Amazon is losing control of e-commerce as TikTok forces sellers to choose sides

For more than two decades, Amazon has built its dominance by owning every step of the online shopping process. People discovered products on Amazon, researched them on Amazon, and relied on Amazon to deliver them. That control gave sellers little choice. If you wanted scale, you played by Amazon’s rules.

That era is ending faster than most sellers expected.

A recent mandate from TikTok has forced thousands of brands to choose between Amazon’s fulfillment network and TikTok’s. Using both is no longer frictionless. And the numbers behind that choice reveal one of the most significant power shifts in e-commerce in years.

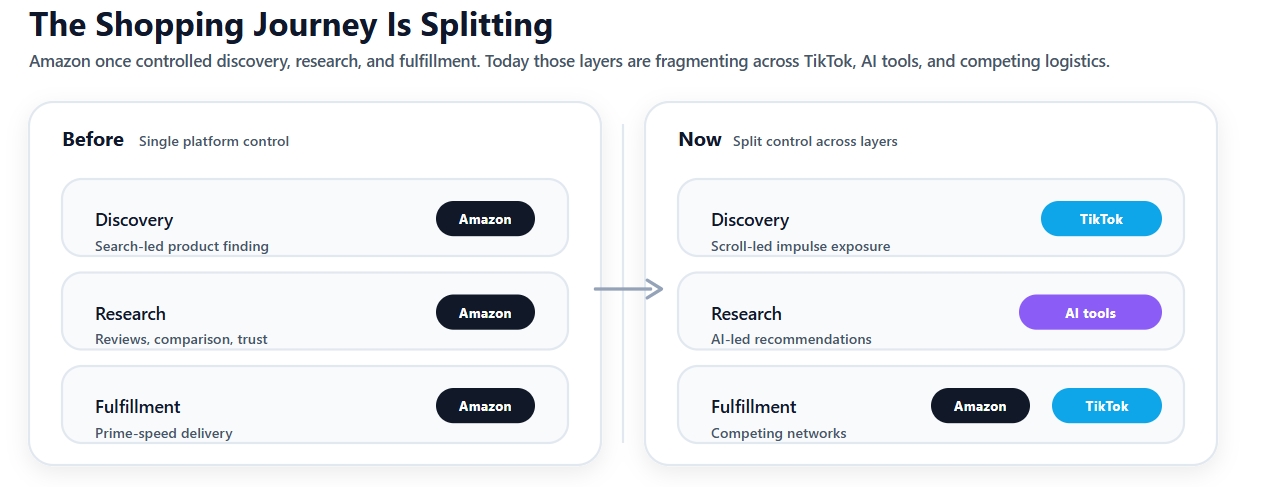

The Shopping Journey: Then and Now

What’s changing is not just where sellers list products, but how the entire shopping journey is structured. The once-unified funnel is breaking apart.

Then: One Platform, One Funnel

In Amazon’s model, the entire shopping journey takes place within a single marketplace. Discovery began with keyword searches. Sellers competed for visibility through SEO-like ranking signals and pay-per-click ads. Product research took place through reviews, star ratings, and comparison listings, all accessed within Amazon’s interface.

Fulfillment completed the loop. Inventory sat in Amazon warehouses, delivery was bundled into Prime, and sellers traded margin for speed and reliability. The system rewarded patience, ad spend, and operational compliance. Growth was incremental, predictable, and gated by Amazon’s rules.

Credit: Steve Chou

Now: A Fragmented, Algorithm-Driven Journey

That unified funnel is coming apart. Discovery now happens in scroll-based feeds. Product research increasingly starts with AI tools. Fulfillment is no longer exclusive to a single platform.

Each layer of the journey is being claimed by a different player, fundamentally reshaping how brands reach customers and where value accrues. But this structure is quickly breaking apart. Each layer of the shopping journey is now being claimed by a different player.

The Shopping Journey is Splitting: Discovery, research, and fulfillment no longer sit under one platform. – Click for bigger image.

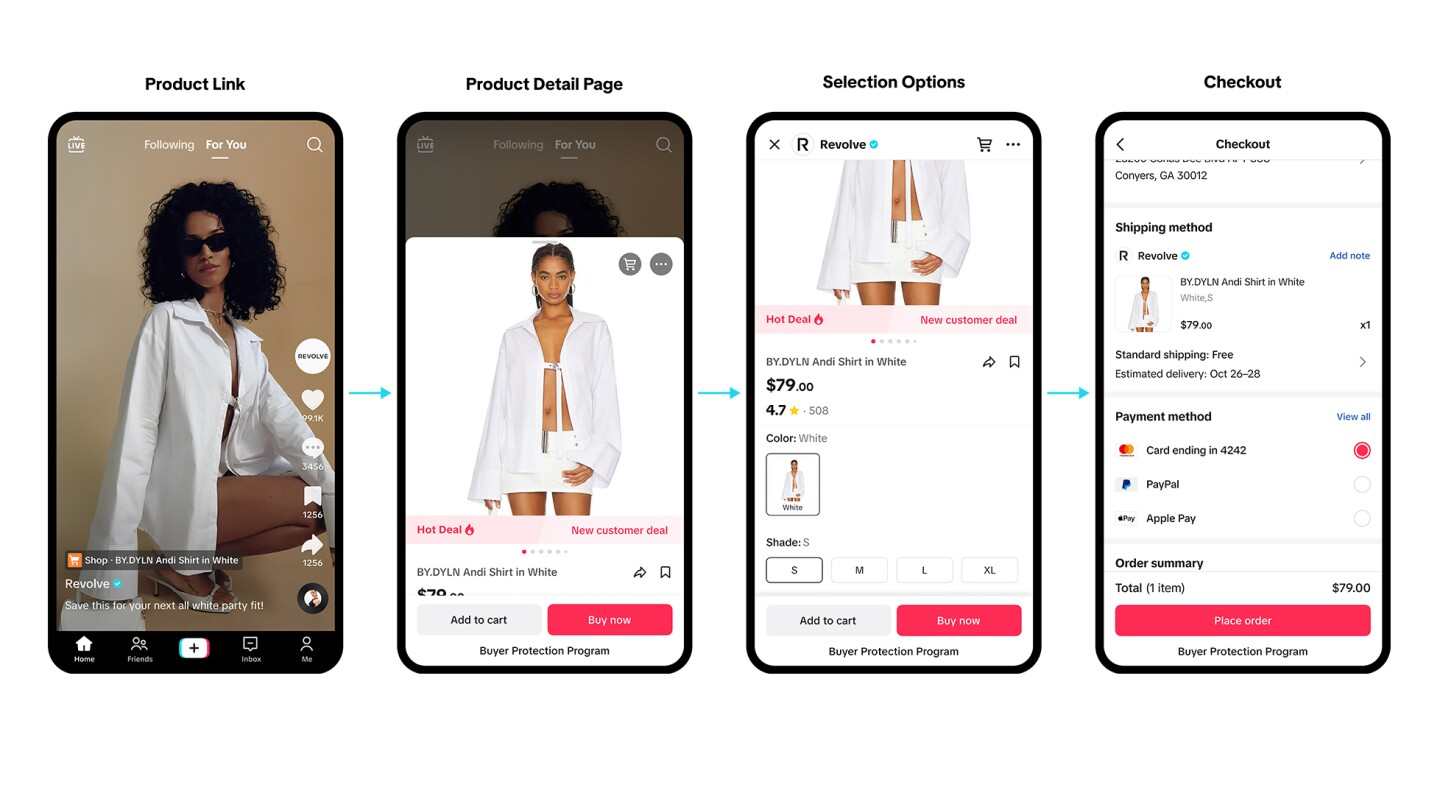

TikTok Asks Sellers to Choose Sides

TikTok Shop sellers have been told they must move to TikTok’s own fulfillment system on an exclusive basis, with enforcement beginning in late February and a hard transition deadline by the end of March. There is no meaningful opt-out.

For brands that rely on Amazon FBA, this creates an operational fork in the road. Either inventory is split across platforms, increasing complexity and cost, or sellers commit to one ecosystem and accept the trade-offs.

TikTok’s move is not accidental. Forcing a decision is the point. The company is betting that once sellers run the numbers, many will side with TikTok.

How Amazon Lost the Funnel, One Layer at a Time

Amazon’s power came from controlling three stages of commerce: discovery, research, and fulfillment. That control has been breaking down.

Discovery Has Moved to TikTok

Product discovery no longer begins with a search box. It begins with a scroll.

Hundreds of millions of users now encounter products through short videos they were not actively looking for. TikTok’s algorithm decides who sees what, and when it works, discovery converts instantly. Users are buying products seconds after first seeing them, without comparing prices or conducting keyword searches.

TikTok also has something Amazon never built: a massive affiliate creator ecosystem. Creators with loyal audiences recommend products directly, and followers trust those recommendations. Discovery is embedded in entertainment, not auctions for ad placements.

Amazon, by contrast, still relies on paid visibility inside a search-driven marketplace where sellers bid against one another for attention.

Research Has Shifted to AI

At the same time, product research is increasingly happening outside Amazon. Shoppers now ask AI tools for recommendations instead of browsing listings.

When users ask ChatGPT for product suggestions, the answers are pulled from across the open web. Amazon listings are absent. Amazon chose to block AI models from indexing its marketplace, cutting itself out of this growing research channel.

The result is a quiet but profound change: shoppers can discover products on TikTok, research them through AI, and never touch Amazon’s front end at all.

Fulfillment Is the Final Battleground

That leaves fulfillment as Amazon’s last stronghold. TikTok’s mandate is a direct challenge to it.

For small, lightweight products—the core of TikTok Shop—TikTok’s fulfillment costs are materially lower. On a typical $30 item under one pound, sellers often pay around $5 through TikTok’s system versus roughly $8 through Amazon FBA. That difference compounds quickly at scale.

And those numbers exclude advertising.

The Economics Are Where the Shift Becomes Unavoidable

Amazon’s fastest-growing business is advertising. Sellers routinely spend 10 to 30 percent of revenue on ads just to remain visible in search results. For a $30 product, that can mean another $3 to $9 per sale, in addition to fulfillment fees.

TikTok flips that model. Discovery is algorithmic. When a product performs in content, sellers are not paying for impressions in the same way. Visibility comes from engagement, not bids.

When sellers compare:

-

higher fulfillment fees,

-

mandatory ad spend,

-

and rising competition on Amazon,

against:

-

lower fulfillment costs,

-

organic discovery,

-

and creator-driven demand on TikTok,

The gap becomes difficult to ignore.

Why Speed Favors TikTok

Amazon’s marketplace rewards time. Reviews accumulate slowly. Rankings take months. Momentum builds incrementally.

TikTok rewards velocity. A single video can reshape a brand’s trajectory in days. Sellers have seen entire product lines sell out after one piece of content takes off. That kind of acceleration is structurally incompatible with Amazon’s search-based model.

This is not about luck. It is about distribution mechanics. Amazon is optimized for planned purchases. TikTok is optimized for impulse.

Amazon Tried to Imitate This and Failed

Amazon saw this shift coming. In 2023, it launched Inspire, a short-form discovery feed designed to mimic TikTok’s shopping experience.

It never gained traction.

The reason is simple. Users do not go to Amazon for entertainment or exploration. They go there to buy things they already decided they need. Scroll-based discovery requires a different mindset, and by the time Amazon attempted it, consumer behavior had already moved on.

What Sellers Are Doing Now

Sellers responding fastest are not abandoning Amazon entirely. They are redefining its role.

Many are:

-

recalculating true Amazon margins, including ads,

-

testing TikTok fulfillment early before competition intensifies,

-

building creator partnerships instead of scaling PPC budgets,

-

and treating Amazon as a channel for planned, utility purchases rather than discovery.

In this model, Amazon becomes the place for predictable replenishment. TikTok becomes the growth engine.

The Long-Term Split in E-Commerce

Amazon is not disappearing. Its logistics network remains unmatched, and its role in everyday necessities is secure.

But growth and margin expansion are shifting elsewhere.

TikTok is becoming the place where products are discovered. AI tools are becoming the place where products are compared. And fulfillment is no longer exclusive to one platform.

Amazon built a trillion-dollar company by owning the entire shopping journey. Today, that journey is fractured. Discovery, research, and fulfillment no longer sit under one roof.

For sellers, this is not a theory. It is a balance sheet decision. And for the first time in years, Amazon is not the default answer.

Source & In-Depth Analysis

This article draws on a recent video analysis examining TikTok Shop’s growing pressure on Amazon FBA sellers and the broader implications for e-commerce platforms. The original video provides additional operator-level perspective and tactical detail.

You can watch the full video below.