Paperspace founders’ AI startup ATG emerges from stealth with $15M to bring autonomous AI financial advisors to everyone

For years, investors have faced an uncomfortable tradeoff. On one side sit robo-advisors that rebalance portfolios but stop short of offering real guidance. On the other hand, are traditional financial advisors who manage hundreds of clients at once while charging fees that quietly erode long-term returns. The result has been a system that works well for institutions and the wealthy, and far less well for everyone else.

That gap is what Autonomous Technologies Group, or ATG, is betting it can close.

The New York– and San Francisco–based AI startup has emerged from stealth with $15 million in pre-seed funding to build what it calls an autonomous AI financial advisor, one that aims to deliver private-bank-level guidance without the traditional cost structure. The round was backed by Y Combinator’s Alumni Fund, Garry Tan, Collaborative Group, Fusion Fund, Box Group, and the founder of a leading quantitative hedge fund.

YC-Backed Startup ATG Raises $15M for a Fully Autonomous AI Financial Advisor

ATG was founded by Dillon Erb and Daniel Kobran, the co-founders of Paperspace, an early GPU cloud provider that DigitalOcean acquired in 2023 for $111 million. After that exit, the pair spoke with financial advisors across firms and regions. They found an industry full of inconsistencies, high fees, and wildly different recommendations for similar clients.

Rather than build another portfolio-balancing tool, ATG set out to automate the advisory layer itself.

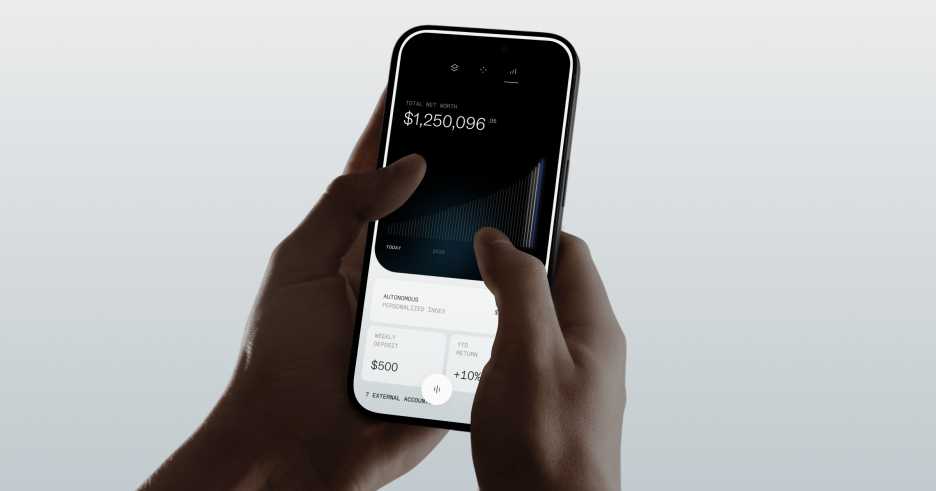

Its core product, Autonomous, is being developed as an AI-driven investment strategist that evaluates market data, portfolio construction, tax considerations, behavioral finance, and individual context within a single system. The company says users will be able to receive advice on existing accounts or move assets onto the platform to implement strategies directly. Public access is expected in early 2026, with an iOS launch planned for the first quarter.

“The financial advisory industry is one of the last holdouts where human intermediaries extract massive value without creating it,” said Garry Tan, CEO of Y Combinator. “Dillon and Daniel predicted the meteoric rise of GPUs in 2015 with Paperspace. They understand where AI capabilities are heading. This is the right team at the right inflection point.”

ATG’s pitch lands at a moment when fee pressure across wealth management is rising, and investors are paying closer attention to the long-term cost of advice. A one- to two-percent annual advisory fee may sound modest, but over decades it can quietly consume a large share of retirement savings. ATG’s founders argue that software can shoulder much of that advisory work at scale, without asking clients to give up a slice of their future.

“High quality and personalized financial advising shouldn’t be a luxury reserved for the ultrawealthy,” said Dillon Erb, founder and CEO of ATG. “Our mission is to help millions of people across the income spectrum 2x their retirement savings so they can live a confident and fulfilled life.”

The company plans to launch with zero advisory fees for early users and no trading fees, with a long-term goal of keeping the service free or priced well below traditional advisors. By launch, ATG says the platform will be SOC 2 compliant, FINRA-licensed, FDIC-approved, and fully SEC-compliant.

Behind the scenes, ATG has grown to a team of 15, including engineers and researchers from companies such as Meta, Spotify, and American Express. The company positions itself as both an AI research lab and a product company, focused on applied reasoning models for financial decision-making.

Whether investors are ready to trust an autonomous system with life savings remains an open question. Still, the combination of a proven founding team, a clear target, and early institutional backing suggests ATG is taking a serious swing at one of finance’s most entrenched businesses.

Users can learn more and join the waitlist at becomeautonomous.com.