Jeff Bezos’ Blue Origin unveils 5,408-satellite network to challenge SpaceX’s Starlink

Jeff Bezos is making a serious move into the satellite communications race. Blue Origin, the space company he founded in 2000, announced plans Wednesday to deploy a massive constellation of 5,408 satellites, setting up a direct challenge to Elon Musk’s Starlink. The network, called TeraWave, marks Bezos’ boldest push yet into one of the most competitive battles in space.

“Blue Origin today announced TeraWave, a satellite communications network designed to deliver symmetrical data speeds of up to 6 Tbps anywhere on Earth. This network will service tens of thousands of enterprise, data center, and government users who require reliable connectivity for critical operations,” the company said in a news release.

The announcement puts Bezos in direct competition with Musk. SpaceX’s Starlink currently operates more than 9,000 satellites and serves roughly 9 million customers worldwide. What began as a consumer broadband play has evolved into a global infrastructure layer used by militaries, disaster responders, airlines, and shipping companies.

Bezos is no stranger to the satellite business. Amazon, which he founded in 1994, has been building its own constellation under what was once known as Project Kuiper. The service recently rebranded to Leo and has already launched 180 satellites since April through missions run by partners such as United Launch Alliance and SpaceX. Several upcoming launches will be handled by Blue Origin itself.

TeraWave: Inside Blue Origin’s Satellite Network

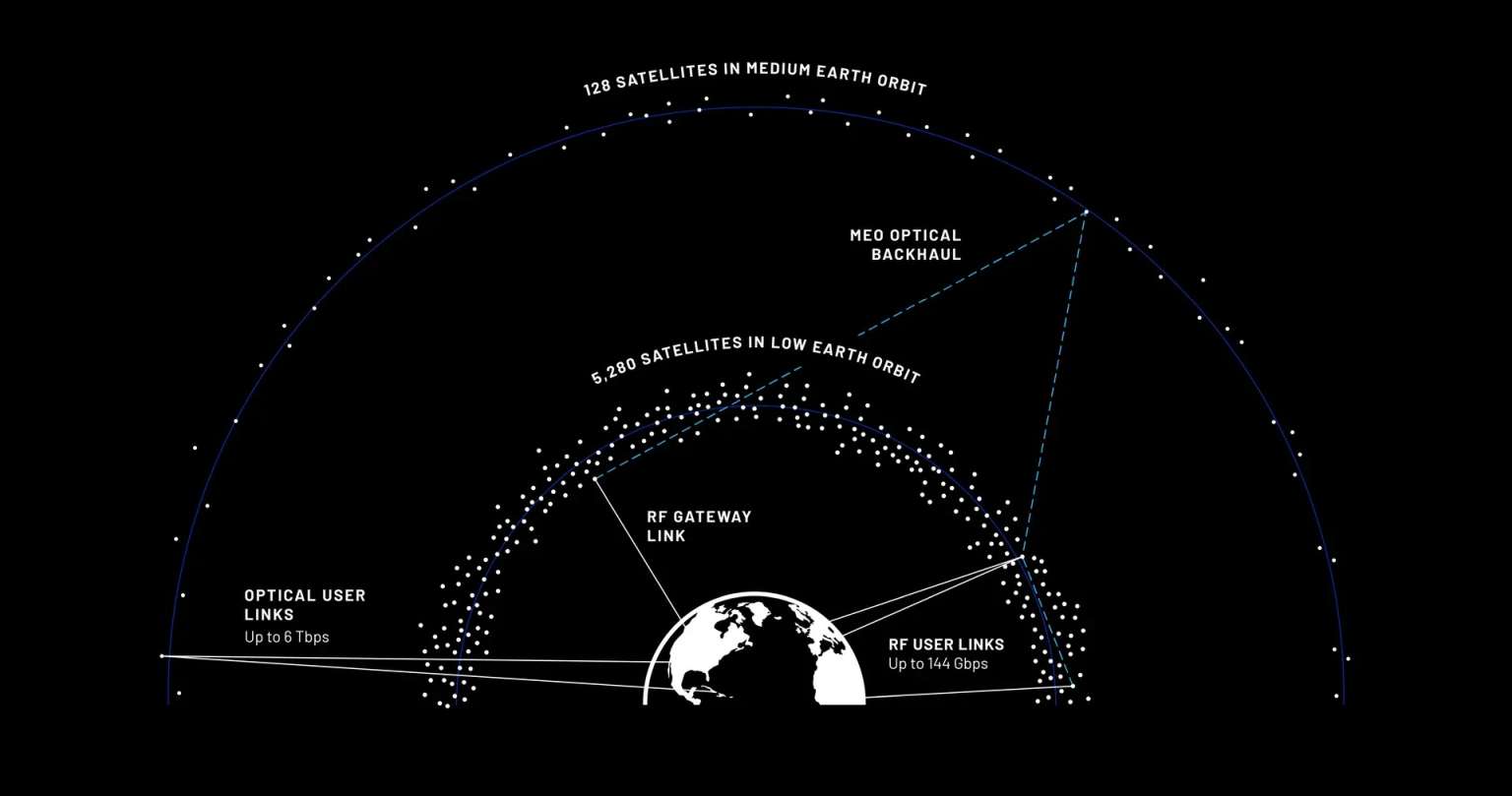

TeraWave is built for enterprise, data center operators, and government customers. Blue Origin says the system will deliver data speeds of “up to 6 terabits per second” using satellites stationed across low Earth orbit and medium Earth orbit. That places them between roughly 100 miles and 21,000 miles above the planet, a range meant to balance speed, coverage, and reliability. The company expects to begin launching the constellation in the fourth quarter of 2027.

The network is built around a constellation of 5,408 satellites connected through optical links, spread across low Earth orbit and medium Earth orbit. This dual-orbit setup lets Blue Origin move massive amounts of data between global hubs and end users, even in places where laying fiber is expensive, impractical, or slow. That includes remote regions, rural communities, and fast-growing suburban areas where traditional infrastructure struggles to keep up.

The company says its enterprise-grade terminals can be deployed quickly anywhere in the world and plug directly into existing high-capacity networks. That adds new routing options and strengthens overall network reliability, giving customers more paths for their data instead of relying on a single connection.

TeraWave Specs

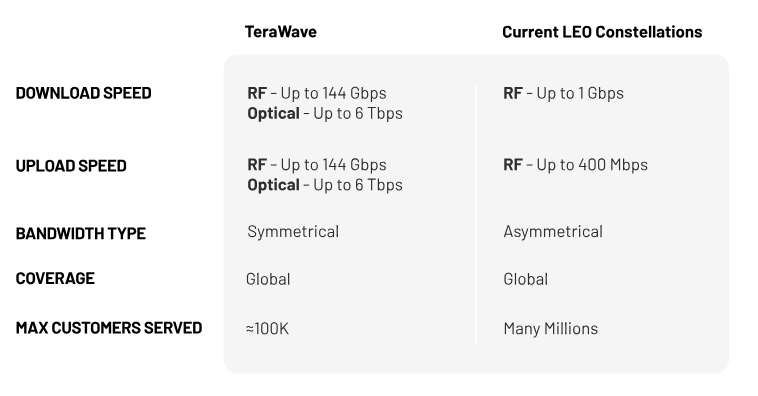

TeraWave targets organizations that need more than standard satellite service. Blue Origin is going after higher throughput, balanced upload and download speeds, built-in redundancy, and the ability to scale quickly as demand grows. The system pairs radio frequency and optical links to deliver performance that complements fiber rather than trying to replace it.

Customers connected to the low Earth orbit portion of the network can access speeds of up to 144 gigabits per second through Q/V-band links from more than 5,000 satellites. For heavier data loads, optical links from 128 medium Earth orbit satellites unlock up to 6 terabits per second of capacity.

The network supports both point-to-point connections and full enterprise internet access. That gives customers flexibility to adjust capacity and physical presence as their needs change, whether they’re expanding operations, shifting data centers, or building redundancy into their infrastructure.

Amazon plans to operate 3,236 low Earth orbit satellites to serve businesses, governments, and consumers. Last November, the company opened an “enterprise preview” to select customers ahead of a wider commercial rollout. The overlap between Amazon’s network and Blue Origin’s ambitions raises questions about how tightly the two efforts will align, though Bezos has positioned them as separate ventures with shared technical roots.

Bezos has made no secret of his long-term vision. In 2024, he said Blue Origin could one day outgrow Amazon. “I think it’s going to be the best business that I’ve ever been involved in, but it’s going to take a while,” he said during an interview at The New York Times’ DealBook Summit. Dave Limp, Amazon’s former devices chief, now runs Blue Origin as CEO.

Until now, Blue Origin has been best known for suborbital tourism and research missions. The company reached a major milestone last January with the first successful launch of its heavy-lift New Glenn rocket. While the booster missed its initial recovery attempt, Blue Origin later stuck the landing in November following a mission that carried a NASA spacecraft. That success marked a turning point for the company’s reusability goals.

With TeraWave, Blue Origin is stepping beyond rockets and into the infrastructure business. The move places Bezos in direct competition with Musk, Amazon, and a growing list of satellite operators racing to control the next layer of global connectivity. Space may be vast, but the fight for orbital real estate is getting crowded fast.