Tesla survey halted in Germany after 253,000 votes from just 2 IP addresses in the USA

A German news site pulled the plug on a Tesla buying survey after something didn’t add up. What began as a simple reader poll turned into a cautionary tale about how fragile online voting can be.

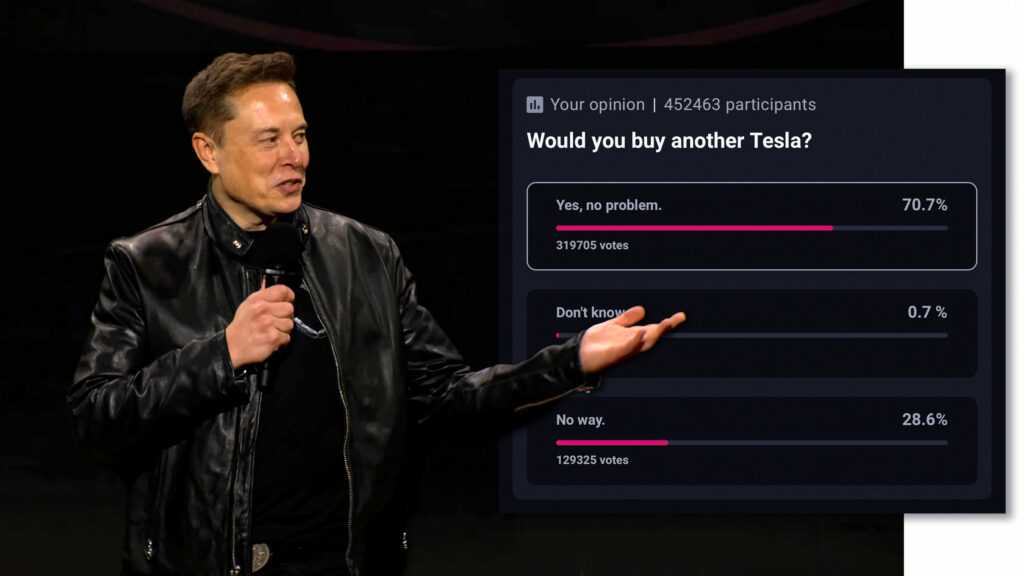

The survey, published in March 2025 by major outlet T-online, asked a straightforward question: Would you still consider buying a Tesla? Early responses painted a clear picture. Roughly 94 percent of participants said no. Interest looked weak. Sentiment stayed steady.

Then everything changed.

Within days, participation exploded past 467,500 votes. The mood flipped just as sharply. Nearly 70 percent of respondents now said they would consider buying a Tesla. The reversal was dramatic enough to trigger concern inside the newsroom.

Editors launched an internal review.

What they uncovered stopped the poll cold.

More than 253,000 votes traced back to just two IP addresses located in the United States. That level of activity from such a narrow source made organic participation implausible. T-online immediately suspended the survey and removed it from public view.

“T-Online withdraws Tesla survey after 253,000 votes from 2 IP addresses in the USA,” the German news outlet wrote.

In its report, the outlet wrote: “This indicates that the survey might have been distorted.”

The story didn’t end there.

Editors noticed the poll had been widely shared on X, drawing thousands of reposts. One high-profile share came from Elon Musk himself after the results turned favorable. His post alone generated roughly 2.8 million views within two hours.

“Survey Results Took a Wild Turn After a week, the number of people voting in the still-open survey grew beyond 467,500, and an impressive 70 percent stated they would consider purchasing. T-Online investigated the sudden surge and found that 253,000 votes came from just two IP addresses in.”

Traffic surged. By Tuesday evening, several hundred votes were flooding in every minute.

Who controlled those votes remains unclear. What was clear to editors was that the data could no longer be trusted.

The episode spread quickly across German and international media. Fact-checking organizations confirmed the irregular traffic patterns and reinforced T-online’s conclusion. This was never a scientific survey. It lacked safeguards. It allowed unlimited voting. It was easy to manipulate.

The poll was shut down shortly after.

Reader surveys still carry weight in public conversation, even with disclaimers. Headlines move fast. Screenshots outlive retractions. A single distorted chart can shape perception long after the facts emerge.

T-online’s decision to pull the poll was a course correction that many outlets fail to make in time. The publication acknowledged the anomaly, explained its findings, and removed the data rather than letting it linger.

This wasn’t about defending Tesla or attacking critics. It was about protecting credibility.

As scrutiny around electric vehicle brands grows across Europe, sentiment matters. Public perception influences buyer confidence, policy debates, and market direction. That makes clean data more valuable than viral charts.

Musk shared the poll before the manipulation was publicly confirmed. Once it was taken down, the conversation shifted away from Tesla’s image and toward a larger issue: trust in online data.

That’s the real takeaway.

For readers, the lesson is simple. Treat online polls like what they are: entertainment, not evidence. For publishers, the bar is higher. Guardrails matter. Traffic patterns matter. Trust matters.

This story didn’t expose a corporate plot. It showed how easily perception can be bent online — and how quickly one newsroom chose to step in and stop it.

Tesla Sales Slump Puts the Survey in New Light

The halted German survey reads differently in light of Tesla’s 2025 performance.

Nine months after the poll controversy, Tesla confirmed what early European sentiment hinted at. In January 2026, the company reported a 16 percent drop in global deliveries to 1.64 million vehicles, marking its second straight annual decline. At the same time, Chinese rival BYD overtook Tesla to become the world’s largest EV seller.

That context reframes the March 2025 poll.

Early results showed resistance among German consumers, one of Tesla’s most strategic markets outside the U.S. The sudden vote reversal briefly created a more optimistic online narrative. Tesla’s full-year numbers later told a very different story.

The poll didn’t predict Tesla’s downturn. It didn’t cause it either. But it captured something real: a cooling mood among European buyers months before the delivery data made it official.

By the time Tesla released its 2025 figures, the shift was undeniable. Competition intensified. Price cuts squeezed margins. BYD reshaped the global EV leaderboard.

Looking back, the survey controversy feels less like internet noise and more like an early snapshot of a brand losing momentum in key markets.