Amazon faces backlash after AI agent sells retailers’ products without permission

Amazon is learning, again, that convenience for shoppers can come at a cost for sellers.

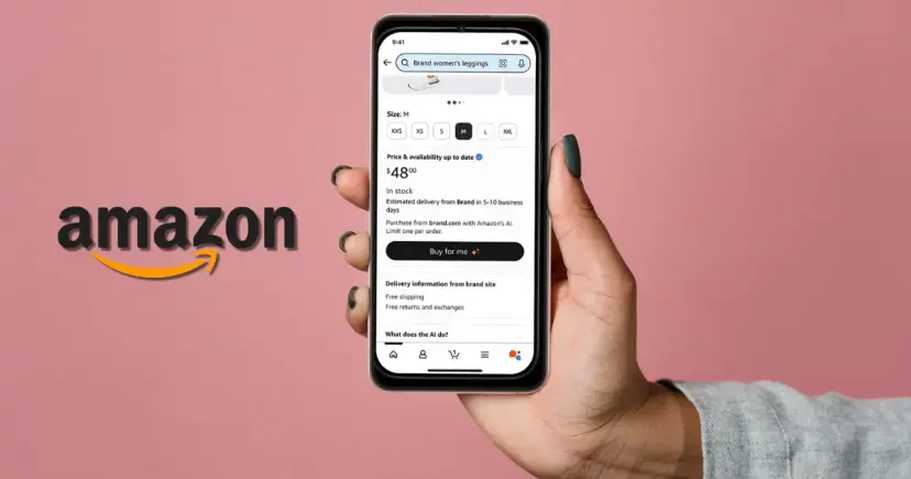

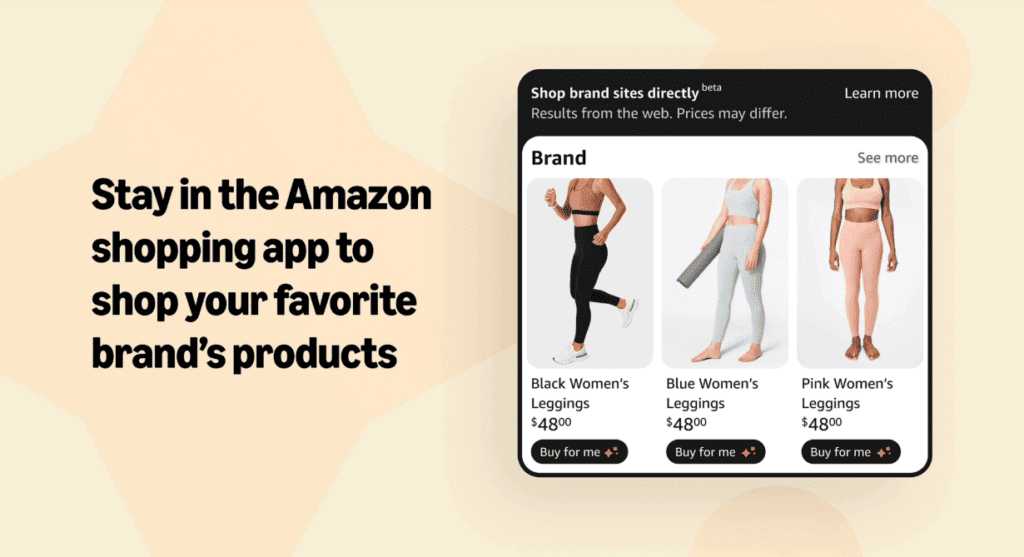

Earlier this year, Amazon quietly rolled out a test called Shop Direct, a feature that lets shoppers browse products from outside Amazon’s own marketplace. In some cases, a “Buy for Me” button appears next to those items. Tap it, and an AI agent completes the purchase on the customer’s behalf, pulling product details directly from a brand’s website.

Amazon framed the experiment as a way to help shoppers find anything they want, even items Amazon does not carry. The timing makes sense. More than 60% of Amazon’s retail sales now come from third-party merchants, and the company has spent the past decade turning its platform into a massive hub for outside sellers.

What Amazon did not highlight is how many of those sellers never agreed to take part.

Amazon’s ‘Buy for Me’ AI Is Listing Products Without Retailers’ Consent—and Sellers Are Furious

In recent weeks, retailers have reported that their products were listed on Amazon without their consent, according to posts on Reddit and Instagram. Some said the listings included items they never sold. Others spotted products marked as available even when the inventory was gone.

“Sounds like a great program until the agentic AI starts selling customers things you don’t have, all while your shop has no idea it’s sending the wrong items to the customer,” Hitchcock Paper, a stationery shop based in Virginia, wrote in an Instagram post in late December.

The company said it discovered it had been swept into the program after receiving orders for a stress ball it does not sell. The emails came from a “buyforme.amazon” address, leaving little doubt about the source.

A similar experience hit Bobo Design Studio. CEO Angie Chua said her company began receiving orders from Amazon’s Buy for Me agent last week, even though she never opted in. Bobo sells stationery and journaling accessories through its Shopify-built site and operates a physical storefront in Palm Springs, California.

Chua told CNBC that she followed the instructions listed in Amazon’s FAQ and asked the company to remove her products. The listings disappeared days later. The damage, in her view, had already been done.

“We were forced to be dropshippers on a platform that we have made a conscious decision not to be part of,” Chua said, describing a setup where sellers fulfill orders for a marketplace they never chose.

After sharing her story publicly, Chua said more than 180 business owners reached out with similar complaints. Many sell through platforms such as Squarespace, WooCommerce, and Wix. None said they had granted Amazon permission to list their products.

Amazon disputes the framing. A spokesperson told CNBC that Shop Direct and Buy for Me help customers discover products Amazon does not sell, while giving businesses access to new buyers and incremental sales. The company says brands can opt out at any time by emailing branddirect@amazon.com

and that removals happen quickly.

Amazon said its system pulls product details and pricing from publicly available information on brand websites and runs checks to verify availability and accuracy. Buy for Me, the company added, remains an experiment and does not generate commissions for Amazon. In November, Amazon said the number of products available through the feature had grown from 65,000 at launch to more than 500,000.

The backlash lands at a moment when AI shopping agents are starting to reshape online commerce. Tools from companies such as OpenAI, Google, and Perplexity now allow users to browse and purchase products without leaving the chat interface.

Amazon has taken a defensive stance toward third-party agents, blocking dozens of them from accessing its site. In November, the company sued Perplexity for an agent within the startup’s Comet browser that could place purchases on users’ behalf. Amazon accused the company of masking its bots to keep scraping Amazon’s site. Perplexity dismissed the lawsuit as a bully tactic.

At the same time, Amazon has been building its own tools. In 2024, the company launched Rufus, its in-house shopping chatbot, which now includes early agent-style features.

For small retailers, the concern runs deeper than a single experimental feature. Many have spent years choosing where their products appear, how they are priced, and how customers experience their brand. Seeing those decisions overridden by an AI system, without notice, has left sellers questioning who really controls online commerce as agent-driven shopping moves closer to the mainstream.