KuCoin Ranks Top 3 Global Crypto Exchanges by Market Share Growth in 2025, TokenInsight Reports

KCS Defies Market Slump as KuCoin Claims Top Spot in Spot Trading Growth

KuCoin is having a strong year, and the numbers back it up.

TokenInsight’s newly released 2025 Cryptocurrency Exchange Annual Report places the global crypto platform among the top three exchanges worldwide for annual market share growth. In an industry where user trust shifts fast, and competition never lets up, KuCoin managed to stand out when many rivals struggled to hold ground.

KuCoin Tops Spot Market Share Growth in 2025, Ranks Top Three Industry-Wide

The report tracks performance across major centralized exchanges and shows KuCoin posting solid year-over-year gains. As market concentration shifted and top platforms traded positions, KuCoin remained one of the few exchanges to grow steadily through the turbulence. That consistency points to a platform built for the long haul, with a wide asset lineup and a user base spread across the globe.

Average Market Share Change

KCS Delivers Counter-Cyclical Performance, Ranking Top Three by Annual Price Growth

KCS, KuCoin’s native token, tells a similar story. While most exchange tokens slid through 2025, KCS moved in the opposite direction. TokenInsight ranks it among the top three exchange tokens by annual price growth, trailing only OKB and BNB. It was one of the rare platform tokens to finish the year in positive territory. That performance reflects steady confidence from traders who continue to back KuCoin’s broader ecosystem.

Exchange Tokens Price Return

KuCoin Leads the Industry in Spot Market Share Growth

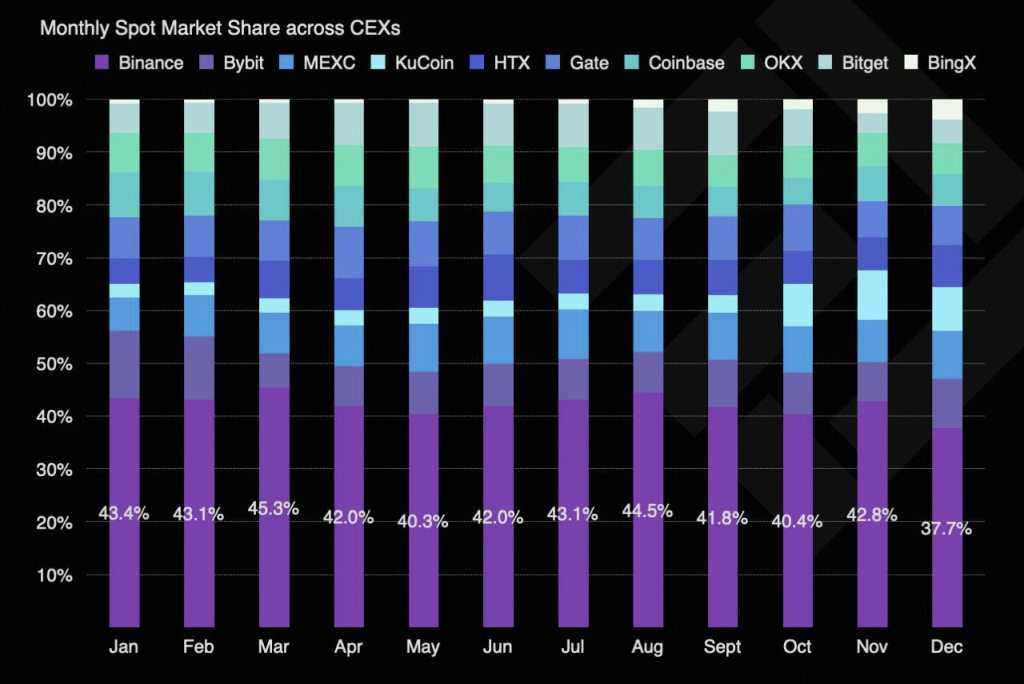

Spot trading has been another bright spot. Between January and December 2025, KuCoin recorded a net increase of 5.83 percent in spot market share, placing it first among major centralized exchanges. The gains came from deeper liquidity, wider token availability, and a push into more global markets. For traders, that translated into more choices and tighter spreads across popular pairs.

TokenInsight says 2025 marked a turning point for exchanges. Market share and token performance now track closely with long-term operations and user trust rather than short-term hype. KuCoin’s results show what steady execution looks like when market cycles turn rough.

Monthly Spot Market

The company says it plans to keep its focus on security, compliance, and user experience as it grows. The goal is simple: stable, transparent services that work for traders no matter where they live.

Founded in 2017, KuCoin now serves more than 40 million users across 200 countries and regions. The platform lists over 1,000 tokens and offers spot and futures trading, institutional products, and a Web3 wallet. It has earned recognition from Forbes and Hurun and holds SOC 2 Type II and ISO 27001:2022 certifications. KuCoin is registered with AUSTRAC in Australia and holds a MiCA license in Austria, as CEO BC Wong continues to expand its regulated footprint.

In a year when crypto platforms faced relentless pressure, KuCoin didn’t just hold steady; it thrived. It grew.