Are we in an AI Bubble? Tech leaders warn today’s frenzy mirrors the Dot-Com era

Late last year, we flagged early signs of an AI bubble as investors began sounding the alarm over sky-high startup valuations. At the time, the artificial intelligence boom was already dominating headlines. Massive funding rounds. Eye-popping deal sizes. Predictions that bordered on sci-fi.

Then, in August, OpenAI CEO Sam Altman stepped off the hype train and said what many were thinking. Investors, he suggested, might be getting ahead of themselves. That comment sparked a debate the industry still hasn’t resolved. Fast forward a month, and the question resurfaced.

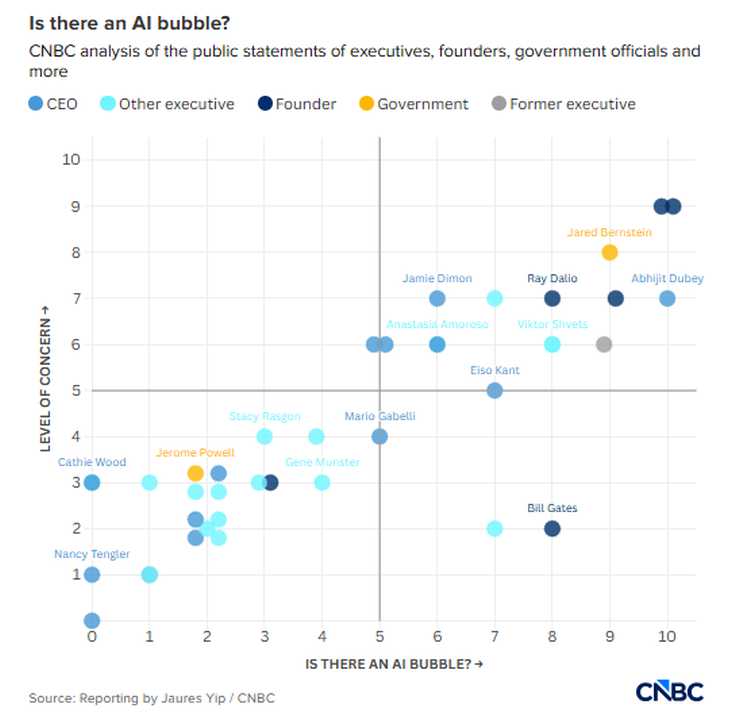

What reignited it? A new CNBC survey of 40 tech leaders, investors, and analysts. Their responses pulled back the curtain on how uneasy insiders really feel. The question was blunt: Are we in an AI bubble? And how worried should we be?

The timing feels telling. Reuters reports that venture capital continues to flood into AI startups at record levels, even as senior executives admit valuations, especially at the early stage, appear stretched. The disconnect is hard to ignore. Money keeps flowing. Doubt keeps growing.

OpenAI and Nvidia continue stacking headline deals with cloud providers. Amazon, Microsoft, and Google are pouring billions into new data centers to meet surging demand. The scale of the buildout looks staggering. The debt backing it has some insiders quietly nervous.

CNBC didn’t stop at collecting opinions. It scored each response on two dimensions: how strongly each person believes AI is inside a bubble and how concerned they are about it. The results landed across the spectrum. Some executives see hype spiraling. Others argue this is simply the early phase of something much bigger.

Credit: CNBC

Economic bubbles tend to follow a familiar script. Prices surge on speculation and excitement. Reality catches up. Then comes the drop. That memory still haunts veterans of the dot-com crash, which explains why the comparisons keep coming.

Nvidia CEO Jensen Huang tried to cool the chatter during a recent earnings call. “There’s been a lot of talk about an AI bubble,” he said. “From our vantage point, we see something very different.”

Michael Burry sounds less relaxed. The investor who famously predicted the 2008 housing collapse compared today’s spending spree to late-90s tech mania in a Substack essay. He later doubled down on X with a blunt warning: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

Altman struck a similar tone last summer over dinner with reporters.

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes,” he said.

That tension sits at the center of this debate. AI looks transformative. The market feels overheated.

Here’s the twist.

AI today feels a lot like electricity in its early days. Power grids existed long before refrigerators or air conditioners reshaped daily life. It took decades for those breakthroughs to arrive. Demand exploded only after people discovered what electricity could truly do.

AI may follow the same arc. The tools look impressive. The killer applications still wait offstage. When they arrive, data center growth will likely make today’s buildout look small.

For now, we live inside a strange paradox. Startups sit on mountains of cash. Investors whisper about overheating markets. The mood feels uncomfortably close to the dot-com era.

Will this end in a spectacular pop or fuel the next trillion-dollar wave? No one knows. That uncertainty is exactly why the debate persists.