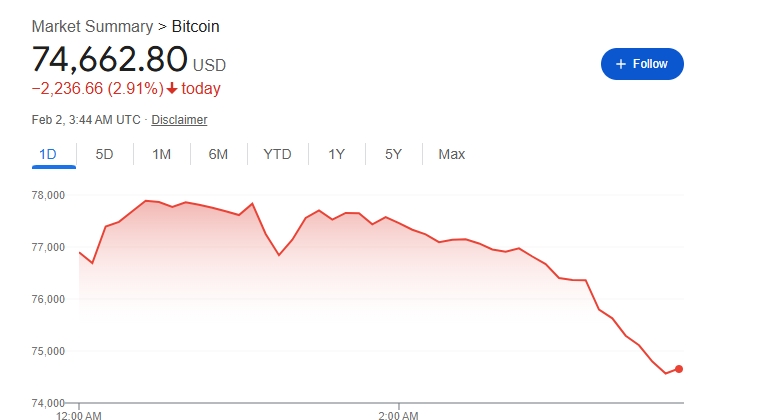

Bitcoin crashes to $74,662.80, triggering $2.5 billion in liquidations across crypto markets

Bitcoin’s latest slide did not arrive quietly. Prices broke down fast, liquidity vanished, and leverage snapped.

On Saturday, Bitcoin sank to $74,662.80, dropping more than 7% in a single session and setting off one of the largest liquidation events in crypto history. Roughly $2.5 billion in leveraged positions vanished as stop-loss clusters triggered forced selling across major exchanges. Long traders took the hardest hit. Bitcoin longs alone accounted for about $767 million of the damage.

The selloff spilled across the broader market. Ethereum slipped under $2,300. Solana fell below $100. Total crypto market value shrank by more than $200 billion in a matter of hours as cascading liquidations fed on themselves.

Bitcoin has recovered some ground and is now trading at $75,102.67 as of the time of writing.

This move followed an already fragile stretch. Just a day earlier, Bitcoin slid to $77,091 for the first time since April 2025. That decline capped a brutal sequence that erased roughly $1 trillion from the crypto market over a short window, rattling both retail traders and institutions.

The decisive moment came at $80,000. After two days of steady selling pressure, that level finally gave way. Bitcoin dropped from the mid-$84,000 range to just above $78,000, wiping out around $5,400 per coin in a 6.4% slide. Buyers stepped back after a failed bounce near short-term resistance, leaving the market exposed once momentum turned.

Corporate exposure surfaced in the fallout. MicroStrategy’s massive Bitcoin position slipped into unrealized losses for the first time since October 2023, a psychological marker for traders tracking institutional conviction. Bitcoin later stabilized in a wide $77,000 to $81,000 range, easing immediate panic without restoring confidence.

Traders searched for explanations. Analysts pointed to crypto’s familiar volatility rather than a single external trigger. No sudden regulatory shock. No macro headline. Just leverage stacked too high, liquidity thinning, and technical levels breaking in sequence.

Stress signals appeared beyond crypto. Gold suffered a sharp decline late in the week, falling close to 10% between Thursday and Friday. Bitcoin dropped about 5.6% over the same stretch. That gap stood out. For newer market participants, the smaller drawdown reinforced a growing belief that Bitcoin behaves differently during periods of broader market tension.

Signs of demand emerged near the lows. On-chain activity and exchange flow data suggested renewed accumulation as prices slid, hinting that some investors treated the drop as an entry point rather than an exit. That behavior contrasted with sharper withdrawals seen in parts of the commodities market.

From a technical lens, the damage was visible. Bitcoin lost the rising support line that had guided price action since late December. Once that level broke, price sliced through support zones between $86,000 and $82,000 in quick succession. The 50-day exponential moving average near $90,000 flipped from support to resistance, leaving heavy pressure overhead.

As of the time of writing, Bitcoin trades near $77,831.77, steadier than the lows yet far from repaired. The market absorbed the shock. The leverage cleared. What comes next depends on whether buyers step forward with conviction or allow another test of the downside.

If you want, I can: