Bitcoin price falls below $73,000, plummets to 15-month low as crypto market selloff continues

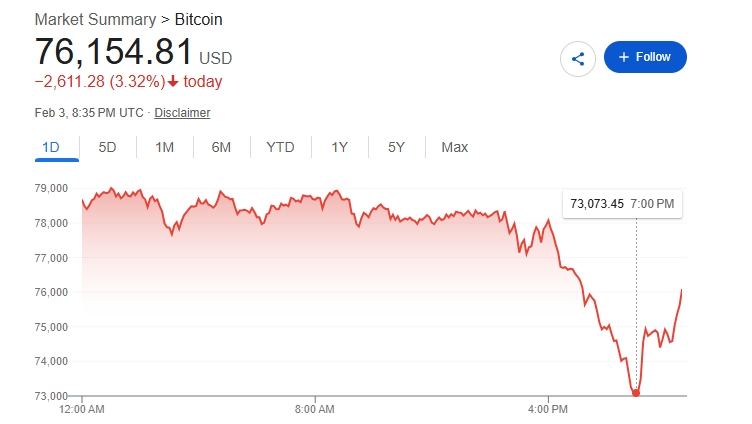

Bitcoin’s slide picked up speed over the last 24 hours, dragging the world’s largest cryptocurrency to a daily low of $73,073, its weakest level in roughly 15 months. The drop capped a bruising week that has erased more than 15% of Bitcoin’s value and rattled confidence across crypto markets.

Prices later clawed back some ground, with Bitcoin trading near $74,744 at the time of writing. The rebound offered little relief. The asset still logged a daily loss of more than 4%, mirroring a broader selloff sweeping through risk assets. Bitcoin has since gained some ground and is now trading at $76,226.61 as of the time of writing.

Traditional markets moved in lockstep. The S&P 500 fell 1.41% in the most recent session, and the Nasdaq Composite sank 2.22%, weighed down by sharp declines in major tech names. Shares of PayPal slid more than 19% after the company’s earnings report rattled investors, adding fresh pressure to an already fragile market tone. The pullback coincided with a partial U.S. government shutdown that has now stretched into its fourth day, injecting fresh uncertainty into financial markets.

Crypto-linked stocks followed the same downward path. Coinbase, along with bitcoin-heavy balance sheet holders Strategy and BitMine Immersion Technologies, each dropped more than 7% since the opening bell. The declines came even as institutional buyers such as Ark Invest continued to add exposure in recent sessions.

Losses across the crypto market ran deeper than Bitcoin alone. Ethereum slid 9.6% to around $2,118, and Solana fell 7.1% to roughly $97.10. Both tokens now trade well below levels seen during last April’s tariff-driven market shock and remain down 57% and 67% from their respective 2025 peaks.

The damage was most evident in derivatives markets. Bitcoin led all assets in liquidations over the past day, accounting for nearly $234 million in wiped-out long positions, according to Yahoo Finance, citing CoinGlass data. Across the broader crypto market, total liquidations reached roughly $659 million in just 24 hours, a sign that leverage built up during the prior rally has started to unwind fast.

Further downside remains on the table. Galaxy Digital’s head of research, Alex Thorn, pointed to structural weaknesses in Bitcoin’s price action and a lack of near-term catalysts to attract new buyers. In recent commentary, Thorn said the market could drift toward Bitcoin’s 200-week moving average near $58,000 if current conditions hold.

Thorn drew attention to what he described as a breakdown in Bitcoin’s long-standing “debasement trade” narrative, especially when set against gold’s recent surge. Gold pushed to a new all-time high above $5,600 per ounce last week and extended gains again on Tuesday as investors leaned into defensive assets. The metal jumped nearly 6% during the session and recently traded near $4,924 after rebounding from a pre-weekend drop.

Cathie Wood, whose firm holds significant Bitcoin exposure, recently told investors she sees gold as the asset caught in a bubble, not artificial intelligence or crypto. Her comments landed as sentiment across digital assets continued to sour.

That shift is visible in prediction markets. Traders on Myriad, a platform operated by Decrypt’s parent company Dastan, now favor a drop to $69,000 before any renewed push toward six figures. Just last week, odds on the platform leaned heavily toward a move to $100,000, peaking near 70%. Those expectations have flipped sharply. Current pricing gives a 75% probability to a slide toward $69,000 first.

For now, Bitcoin’s recent bounce has done little to calm nerves. With stocks under pressure, leverage unwinding, and safe-haven assets drawing capital, traders are bracing for more volatility ahead.