Top Startup and Tech Funding News – January 29, 2025

It’s Thursday, January 29, 2026, and we’re back with today’s top startup and tech funding news. Today’s deals reflect deepening investor commitment to AI cloud infrastructure, chiplet interconnects, fintech orchestration, and scalable biotech. As competition accelerates in AI and advanced compute, investors are writing large checks to back foundational technologies that are reshaping enterprise systems and digital infrastructure.

Strategic and early-stage rounds centered on financial automation, blockchain interoperability, and logistics OS innovation. Rogo raised $75 million to unify CFO workflows with AI, while Datatruck closed $12 million to modernize freight with predictive routing. Tenbin Labs debuted with $7 million to tokenize commodities and currencies on-chain, and Easy Home Finance secured $30 million to scale AI-driven mortgage origination in India.

Cloud, semiconductors, and biotech dominated late-stage and strategic investments. CoreWeave secured a massive $2 billion strategic round from Nvidia to expand GPU cloud infrastructure. Upwind landed $250 million to bring real-time runtime protection to enterprise cloud workloads, and Tenpoint Therapeutics raised $235 million to launch its FDA-approved presbyopia treatment. Major bets also flowed to Vention, Eliyan, and others building platform-scale automation across physical AI, chiplet packaging, and developer productivity.

Tech Funding News

Funding Highlights

- CoreWeave secures $2B strategic investment from Nvidia for AI cloud expansion

- Upwind raises $250M Series B to expand runtime cloud security

- Tenpoint Therapeutics raises $235M Series B to launch eye treatment for presbyopia

- Vention raises $110M Series D to accelerate physical AI in manufacturing

- Mesh nets $75M Series C to build a global crypto payments network

- Rogo raises $75M Series C for AI-powered finance platform

- Eliyan scores $50M strategic funding to accelerate AI interconnect chiplets

- Easy Home Finance raises $30M Series C to expand fintech lending

- Datatruck raises $12M Series A to launch AI operating system for trucking

- Tenbin Labs raises $7M seed to tokenize gold and forex on blockchain

Investor Activity

Today’s rounds attracted leading venture firms, strategic investors, and industry incumbents. Notable participants included Nvidia, Samsung, Intel, and global crossover funds targeting AI infrastructure, financial systems, and decentralized applications. Across sectors, investors are backing platforms that simplify complexity at scale—whether in compute, compliance, or capital markets. Here’s the full breakdown of January 29’s most significant startup and tech fundings.

Upwind Raises $250M in Series B Funding to Expand Runtime Cloud Security

Upwind, a cloud security startup, has built an “inside-out” runtime security platform that embeds visibility and protection directly into cloud workloads. The Tel Aviv–based company claims its agent-based approach prevents misconfigurations and malware across containers and serverless environments. In its Series B round, Upwind raised $250 million at a $1.5 billion valuation, led by Bessemer Venture Partners.

The financing will fuel product development and bolster Upwind’s AI-powered threat protection. The round comes as enterprises face a proliferation of cloud services and seek more integrated security tools; since raising a $100M Series A in 2024, Upwind has grown rapidly, with 900% year-over-year revenue growth and global expansion into new markets.

-

Startup: Upwind

-

Investors: Bessemer Venture Partners (lead), Salesforce Ventures, Picture Capital

-

Amount Raised: $250 million

-

Total Raised: $350 million

-

Funding Stage: Series B

-

Funding Date: Jan 29, 2026

CoreWeave Secures $2B Strategic Investment from Nvidia for AI Cloud Expansion

CoreWeave, a specialist cloud infrastructure provider focused on GPU-accelerated computing, has attracted a massive investment from chipmaker Nvidia, deepening its bet on U.S. AI data center infrastructure. Nvidia invested $2 billion to become the second-largest shareholder in CoreWeave’s AI-focused cloud service. The strategic funding will help CoreWeave accelerate its build-out of AI data centers, targeting more than 5 gigawatts of GPU capacity by 2030.

CoreWeave pivoted from cryptocurrency mining to serve tech and AI firms, and this infusion of capital comes amid surging demand for GPU capacity. By deepening its partnership with Nvidia, CoreWeave aims to scale rapidly and meet enterprise AI workload needs while Nvidia secures a key channel for its processors.

-

Startup: CoreWeave

-

Investors: Nvidia (strategic investor)

-

Amount Raised: $2 billion

-

Total Raised: –

-

Funding Stage: Strategic Investment

-

Funding Date: Jan 26, 2026

Tenpoint Therapeutics Raises $235M in Series B Funding to Launch Eye Treatment for Presbyopia

Tenpoint Therapeutics, a biotech developing treatments for age-related vision loss, secured $235 million in Series B funding to support the U.S. launch of its presbyopia eye drop, YUVEZZI. The round was led by Janus Henderson along with EQT Nexus, Hillhouse, and the British Business Bank.

The fresh capital infusion will enable the scale-up of manufacturing and the commercialization of YUVEZZI, which recently won FDA approval for an early-2026 launch. Tenpoint focuses on a dual-agent formula designed to improve near vision in older adults. The new capital, paired with regulatory clearance, “creates the perfect launch point” for bringing this first-of-its-kind treatment to a large patient population.

-

Startup: Tenpoint Therapeutics

-

Investors: Janus Henderson (lead), EQT Nexus, Hillhouse, British Business Bank, others

-

Amount Raised: $235 million

-

Total Raised: $235 million

-

Funding Stage: Series B

-

Funding Date: Jan 29, 2026

Vention Raises $110M in Series D Funding to Accelerate Physical AI in Manufacturing

Vention, a maker of an integrated software-hardware automation platform for industrial robotics, raised $110 million in a Series D round to expand its “physical AI” solutions. The round was led by Investissement Québec, with participation from Desjardins Capital, Fidelity Investments Canada, Nvidia’s NVentures, and others. Vention’s platform uses generative AI to automate the design and programming of robotic manufacturing cells, aiming to drastically shorten deployment times.

The new funding will accelerate R&D on Vention’s AI-powered automation tools and support growth in North America and Europe. The company’s investors say the capital arrives as manufacturers increasingly seek simpler, software-driven automation to keep pace with industry demands.

-

Startup: Vention

-

Investors: Investissement Québec (lead), Desjardins Capital, Fidelity Canada, NVentures (Nvidia), others

-

Amount Raised: $110 million

-

Total Raised: $110 million

-

Funding Stage: Series D

-

Funding Date: Jan 27, 2026

Mesh Nets $75M in Series C Funding to Build a Global Crypto Payments Network

Mesh, a blockchain payments network, closed a $75 million Series C round at a $1 billion valuation to advance its universal crypto payment infrastructure. The round was led by Dragonfly Capital, with participation from Paradigm, Moderne Ventures, Coinbase Ventures, SBI Investment, and Liberty City Ventures. Mesh’s platform enables any-to-any cryptocurrency payments with instant settlement and serves as an “interoperability layer” across multiple blockchains.

The funding will drive Mesh’s expansion into Latin America, Asia, and Europe, building out its network to support over 900 million users globally. By unifying fragmented stablecoins and payment rails, Mesh aims to simplify crypto transactions for consumers and merchants worldwide.

-

Startup: Mesh

-

Investors: Dragonfly Capital (lead), Paradigm, Moderne Ventures, Coinbase Ventures, SBI Investment, Liberty City Ventures

-

Amount Raised: $75 million

-

Total Raised: $200 million

-

Funding Stage: Series C

-

Funding Date: Jan 27, 2026

Rogo Raises $75M in Series C Funding for AI-Powered Finance Platform

Rogo, a fintech startup providing an AI-driven platform for corporate finance, raised $75 million in a Series C round led by Sequoia Capital. The New York company’s software consolidates financial data (e.g., AP/AR, ERP) to automate forecasts and compliance for CFOs. Returning backers include Thrive Capital, Khosla Ventures, Tiger Global, and JPMorgan, while new investors such as financier Henry Kravis and Wells Fargo joined the round.

This brings Rogo’s total funding to about $135 million. Rogo will use the capital to speed development of its product and expand partnerships with financial institutions, aiming to bring its data-driven insights to larger enterprises.

-

Startup: Rogo

-

Investors: Sequoia Capital (lead), Henry Kravis, Wells Fargo, Thrive Capital, Khosla Ventures, Tiger Global, JP Morgan

-

Amount Raised: $75 million

-

Total Raised: $135 million

-

Funding Stage: Series C

-

Funding Date: Jan 29, 2026

Eliyan Scores $50M Strategic Funding to Accelerate AI Interconnect Chiplets

Eliyan, a startup designing advanced chiplet interconnects for AI hardware, announced $50 million in strategic financing led by Samsung Catalyst Fund and Intel Capital. The round also included participation from AMD, Arm, Coherent Corp., Meta, and others. Eliyan’s technology aims to enable high-bandwidth, energy-efficient data transfer between next-generation multi-chip AI systems. The proceeds will support commercialization of Eliyan’s NuLink and NuGear chiplet products, which its founders say will “break through memory and I/O limits” in scale-up AI servers.

-

Startup: Eliyan Corporation

-

Investors: Samsung Catalyst Fund (lead), Intel Capital, AMD, Arm, Coherent, Meta

-

Amount Raised: $50 million

-

Total Raised: ~$100 million

-

Funding Stage: Strategic Funding

-

Funding Date: Jan 29, 2026

Easy Home Finance Raises $30M in Series C Funding to Expand Fintech Lending

Easy Home Finance, an Indian fintech company offering digital home loans, raised $30 million in a Series C round led by Investcorp’s Growth Equity Fund and Growth Opportunity Fund. Existing backers Claypond Capital and SMBC Asia Fund also participated. The financing brings Easy Home Finance’s total equity funding to over $80 million.

The startup will use the funds to enter new markets, enhance its tech platform, and scale its distribution network. Easy Home Finance uses AI and analytics to underwrite borrowers, reflecting a broader trend of tech-driven expansion in emerging-market financial services.

-

Startup: Easy Home Finance

-

Investors: Investcorp Growth Equity Fund (lead), Investcorp Growth Opportunity Fund, Claypond Capital, SMBC Asia Fund

-

Amount Raised: $30 million

-

Total Raised: $80+ million

-

Funding Stage: Series C

-

Funding Date: Jan 29, 2026

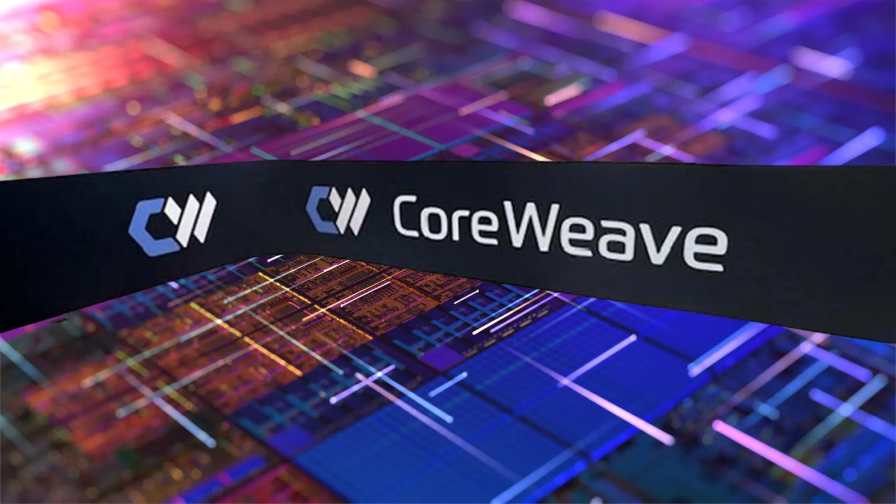

Datatruck Raises $12M in Series A Funding to Launch AI Operating System for Trucking

Datatruck, a Chicago-based logistics startup, raised $12 million in Series A funding to commercialize its AI-native operating system for long-haul trucking. The platform uses machine learning to automate routing and load-matching, effectively replacing legacy transportation management systems.

The round was led by Avenue Growth Partners. Datatruck plans to use the capital to accelerate product development and expand its carrier network. By embedding predictive AI directly into trucking operations, the startup aims to improve efficiency and driver productivity in a heavily fragmented freight industry.

-

Startup: Datatruck

-

Investors: Avenue Growth Partners (lead)

-

Amount Raised: $12 million

-

Total Raised: $12 million

-

Funding Stage: Series A

-

Funding Date: Jan 29, 2026

Tenbin Labs Raises $7M in Seed Round to Tokenize Gold and Forex on Blockchain

Tenbin Labs, a New York-based startup, secured $7 million in a seed round led by Galaxy Ventures (the venture arm of Galaxy Digital). The company is developing blockchain-based tokens for gold and foreign exchange, backed by CME futures prices. Other investors in the round included Wintermute Ventures, GSR, and FalconX.

Tenbin’s goal is to launch tokenized gold and emerging-market currency assets later this year, offering faster settlement and yield to DeFi users. The new funding will support the development of Tenbin’s smart contracts and market infrastructure.

-

Startup: Tenbin Labs

-

Investors: Galaxy Ventures (lead), Wintermute Ventures, GSR, FalconX

-

Amount Raised: $7 million

-

Total Raised: $7 million

-

Funding Stage: Seed

-

Funding Date: Jan 27, 2026

Tech Funding Summary Table

| Startup | Investors (Lead & Notable) | Amount Raised | Total Raised | Funding Stage | Funding Date |

|---|---|---|---|---|---|

| Upwind | Bessemer VP (lead), Salesforce Ventures, Picture Capital | $250M | $350M | Series B | Jan 29, 2026 |

| CoreWeave | Nvidia (strategic) | $2,000M | – | Strategic | Jan 26, 2026 |

| Tenpoint Therapeutics | Janus Henderson (lead), EQT Nexus, Hillhouse, BB Bank | $235M | $235M | Series B | Jan 29, 2026 |

| Vention | Investissement Québec (lead), Desjardins, Fidelity CAN, NVentures | $110M | $110M | Series D | Jan 27, 2026 |

| Mesh | Dragonfly (lead), Paradigm, Moderne, Coinbase Ventures, SBI | $75M | $200M+ | Series C | Jan 27, 2026 |

| Rogo | Sequoia (lead), Henry Kravis, Wells Fargo, Thrive, others | $75M | $135M | Series C | Jan 29, 2026 |

| Eliyan | Samsung Catalyst (lead), Intel, AMD, Arm, Coherent, Meta | $50M | ~$100M | Strategic | Jan 29, 2026 |

| Easy Home Finance | Investcorp Growth Equity (lead), Growth Opportunity, Claypond, SMBC | $30M | $80M+ | Series C | Jan 29, 2026 |

| Datatruck | Avenue Growth Partners (lead) | $12M | $12M | Series A | Jan 29, 2026 |

| Tenbin Labs | Galaxy Ventures (Galaxy Digital, lead), Wintermute, GSR, FalconX | $7M | $7M | Seed | Jan 27, 2026 |