Bitcoin price drops to $69,322.21 amid massive ETF outflows; falls further to $62,473 in latest selloff [UPDATE]

Bitcoin slipped below $70,000 on Thursday, a level traders had treated as psychological bedrock for months. The world’s largest cryptocurrency fell to an intraday low of $69,322.212, its weakest print since November 2024, closing out a bruising stretch that has stripped more than 15% off its value in a single week and shaken confidence across crypto markets, according to Reuters.

The selloff landed as investors reacted to a shift in Washington. President Donald Trump’s selection of Kevin Warsh as the next chair of the Federal Reserve revived concerns around a more aggressive drawdown of the central bank’s balance sheet. Liquidity expectations shifted fast. “The market fears a hawk with him,” said Manuel Villegas Franceschi of Julius Baer, capturing the mood rippling through risk assets.

Bitcoin has since gained some ground and is now trading at $69,617.56 as of the time of writing.

Bitcoin sinks below $70,000 for first time since November as ETF outflows and Fed fears rattle crypto markets

Pressure intensified as institutional money pulled back. Analysts at Deutsche Bank pointed to heavy redemptions from U.S. spot bitcoin ETFs, with more than $3 billion in outflows in January alone, following sizable withdrawals late last year. Bitcoin has slid over 7% this week and is down about 20% for the year, the bank said.

Crypto traders closely track the Fed’s balance sheet, treating it as a proxy for system-wide liquidity. A shrinking balance sheet often translates into tighter conditions for speculative assets, and bitcoin has shown little immunity during periods of restraint. That dynamic returned to center stage as prices rolled over.

Derivatives markets added fuel to the slide. A wave of forced unwinds swept through leveraged positions, sending roughly $451 million in liquidations across exchanges in the past 24 hours. The cascade accelerated losses and reinforced the downward momentum already in motion.

With the $70,000 floor broken, attention has shifted to what comes next. Traders now eye $65,000 as the next meaningful checkpoint if selling pressure holds. For a market that thrives on confidence and liquidity, the latest move serves as a reminder of how quickly sentiment can flip when macro signals turn against it.

[Update 1] 10:27 AM ET, February 5, 2026: Bitcoin extended losses into the afternoon, falling further to approximately $67,706, down more than 7% on the day. The continued slide underscores persistent selling pressure as crypto markets remain volatile and risk appetite stays subdued.

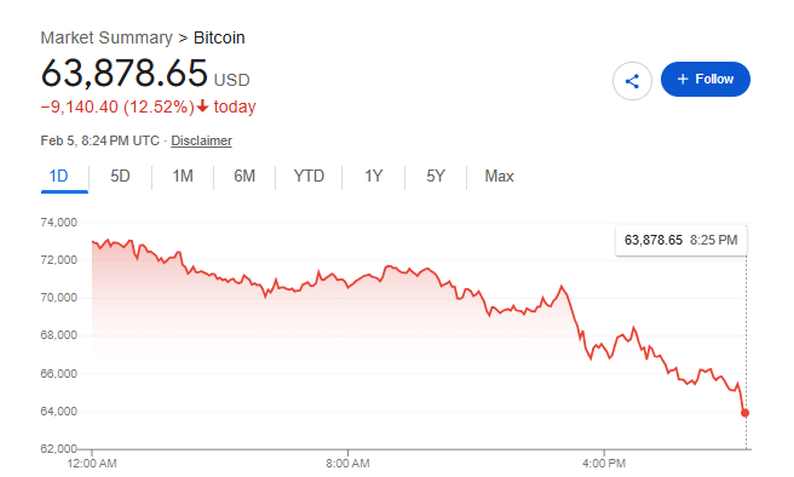

[Update 2] 3:30 PM ET, February 5, 2026: Bitcoin extended losses into the afternoon, now trading at $63,878.65, down more than 9% on the day and trading below the target of $65,000.

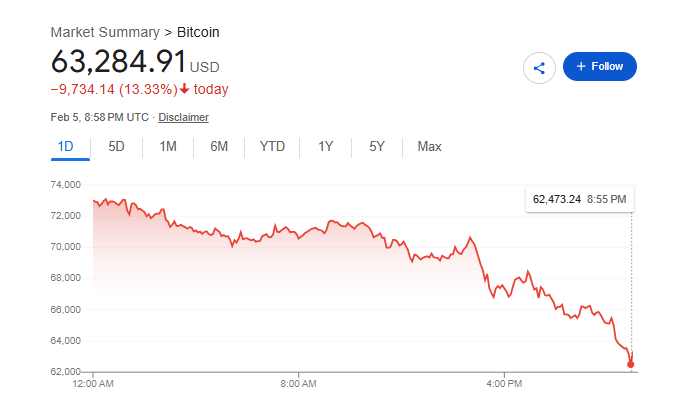

[Update 3] 3:55 PM ET, February 5, 2026: Bitcoin extended losses into the afternoon, now trading at $62,473.24, down more than 9% on the day.