Apptronik raises $520M at $5B valuation to bring humanoid robots to market ahead of Tesla

For years, humanoid robots have lived comfortably in demos, research labs, and keynote slides. Apptronik is trying to move them onto factory floors before the hype cycle runs out.

The Austin-based startup has raised $520 million in new funding at a $5 billion valuation, pushing its Series A total to $935 million. The round was co-led by B Capital, chaired by Howard Morgan, and Google. The financing arrives exactly a year after Apptronik pulled in $350 million to accelerate work on its Apollo humanoid robot and sharpen its lead in a crowded field that includes Tesla and several fast-moving Chinese rivals.

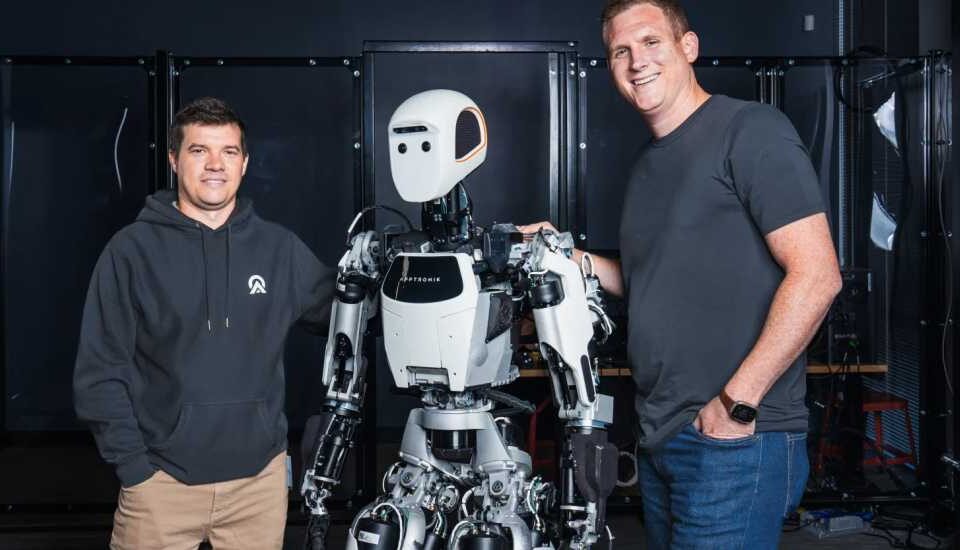

Apptronik was founded in 2016 by CEO Jeff Cardenas, Nicholas Paine, and Bill Helmsing. The company emerged from the Human Centered Robotics Lab at the University of Texas at Austin, long before humanoid robots became a staple of investor decks. The original goal was straightforward: build general-purpose robots meant for real work, not staged demos.

That effort has produced a wide range of machines over the years, from exoskeletons and humanoid torsos to bipedal mobility platforms and robotic arms that lift more than their own weight. Those experiments eventually converged into Apollo, a full-size humanoid robot that Apptronik now views as its commercial breakthrough.

Apollo is already working in controlled environments across factories and warehouses operated by strategic partners such as Mercedes-Benz, GXO Logistics, and Jabil. These early deployments run inside designated zones monitored by external sensors and light curtains. If a human crosses a boundary, the robot pauses. Cardenas says future versions will support what he calls “collaborative safety,” allowing Apollo to slow, stop, or reroute itself near people while moving parts, sorting items, or lifting components.

Humanoid Robotics Race Heats Up as Google-backed Apptronik Reaches $5B Valuation With New $520M Round

The push toward real-world use sets Apptronik apart from several rivals still deep in development cycles. Competitors include China-based Unitree, along with Figure, Agility Robotics, and 1X. Tesla remains the most visible entrant, with CEO Elon Musk frequently promoting the Optimus humanoid robot as a pillar of the company’s future.

Tesla plans to spend roughly $20 billion on capital expenditures in 2026 to support robot and self-driving vehicle manufacturing. Still, Musk has acknowledged during earnings calls that Optimus remains in early research and development. Apptronik, located just miles from Tesla’s Austin headquarters, is already collecting field data from working robots.

In automation, the appeal of humanoids lies in their flexibility. Cardenas frames it simply: “one robot to do thousands of tasks, versus a thousand robots doing a single task.” Pilot deployments allow Apptronik to observe Apollo operating in live environments, collect performance data, and refine both hardware and software across its growing fleet.

A key piece of that refinement comes from AI. Apptronik recently partnered with Google DeepMind, integrating its Gemini Robotics models to support Apollo’s perception and task execution. The collaboration ties the company closer to Google’s broader AI ecosystem at a moment when investors are pouring capital into physical AI.

Morgan believes the timing matters. He expects demand for Apollo to reach $1 billion in orders starting in 2027, with robots priced at roughly $80,000 per year, about the cost of a luxury car. “Think about a factory worker doing three or four shifts, and on any weekend,” Morgan told CNBC. “Eighty thousand is cheap!”

Apptronik employs about 300 people today and plans to hire at least 200 more over the next year. Some of the new capital will fund an expanded Austin footprint and a new California office, which is slated to open later this year. The company is also preparing its facilities and supply chain for higher-volume production.

Cardenas remains cautious in public forecasts. He declined to give timelines for wide deployment or list precise capabilities for early commercial units. More details on what Apollo will and won’t do are expected later this year.

That restraint stands out in a sector known for bold claims. Apptronik’s pitch rests less on promises and more on proof points: robots already at work, partners already signed, and capital already committed. In a race where many humanoids still live on slides, Apptronik is betting that execution, not spectacle, decides who reaches the factory floor first.