Tesla’s 2025 deliveries drop 16% to 1.64 million, marking a second straight annual decline as BYD overtakes the global EV market

Tesla closed out 2025 with another clear signal that its growth era is under pressure.

On Friday, Tesla released its fourth-quarter vehicle production and delivery report, confirming a second straight year of declining deliveries for the electric carmaker. The numbers came in below Wall Street expectations and reinforced a shift already visible across the global EV market.

Tesla reported total fourth-quarter deliveries of 418,227 vehicles, alongside production of 434,358 units. For the full year, deliveries reached 1.64 million vehicles, narrowly trailing production at 1.65 million, according to CNBC, which cited estimates from StreetAccount.

The news comes just a month after Tesla’s sales collapsed across Europe, while BYD gained ground. In Sweden, Tesla’s new-car registrations — a key proxy for sales — fell 89%. The fall was almost as steep in Denmark, where sales tumbled 86%, and Norway wasn’t far behind with a 50% decline. These countries, once reliable strongholds for Tesla, now reflect a broader cooling trend that’s been unfolding across the continent throughout the year.

Tesla’s Sales Slide in 2025 as Musk’s Politics, Competition, and Incentive Cuts Collide

The latest key figures from Tesla’s fourth-quarter report clearly show the gap. The company delivered 418,227 vehicles in Q4 and produced 434,358. Full-year deliveries reached 1.64 million, just below the annual production of 1.65 million.

Analysts had expected stronger results. StreetAccount data showed consensus forecasts pointing to roughly 426,000 deliveries for the quarter. Tesla’s own analyst survey, posted on its website in late December, projected deliveries of approximately 422,850 vehicles, already reflecting a sharp year-over-year decline.

The final figures landed lower. Fourth-quarter deliveries declined about 16% compared with the same period a year earlier, when Tesla delivered 495,570 vehicles. Production slipped 5.5% year over year. On an annual basis, deliveries fell 8.6% from 1.79 million vehicles in 2024.

Most of Tesla’s sales volume continued to come from its mass-market lineup. The Model 3 sedan and Model Y SUV accounted for 406,585 deliveries during the quarter, or roughly 97% of total deliveries. Higher-priced models, including the Model S, Model X, and Cybertruck, combined for just 11,642 units.

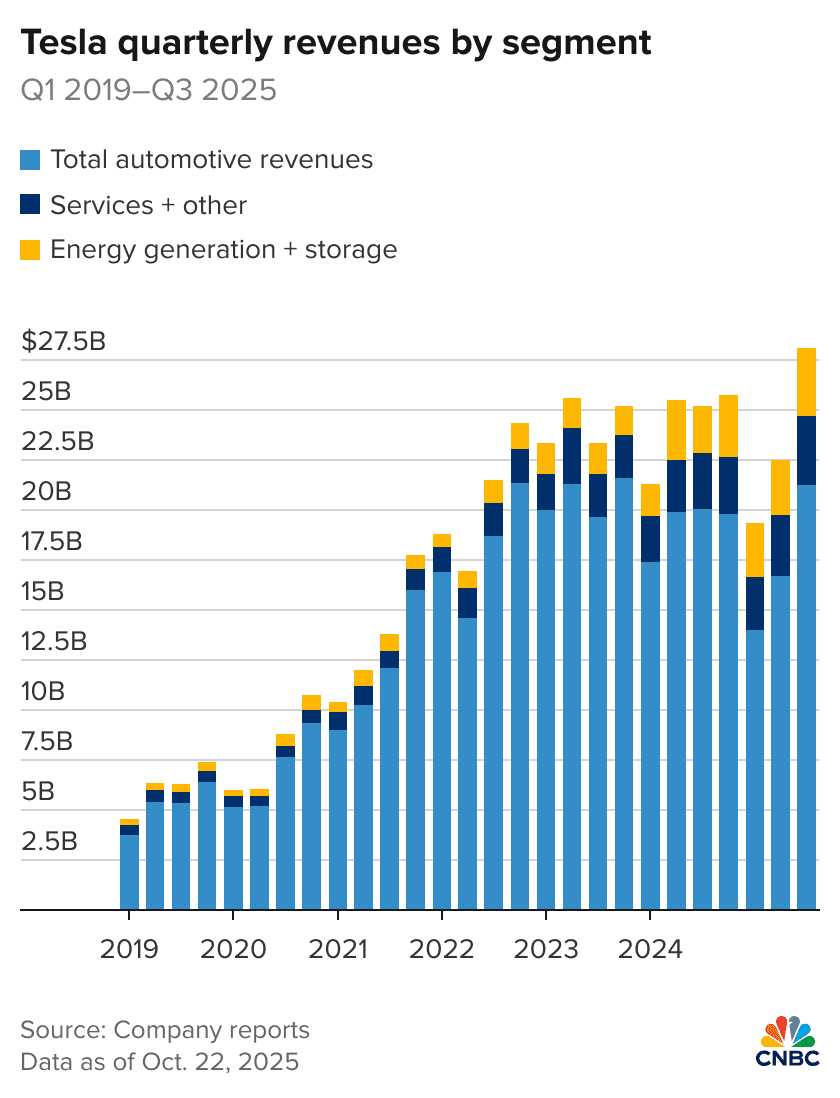

Tesla Quarterly Revenue by Segments (Credit: CNBC)

That gap highlights the challenge Tesla still faces with the Cybertruck. After its debut, the company reported that more than one million reservations were made. Sales momentum never followed. Reports in 2025 indicated that SpaceX, another company led by Elon Musk, purchased tens of millions of dollars’ worth of Cybertrucks, raising questions about demand outside Musk’s corporate orbit.

Tesla’s slowing sales come amid rising pressure from competitors across nearly every major market. China’s BYD surpassed Tesla as the world’s largest EV seller on a calendar-year basis in 2025, reporting a 28% jump in sales to 2.26 million vehicles. Korean automakers Kia and Hyundai continued to gain ground, Volkswagen pushed harder across Europe, and newer Chinese players such as Xiaomi and Geely entered the market with aggressive pricing.

Europe stood out as one of Tesla’s toughest regions last year. Data from the European Automobile Manufacturers’ Association showed Tesla registrations falling 39% during the first 11 months of 2025. Over the same period, BYD registrations surged 240%. EV adoption across Europe continued to rise, with battery-powered vehicles accounting for about 16% of all new car sales.

Tesla does not break out deliveries by region, leaving investors to piece together the picture from third-party data and registration figures.

Beyond competition, policy shifts weighed on demand. U.S. sales were hit by President Donald Trump’s decision to end a federal EV incentive earlier than expected, pulling some purchases into the third quarter and thinning demand later in the year. Tesla entered 2025 facing a pull-forward effect, coupled with public backlash stemming from Musk’s political activity in the U.S. and Europe.

Musk spent much of the first quarter leading the administration’s DOGE initiative to reduce the federal workforce after backing Trump’s return to office. His endorsements of Germany’s AfD party and British activist Tommy Robinson, followed by calls to dismantle the European Union, fueled criticism that lingered through the year.

Tesla attempted to reset the narrative in October with a more affordable version of the Model Y. Early signs suggest it helped stabilize interest, though a full rebound remains uncertain. Analysts at Cannacord Genuity pointed to rising EV adoption in emerging markets such as Thailand, Vietnam, and Brazil as a longer-term opportunity.

Away from vehicles, Tesla’s energy business continued to post steady growth. The company deployed 14.2 gigawatt-hours of battery energy storage products in the fourth quarter, following a prior record of 12.5 GWh. These systems now serve homes, utilities, and large data centers.

Investors have stayed largely optimistic. Tesla shares climbed 40% during the third quarter and hit a new record in mid-December. Musk bought $1 billion in stock in September, then secured shareholder approval in November for a new compensation plan valued at up to $1 trillion, thereby expanding his control over the company.

Tesla is scheduled to report its fourth-quarter financial results on Jan. 28. The numbers will offer a clearer view of margins, pricing pressures, and the level of confidence the company still commands as EV sales slow and competition tightens.

For now, Tesla’s story rests less on vehicle volume and more on belief. Musk continues to pitch a future shaped by robotaxis, humanoid robots, and what he calls “sustainable abundance.” The market appears willing to wait. The delivery numbers show that patience is being tested.