainty. According to McKinsey, over 70 percent of supply chain leaders say they’ve had to reconfigure their footprint in the past year, yet many are still stuck reacting to issues after they’ve already occurred.

Funding Details:

-

Startup: Nauta

-

Investors: Construct Capital (lead), Predictive VC

-

Amount Raised: $7 million

-

Total Raised: $7 million

-

Funding Stage: Seed

-

Funding Date: August 26, 2025

Payment Labs Raises $3.25M in Seed Funding for Sports & Creator Payments

Los Angeles fintech Payment Labs closed a $3.25 million seed round led by Aperture Venture Capital, with participation from Capital Eleven, ESPMX, and others. Payment Labs provides a SaaS platform to simplify complex pay-in and payout processes (including tax and compliance) for high-growth industries like sports, esports, and creator economy businesses.

The funding will scale the team and accelerate the development of industry-specific payment features for its global clients.

Funding Details:

-

Startup: Payment Labs

-

Investors: Aperture Venture Capital (lead), Capital Eleven, ESPMX, and others

-

Amount Raised: $3.25 million

-

Total Raised: $3.25 million

-

Funding Stage: Seed

-

Funding Date: August 26, 2025

FieldAI Lands $405M in Funding for Robotics AI

FieldAI, an Irvine-based robotics AI startup, announced a colossal $405 million funding across two late-stage rounds, valuing the company at about $2 billion. The raise was backed by Nvidia’s venture arm (NVentures, lead), Bezos Expeditions (lead), and included Khosla Ventures, Temasek, Canaan Partners, Intel Capital, Prysm Capital, Gates Frontier, Samsung, and others.

FieldAI’s “physics-first” AI models are designed to endow general-purpose robots with real-time skills. The new capital will scale global deployments and R&D on FieldAI’s foundation models for robotics intelligence.

The company’s pitch is bold: instead of building single-purpose robots, FieldAI has created Field Foundation Models (FFMs), physics-first foundation models for embodied intelligence.

These models give robots the ability to adapt in unpredictable environments—mining sites, factories, urban delivery routes—without needing pre-mapped instructions, GPS, or tightly controlled conditions. According to the company, its approach lets robots learn on the job while managing safety risks, a capability proven across quadrupeds, humanoids, wheeled machines, and even passenger-scale vehicles.

Funding Details:

-

Startup: FieldAI

-

Investors: NVentures (Nvidia, lead), Bezos Expeditions (lead), Khosla Ventures, Temasek, Canaan Partners, Intel Capital, Prysm Capital, Gates Frontier, Samsung, and others

-

Amount Raised: $405 million

-

Total Raised: $405 million

-

Funding Stage: Series C

-

Funding Date: August 27, 2025

InstaLILY Raises $25M in Series A Funding for AI Teammates

InstaLILY AI, which builds vertical-specific AI “teammates” (InstaWorkers™) to automate enterprise workflows, has closed a $25 million Series A led by Insight Partners. InstaLILY’s co-founders describe their “code-as-work” approach that lets AI agents autonomously execute end-to-end tasks.

The San Francisco–based company’s platform enables companies in heavy industries (like manufacturing, distribution, insurance, and healthcare) to deploy AI agents that plug into existing software systems (ERPs, CRMs, etc.) and autonomously execute end-to-end tasks. InstaLILY’s co-founders say this “Code-as-Work” approach expands human capacity by having AI actually do work, rather than just assist.

The new funding will be used to expand the library of pre-trained AI workers across additional industries and deepen integrations with enterprise systems.

Funding Details:

-

Startup: InstaLILY AI

-

Investors: Insight Partners (lead), Perceptive Ventures, Marvin Ventures

-

Amount Raised: $25 million

-

Total Raised: Not disclosed

-

Funding Stage: Series A

-

Funding Date: August 27, 2025

Vox AI Raises $8.7M Seed for Restaurant Voice AI

Amsterdam/SF’s Vox AI, a conversational voice AI platform for quick-service restaurants, has raised $8.7 million in seed funding led by Headline, with participation from True, Simon Capital, and Souschef Ventures. Vox AI’s technology enables multilingual drive-thru ordering and staff support, and the new funds (bringing the total raised to $10 million) will accelerate global expansion, including opening a San Francisco office.

Founded in October 2023, Vox AI is targeting the $1 trillion quick-service restaurant market, where operators are facing labor shortages, high turnover, and rising wage pressures. Its voice platform lets customers place orders in drive-thrus and mobile apps while giving staff real-time shift guidance and system alerts.

Unlike many speech technologies that still rely on human oversight, Vox AI’s system is fully autonomous from day one. It doesn’t require a human-in-the-loop during training or deployment, meaning restaurants can roll it out across multiple locations without costly adjustments. The software understands more than 90 languages and dialects, learns accents, menu synonyms, and even adapts to background noise or the quirks of a building’s acoustics.

Funding Details:

-

Startup: Vox AI

-

Investors: Headline (lead), True, Simon Capital, Souschef Ventures

-

Amount Raised: $8.7 million

-

Total Raised: $10 million

-

Funding Stage: Seed

-

Funding Date: August 27, 2025

Sola Raises $8M in Series A Funding for Parametric Home Insurance

UK insurtech Sola raised $8 million in Series A funding led by FINTOP Capital and JAM FINTOP (John Philpott’s fund). The round included 10VC and Georgia Tech’s investment arm. Sola uses data-driven models to offer parametric home insurance for events like wind and hail damage – policies that automatically pay out when conditions meet pre-set parameters.

The new capital (bringing Sola’s total to $11.7M) will scale revenue, grow the sales and product teams, and expand its coverage into more markets.

CEO Wesley Pergament said the company has grown revenue sevenfold since its last round and has become a Lloyd’s of London coverholder. The new funding (bringing total funding to $11.7 million) will enable Sola to scale its sales and product teams and make its weather insurance available to more homeowners nationwide.

Funding Details:

-

Startup: Sola

-

Investors: FINTOP Capital (lead), JAM FINTOP, 10vc, Georgia Tech

-

Amount Raised: $8 million

-

Total Raised: $11.7 million

-

Funding Stage: Series A

-

Funding Date: August 27, 2025

BIGC Raises $14M in Series A Funding for Entertainment-Tech Platform

Seoul’s BIGC, which offers a digital venue platform for global entertainment (K-pop, concerts, etc.), secured $14 million in Series A funding. The round was led by Stonebridge Ventures and BonAngels Venture Partners, with participation from Nextrans, NAU IB, Hana Ventures, Industrial Bank of Korea, and Alois Ventures.

BIGC connects artists with fans through ticketing, AI streaming, fan interaction tools, and commerce across 224 countries. The funding brings BIGC’s total to $25.4M and will fuel its global expansion in entertainment tech.

Funding Details:

-

Startup: BIGC

-

Investors: Stonebridge Ventures (lead), BonAngels Ventures (lead); Nextrans, NAU IB, Hana Ventures, Industrial Bank of Korea, Alois Ventures

-

Amount Raised: $14 million

-

Total Raised: $25.4 million

-

Funding Stage: Series A

-

Funding Date: August 27, 2025

Central Raises $8.6M in Seed Funding for Startup Back-Office AI

Central, a San Francisco–based startup offering an autonomous back-office platform for startups, raised $8.6 million in seed funding. The round was led by First Round Capital, with participation from Y Combinator, Ritual Capital, Multimodal Ventures, Alumni Ventures, Surgepoint Capital, and angel investors including Kulveer Taggar (founder of Zeus), JJ Fliegelman, and Richard Aberman.

Central automates payroll, benefits, compliance, accounting, and other back-office tasks via AI agents (eliminating to-do lists) and integrated expert support. The new funding will help Central scale its team and accelerate its mission of “killing business bullshit” for founders by doing all their back-office work.

Funding Details:

-

Startup: Central

-

Investors: First Round Capital (lead), Y Combinator, Ritual Capital, Multimodal Ventures, Alumni Ventures, Surgepoint Capital

-

Amount Raised: $8.6 million

-

Total Raised: $8.6 million

-

Funding Stage: Seed

-

Funding Date: August 27, 2025

Terraton Raises $11.5M in Seed Funding for Biochar Carbon Removal

San Francisco’s Terraton, a biochar carbon removal platform for emerging markets, announced $11.5 million in seed funding. The round was co-led by Lowercarbon Capital and Gigascale Capital, with participation from angel investors including Jeff Dean, Bret Taylor, Pete Koomen, Lars Rasmussen, John Lilly, Tom Stocky, and others.

Terraton’s integrated solution turns agricultural waste into biochar (for soil health and carbon credits) in Ghana and Kenya. The funding will accelerate development of Terraton’s full-stack platform and expand its generation of high-integrity carbon credits.

Funding Details:

-

Startup: Terraton

-

Investors: Lowercarbon Capital (lead), Gigascale Capital (lead); plus angels Jeff Dean, Bret Taylor, Pete Koomen, Lars Rasmussen, John Lilly, Tom Stocky, Tim Rann, Ryan Aytay, Matt Portman, Stephanie Hannon; corporate backers ANA Holdings and East Japan Railway venture arms

-

Amount Raised: $11.5 million

-

Total Raised: $11.5 million

-

Funding Stage: Seed

-

Funding Date: August 27, 2025

Bench IQ Raises $5.3M in Seed Funding for AI Judicial Analytics

Toronto-based Bench IQ, which offers an AI-powered judicial intelligence platform, raised $5.3 million in seed funding. The round was co-led by Battery Ventures and Inovia Capital, with participation from CIBC Innovation Banking, MVP Ventures, Maple VC, and Haystack VC.

Bench IQ has built a proprietary dataset of judges’ decision reasoning (to capture the ~97% of rulings not recorded as written opinions) and provides law firms with insights into how judges think. Bench IQ plans to use the new capital to expand its data set to state courts and improve its analytics, enabling lawyers to strategize cases with unprecedented insight into judges’ decision patterns

Funding Details:

-

Startup: Bench IQ

-

Investors: Battery Ventures (lead), Inovia Capital (lead), CIBC Innovation Banking, MVP Ventures, Maple VC, Haystack VC

-

Amount Raised: $5.3 million

-

Total Raised: $5.3 million

-

Funding Stage: Seed

-

Funding Date: August 27, 2025

Rain Raises $58M in Series B Funding for Stablecoin Infrastructure

Rain, a New York enterprise-grade stablecoin payments platform, raised $58 million in Series B funding led by Sapphire Ventures. Other investors include Dragonfly Capital, Galaxy Ventures, Endeavor Catalyst, Samsung Next, Lightspeed Venture Partners, Norwest, and others. The funding brings Rain’s total raised to about $88.5 million.

Rain will use the capital to expand its Visa-linked stablecoin cards and wallets globally (especially in Europe) as the demand for compliant crypto payment rails grows.

Funding Details:

-

Startup: Rain

-

Investors: Sapphire Ventures (lead), Dragonfly Capital, Galaxy Ventures, Endeavor Catalyst, Samsung Next, Lightspeed Venture Partners, Norwest Venture Partners

-

Amount Raised: $58 million

-

Total Raised: ~$88.5 million

-

Funding Stage: Series B

-

Funding Date: August 28, 2025

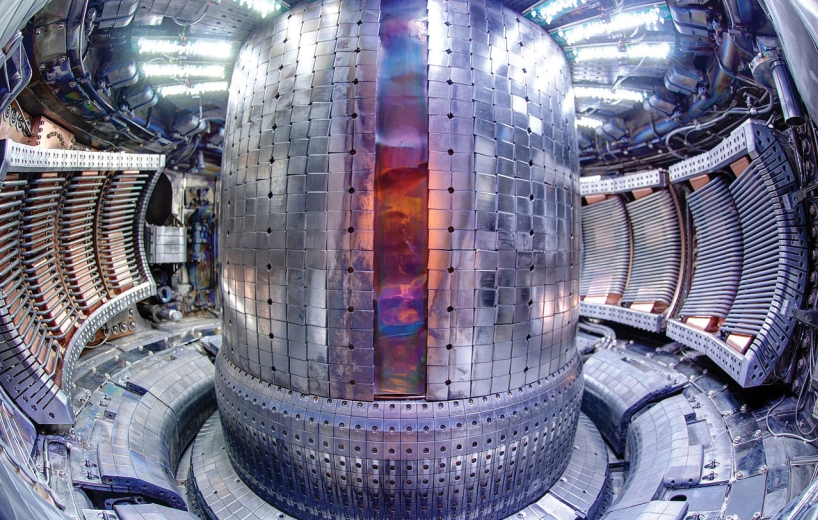

Commonwealth Fusion Systems Raises $863M for Fusion Reactor

Commonwealth Fusion Systems (CFS), a Massachusetts nuclear fusion startup, closed an $863 million mega-round. The round united strategic and financial investors: Nvidia and Google Ventures (lead backers), Breakthrough Energy Ventures (Bill Gates), Tiger Global, Khosla Ventures, Lowercarbon Capital, Emerson Collective, Eni (Italian energy company), Future Ventures, and others. CFS will use the funding to advance its SPARC fusion reactor toward commercial viability.

With this raise, CFS’s total funding climbs to roughly $3 billion, positioning it as one of the world’s best-capitalized private fusion ventures.

This financing makes CFS the best-funded fusion company in the world, with nearly $3 billion raised to date. CFS plans to use the new capital to advance its SPARC experimental reactor toward scientific breakeven and to lay the groundwork for its future ARC commercial power plant.

Funding Details:

-

Startup: Commonwealth Fusion Systems (CFS)

-

Investors: Nvidia (lead), Google Ventures (lead), Breakthrough Energy Ventures (Bill Gates), Tiger Global, Khosla Ventures, Lowercarbon Capital, Emerson Collective, Eni, Future Ventures, and others

-

Amount Raised: $863 million

-

Total Raised: ~$3.0 billion (approx.)

-

Funding Stage: Mega funding round (beyond Series C)

-

Funding Date: August 28, 2025

M0 Raises $40M in Series B Funding for Cross-Chain Stablecoins

Crypto startup M0 announced a $40 million Series B co-led by Polychain Capital and Ribbit Capital. Endeavor Catalyst, Pantera Capital, and Bain Capital Crypto also participated. M0 is building a cross-chain stablecoin issuance network, enabling issuers to create stablecoins that can operate seamlessly across different blockchains.

The new funds, which bring M0’s total to about $100 million, will expand its network infrastructure and accelerate adoption as global demand for stablecoin interoperability surges.

Funding Details:

-

Startup: M0

-

Investors: Polychain Capital (lead), Ribbit Capital (lead), Endeavor Catalyst, Pantera Capital, Bain Capital Crypto

-

Amount Raised: $40 million

-

Total Raised: ~$100 million (approx.)

-

Funding Stage: Series B

-

Funding Date: August 28, 2025

Framer Raises $100M in Series D Funding at $2B Valuation

Amsterdam-based design platform Framer has raised $100 million in a Series D round at a $2 billion valuation. The round was led by existing investors Meritech Capital Partners and Atomico. Framer’s no-code website and prototyping tools have amassed about 500,000 users, making it a key player in the global design and collaboration market. Including this round, Framer has now raised roughly $127 million in total.

The new capital will accelerate product development and expand Framer’s global team as demand for intuitive, AI-augmented design tools grows.

The timing of this raise comes as optimism starts to creep back into venture funding for software companies. Reuters pointed out that macroeconomic shifts—including potential Fed rate cuts and the recent stock market rebound—are giving investors room to take bigger bets again. Framer’s surge also arrives in the wake of Figma’s IPO, which showed $228 million in first-quarter sales, reinforcing the broader demand for collaborative design platforms. Bloomberg recently noted that Framer is carving out its space as a simpler alternative to Figma and Squarespace, with a strong emphasis on automation and no-code accessibility.

Framer’s last round was a $27 million Series C in 2023, also backed by Meritech, Atomico, and Accel. The jump to a $2 billion valuation in just two years shows the momentum behind no-code web builders in an era shaped by AI-driven workflows.

Funding Details:

-

Startup: Framer

-

Investors: Meritech Capital Partners (lead), Atomico (lead)

-

Amount Raised: $100 million

-

Total Raised: ~$127 million (approx.)

-

Funding Stage: Series D

-

Funding Date: August 28, 2025

Ordinal Raises $1M in Seed Funding for AI Government Assistant

Ordinal, a Bentonville, Arkansas–based startup providing AI research assistants for municipal governments, raised a $1 million seed round led by Plains Ventures. Other investors include Winrock International and The Venture Center Arkansas Fund. Ordinal’s AI platform uses retrieval-augmented models to help city staff quickly answer questions using local laws, codes, and documents. The seed funding will enable Ordinal to scale its technology to more U.S. cities, expanding beyond its initial deployments.

Funding Details:

-

Startup: Ordinal

-

Investors: Plains Ventures (lead), Winrock International, The Venture Center Arkansas Fund

-

Amount Raised: $1 million

-

Total Raised: $1 million

-

Funding Stage: Seed

-

Funding Date: August 28, 2025

FriendliAI Raises $20M Seed Extension for AI Inference

California-based FriendliAI closed a $20 million seed extension round led by Capstone Partners. New investors included Sierra Ventures, Alumni Ventures, KDB Investment, and KB Securities. FriendliAI’s platform helps companies run large AI models more efficiently by reducing GPU inference costs. The fresh capital, bringing its total to at least $20 million, will accelerate development of its inference engine as demand grows for cost-effective cloud AI processing.

Funding Details:

-

Startup: FriendliAI

-

Investors: Capstone Partners (lead), Sierra Ventures, Alumni Ventures, KDB Investment, KB Securities

-

Amount Raised: $20 million

-

Total Raised: $20 million

-

Funding Stage: Seed (extension)

-

Funding Date: August 28, 2025

Portal to Bitcoin Raises $50M in Funding for Bitcoin Trading Protocol

Portal to Bitcoin, a startup building a Bitcoin-centric cross-chain trading protocol, secured $50 million in new financing led by Paloma Investments. This brings Portal’s total funding to $92 million. Portal’s technology enables non-custodial trading of assets settled on the Bitcoin blockchain.

The new funds will expand Portal’s grant program and integrations, and accelerate development of its BitScaler adapter for Bitcoin scalability, as it onboards institutional liquidity providers.

Funding Details:

-

Startup: Portal to Bitcoin

-

Investors: Paloma Investments (lead)

-

Amount Raised: $50 million

-

Total Raised: $92 million

-

Funding Stage: Series B

-

Funding Date: August 28, 2025

aPriori Raises $20M in Funding for DeFi Trading Infrastructure

San Francisco’s aPriori, founded by former Jump Trading engineers, raised $20 million to build high-performance on-chain trading infrastructure. Pantera Capital, HashKey Capital, IMC Trading, Primitive Ventures, Gate Labs, GEM, Ambush Capital, and Big Brain Collective participated in the round.

aPriori develops an execution layer applying high-frequency trading techniques to DeFi markets; the funding, which brings its total to $30 million, will expand hiring, accelerate rollouts (including a liquid-staking platform and AI DEX aggregator), and deepen industry partnerships.

Funding Details:

-

Startup: aPriori

-

Investors: Pantera Capital, HashKey Capital, IMC Trading, Primitive Ventures, Gate Labs, GEM, Ambush Capital, Big Brain Collective

-

Amount Raised: $20 million

-

Total Raised: $30 million

-

Funding Stage: Series A

-

Funding Date: August 28, 2025

Palmer Energy (PETL) Raises £5M Series A Funding, Acquires Battery Spinout

London-based battery storage startup Palmer Energy Technology Ltd (PETL), founded by ex-Aston Martin CEO Andy Palmer, raised a new £5 million Series A and used it to acquire Oxford University spinout Brill Power. The funding round was led by FTSE-250 operator FirstGroup (through its FirstGroup Energy arm), with Barclays Climate Ventures and the University of Oxford also participating. PETL will integrate Brill Power’s advanced cell-level battery management software into its automotive-grade energy storage systems, accelerating development of next-gen battery systems for FirstGroup’s electric buses and beyond.

Funding Details:

-

Startup: Palmer Energy Technology Ltd (PETL)

-

Investors: FirstGroup Energy (lead, via FirstGroup plc), Barclays Climate Ventures, University of Oxford

-

Amount Raised: £5 million

-

Total Raised: £5 million (new round)

-

Funding Stage: Series A

-

Funding Date: August 29, 2025

Munify Raises $3M in Seed Funding for Egyptian Diaspora Neobank

Munify, a cross-border neobank founded by a Microsoft and Uber alum, raised $3 million in seed funding. The round included Y Combinator (which recently added Munify to its Summer 2025 batch) as well as regional investors BYLD and DCG.

Munify’s platform aims to provide Egyptians abroad a faster, cheaper way to send money home and allows residents to access U.S. banking. The funds will help launch its banking rails and services tailored to remittance customers in the U.S., U.K., Europe, and Gulf states.

Funding Details:

-

Startup: Munify

-

Investors: Y Combinator, BYLD, DCG

-

Amount Raised: $3 million

-

Total Raised: $3 million

-

Funding Stage: Seed

-

Funding Date: August 29, 2025

Tech Funding Summary Table

| Startup | Investors (Lead and notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Nuro | Nvidia (lead), Icehouse, Kindred, Pledge, Uber (strategic), Baillie Gifford, T. Rowe Price, Fidelity, Tiger, Greylock, XN | $203M | ~$2.3B | Series E | Aug 25, 2025 |

| Eight Sleep | Valor Equity (lead), Founders Fund, Y Combinator, Atreides, HSG, Charles Leclerc, Zak Brown | $100M | Not disclosed | Growth (UND) | Aug 25, 2025 |

| Aalo Atomics | Valor Equity (lead), Fine Structure, Hitachi Ventures, NRG, LGT Crestone, Tishman Speyer, Kindred, 50Y, Harpoon, Alumni | $100M | $136M | Series B | Aug 25, 2025 |

| Firecrawl | Nexus Venture Partners (lead), Y Combinator, Tobias Lütke | $14.5M | $16.2M | Series A | Aug 25, 2025 |

| Cointel | Avalanche (lead), Sugafam, others | $7.4M | $7.4M | Strategic (seed) | Aug 25, 2025 |

| Equatic | Catalytic Capital (Temasek Trust) (lead), Kibo Invest | $11.6M | $11.6M | Series A | Aug 25, 2025 |

| Vaxxas | SPRIM (lead), LGT Crestone, OneVentures, Brandon Capital–Hostplus | ~$60M | ~$60M | Series D (equity+debt) | Aug 25, 2025 |

| Attio | Google Ventures (lead), Redpoint, Balderton, Point Nine, 01A | $52M | $116M | Series B | Aug 26, 2025 |

| Aurasell | Next47 (lead), Menlo Ventures, Unusual Ventures | $30M | $30M | Seed | Aug 26, 2025 |

| GoodShip | Greenfield Partners (lead), Bessemer, Ironspring, Chicago Ventures, FUSE VC | $25M | ~$40M | Series B | Aug 26, 2025 |

| Debut | Fine Structure (lead), EDBI, Wealthberry, L’Oréal BOLD, GS Futures, Sandbox, Material Impact | $20M | $20M | Series A | Aug 27, 2025 |

| Eyebot | General Catalyst (lead), AlleyCorp, Baukunst, Village Global, Ubiquity | $20M | $30M+ | Series A | Aug 26, 2025 |

| Hemi Labs | YZi Labs (Binance Labs), Republic Digital, HyperChain, Breyer, Big Brain, Crypto.com | $15M | $30M | Growth round | Aug 27, 2025 |

| Splight | Blue Bear Capital (lead), ZOMA Capital | $12.4M | $12.4M | Seed (SAFE) | Aug 26, 2025 |

| Nauta | Construct Capital (lead), Predictive VC | $7M | $7M | Seed | Aug 26, 2025 |

| Payment Labs | Aperture VC (lead), Capital Eleven, ESPMX, others | $3.25M | $3.25M | Seed | Aug 26, 2025 |

| FieldAI | NVentures (Nvidia, lead), Bezos Expeditions (lead), Khosla, Temasek, Canaan, Intel, Prysm, Gates, Samsung | $405M | $405M | Series C | Aug 27, 2025 |

| InstaLILY AI | Insight Partners (lead), Perceptive, Marvin Ventures | $25M | Not disclosed | Series A | Aug 27, 2025 |

| Vox AI | Headline (lead), True, Simon Capital, Souschef Ventures | $8.7M | $10M | Seed | Aug 27, 2025 |

| Sola | FINTOP Capital (lead), JAM FINTOP, 10vc, Georgia Tech | $8M | $11.7M | Series A | Aug 27, 2025 |

| BIGC | Stonebridge (lead), BonAngels (lead), Nextrans, NAU IB, Hana Ventures, IBK, Alois | $14M | $25.4M | Series A | Aug 27, 2025 |

| Central | First Round Capital (lead), Y Combinator, Ritual Capital, Multimodal, Alumni, Surgepoint | $8.6M | $8.6M | Seed | Aug 27, 2025 |

| Terraton | Lowercarbon (lead), Gigascale (lead), angels Jeff Dean, Bret Taylor, Pete Koomen, Lars Rasmussen, John Lilly, etc. | $11.5M | $11.5M | Seed | Aug 27, 2025 |

| Bench IQ | Battery Ventures (lead), Inovia Capital (lead), CIBC Innovation Banking, MVP Ventures, Maple VC, Haystack VC | $5.3M | $5.3M | Seed | Aug 27, 2025 |

| Rain | Sapphire Ventures (lead), Dragonfly, Galaxy Ventures, Endeavor Catalyst, Samsung Next, Lightspeed, Norwest | $58M | ~$88.5M | Series B | Aug 28, 2025 |

| Commonwealth Fusion Systems | Nvidia, Google, Breakthrough Energy Ventures, Tiger Global, Khosla, Lowercarbon, Emerson, Eni, Future Ventures | $863M | ~$3.0B | Mega round | Aug 28, 2025 |

| M0 | Polychain Capital (lead), Ribbit Capital (lead), Endeavor Catalyst, Pantera, Bain Capital Crypto | $40M | ~$100M | Series B | Aug 28, 2025 |

| Framer | Meritech (lead), Atomico (lead) | $100M | ~$127M | Series D | Aug 28, 2025 |

| Ordinal | Plains Ventures (lead), Winrock International, Venture Center AR Fund | $1M | $1M | Seed | Aug 28, 2025 |

| FriendliAI | Capstone (lead), Sierra Ventures, Alumni Ventures, KDB Investment, KB Securities | $20M | $20M | Seed (extension) | Aug 28, 2025 |

| Portal to Bitcoin | Paloma Investments (lead) | $50M | $92M | Series B | Aug 28, 2025 |

| aPriori | Pantera, HashKey, IMC Trading, Primitive Ventures, Gate Labs, GEM, Ambush, Big Brain | $20M | $30M | Series A | Aug 28, 2025 |

| Palmer Energy (PETL) | FirstGroup Energy (lead), Barclays Climate Ventures, University of Oxford | £5M | £5M | Series A | Aug 29, 2025 |

| Munify | Y Combinator, BYLD, DCG | $3M | $3M | Seed | Aug 29, 2025 |